- November 23, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

On-chain data shows the Bitcoin Hashrate has surged to a record value as the coin’s price has continued to explore new all-time highs (ATHs).

7-Day Average Bitcoin Mining Hashrate Has Shot Up Recently

The “Hashrate” refers to a metric that keeps track of the total amount of computing power that the Bitcoin miners as a whole have currently connected with the network. Its value is measured in units of hashes per second (H/s), or the larger and more practical terahashes per second (TH/s).

The miners use their computing power for solving certain mathematical puzzles, with the reward being the opportunity to add the next block to the chain. At no point, however, does the collective computing power connected to the network work in tandem.

Rather, miners compete against each other using their individual Hashrate to be the first to solve these puzzles and receive the compensation. Despite this fact, though, the ‘total’ Hashrate is still a useful indicator, as it provides a look into the situation of these validators as a whole.

When the value of this metric rises, it means the miners are connecting additional power to the network. Such a trend suggests this group is finding BTC mining to be a profitable venture.

On the other hand, the indicator going down implies some of the miners have decided to leave the blockchain, potentially because they are no longer making a positive return.

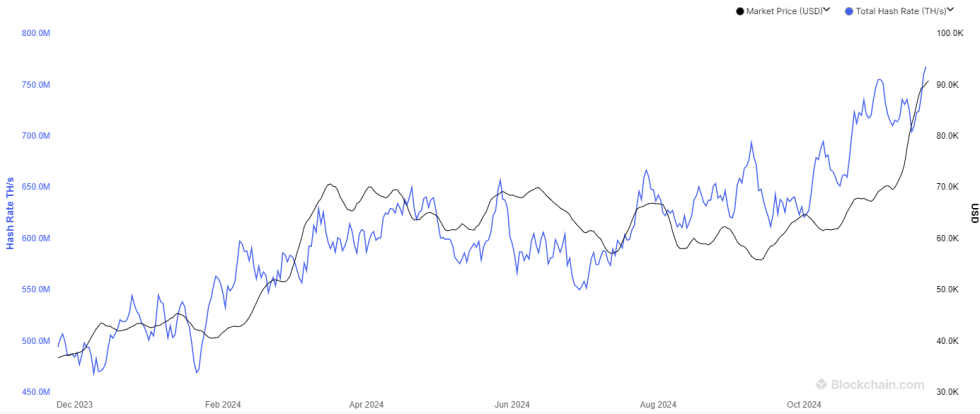

Now, here is a chart that shows the trend in the 7-day average Bitcoin Hashrate over the past year:

As displayed in the above graph, the 7-day average Bitcoin Hashrate has observed a rapid climb recently, implying that miners have been expanding their facilities.

Around the start of the month, the metric had set a new record of 755 TH/s, but even though the cryptocurrency had gone on to rally to new highs in the following weeks, the metric had registered a drawdown instead.

Bitcoin miners make their revenue from two sources, the transaction fees and the block subsidy, but the latter usually contributes to the vast majority of their income, so the former can be ignored when trying to gauge miner profitability.

The block subsidy remains fixed in BTC value (except for during Halvings, events occurring about every four years where it is permanently slashed in half) and is given out at a nearly constant rate of time. As such, the only way miner revenue can change is when the price of BTC itself changes.

Bullish periods naturally lead to higher profitability for these chain validators, so they tend to invest more in their farms. This is why the trend seen earlier in the month was surprising.

Miners may not have been too confident about the bull run then, but with the latest leg up to prices close to the $100,000 level, the Hashrate has appeared to be back on track, signaling that this cohort has bought into the rally.

Following the latest increase, the 7-day average Bitcoin Hashrate has achieved a new record of more than 768 TH/s.

BTC Price

At the time of writing, Bitcoin is floating around $98,000, up more than 9% over the last week.