- July 24, 2022

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

On-chain data shows the Bitcoin mining difficulty’s latest negative adjustment means the metric has now seen three consecutive downspikes for the first time in more than a year.

Bitcoin Mining Difficulty Suffers Third Straight Negative Adjustment

As pointed out by an analyst in a CryptoQuant post, miner capitulation has meant that the hashrate has gone down recently, resulting in the difficulty going down.

The “mining hashrate” is an indicator that measures the total amount of computing power connected to the Bitcoin blockchain.

The total hashrate can be thought of as a representation of the competition between the miners on the network. Higher values of the metric mean more mining rigs are connected to the network and hence there is more competition between the individual machines.

Related Reading | Quant Suggests Tesla’s Bitcoin Dump Behind Recent Red Coinbase Premium

On the other hand, lower values of the indicator lead to lesser competition for everyone still connected to the network.

Another metric is the “mining difficulty.” Since the Bitcoin network has to maintain a constant “block production rate” (basically, it has to limit how many transactions can be handled per day), this mining difficulty keeps fluctuating to take into account for changes in the hashrate.

For example, when the hashrate suddenly rises up, miners start producing blocks faster than the limit. To counteract this, the network increases the difficulty during the next adjustment so that it becomes harder to mine and thus miners hash blocks slower.

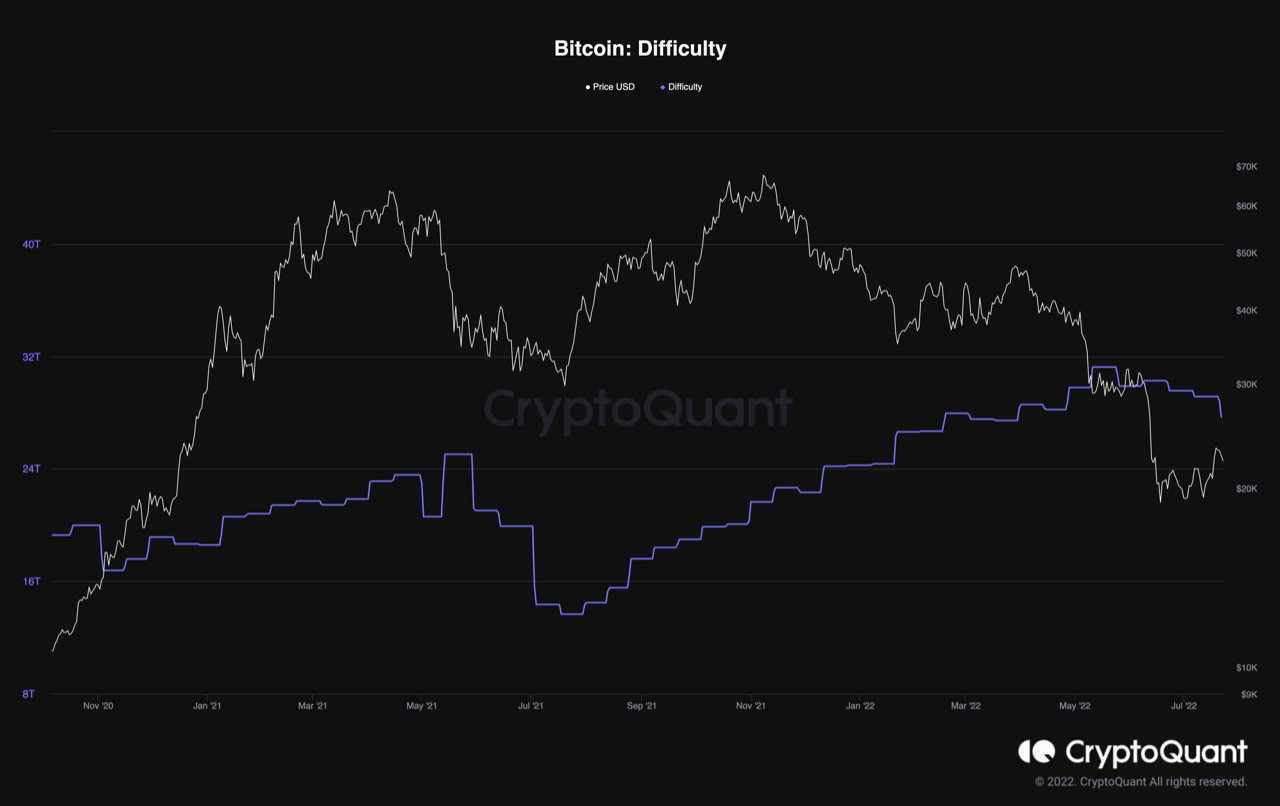

The below chart shows the trend in the Bitcoin mining difficulty over the last couple of years:

Looks like the metric's value has plunged down recently | Source: CryptoQuant

As you can see in the above graph, the latest three Bitcoin mining difficulty adjustments have been negative ones. The most recent of these was the largest such spike in the past year.

The reason behind this trend is that due to the recent low mining profitability, many miners have been forced to capitulate and sell off their mining rigs. This has lead to a decrease in the hashrate, which has ultimately resulted in the difficulty observing a plummet.

Related Reading | Bitcoin Mining Gets Cleaner As U.S. Lawmakers Call for More Transparency

The analyst in the post notes that miner capitulation has historically lead to the end of the bear market, which means the bottom could be near for the crypto.

BTC Price

At the time of writing, Bitcoin’s price floats around $22.5k up 6% in the past week. The below chart shows the trend in the price of the coin over the last five days.

The value of the crypto seems to have been going down over the last few days | Source: BTCUSD on TradingView

Featured image from Dmitry Demidko on Unspash.com, charts from TradingView.com, CryptoQuant.com