- June 8, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Onchain Highlights

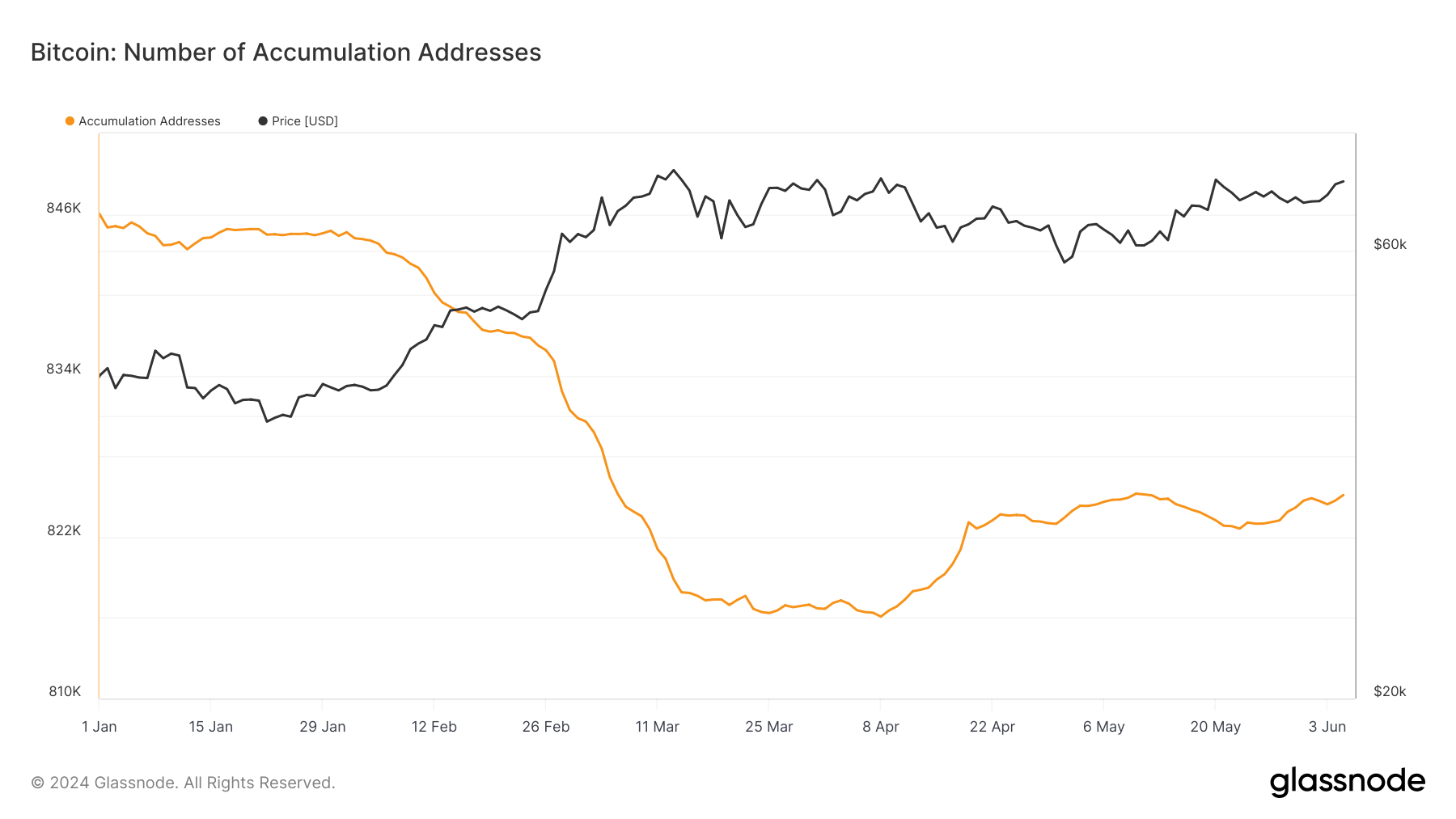

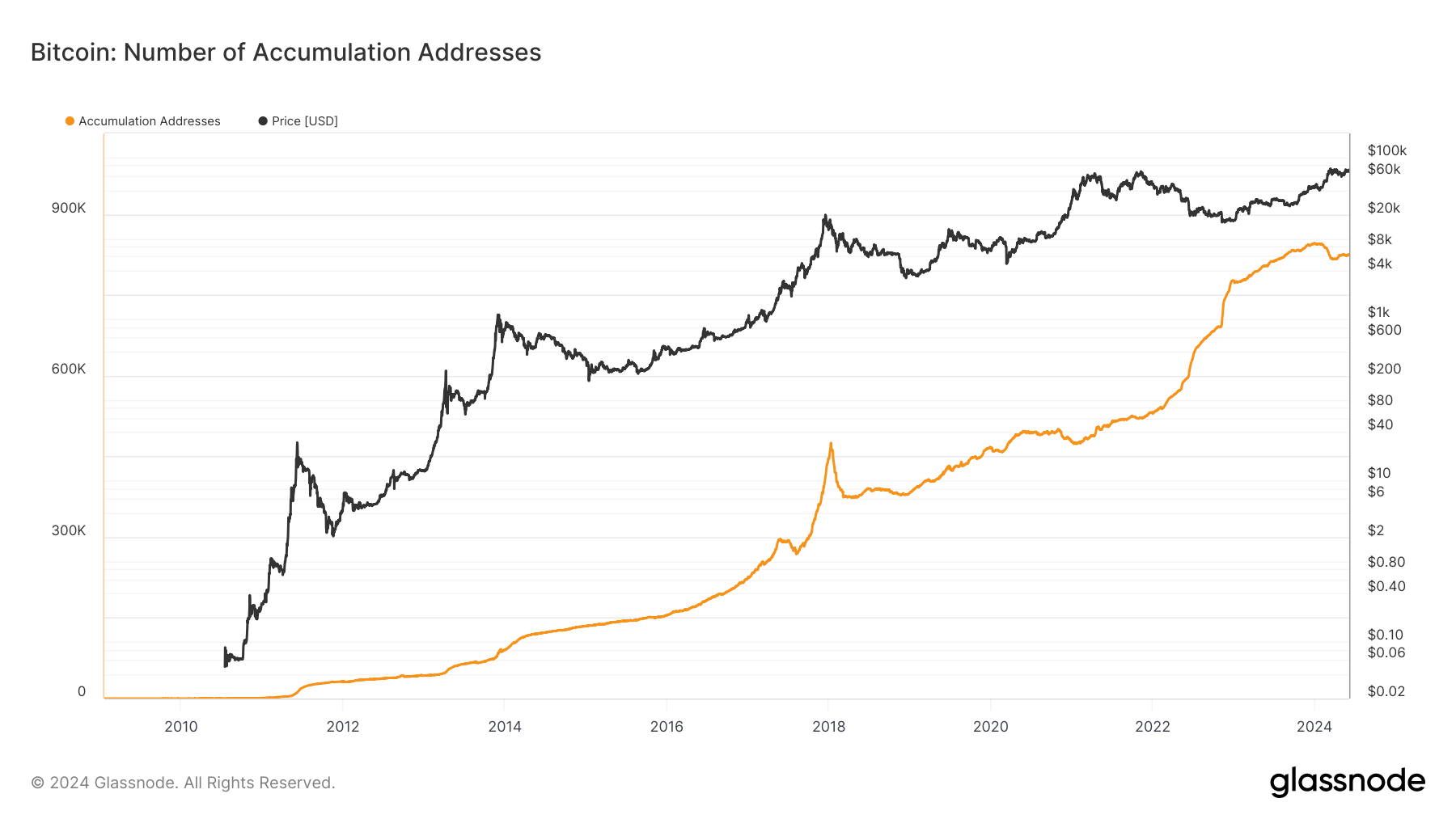

DEFINITION: The number of unique accumulation addresses. Accumulation addresses are defined as addresses that have at least two incoming non-dust transfers and have never spent funds. Exchange addresses and addresses received from coinbase transactions (miner addresses) are discarded. To account for lost coins, addresses that were active more than seven years ago were also omitted.

Recent data from Glassnode indicates notable movements in Bitcoin accumulation addresses. The number of these addresses declined earlier this year, and a resurgence started in late April. This increase aligns with broader market optimism and Bitcoin’s price stabilization around $60,000. According to CryptoSlate, long-term holders have added nearly 70,000 BTC since the cycle’s bottom, reversing a previous divestment trend.

Additionally, the Bitcoin halving spurred substantial accumulation. Over 115,000 BTC were accumulated in April alone, reflecting strong market confidence. This behavior is further evidenced by a surge in investor activity, with significant inflows into Bitcoin accumulation addresses reaching record levels in April.

These patterns suggest a bullish outlook among long-term holders and other key market participants, highlighting a collective confidence in Bitcoin’s future prospects. The interplay between these accumulation trends and market events like the halving will be crucial in shaping Bitcoin’s trajectory in the coming months.

The post Bitcoin accumulation addresses surge as market optimism returns appeared first on CryptoSlate.