- April 18, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

No Comments

Quick Take

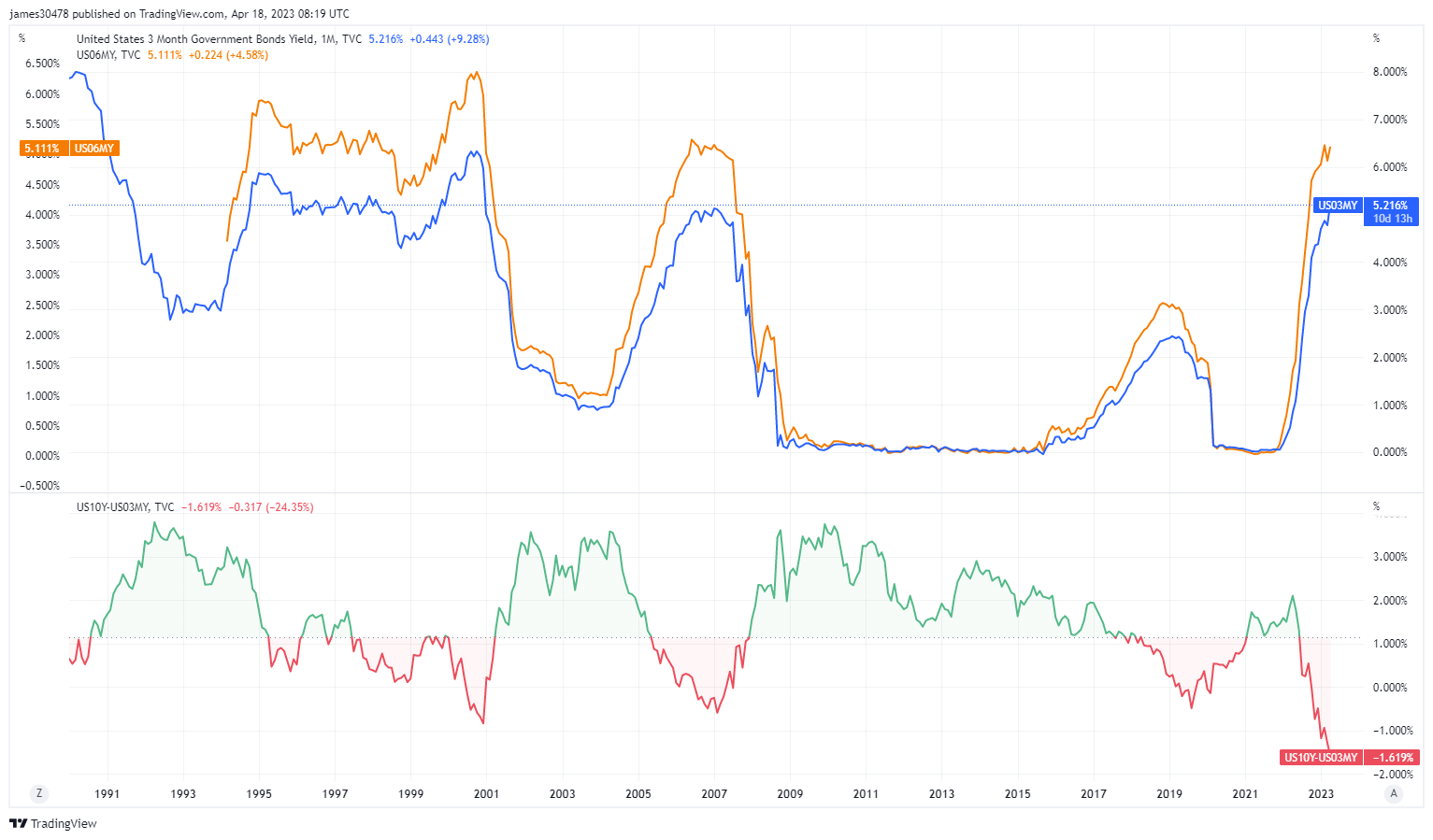

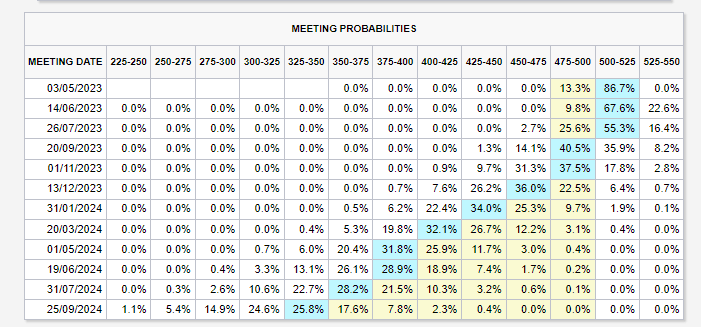

- The market is reversing the assumed fed pause and the aggressive subsequent rate cuts for the second half of 2023.

- The three and six-month T-Bill is now above 5% for the first time in over 15 years.

- On top of that, the 3-month/ 10-year U.S. treasury spread is the deepest inversion for over 30 years. The market is signaling huge policy errors by the Fed.

- Investors are rushing to money market funds and the short end of the yield curve to get 5% on their cash — which will put further pressure on banks to raise deposits.

- But the biggest news is Apple is offering 4.15% off US savings accounts. Ordinary people feel safe using Apple and have a recognized and trusted brand. There are also no fees, minimum deposits, and a buy now, pay later program.

The post Banks face further pressure as front end of the yield curve surges past 5% appeared first on CryptoSlate.