- September 11, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

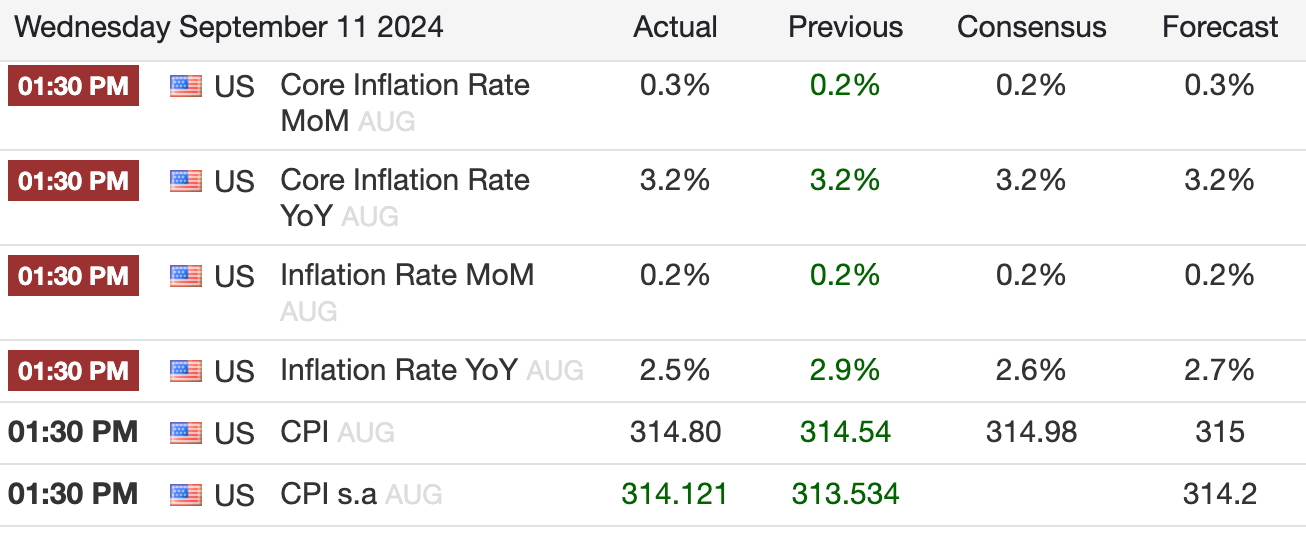

Today’s US inflation data showed a slight uptick in August, with the Consumer Price Index (CPI) rising 0.2% monthly. Year-over-year data is at 2.5%, down from 2.9% and a consensus of 2.6%. The core CPI, which excludes volatile food and energy prices, increased 0.3% month over month and held steady at 3.2% year over year.

Despite the marginally higher-than-expected MoM inflation figures, Bitcoin has remained relatively stable, trading around $56,700 as of 1:30 P.M. EST. While inflation has increased 0.1% higher than analysts expected this month, it continues to fall overall. This stability suggests that crypto investors had largely priced in the inflation data and are not significantly altering their positions based on this report.

The slight increase moves annual inflation closer to the Federal Reserve’s 2% target and does not appear to have dramatically shifted market expectations regarding future monetary policy. The Fed recently indicated a greater focus on employment data than inflation in guiding its decisions.

Bitcoin’s resilience in the face of this economic data highlights its growing maturity as an asset class. The ability of digital assets to maintain their price level of around $56,000 despite minor fluctuations in traditional economic indicators demonstrates that they are increasingly viewed as a potential hedge against inflation and economic uncertainty.

Analysts now expect a 25bps rate cut over a 50bps cut in September following the data release.

The post Annual US inflation falls to 2.5% as monthly CPI increases 0.2%, Bitcoin initially remains stable appeared first on CryptoSlate.