- September 24, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Matthew Sigel, Head of Digital Assets Research at VanEck, has highlighted the significant potential for growth in Bitcoin’s derivatives market.

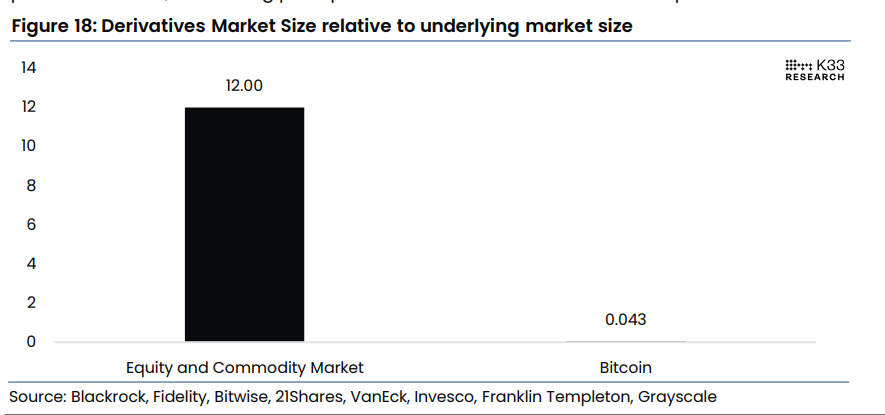

In a recent post, he noted that equity and commodity derivatives are 279 times larger than Bitcoin’s relative to their underlying markets. A chart he shared showed that while equity and commodity derivatives are 12 times the size of their underlying markets, Bitcoin’s derivatives are only 4.3% of its own.

The US Securities and Exchange Commission’s approval of options trading for BlackRock’s iShares Bitcoin Trust (IBIT) could catalyze this growth. IBIT ranks among the most liquid ETFs in the country, and the introduction of options trading is expected to draw more liquidity and institutional investors to Bitcoin.

As of September 2024, the Bitcoin derivatives market has grown but remains modest compared to traditional markets. Monthly crypto derivatives volumes have surpassed spot markets, reaching $1.33 trillion. Bitcoin and Ethereum are the most frequently referenced assets in crypto derivatives.

Regulatory acceptance is increasing, signaling greater legitimacy for Bitcoin in traditional finance. New products like physically settled options and non-deliverable forwards indicate ongoing innovation in the sector.

The substantial gap between Bitcoin’s derivatives market and those of traditional assets suggests significant room for expansion. Institutional adoption and market maturation are expected to drive growth, positioning Bitcoin derivatives to potentially catch up with their conventional counterparts.

The post Bitcoin derivatives market shows immense growth potential, dwarfed 279x by traditional counterparts appeared first on CryptoSlate.