- January 3, 2025

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The first trading day of the year saw notable outflows from spot Bitcoin and Ethereum exchange-traded funds (ETFs), totaling over $310 million.

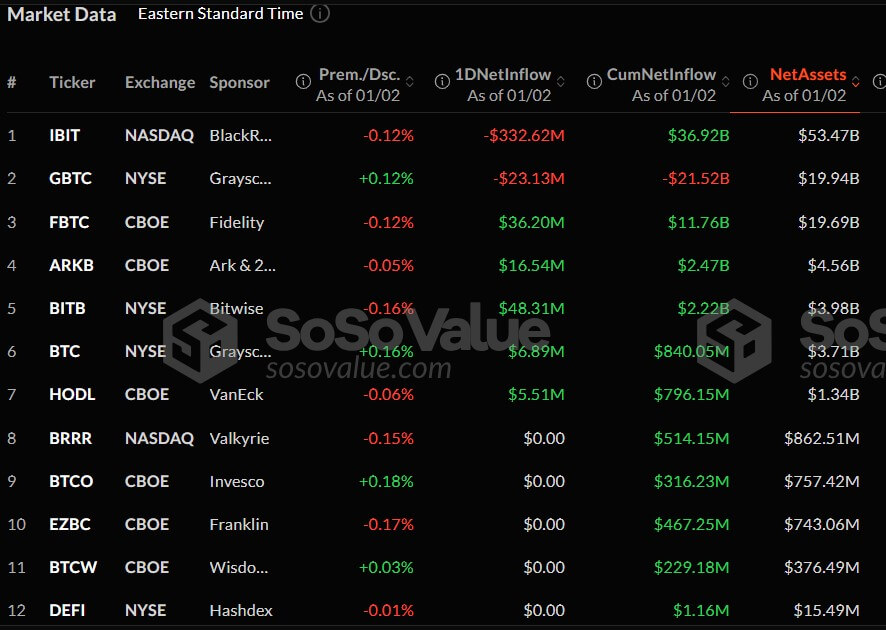

On Jan. 2, data from SoSoValue revealed that Bitcoin-focused ETFs experienced $242.3 million in outflows.

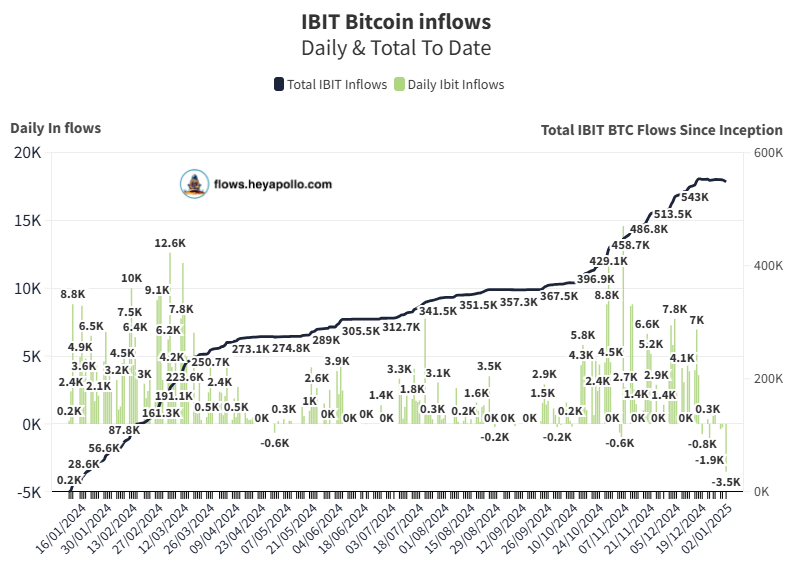

BlackRock’s iShares Bitcoin Trust (IBIT), the largest Bitcoin ETF, recorded its highest outflow since its inception, losing $332 million—or more than 3,500 BTC. This figure surpasses the previous record of $188 million set during the holiday season last year.

The latest outflow marks IBIT’s third consecutive trading day of losses, amounting to $392.6 million in the past week. Despite these challenges, IBIT remains the leading spot Bitcoin ETF, with total net inflows of $36.9 billion and assets under management nearing $53.5 billion.

While IBIT struggled, competitors showed resilience. Bitwise’s BITB, Fidelity’s FBTC, and Ark 21Shares’s ARKB reported inflows of $48.3 million, $36.2 million, and $16.5 million, respectively.

Meanwhile, Grayscale’s Bitcoin products recorded divergent fates on the day. Per the data, the firm’s smaller Bitcoin Mini Trust attracted $6.9 million in fresh capital, though its flagship GBTC fund saw outflows of $23.1 million.

As of Jan. 2, spot Bitcoin ETFs have a cumulative flow of $35 billion and hold $109 billion in assets.

Ethereum ETFs have modest outflows.

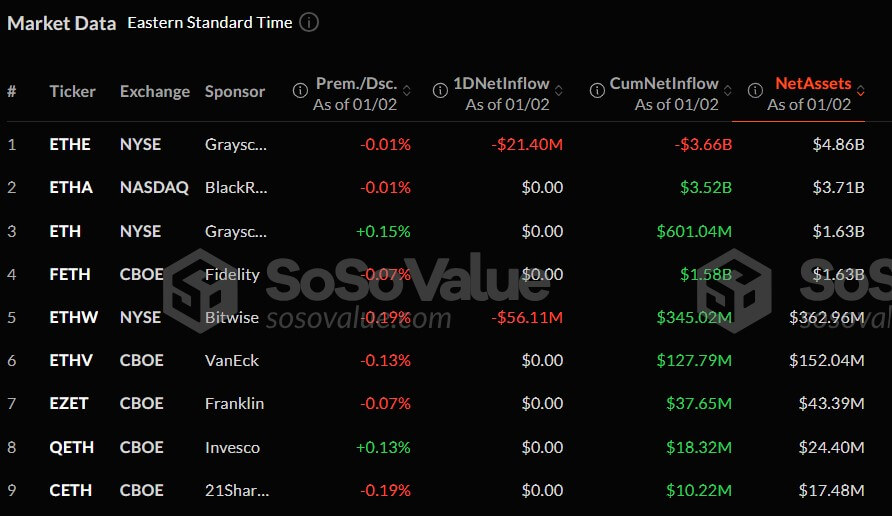

Ethereum ETFs also faced challenges, recording a combined outflow of $77.5 million.

Bitwise’s ETHW fund led these losses with $56.1 million withdrawn, while Grayscale’s ETHE product followed, shedding $21.4 million.

Other Ethereum-linked ETFs, including BlackRock’s ETHA, reported no changes in fund flows for the day.

Ethereum-focused ETFs held a combined total of $2.58 billion in net inflows, with $12.4 billion in assets.

The post Bitcoin ETFs face new year exodus, BlackRock loses 3,500 BTC amid price rally appeared first on CryptoSlate.