- March 23, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Following a momenumentous S1 filing, the cryptocurrency exchange Coinbase appears poised to shift the public perception of exchanges at large.

Coinbase’s recent S1 filing has been hailed as something of a watershed moment.

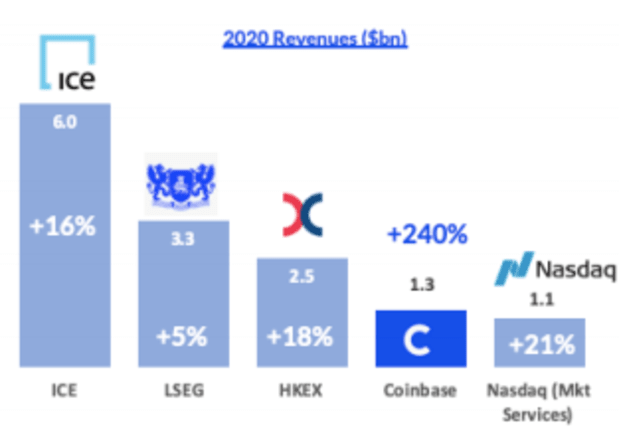

What might be most incredible is that private markets value the company at about $100 billion, putting it ahead of the most-established traditional exchanges. And that’s by quite a margin! If we look at traditional exchanges, one of the more robust has been Hong Kong’s HKEX, which was strong enough to attempt a takeover of the London Stock Exchange last year. As of now, it’s market cap comes to a mere 75 percent of Coinbase’s pre-IPO price.

Even cryptocurrency enthusiasts may be wondering if that number is a little overstated. The short answer is, that like much else in the digital asset and fintech space, this valuation is largely based on forward-looking factors. However, when looking at the S1 filing, the numbers aren’t actually that unrealistic.

Coinbase’s 2020 revenue of $1.3 billion puts it ahead of Nasdaq’s “Market Services” segment and at a half of HKEX. What’s eye-popping is the 240 percent growth in revenue year-over-year. Even with continued liberalization of Chinese Markets, HKEX is unlikely to improve exponentially on it’s already-impressive 18 percent year-over-year growth, for instance.

And that is almost certainly what’s driving the bull case for Coinbase. Cryptocurrency is still a nascent market, driven in large part by retail customers. In terms of margins, Coinbase doesn’t fare too badly either with its net-income margin of roughly 33 percent — far below HKEX’s 77 percent margin but quite reasonable for what’s effectively an early-stage company.

The bears do have a lot going for them also. And I won’t get into all the risk factors as the challenges of regulatory oversight and the volatile nature of cryptocurrency itself are well-understood. But what’s interesting is the imminent challenge to centralized exchanges from within the cryptocurrency space.

UniSwap is one such contender. It’s a decentralized exchange that operates with no central authority. Indeed many decentralized finance (DeFI) exchanges like UniSwap and Kyber, as well as banking and lending protocols like AAVE, can potentially herald a paradigm shift for the entire concept of an “exchange” as we know it. Uniswap’s trading volumes have grown exponentially and has already facilitated $100 billion of cryptocurrency in its life-to-date (much of it in 2020).

Time will tell whether or not Coinbase lives up to its pre-public valuation hype, but it appears there is a very realistic chance that this is the beginning in a larger trend of cryptocurrency exchanges catching up to or even supplanting traditional ones.

This is a guest post by Muneeb Jan. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.