- December 30, 2022

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The run-up to Christmas was filled with hope for a Santa rally that would close the year on a high note.

Unfortunately, the three days before Christmas Day saw price stagnation, with Bitcoin moving in a tight range between $16,585 and $16,940 over this period. Likewise, Dec. 25 resulted in a flat 0.8%, or $136, downside swing in the daily candle before closing above the daily low at $16,830.

Since then, the leading cryptocurrency has dropped further, with $16,480 providing local support on Dec. 28.

With that, the failed Santa rally is rapidly developing into an increasingly unlikely end-of-year high. But what might 2023 hold?

Bitcoin to recover in 2023?

For Bitcoin and cryptocurrency investors, 2022 was a humbling experience for many reasons.

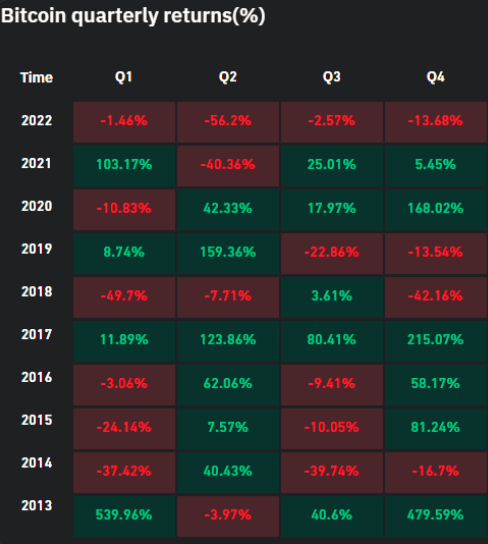

Documenting Bitcoin’s quarterly price performance, @esatoshiclub pointed out 2022 was the worst year since 2018.

A review of the data shows all four quarters in 2022 posting losses, which is an event that has never happened before. Similarly, Q2 2022 had the most significant percentage loss on record.

“#Bitcoin price looks prepared to close 2022 down nearly 70% – its worst year since the crypto crash of 2018.”

Summing up the year, a typical response among believers is that the market has reached rock bottom, and things can only get better. For example, commenting on the current state of affairs, @rovercrc said, “2023 can’t be much worse…”

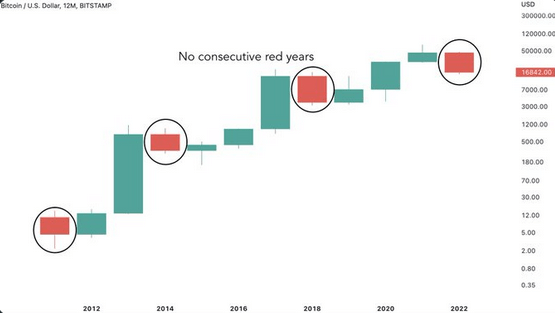

To rouse spirits, @GameofTrades_ pointed out that “Bitcoin has never seen back-to-back red years in its history.” Thus, based on past data, 2023 will likely close above the approximate $17,000 mark.

However, considering 2022 was the first year with all four quarters in the red, we are reminded that past data is no guarantee of future performance. Especially as the macro landscape remains uncertain going into the new year.

The post Bitcoin investors look to 2023 after disappointment of Santa rally that never was appeared first on CryptoSlate.