- September 18, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

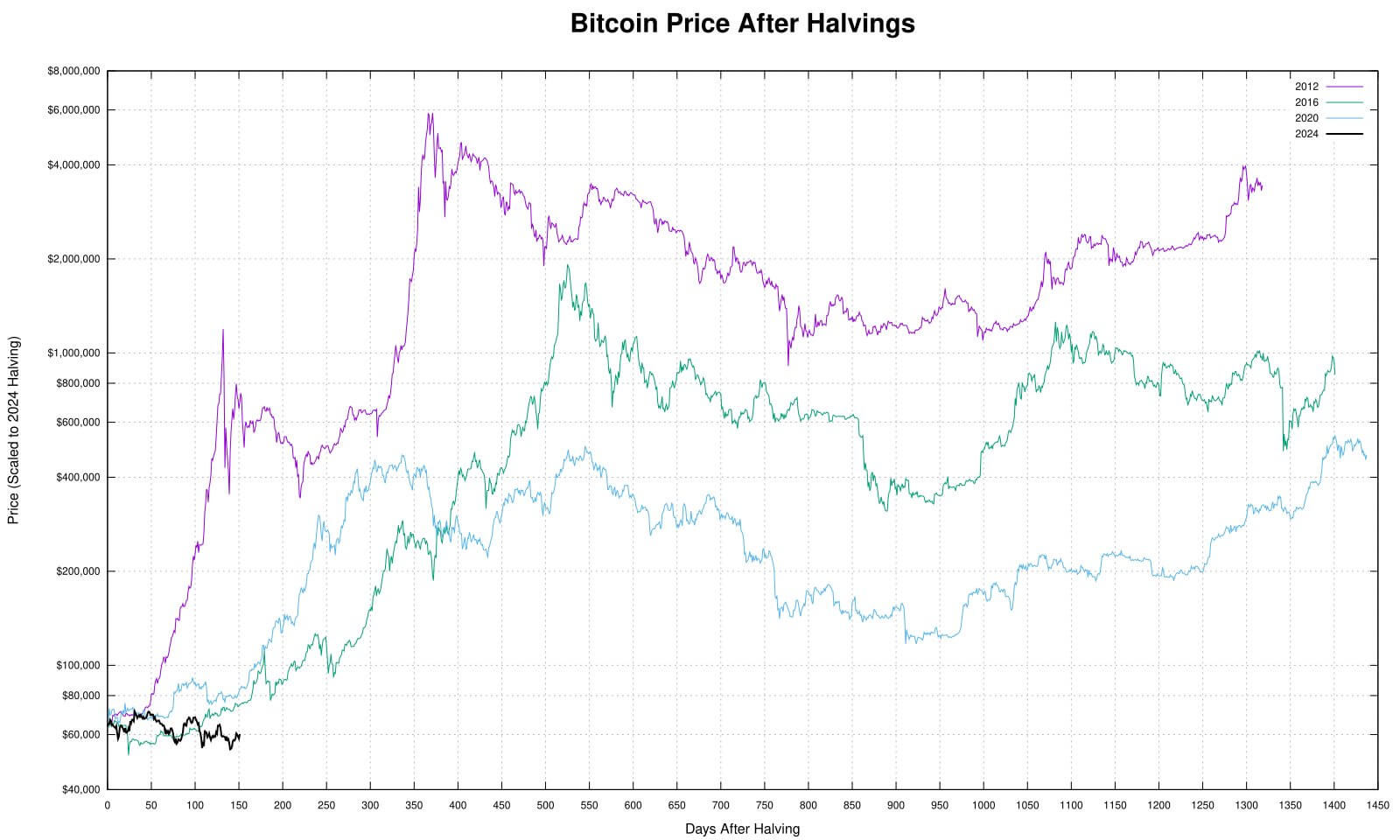

Bitcoin’s price is lagging behind previous halving cycles, according to recent data from Halving Tracker. At 151 days after the 2024 halving, Bitcoin stands around $59,800, significantly lower than scaled prices from past cycles.

Comparative figures show that at the same point post-halving, the 2012 cycle would scale Bitcoin’s price to $696,090.64, the 2016 cycle to $74,818.97, and the 2020 cycle to $83,883.71. This underperformance has prompted industry experts to express concern over Bitcoin’s valuation.

Pierre Rochard, VP of Research at Riot Platforms, described the current cycle as the worst so far, suggesting that Bitcoin remains deeply undervalued. His remarks highlight growing apprehension about the crypto’s market trajectory this cycle.

Historical data indicates that previous halving cycles experienced more robust price surges within the first 151 days. In particular, the 2012 and 2016 cycles showed significant growth, followed by sharp pullbacks, reflecting higher volatility in earlier years.

Analysts suggest that while Bitcoin’s current performance is subdued, there is potential for future growth. The 2020 cycle demonstrated steadier progression, and if the 2024 cycle follows a similar pattern, a gradual increase may occur in the coming months.

External factors such as macroeconomic conditions, regulatory developments, and investor sentiment will play crucial roles in shaping Bitcoin’s price movement. Market maturity may lead to reduced volatility compared to earlier cycles, dependent on macro factors such as rate cuts.

The post Bitcoin should be at $83,883 by 2020 standards, $696k scaled to 2012 growth appeared first on CryptoSlate.