- May 27, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

When analyzing the Bitcoin market, it’s equally important to understand the behavior of different market participants as it is to understand the technical foundations of Bitcoin’s price movement. On-chain analysis frequently analyzes short– and long-term holders, as their behavior is inherently different. However, Bitcoin’s maturity enables us to differentiate between large and small entities, as hundreds of institutions have populated the space and become a dominant force in the market.

Large entities tend to make strategic moves based on long-term outlooks and substantial market analysis. In contrast, small entities, typically retail investors, are more reactive and driven by short-term speculation and sentiment.

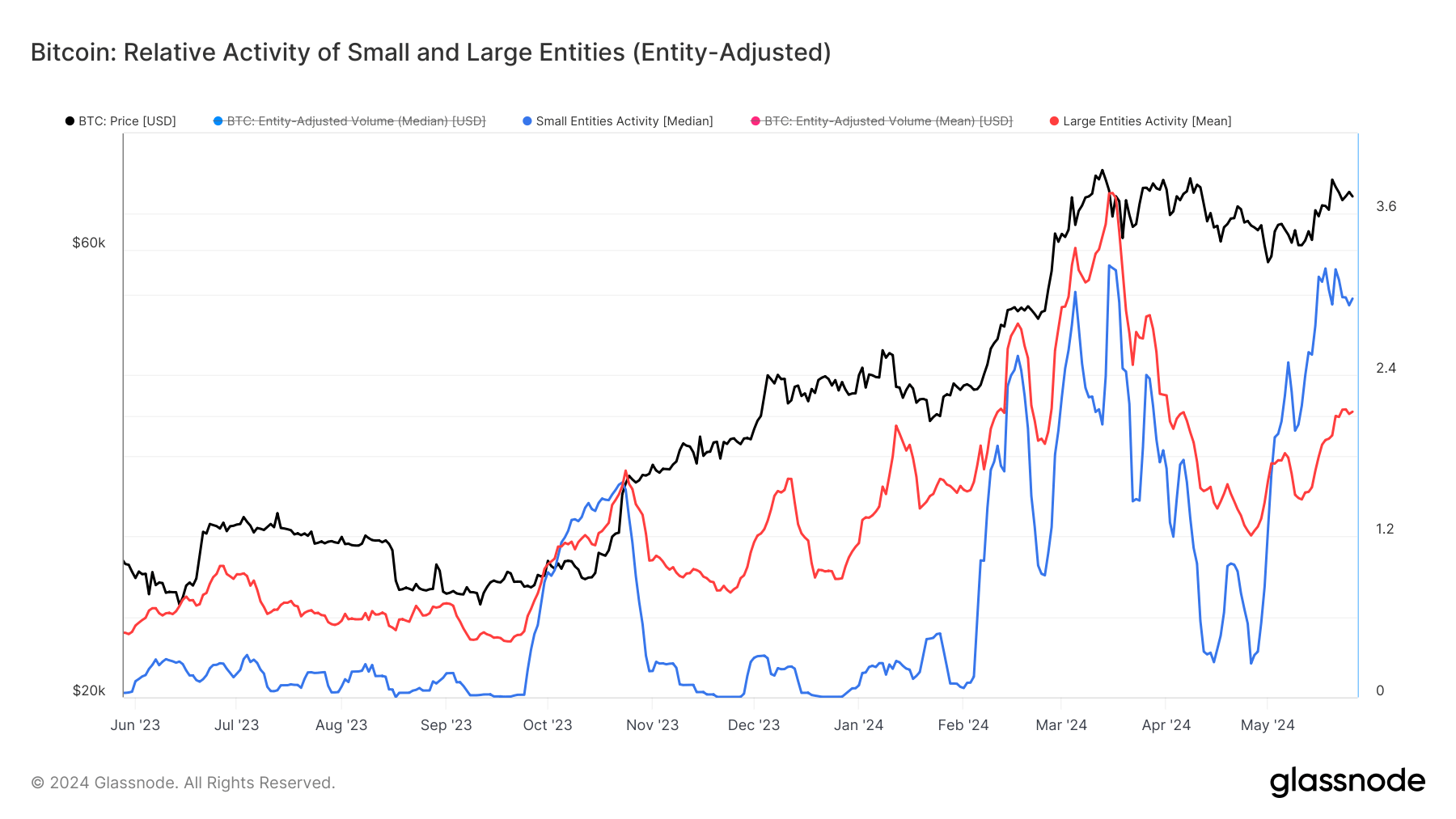

The relative activity of small and large entities is an excellent metric for distinguishing between these two cohorts. Although relying solely on this metric has limitations — such as oversimplifying the complex behavior of a diverse range of investors — it still offers a straightforward, binary check of market conditions. Glassnode’s metric differentiates between the median transaction volumes of small entities and the mean transaction volumes of large entities to reveal trends that suggest potential shifts in the market.

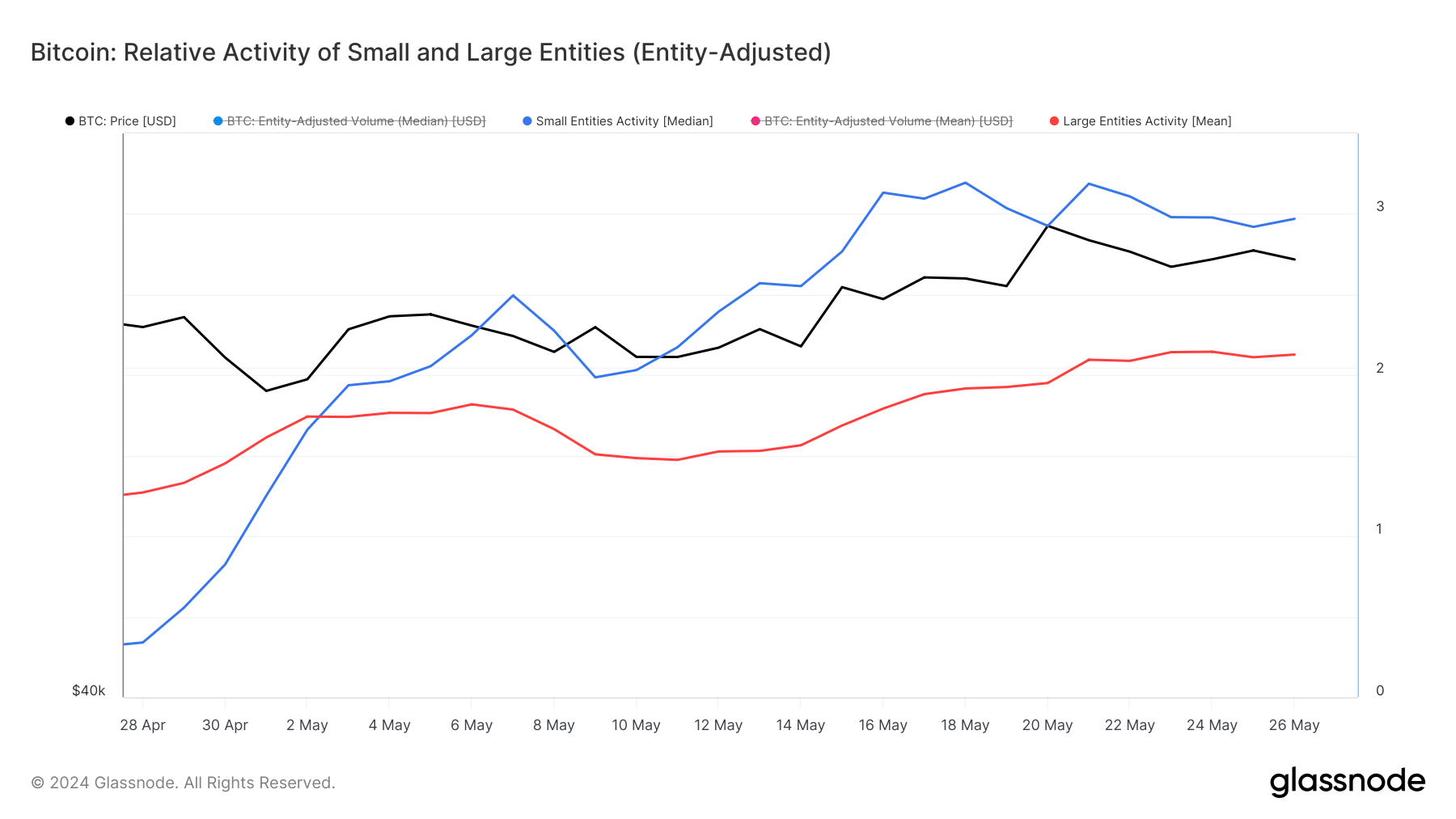

Since May 3, the activity levels of small entities, represented by the median transaction volumes, have consistently outpaced those of large entities.

The skewness in transaction volumes, where the average transaction size (mean) is larger than the typical transaction size (median), indicates that many small transactions happen frequently. This pattern is typical in Bitcoin markets and shows strong involvement from retail investors, who generally make smaller trades. When the activity of small entities is higher than that of large entities, it usually means the market is driven by retail investors’ excitement and speculation, often seen at the beginning of a bull market. On the other hand, if this activity decreases, it can suggest that retail interest is fading and the market might be stabilizing or consolidating.

On May 18, the median transaction volume of small entities reached a peak activity ratio of 3.194, while the mean transaction volume of large entities was at 1.916. This divergence shows a much larger base of smaller transactions, indicating increased demand and speculative activity among retail investors.

The continuous increase in small entities’ activity, especially during significant price volatility, such as the peak of $71,400 on May 20, shows significant retail enthusiasm. Retail-driven demand like this can often increase market volatility, as smaller investors react more swiftly to market changes than large institutional players. Glassnode’s data for May 26 further confirms this trend, with small entities maintaining a high activity ratio of 2.969 compared to large entities’ 2.127, despite a price correction to $68,500.

Given that this is the first time small entities’ activity has outpaced large entities since October 2023, it’s safe to say that the market has become increasingly bullish.

The increased activity among small entities indicates strong grassroots support for Bitcoin’s price movements, which could sustain upward momentum in the short to medium term. A decrease in activity from large entities during this time would be a warning sign, as markets driven solely by retail speculation are incredibly unstable and prone to volatility.

However, there has also been a continuous increase in large entity activity. The influx of large investors into the space, driven largely by the popularity and accessibility of spot Bitcoin ETFs in the US, has kept activity consistently high. The fact that small entities had a higher rate of activity during the past month shows that most of the volatility came from retail, while foundational growth was fueled by institutions.

The post Retail activity dominates Bitcoin, overshadowing institutional moves appeared first on CryptoSlate.