- August 28, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

As the options expiry for Bitcoin (BTC) approaches on Aug. 30, significant market activity is anticipated, especially with a large volume of options set to expire.

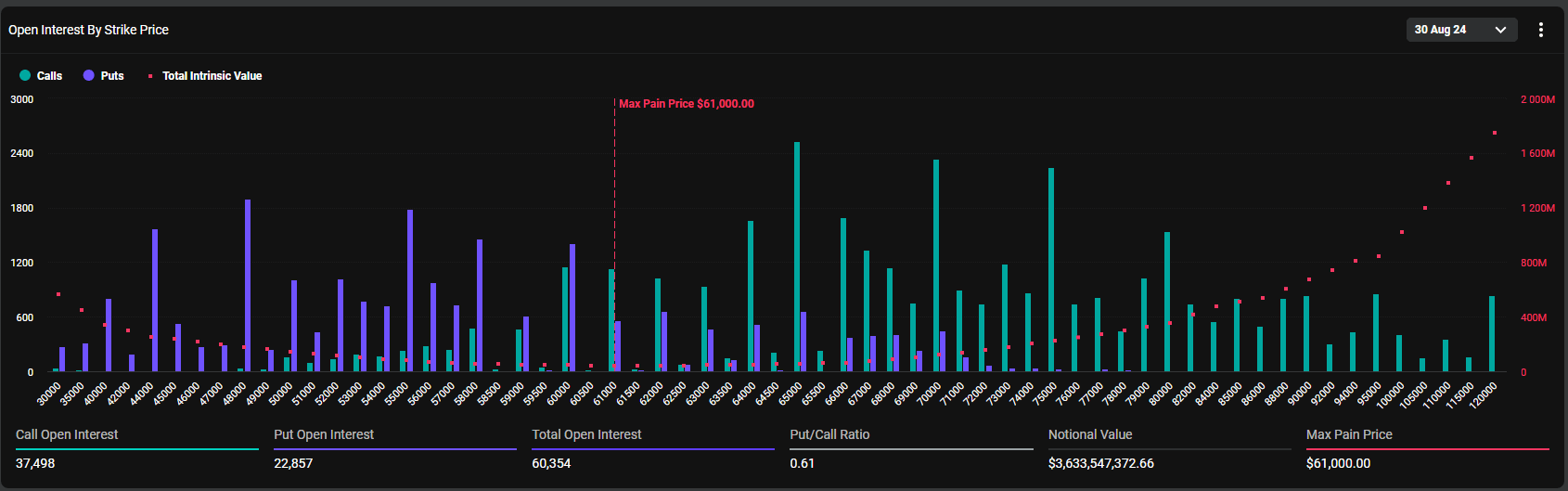

For Bitcoin, approximately $3.6 billion of notional value is set to expire, with a total open interest of 60,316 BTC. The put-to-call ratio stands at 0.61, indicating a somewhat bullish sentiment. Specifically, there is 37,477 BTC in call open interest compared to 22,839 BTC in put open interest, with the max pain price positioned at $61,000. This price level, close to Bitcoin’s current trading value of around $60,000, suggests that many traders are positioning for stability or a slight upward movement in the short term.

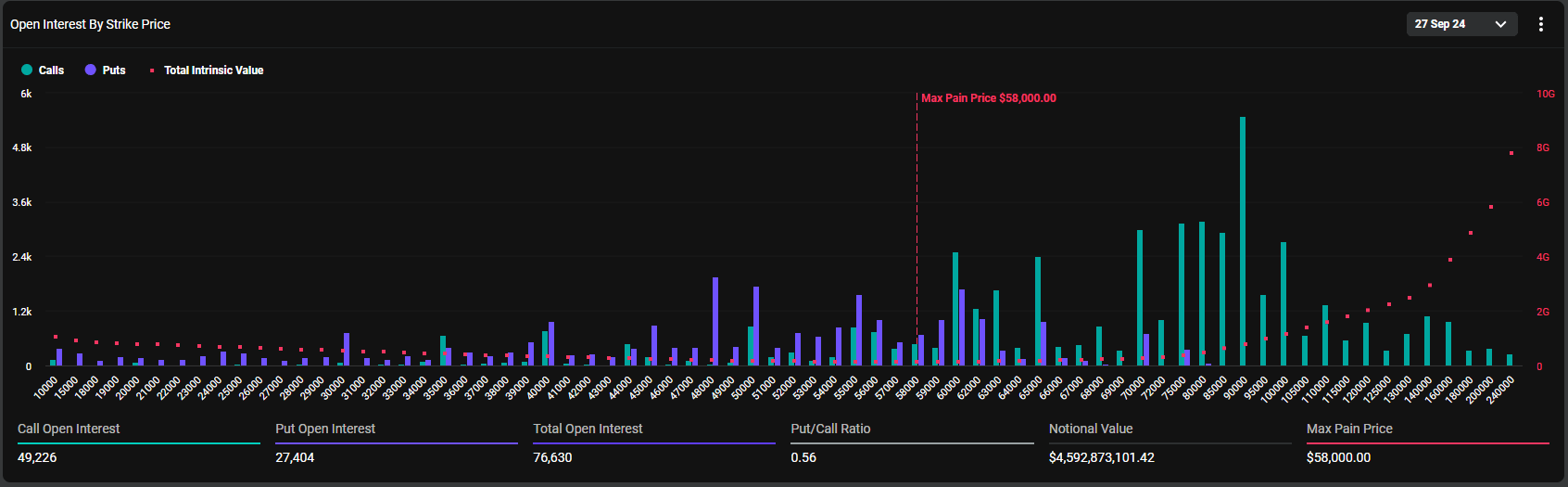

Looking ahead to the Sep. 27, expiry, the data reveals an even more bullish sentiment. The total open interest increases to 76,630 BTC, with a lower put-to-call ratio of 0.56. A striking feature of this expiry is the significant concentration of call open interest at the $90,000 strike price, totaling 49,226 BTC. This indicates that a substantial portion of the market is betting on Bitcoin, potentially reaching or exceeding $90,000 by late September.

The max pain price for this expiry is $58,000, below the current trading level, further hinting at expectations for a significant upward price movement in the coming month.

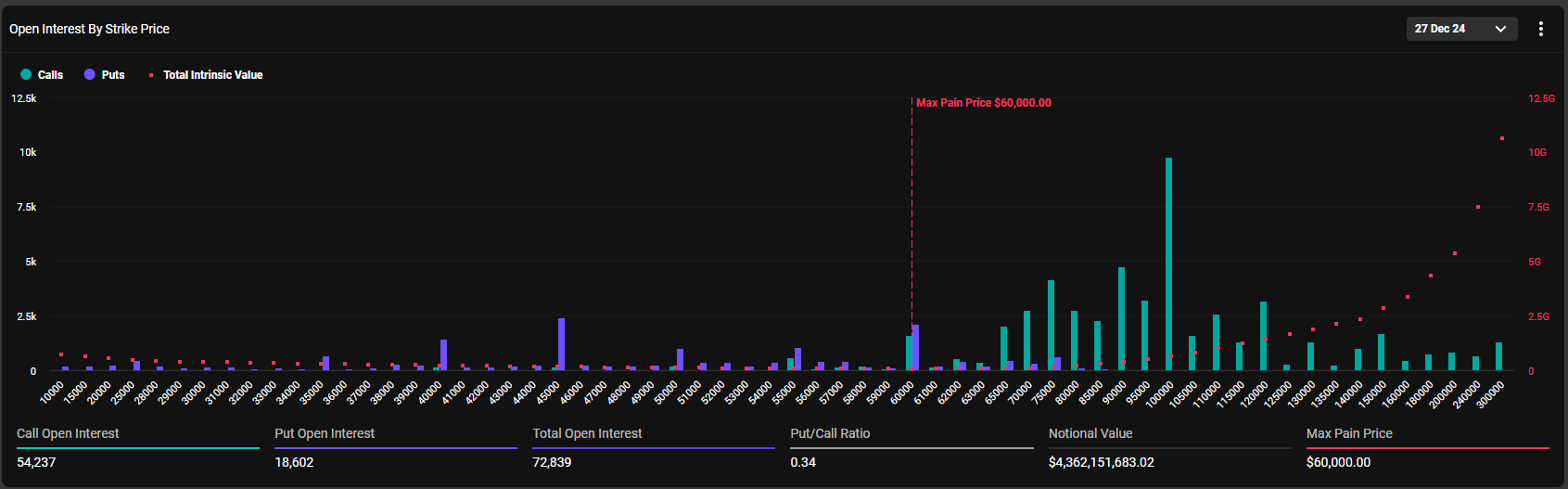

Further out, the Dec. 27 expiry also reflects strong bullish sentiment, with a total open interest of 72,839 BTC and a notably low put-to-call ratio of 0.34. There is a significant call open interest at higher strike prices, especially at the $100,000 level, which could suggest that traders are expecting Bitcoin to experience substantial price gains by the end of the year.

The max pain price for this expiry is set at $60,000, similar to the current trading range, but the clustering of open interest at much higher strike prices indicates a long-term bullish outlook.

In summary, while the Aug. 30 expiry shows immediate positioning around the $61,000 level, the September and December expiries suggest increasing optimism, with traders potentially anticipating significant upward movement in Bitcoin’s price towards the end of the year. The focus on higher strike prices in these later expiries highlights the market’s growing confidence in Bitcoin’s bullish Q4.

The post Bitcoin options highlight bullish sentiment towards $90,000 by September appeared first on CryptoSlate.