- August 14, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Bitcoin’s drop to below $50,000 on Aug. 5 marked the largest drawdown in the current cycle, resulting in substantial profit losses and liquidations. And while BTC has shown solid signs of recovery since then, consolidating around $60,000, the market still remains cautious as it recently dipped below this psychological support.

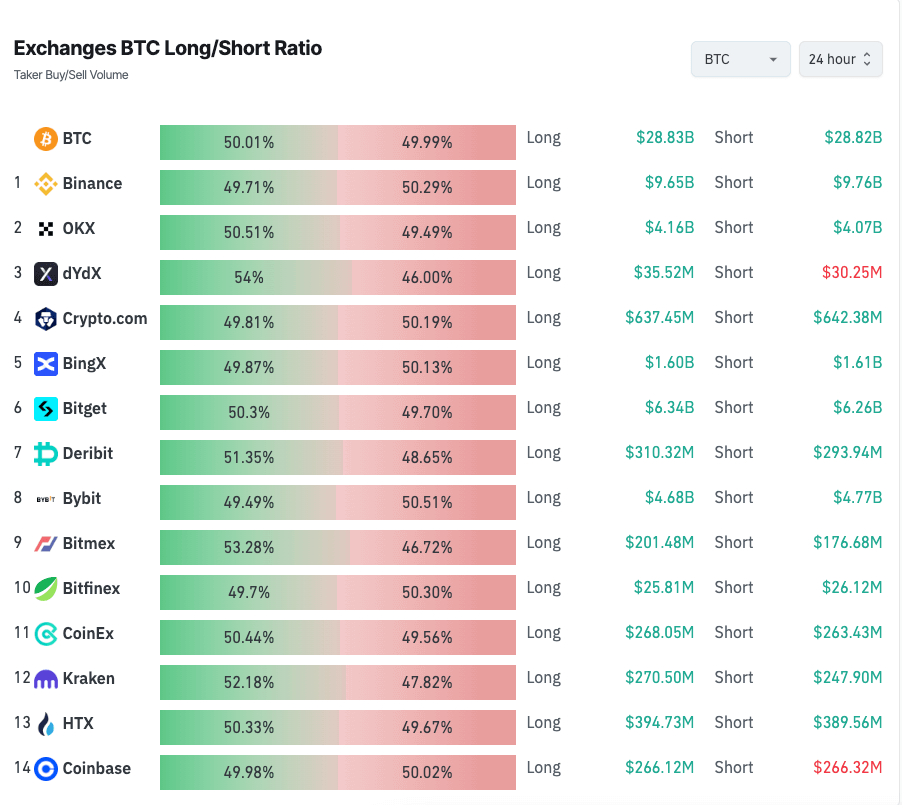

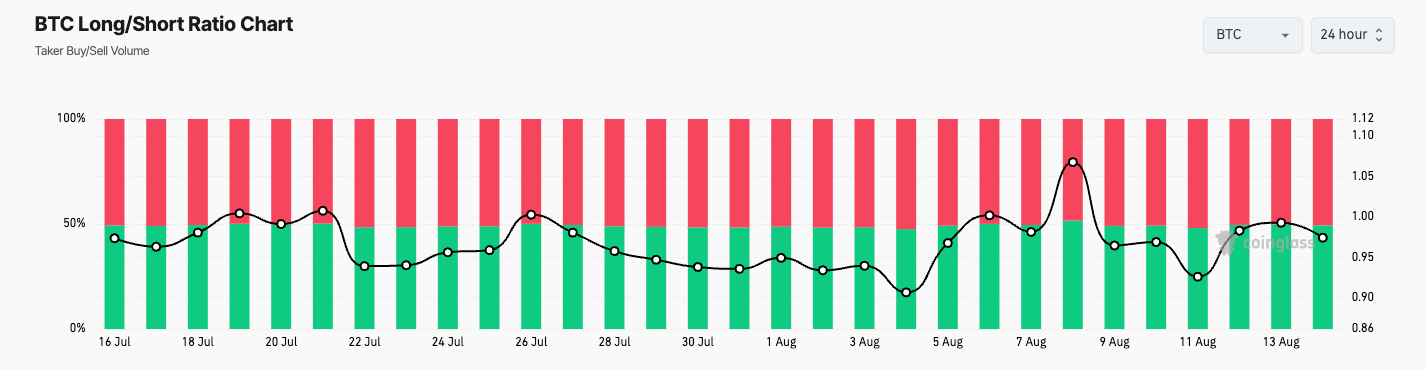

This cautiousness is best seen in the derivatives market, where the futures long/short ratio has stabilized around 1, with longs at 50.16% and shorts at 49.85%.

This near-equal distribution shows a lack of clear directional bias among traders. The current ratio represents a significant shift from the bullish outlook observed earlier in the month, which peaked on Aug. 8 with a ratio of 1.068.

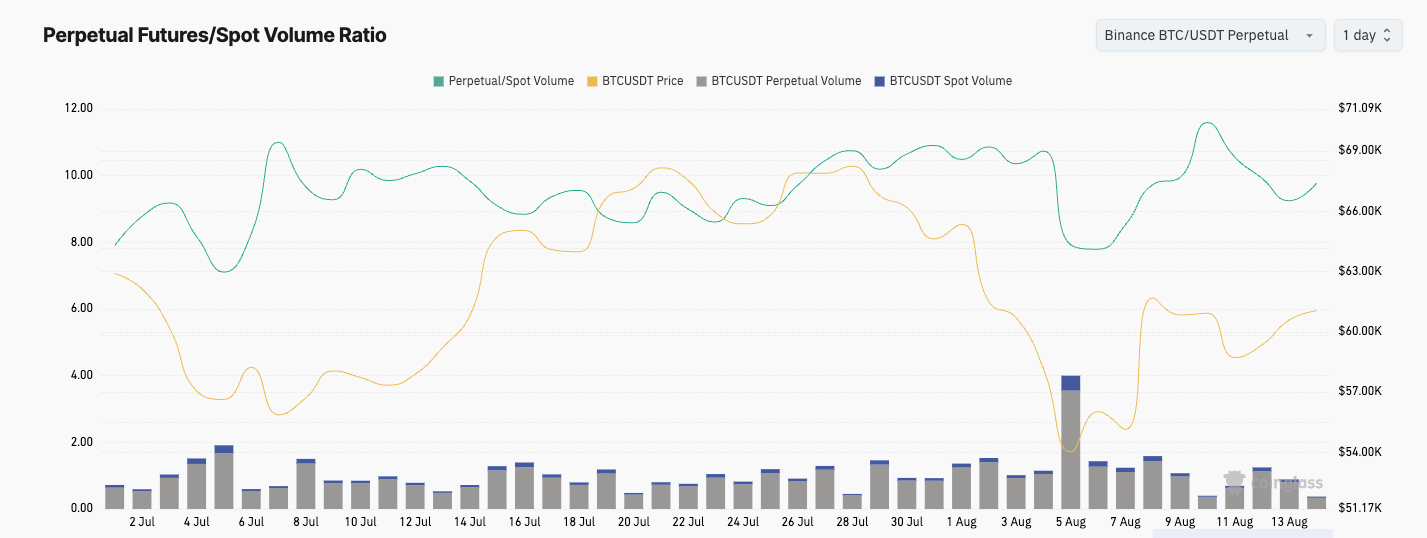

With perpetual futures becoming the dominant Bitcoin derivatives trading instrument, this lack of directional bias can be easily maintained. On Aug. 5, perpetual futures volume reached $67.88 billion, nearly eight times the spot market volume of $8.58 billion. The perpetual futures to spot volume ratio hit its second-highest level this year on Aug.10, reaching 11.60.

Such a high futures-to-spot volume ratio shows just how important derivatives are in price discovery and liquidity. High volumes, as we’ve seen over the past year, tend to lead to increased volatility and faster price movements. And with the majority of that volume on Binance, the volatility risk becomes even greater.

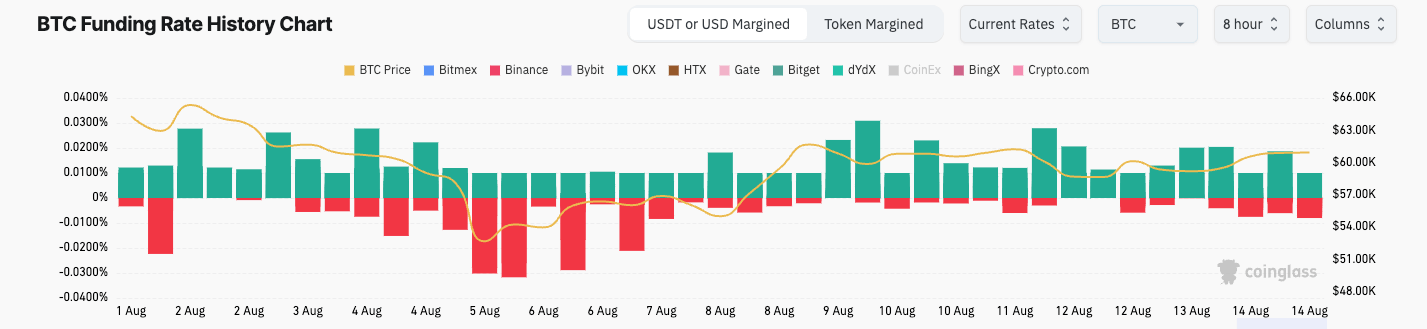

Perpetual futures funding rates have been consistently negative since Aug. 13, following a period of primarily positive rates earlier in the month. The significant volume in Bitcoin perpetual futures suggests high leverage in the market. Negative funding rates in the perpetual futures market indicate short-term bearish pressure. However, this could also set the stage for a potential short squeeze if buying pressure emerges from another rally.

The slow recovery we’ve seen in open interest further confirms that the Bitcoin market is currently in a state of cautious recovery. While the price has rebounded from its recent low, derivatives data shows that traders are still uncertain about future direction.

The dominance of perpetual futures and the balanced long/short ratio point to a market that could experience significant volatility in the near term, as a large portion of highly sophisticated traders are preparing for the market to go both ways.

The post Bitcoin market cautious as longs and shorts balance out appeared first on CryptoSlate.