- June 21, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Bitcoin mining firm HIVE Blockchain has received approval for listing on the Nasdaq Capital Markets exchange.

Bitcoin mining firm HIVE Blockchain Technologies has announced that it has received approval from Nasdaq to list its common stock shares on Nasdaq’s Capital Markets Exchange.

HIVE, which first went public in 2017 on the Toronto Stock Exchange (TSX), said in the announcement that it “will retain its listing on the TSX Venture Exchange.” With the firm’s new listing on the Nasdaq, however, investors in the U.S. will have a more accessible avenue of investing in the bitcoin ecosystem indirectly through its common shares.

In the announcement, HIVE described itself as a “growth-oriented company in an emergent industry” that bridges the blockchain sector with the traditional capital markets. The firm’s data centers in Canada, Sweden and Iceland are all green energy-powered facilities for mining bitcoin and other cryptocurrencies on the cloud.

According to the announcement, in 2020, HIVE traded over two billion shares. And HIVE appears to have adopted a HODL mentality with the BTC it mined since the beginning of 2021.

“Since the beginning of 2021, HIVE has accumulated the majority of its … BTC coin production, which we hold in secure storage,” per the announcement. “Our deployments provide shareholders with exposure to the operating margins of digital currency mining, as well as a portfolio of crypto-coins such as BTC.”

Another Institutional Rail To Bitcoin

While the U.S. Securities and Exchange Commission (SEC) has not yet approved a bitcoin exchange-traded fund (ETF) in the U.S., investors who don’t fully grasp how to buy and hold BTC themselves have resorted to a few different alternatives. Institutional investors, for instance, have commonly invested in Grayscale’s GBTC, shares of which attempt to track the bitcoin market price, minus fees and expenses.

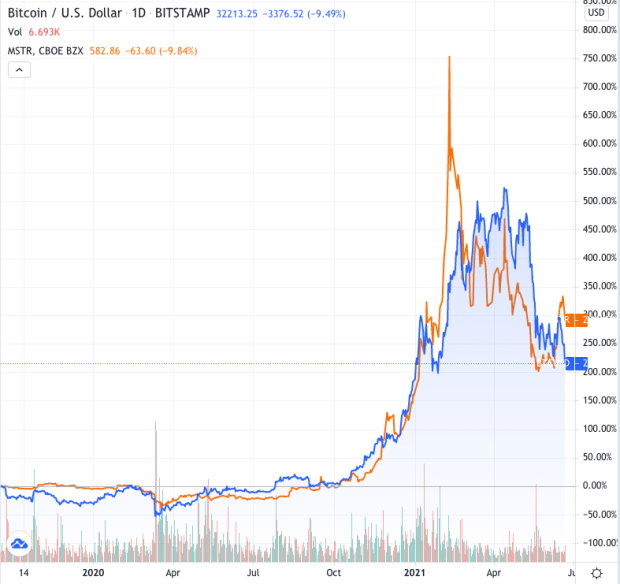

When it comes to retail investors, however, existing exchange-traded alternatives are even more indirect. So, some have resorted to shares Michael Saylor’s MicroStrategy, for example, a company whose stock has closely followed the bitcoin market price since Saylor started adding BTC to its balance sheet nonstop.

A similar proxy could happen with HIVE and other publicly-listed bitcoin mining companies for retail investors to get some exposure to the appreciation of bitcoin’s price. But since investing in proxies is not the same thing as investing in bitcoin, investors should work to buy and hold BTC themselves as well to take full advantage of the possibilities enabled by this new monetary network.