- March 29, 2025

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The post Bitcoin Nears Worst Q1 Close Since 2018: Will Bearish Metrics Push BTC Price Below $80K? appeared first on Coinpedia Fintech News

The crypto market’s recent recovery faded on Friday as a sharp sell-off erased nearly all weekly gains. Investors turned cautious amid concerns over President Trump’s upcoming tariffs scheduled for April 2 along with stronger-than-expected core PCE data. With Bitcoin facing rising selling pressure below $85,000, it’s on track for its worst quarter since 2018, allowing analysts to speculate whether it might finish March below the critical $80,000 level.

Bitcoin to Face Worst Q1 Since 2018

Bitcoin’s price has sharply declined over the past several hours. According to Coinglass data, nearly $90.56 million in BTC positions were liquidated, including $79.3 million from buyers and about $11.25 million from sellers.

This recent price drop places Bitcoin on track for its worst Q1 performance since 2018. Data from CoinGlass indicates Bitcoin fell roughly 11.86% in Q1 2025, slightly worse than the 10.83% loss in Q1 2020, though far from the drastic 49.7% decline seen in Q1 2018.

Bitcoin’s open interest has declined by roughly 4.5% in the past 24 hours, moving closer to a low of around $54 billion. The drop in open interest indicates declining trading activity among BTC traders, which may result in decreased volatility and more cautious market behavior in the short term.

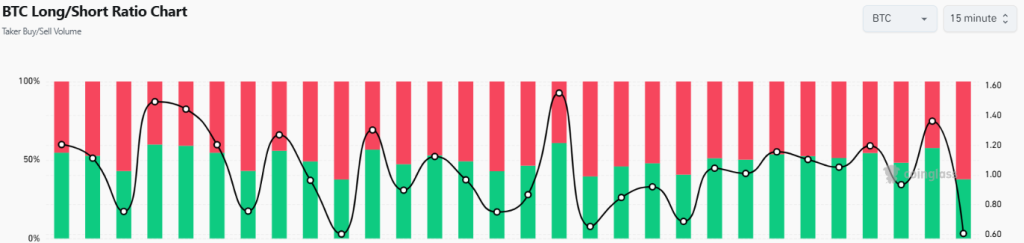

Additionally, the long/short ratio has experienced a noticeable decline, currently standing at 0.6051. This metric reveals that approximately 62.3% of traders are now betting on a further price decrease for Bitcoin, whereas only around 38% are hopeful about a potential rebound. Overall, these figures point to an increasing bearish sentiment among traders.

Also read: Bitcoin ETF Inflow Streak Breaks After 10-Day Surge

Adding to bearish sentiment, Bitcoin ETFs experienced notable outflows, possibly pushing BTC closer to the $80K level. Fidelity’s FBTC fund alone saw $93.16 million in outflows on Friday, ending a 10-day streak of inflows—the longest this year. Notably, FBTC had received $97.14 million of inflows just the previous day, as per SoSoValue. Trading volume across all U.S. Bitcoin ETFs increased slightly on Friday, totaling around $2.22 billion.

What’s Next for BTC Price?

Bitcoin has recently experienced increased selling pressure, causing its price to fall below significant Fibonacci support levels and reaching a low of around $81,644. At present, Bitcoin trades near $82,289, down approximately 1.7% over the past 24 hours.

Sellers are actively holding the crucial resistance at $85,000, aiming to keep the price from bouncing back. Despite this, buyers remain determined and appear prepared for another push to reclaim this key level.

If buyers manage to regain the $85,000 level, market sentiment could shift positively, potentially paving the way for further upward momentum toward the next major resistance near $90,000.

However, if buyers are unsuccessful in overcoming this critical barrier, Bitcoin could face increased selling pressure, possibly dragging the price back toward the support zone between $80,000 and $78,000.