- December 27, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Spot Bitcoin ETFs experienced a strong recovery on Dec. 26, breaking a four-day streak of outflows.

Data from Farside Investors showed that ETFs reported combined net inflows of $475.2 million, indicating renewed investor interest after a period of significant outflows of more than $1.5 billion.

According to the data, Fidelity’s Wise Origin Bitcoin Fund led the recovery by attracting $254.4 million in fresh capital. The ARK 21Shares Bitcoin ETF followed with $186.9 million in inflows.

BlackRock’s iShares Bitcoin Trust ETF (IBIT) secured $56.5 million, while Grayscale’s mini Bitcoin ETF and VanEck’s ETF saw smaller contributions of $7.2 million and $2.7 million, respectively.

Meanwhile, Bitwise’s BITB and Grayscale’s Bitcoin Trust saw outflows of $8.3 million and $24.2 million respectively.

Bitcoin Standard ETF

This significant inflow comes as Bitwise Asset Management has filed an application with the US Securities and Exchange Commission (SEC) to launch a new ETF tailored to corporations adopting the “Bitcoin Standard.”

This means the proposed fund would track companies integrating Bitcoin as a core treasury asset.

Joe Burnett, Director of Market Research at Unchained, described the fund as a modern alternative to traditional stock indices, stating that long-term success hinges on a company’s ability to generate positive Bitcoin returns and retain holdings.

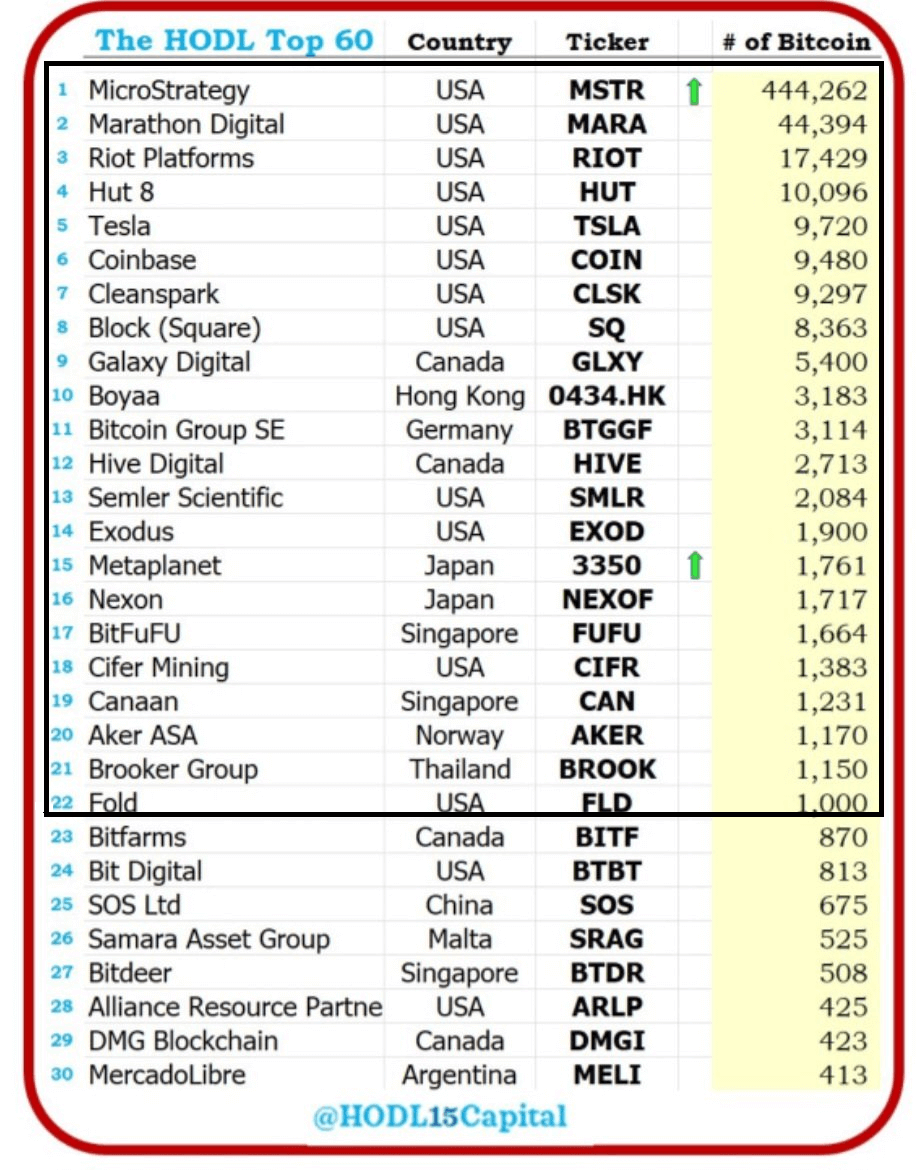

Firms must hold at least 1,000 BTC in reserves to qualify for inclusion and meet strict financial benchmarks. Eligible companies must have a market capitalization exceeding $100 million, daily trading liquidity of at least $1 million, and a public float of at least 10%.

The ETF plans to allocate at least 80% of its net assets to these Bitcoin-focused corporations, weighting selections based on their Bitcoin holdings. To ensure diversification, no single security would represent more than 25% of the fund’s total allocation.

Data compiled by crypto analyst HODL15Capital suggested 22 potential companies for the fund. This list includes notable firms like MicroStrategy, Metaplanet and prominent Bitcoin miners such as Marathon Digital.

The post Bitcoin ETFs get fresh strategies from Bitwise and $475 million in inflows appeared first on CryptoSlate.