- January 25, 2022

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

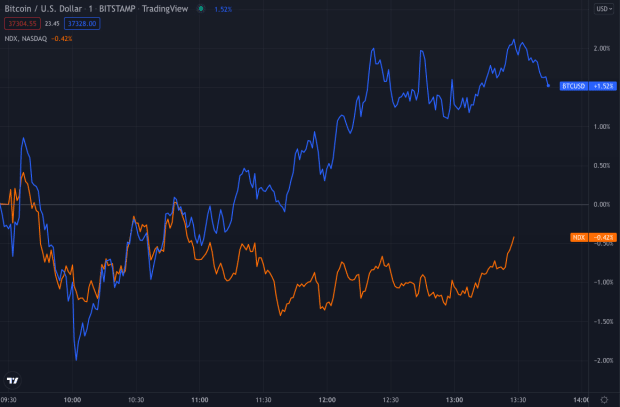

Bitcoin is trading in green territory while the Nasdaq keeps sliding in anticipation of the FOMC meeting.

The bitcoin price enters green territory on Tuesday and decouples from the Nasdaq index as tech stocks extend losses ahead of the Federal Reserve’s Federal Open Market Committee (FOMC) meeting.

Bitcoin recovered quickly from a sharp drawdown on Monday as markets around the globe turned red in a unisonous risk-off movement. As BTC gains prestige among mainstream investors, mainly institutional players, the asset has increasingly been performing in close correlation with “risky” assets that largely thrived in a liquidity-rich environment of quantitative easing.

As the Fed gets hawkish in its monetary policy, withdrawing its asset purchasing programs at a faster pace after each FOMC meeting, markets have flocked towards “safer” investments as worries of lower liquidity could prevent an extended rally for riskier investment bets.

The next two-day FOMC meeting is scheduled for Tuesday and Wednesday with the results being released after its completion as the committee decides the future of U.S. monetary policy. After the last meeting of the committee in December, Fed Chairman Jerome Powell mentioned that increased inflationary pressures, which he then said could no longer be called “transitory,” had prompted increased caution and faster reductions in asset purchases. Powell also hinted at possible interest rate hikes in 2022 to further curb inflation rates and stabilize a “stronger economy” seen in the United States.

Despite joining the Nasdaq in Monday’s losses, Bitcoin swiftly recovered to decouple from the index as tech stocks showed increased weakness ahead of the FOMC meeting. Bitcoin was up about 2% on Tuesday while the Nasdaq traded in slightly negative territory.

Markets have remained uncertain what the Fed’s policy might be — whether the committee will choose to rescue bleeding financial markets, effectively turning its back on previously-announced intentions, or if further tightening will occur, extending the risk-off macroeconomic movement.