- May 16, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

The 13F filings for Bitcoin exchange-traded funds (ETFs) in the first quarter of 2024 have unveiled a significant surge in demand and investor interest.

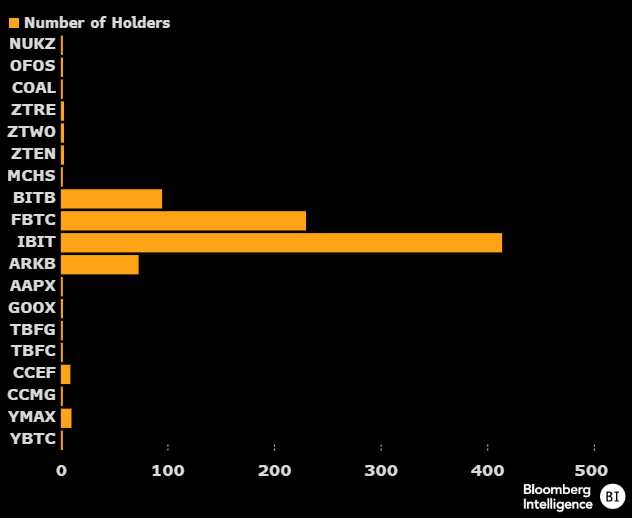

According to Eric Balchunas, a senior ETF analyst at Bloomberg, BlackRock’s (IBIT) had an astounding 414 reported holders in its inaugural 13F season. Balchunas noted that

“Even having 20 holders as a newborn is bfd, highly rare.”

Fidelity’s FBTC, Bitwise’s BITB, and Ark’s ARKB have also garnered substantial investment, contributing to their notable success.

Across nearly 1,500 entries, 929 institutions own at least one Bitcoin ETF, and the top owner was Millenium Management, with $1.9 billion in long positions across the ETFs, according to a pseudonymous Bitcoin analyst, Trader T.

The filings showed that 44% of reported institutions own IBIT, making it the most popular choice among international investors. Additionally, 65% own the Grayscale Bitcoin Trust (GBTC), and 99% of the institutions are based in the US, with Hong Kong-based firms coming in second.

The post Insights from Q1 2024 13F filings for Bitcoin ETFs appeared first on CryptoSlate.