- September 6, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

An analytics firm has revealed that three altcoins have been seeing bearish bets on Binance, which may help fuel rebounds.

Tron, Stellar, And 1inch Have Seen Negative Funding Rates Recently

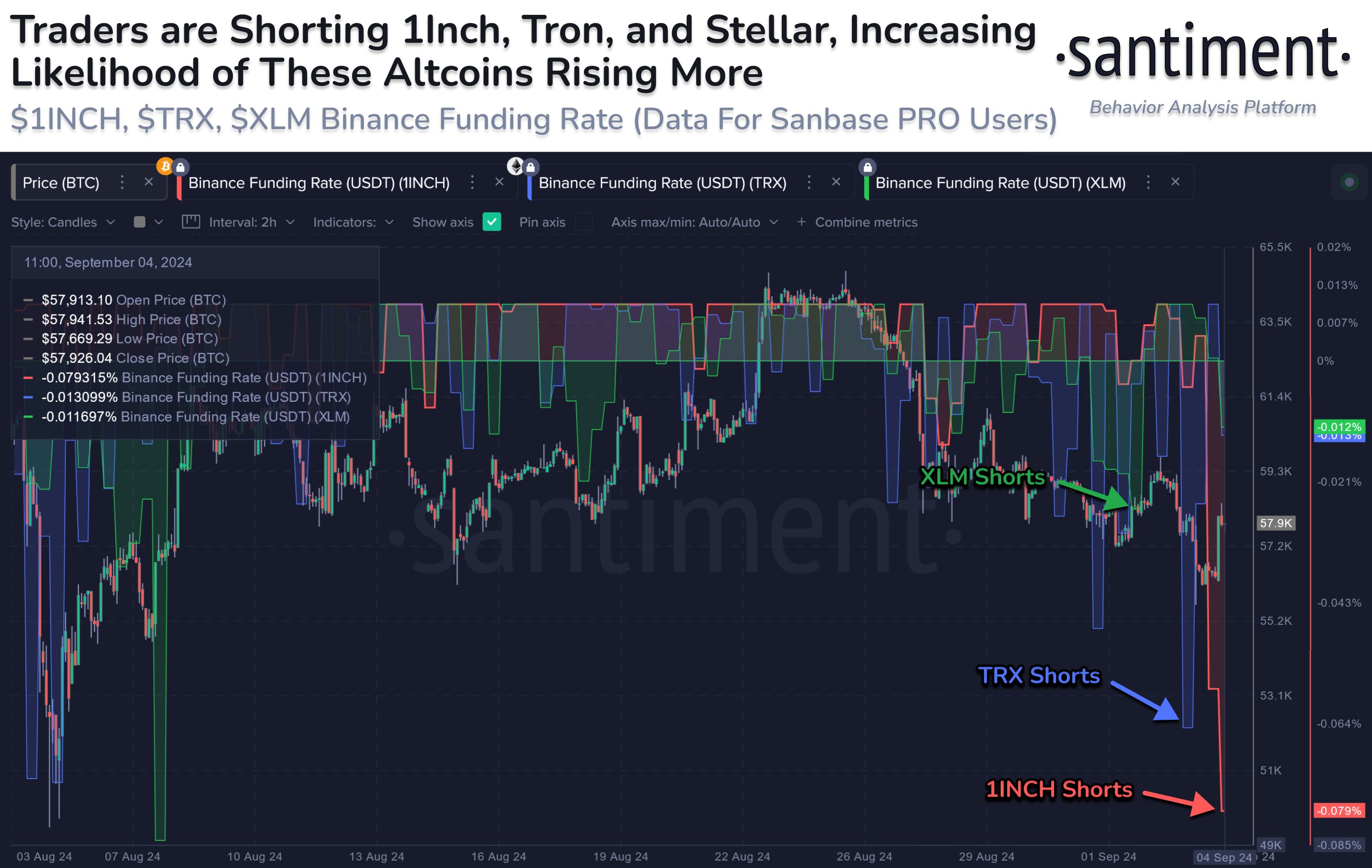

In a new post on X, the on-chain analytics firm Santiment has recently discussed the trend in the Binance Funding Rate for a few different altcoins.

The “Funding Rate” is an indicator that keeps track of the periodic amount of fees that the traders on a given derivatives exchange (which, in the current case, is Binance) are exchanging between each other.

When the metric has a positive value, it means the long contract holders are paying a premium to the short investors to hold onto their positions right now. Such a trend implies a bullish mentality is the dominant one in the market.

On the other hand, the indicator under the zero mark suggests that the short investors currently outweigh the long ones, so the majority shares a bearish sentiment.

Now, here is a chart that shows the trend in the Binance Funding Rate for three altcoins, 1inch Network (1INCH), Tron (TRX), and Stellar (XLM), over the past month:

The above graph shows that the Binance Funding Rate has been negative for all three of these altcoins recently, suggesting that more traders have been trying to bet against a price rise.

1inch appears to have been having it the worst in terms of this indicator, with its value currently being a negative 0.079%. While the red values of the metric would suggest the crowd has been bearish, they may not be bad for their prices.

This is because a mass liquidation event is generally the most likely to affect the market with the most positions. The probability of such liquidations will be raised even more if the positions on the market involve significant leverage. As Santiment explains,

When we see heavy bets against an asset, liquidations can occur which act as “rocket fuel” for the asset’s price to rise higher. Going against the crowd of doubters could pay dividends.

Thus, it remains to be seen how the prices of these altcoins will develop from here on out, given this potential rocket fuel brewing in the background.

TRX Price

Tron, the largest of these three altcoins, has had a bearish week, much like the rest of the cryptocurrency sector, but in terms of monthly returns, TRX investors haven’t had a bad time at all as the asset has managed to outperform the likes of Bitcoin (BTC) with its 18% surge.

The below chart shows what the recent performance of Tron has looked like.