- March 25, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Bitcoin’s innovations and hard money standard could bring innovation and competitive equalizing to international manufacturing and trade.

“You know what the trouble is, Brucey? We used to make shit in this country, build shit. Now we just put our hand in the next guy’s pocket.”

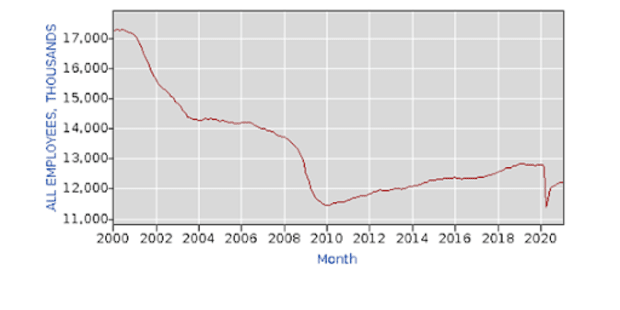

It is no secret that the United States’ manufacturing production has declined over the past few decades. The days of the Industrial Revolution are long gone, as the United States has transformed into a consumer-based economy. This divergence really became clear around the turn of the 21st century. According to the U.S. Bureau of Labor and Statistics, United States manufacturing jobs have dropped from around 17.5 million in 2000 to around 12.5 million today.

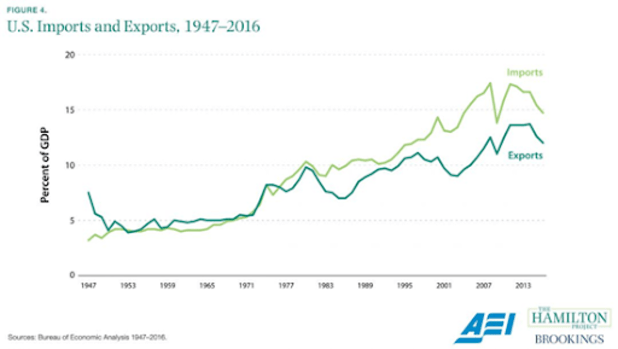

When you look at the United States imports versus exports as a percentage of GDP, a similar trend emerges:

A Shift In Manufacturing Production

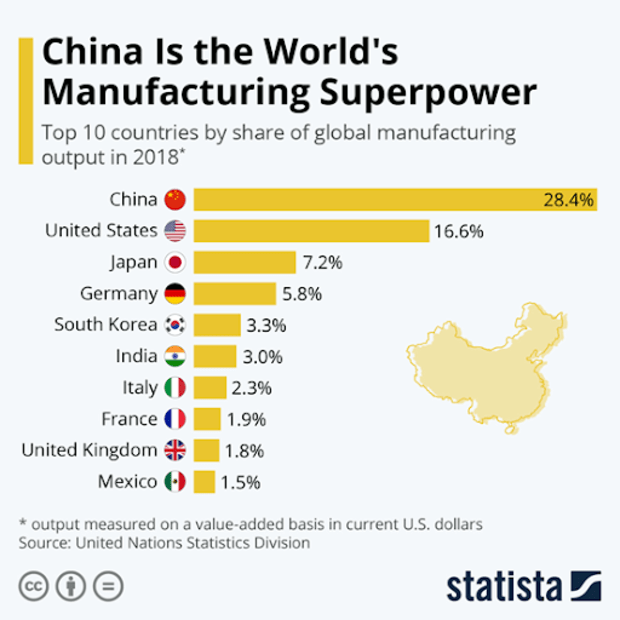

So, where has all of this manufacturing gone? To China, and more recently, other developing Asian nations. Many of these countries have implemented export-led growth strategies in order to take manufacturing share from America. These governments tend to offer attractive tax breaks for foreign companies to bring their manufacturing plants in. On top of that, these developing nations have comparative advantages against developed countries like America. Export-dependent nations like China have fewer labor restrictions, allowing their workers to be more productive for less pay than most developed country employers.

While there are many factors at play that give China a manufacturing edge over other countries, arguably its most important comparative advantage is in currency. China consistently devalues the yuan in order to have its exports priced cheaply for foreigners. When Chinese exports were down 8.3 percent in 2015, the People’s Bank of China took drastic measures to devalue the yuan in order to support their export led strategy.

Historically, China was competing with other fiat currencies in order to offer the most attractive pricing. However, with the recent rise of the global and permissionless cryptocurrency bitcoin, many industries are transforming at a rapid pace.

Will bitcoin compete with fiat currencies as a payment option within global manufacturing and trade? And, if so, how will this new payment option affect the current power dynamic within the global trade ecosystem?

Bitcoin: New Currency Of Global Trade?

Using bitcoin with international transactions has some clear advantages over its fiat counterparts. Bitcoin possesses unique qualities that are not available in government currencies.

While bitcoin gets a lot of heat for its transaction processing time, its final settlement is much more efficient than the archaic foreign exchange process. The average bitcoin transaction settles in around 10 minutes. Compare this to the global foreign exchange market where most currency exchanges settle two days after the trade date, with a few settling one day later. Transacting in bitcoin is more efficient, as both parties would be dealing with just one currency, and the payment would settle faster than it would through the international banking system.

When analyzing large value transactions in bitcoin, it is clear that bitcoin offers more attractive fee options than the fiat banking system. Fiat currencies have wire fees moving from one bank to the other, and also conversion fees for the party converting into its own nation’s currency. Bitcoin simply has miner fees with each transaction. As of February 2021, the average bitcoin transaction fee was $23. Bitcoin is clearly the cheaper option for high-value transactions. Bitcoin transactions are also irreversible, giving transactors assurance once the money hits their wallet. Bitcoin is also permissionless, it can be traded anywhere at any time.

Common pushback on the idea of transacting in bitcoin is that no one in their right mind would want to give up a currency that is expected to appreciate so much in value. But here is where the game theory comes into play. Entrepreneurs that want bitcoin will look to entice others to give their bitcoin away (see “Everyone’s A Scammer”). Earning bitcoin allows individuals to avoid burdensome know your customer (KYC) laws, as well as save money on exchanges and transaction fees. Are there businesses out there willing to undercut their competition to be paid in bitcoin? And can they find a trading partner that is not a believer in the currency, but are looking for an immediate discount in fiat terms?

Only time will tell. Companies like Zap, with its Lightning Strike app, and Square, with its Cash App, are revolutionizing payments. They integrate both bitcoin and fiat payment systems into users accounts, allowing both bitcoin and fiat to be sent interchangeably all over the world. Perhaps the decision for a 10 percent discount in bitcoin won’t even force the buyer to own bitcoin, but will allow for a seamless transition in payments between bitcoin and fiat currencies.

Will Bitcoin Alter Power Dynamics In Global Manufacturing?

Presently, bitcoin is attempting to prove its worth as a store of value. Recently, the currency surpassed $1 trillion in market capitalization, and institutions are starting to pile in. If bitcoin is established as a store of value, many believe that the currency will then begin to evolve as a more widely-used medium of exchange. It would be interesting to see how the implications of a hard money standard like bitcoin could affect global trade and manufacturing.

If we got to the point as a society where bitcoin became the universally-accepted payment network, nations with weaker currencies like China would lose their comparative advantage. With this would come the cat-and-mouse game between regulators and manufacturing companies. Many countries whose economies rely on exports may view bitcoin as a threat to their comparative advantages. On the other side, you will have manufacturers that want to receive bitcoin for their goods. Could there be a migration from traditional export-driven nations to ones that are welcoming to bitcoin?

America and much of Europe was on the gold standard during the late 19th century and into the 20th century. This time period was known as the “Gilded Age” in America, where the United States became the global leader in manufacturing. Many credit the deflationary effects of a hard money standard for technological discoveries and industrial innovations during this time period.

Perhaps another hard money standard in the form of bitcoin can promote further innovation within manufacturing. If the 21st century develops along the same lines as the 19th century, the countries that are on a hard money standard will benefit the most in manufacturing and global trade.

This is a guest post by Jackson Forelli. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.