- March 22, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Bitcoin Magazine’s “Bitcoin Wallets For Beginners” series covers everything you need to know about obtaining and securing your bitcoin in a safe and private way.

This article is designed to explain the importance of self-custody and the dangers of know your customer (KYC) regulations; to demonstrate to Bitcoin beginners how to install, secure and use a Bitcoin wallet; and to explain how to acquire KYC-free bitcoin.

You can find the articles in this series published individually as well:

Bitcoin Wallets For Beginners, Part One: Self Custody And Avoiding KYC

Generally speaking, new Bitcoin users discover the importance of self-custody and the dangers of KYC after they have already started acquiring bitcoin. Since bad habits are hard to break, I wanted to cover this topic for Bitcoin beginners first. This tutorial has been designed for a total Bitcoin beginner, someone who is interested in Bitcoin but has no idea where to begin or what a Bitcoin wallet is or what to do with them.

With this ongoing five-part series, I hope to have put together an informative guide to some pitfalls to watch out for for new users with a focus on the installation and use of their first Bitcoin wallet and how to obtain non-KYC bitcoin. This way. anybody can bookmark this tutorial and reference it when they have the time and interest.

This first part is my attempt to help Bitcoin beginners understand my opinions around the importance of self-custody and the dangers of KYC. I wanted to take the time to share these thoughts in long form because I believe that if a person can understand what is at stake, then they will take this stuff more seriously, forming better habits from the beginning. I’m making the guides I wish I had when I was first getting started with Bitcoin.

FIVE REASONS FOR SELF CUSTODY

When you install a Bitcoin wallet on your mobile device or desktop, you are taking the radical responsibility of self custody. This means that you and you alone are responsible for your bitcoin. Some of this may be alarming, but it’s the honest truth; if you lock yourself out of your wallet, then that is 100 percent your fault and you are responsible for that loss. If you fall victim to a phishing attack and share compromising information with a scammer, that is 100 percent your problem and your loss. There is no customer support hotline in Bitcoin. There is no charge-back feature in Bitcoin. And there is no card-lock security in Bitcoin. Unlike using a bank, you and you alone are responsible for your bitcoin once you cross the threshold into self custody.

As the saying goes: “A ship in harbor is safe, but that’s not what ships were built for.”

You may be asking yourself why I’m such an advocate for self custody after reading that last paragraph.The answer is simple: freedom. With non-KYC bitcoin in self custody, financial permission, confiscation and censorship have no effect on the way that you economically interact with the world. That may come across as hyperbole or a load of buzzwords but let me give you five very real-world examples that may resonate with your life experience.

1. Maybe you have worked your whole life but you have never been able to set aside a meaningful savings account. Maybe you live paycheck to paycheck and you spend 110 percent or more of your wages every pay period.

This is because fiat currency like the USD is a terrible store of value. Your purchasing power is continually being siphoned out from underneath you through various forms of inflation, which is effectively confiscation. Every dollar printed is stealing the value of the dollars you accepted in exchange for your time and effort in labor.

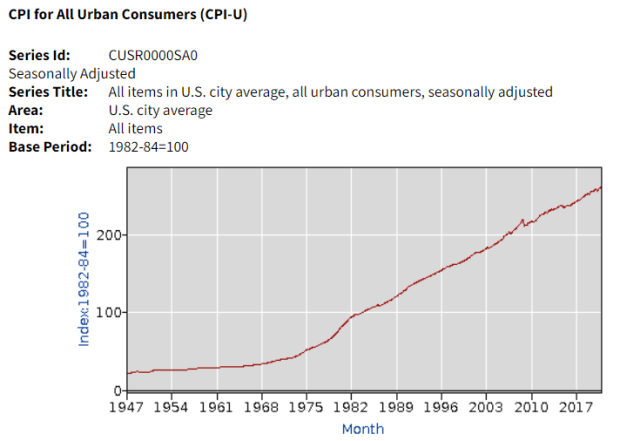

Bitcoin helps ensure that the value stored today will be preserved for the future, and when you self custody your bitcoin, you can verify that your wealth is cryptographically in your possession at all times without trusting a third party. Check the Consumer Price Index to see how the cost of a basket of average consumer goods and services has increased over the years.

The majority of us have only ever seen our money lose purchasing power. If your wages haven’t increased by about 160 percent since 1983, then you’re falling behind.

2. Maybe you have had your wages garnished — that’s a much more direct form of confiscation. Maybe your state government decided that you owed it even more money in taxes than you already paid. Your state government has the authority to siphon money out of your paycheck before you receive it.

You thought living paycheck to paycheck was tough before? Try opening your paycheck one day to find that 15 percent has been confiscated after your federal income tax and state income tax and medicare and social security and mandatory health insurance have been taken.

Every Bitcoin transaction must meet the consensus rules, and if a transaction is not signed by the owner, then it will not be accepted. When you self custody, no third party can arbitrarily confiscate what is yours. When centralized authorities are removed from the equation, value can be transferred from peer to peer, uninhibited.

3. You’ve probably been working for a while. Every paycheck you get has medicare and social security taxes taken out that you will likely never benefit from. But the worst part is that every paycheck has a federal income tax taken out as well.

Federal income taxes are used to pay the interest on the money that the Federal Reserve prints for the United States Treasury. That’s right, you have to pay interest out of your pocket for a monetary policy that you have zero voting rights for. In fact, the people operating this monetary policy are not even elected officials, you have absolutely no voice.

The more money they print, the more purchasing power is confiscated from you, and there is more money circulating for you to pay the interest on. Bitcoin has a 21 million coin hard cap, this means that using bitcoin as a bearer monetary instrument ensures no representative and un-backed IOU is being printed and loaned out for circulating economic activity, thus eliminating the need for an interest-based monetary debt instrument, such as the U.S. dollar.

4. Have you ever had a transaction blocked by your bank because it doesn’t support the type of business you are attempting to interact with? That’s what permission looks like; your money, their rules.

Maybe the business was totally legal but it’s just in a taboo industry, like pornography. Maybe it’s legal in your state but illegal at the federal level, like a marijuana business. Maybe, in a not-so-distant future, your political contributions will be blocked unless they align with your bank’s vision of the world.

When your money is in someone else’s possession, you have to get their permission to use it. With bitcoin in self custody, so long as your transaction follows the consensus rules, i.e., you’re not trying to double spend, then nothing will stop it. No one’s opinion of your business is relevant, Bitcoin is software and will execute as expected for any person for any reason, every single time.

5. Have you ever been blocked from opening an account at a bank or had your account closed? That’s a form of censorship.

In 2019, when I moved my family to Wyoming in an attempt to leverage its “crypto friendly” legislation to start a Bitcoin ATM business, we found out the hard way what financial censorship looked like. We were rejected by 12 banks in Wyoming, plus one bank in California, two banks in New York and two banks in Colorado — 17 banks in total. Two of them had even opened accounts with us and then promptly shut us down and refunded our deposits once they found out our business was Bitcoin-related.

Bitcoin ensures that anyone is free to economically interact with the rest of the world. Because of Bitcoin’s decentralized nature, there is no central authority to deny your transaction or shut you out of the network. So long as your transaction meets the consensus rules, it will be valid and upheld by the network.

These are just a few examples of what it means to take self custody of money that is permissionless, cannot be confiscated and is censorship resistant. Third parties and all of the associated risks can be eliminated by using Bitcoin. There are many more examples and I think that if you reflect on your own life experiences, you will find incidents in which you fell victim to these kinds of problems.

THE RISKS OF TRUSTING BITCOIN EXCHANGES

Let’s say you get all that, you understand why bitcoin is better money — with the hard cap, the permissionlessness and the censorship resistance. But you still think that having your bitcoin in the possession of your exchange or broker is better than self-custody. After all, the exchanges deal with huge volumes of bitcoin everyday, so surely they can be trusted with your bitcoin. But therein lies the problem: trust. Let’s discuss what you’re sacrificing with that trust and see if you still think the same way about self custody afterwards.

Maybe you have heard of Mt. Gox, Quadriga or EXMO? These are a few exchanges that had catastrophic impacts on the people who trusted them.

When an exchange gets hacked, there are no fixes for the end users who have their bitcoin stolen. There is no FDIC or SIPC insurance. Furthermore, there is often no way for the public to verify that an exchange actually has the bitcoin it purports to have. An exchange could potentially sell 100 bitcoin IOUs when it only has 10 actual bitcoin, or it may have zero real bitcoin for that matter. There’s no way for the public to know.

Ask yourself what happens when you’ve handed your life savings over to Coinbase, for example, and suddenly there is a bitcoin liquidity crisis, and it turns out it sold more in bitcoin IOUs than it actually held in real bitcoin. Do you really think you’ll be safe? Do you really think you’ll get your money back? If you had your bitcoin in self custody, it would be safe and you could verify its existence for yourself.

Ask yourself what happens when the U.S. Securities and Exchange Commission decides that bitcoin trading needs to be halted, like it arbitrarily decided for 15 publicly-traded stocks. Do you think Coinbase or other regulated exchanges will keep your best interests in mind?

I want to take a moment to explain another issue that goes hand-in-hand when you trust a custodian with your bitcoin, instead of holding your bitcoin in self custody, and that issue is KYC.

THE DANGERS OF KYC

KYC requirements is an invasive scare tactic used to preemptively collect the data and personally-identifiable information about you that would prove, beyond a reasonable doubt, your ownership of bitcoin. Stemming from the Bank Secrecy Act, KYC regulations are enforced by the Financial Crimes Enforcement Network (FinCEN), a division of the U.S. Treasury.

These regulations were originally the federal government’s attempt to prevent U.S. citizens from funding foreign enemies. However, these regulations have morphed into an excuse for corporations, government contractors and state agents to harvest, track and share your personal information, opening the means by which governments can enforce controls on you. The range of KYC requirements can vary from providing your full name, birth date, email and phone number to your social security number, physical address, IP address, financial background statements, photographs of you holding your government ID, or all of the above.

Since bitcoin exchanges, brokers and most on ramps are conducting what the federal government considers “regulated activity,” these businesses are required by federal law to comply with these regulations. By not complying, a business runs the risk of being fined or shut down, which means that your best interests will always take a back-seat when dealing with regulated entities.

In recent years, it seems as though the federal government has irrationally raised the KYC requirements when it comes to bitcoin. For example, the Travel Rule would require money services businesses to automatically file suspicious activity reports to the federal government for bitcoin transactions exceeding $250 in value that cross a U.S. border, among other things.

The Travel Rule was fueled in part by the Financial Action Task Force (FATF), which is basically a group of assholes that take the broken anti-money laundering (AML) policies of the United States and try to force them into Bitcoin by writing recommendations like this.

This is the basis for my conjectures that forcing broken legacy system regulations into the Bitcoin ecosystem is abhorrently disastrous. The old financial system has failed miserably, the vast majority of people I know have seen their wages stay stagnant for years, they cannot afford to buy a home in the neighborhoods they grew up in, the money they do have is worth less every year, and 75 percent of all USD in existence has been printed after the launch of Bitcoin in 2009. Bitcoin is not the government’s money, they don’t get to make the rules.

Clearly, the rules governing the legacy system have failed, so I find it disturbing that people want to force these same rules into Bitcoin. The rules don’t even work in a system where the orchestrators have all of the control, why in the world would anyone think those kinds of rules are going to make Bitcoin better? I say cut the ties, burn the bridge that connects the old world to the new. Central banking is a rotten corpse and I’m sick of its stench.

The regulations are supposed to inhibit money laundering, however, the world’s largest banks are the ones facilitating the vast majority of money laundering and when they get caught, the penalties are less than the profits they made, which is incentive to do it again. If you haven’t read the articles from the International Consortium of Investigative Journalists, collectively known as the FinCEN Files, I highly recommend familiarizing yourself with them. Their key findings were:

- Global banks moved more than $2 trillion between 1999 and 2017 in payments that they believed were suspicious, The figures include $514 billion at JPMorgan Chase and $1.3 trillion at Deutsche Bank.

- Five global banks moved illicit cash for shadowy characters and criminal networks even after U.S. authorities fined these financial institutions for earlier failures.

- Banks didn’t have information about one or more entities behind the transactions.

- Years after concerns first emerged, banks continued to move money for fraudsters, drug dealers and allegedly corrupt officials, leading to cases of real harm.

There is also a cool map of the major transactions that were flagged in suspicious activity reports provided by ICIJ.

KYC/AML regulations cost businesses billions of dollars, these costs are passed on to the consumers. Ronald Pol of amlAssurance wrote a thought-provoking article about the costs and effectiveness of KYC/AML policies. He wrote:

“…anti-money laundering policy intervention has less than 0.1 percent impact on criminal finances, compliance costs exceed recovered criminal funds more than a hundred times over, and banks, taxpayers and ordinary citizens are penalized more than criminal enterprises.”

Can you see what kind of potential problem is mounting here? There are millions of hard working people who have struggled their entire lives, having their purchasing power confiscated from them through inflation, their money held hostage by the rules of bankers and their freedom of financial expression being censored. These people have discovered a solution to those problems with Bitcoin and they have volunteered their personal information to get it.

The requirement for that information is a cascading shadow of a failed financial system that prolongs the agonizing death of central banking. As country after country falls into a full blown currency crisis, the demand for bitcoin will increase. This means any information related to individuals who are in possession of bitcoin becomes more valuable. With the sovereignty of nations threatened and the masses left to fend for themselves, survival depends on adaptability and the ability to remain anonymous.

Thinking adversarially, as any responsible self-custody advocate should, imagine what happens when a Ledger-style data breach occurs on an exchange with more detailed personally-identifiable information and the individual’s Bitcoin addresses. I’m not even talking about the security of the bitcoin in the exchange’s possession, I’m talking about customers’ identifying information linked to their bitcoin holdings being breached.

Now, imagine a complete currency collapse of the U.S. dollar coupled with an inversely proportional rise in bitcoin demand. Meanwhile, your name, physical address, photograph and the amount of bitcoin you own is publically available. This may sound like I’m being an alarmist, but this will be an unfortunate reality that many people will have to face. People who are known to have bitcoin will be targeted and attempted kidnappings, ransoms or worse will occur. Start using the tools to protect yourself now.

It is already known that major exchanges actively partner with law enforcement agencies. Take, for example, the Coinbase/IRS/DEA announcement. These corporations are not your friends, they do not have your best interests in mind, they will protect themselves first and foremost and they will obey the government’s commands to make sure that they can stay in business and to make sure you are the product.

Consider another attack vector: If the government knows your identifying information and your bitcoin holdings, then you are more likely to become a target of theft through unrealized capital gains taxes, enforcement of a 6102-style executive order or full forfeiture of your assets as a matter of “national security.” When the sovereignty of a nation-state is threatened, nothing will stand in the way of isolating that threat. Even if it means imprisoning swaths of the population.

Keep in mind that the whole reason Bitcoin was created is because the ruling authorities completely messed up the money to begin with. Not by accident, but by systematically and methodically destroying the functions of money to purposefully enrich the few and create debt slaves out of the many. For generations, the majority of society has been harvested and used as fuel to keep the machine running. Now that Bitcoin has fixed the money, this thwarts the efforts of those in power to remain in power. They will not give up easily and they will try to drag you down with them.

Furthermore, KYC information polluting the Bitcoin ecosystem cripples the permissionless state of the network and opens the door for censorship opportunities.

Spend some time reflecting on these war games. Hope for the best, be prepared for the worst. Users can mitigate all of the issues listed above and more by taking the radical responsibility of self custody over their non-KYC bitcoin. The first step in doing that is to install a wallet on your Android, iPhone or desktop.

Bitcoin Wallets For Beginners, Part Two: How To Install Samourai

If you have an Android mobile phone, then I highly recommend using Samourai Wallet. This article will walk you through the basic steps for installing, securing and using Samourai Wallet on Android. Before getting started, it is a good idea to have a pen and paper ready. And Remember to start with small amounts of bitcoin until these concepts make more sense and you are comfortable putting your funds in a mobile wallet. And always backup your seed phrase!

Step One: Install Samourai Wallet

Samourai Wallet can be downloaded from its website or F-Droid, compiled from source code or installed directly on your Android device from Google Play Store.

For the simplistic and basic purposes of this guide, I’m only going to cover the installation instructions from Google Play Store. Be aware of malicious apps that may look similar, ensure that you are getting the Samourai Wallet app with over 100,000 downloads.

From your Android device, navigate to the Google Play Store app and then search for Samourai Wallet and install it, then open it.

Step Two: Allow Permissions

Allow camera permission for the app and operating system (OS). This allows for QR code scanning. Then, Allow read/write permission for the app and OS. This allows the encrypted backup file to be saved.

Step Three: Enable Tor

Make sure you enable Tor by moving the slider to the right. Wait for the confirmation, this allows app communication over Tor.

Note: If you have a Dojo, this is the step at which you would connect it. Keep in mind that, although running your own node is an advanced topic, it is highly recommended that you learn about it. If you do not use your own node, then you are trusting someone else’s node. There are many full node implementations available. This goes beyond the scope of this article but for some good resources, check here.

After enabling Tor, Select “START NEW WALLET.” Once installed, your Samourai Wallet will save an encrypted backup file to your Android device.

Step Four: Create A Passphrase And PIN

Next, you will be asked to create a passphrase. This is the passphrase that encrypts your backup file and your wallet’s BIP39 passphrase, also known as your “thirteenth word.” Any combination of numbers, letters and special characters is acceptable. I suggest trying to use a high-entropy password that cannot be guessed, such as one from a random password generator. Others may suggest using a passphrase that can be easily memorized. Weigh the tradeoffs for yourself and do what is best for you. Whatever you choose, remember that this passphrase will be necessary to recover your wallet in the event that your mobile phone is lost, damaged or replaced. Confirm acknowledgement that no one can help you recover this passphrase, then select “Next.”

Next, create a PIN code for accessing the app. If someone were to gain access to your Android phone, then this PIN code will protect your wallet. Any combination of numbers between five and eight digits will work. Try to use a PIN that cannot be guessed. Once entered, you will be asked to confirm the PIN code. Then select “Next.”

Step Five: Secure the Seed Phrase

Note: This is the most important step.

- Write down your words in order on a piece of paper

- Secure this piece of paper as if it were gold or jewelry

- Do not screenshot these words.

- Do not save these words on a computer or on your phone

- Do not say these words out loud

- Never share these words with anyone for any reason

- Your bitcoin is only as secure as your 12-words and passphrase.

- Double check your work, then confirm acknowledgement that you have secured your 12 words

- Select “RETURN TO WALLET”

- You will also need your passphrase from above for a complete secure backup

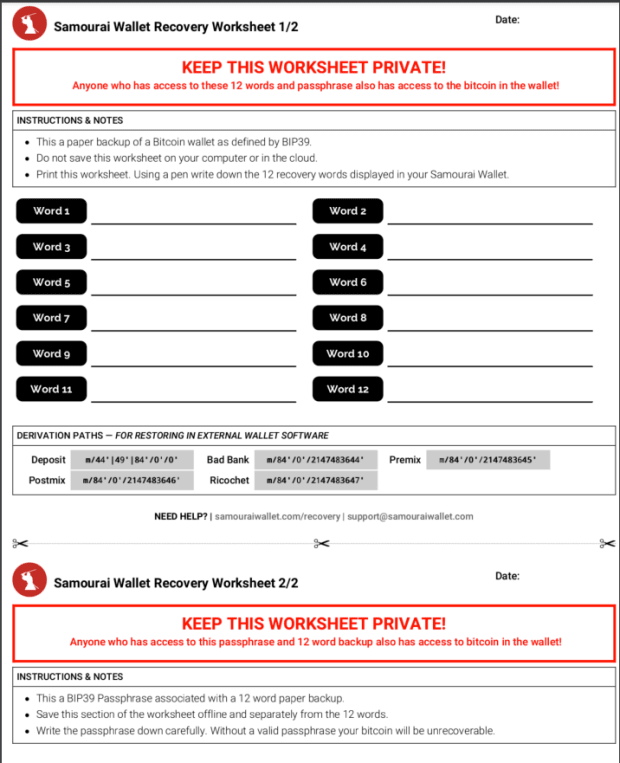

It’s a good idea to use the recovery worksheet provided by Samourai Wallet, it has all of the necessary fields specifically for your Samourai Wallet to fill in and help you keep your backup information organized. Find the downloadable PDF here.

Note: Once you get more serious about Bitcoin, consider securing your seed phrases on metal instead of on paper.

Step Six: Claim Your PayNym

Each Samourai Wallet user gets a unique “PayNym.” This can be used to collaborate with other Samourai Wallet users in cahoots transactions, to post public payment codes without revealing transaction history and more.

Select “CLAIM YOUR PAYNYM” at the bottom of the screen. Then select “YES” to claim your new PayNym.

Step Seven: Receive Bitcoin

There are different ways to receive bitcoin to your new wallet. From your wallet home screen, select the blue plus (+) sign and then select the green “Receive” piggy-bank button. This will bring up your first receiving address QR code. Or, to receive from another Samourai Wallet user, you can select the purple “PayNyms” icon instead, which will allow you to share the payment code in QR format or in text. Once you and another Samourai Wallet user follow one another’s PayNyms, then you can collaborate in cahoots transactions together.

The person sending you bitcoin can scan your wallet address QR code and spend from their wallet.

For example: Samourai Wallet users can collaborate in privacy-enhancing transactions like Stonewallx2. Using your bitcoin address QR code as the receiver, your sender can use their PayNym to collaborate with others to send you funds more privately. With the bitcoin address displayed above, the receiver has now been given 0.015 BTC from a privacy-enhancing Stonewallx2 transaction.

Once you have an unspent transaction output (UTXO) in your wallet like this, you can easily click on it and view more details. You can even open the transaction identification (TXID) on a block explorer and see even more details.

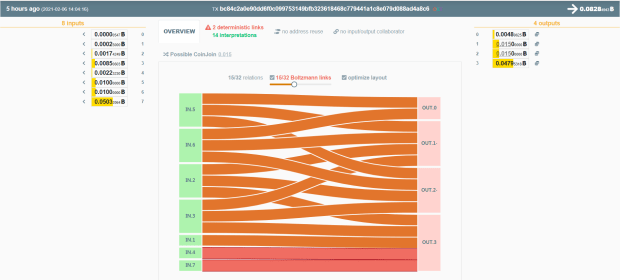

Below is how the transaction looks on-chain. Eight inputs, four outputs, in this example. Two of the outputs are identical, one is the actual spend and the other is a decoy. The common ownership heuristics have been broken. This is one way that privacy can be enhanced with these tools.

Step Eight: Spend Bitcoin

Find a collaborator and create a privacy-enhancing transaction with another Samourai Wallet user to send to any third party. First, select the blue “+” sign, then select the red “send” button, then enable cahoots.

Next, select “STONEWALLx2” and then select “Online” for the participant.

You and your collaborator should be following one another’s PayNyms, and then you can select your collaborator’s PayNym from your contact list. Then select the square-looking icon at the top to open your camera and scan the QR code from the person receiving your payment (a Blue Wallet user, in this example). Then, fill in the amount to send, 0.01 BTC in this example. Finally, select “REVIEW TRANSACTION.”

Next, you will be able to select your miner’s fee rate. Set it higher for more urgent payments accordingly. Once you begin the Stonewallx2 transaction, Samourai Wallet will exchange details of the transaction between the two collaborators’ wallets. This process is encrypted over Tor on the Soroban communication layer. You’ll get one last chance to review your transaction before broadcasting. The receiver should see a pending transaction arrive within moments.

You can also watch this demonstration video for installing Samourai Wallet on an Android for the first time here:

Conclusion

Samourai Wallet is a privacy-focused Bitcoin wallet that is most popular for its CoinJoin implementation, Whirlpool. Additionally, Samourai Wallet has post-mix cahoots spending tools like Stowaway and Stonewallx2. These collaborative transactions break common input ownership heuristics by obfuscating the true amount being sent and using decoy outputs.

Samourai Wallet was also the first Bitcoin wallet to implement BIP47, which enables users to share a payment code without exposing additional wallet details, enhancing privacy. Also, Samourai Wallet never reuses address and segregates toxic change and it has coin control and other advanced features. Your Samourai Wallet can also be connected to your own Bitcoin full node by using Ronin Dojo; another developer team that has built a powerful Bitcoin full node stack that is designed specifically for integrating with your Samourai mobile wallet and your desktop Whirlpool client. All communications in the Samourai Wallet/Ronin Dojo stack are routed over Tor by default.

To learn more about using Samourai Wallet, jump in its Telegram channel here.

You should now have a basic understanding of how to install Samourai Wallet on your Android, how to secure your wallet’s 12-word seed and passphrase and how to receive/send bitcoin in a privacy-enhancing way.

Bitcoin Wallets For Beginners, Part Three: Installing Blue Wallet

If you have an iPhone and have bitcoin, then I highly recommend using Blue Wallet to secure your BTC. This article will walk you through the basic steps for installing, securing and using Blue Wallet on iPhone. But, before getting started, it is a good idea to have a pen and paper ready. Remember to start with small amounts of bitcoin until these concepts make more sense and you are comfortable putting your funds in a mobile wallet. And always backup your seed phrase!

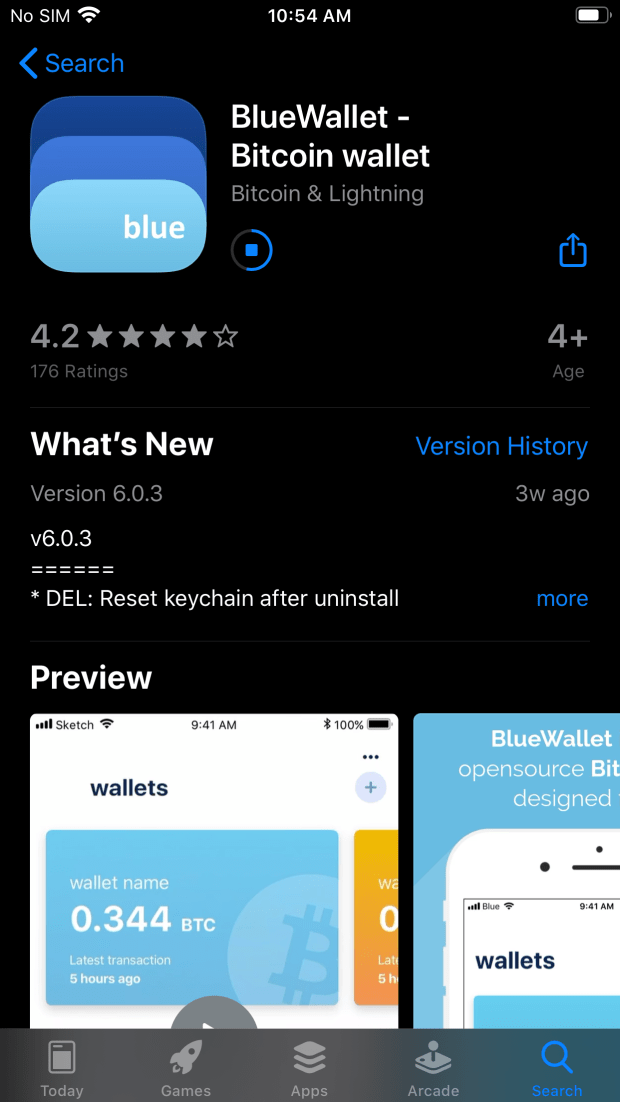

Step One: Install Blue Wallet

Blue Wallet installs just like any other app on your iPhone. Navigate to your Apple App store app and select download. Check Blue Wallet’s website for more details.

If prompted, enter your Apple ID password. Once installed, launch the Blue Wallet application.

Step Two: Wallet Setup

Users can decide to use Blue Wallet with the standard settings or with advanced settings enabled. Advanced settings allow users to utilize more features, like adding entropy (randomness) to their seeds with dice rolls or coin flips, to set up wallets for different Bitcoin address types and more.

To enable advanced options, select the three-dot menu in the upper-righthand corner of the homescreen, then select “General.”

Then toggle the “Advanced Mode” slider and select the back arrow to return to the wallet homescreen.

From there, select “Add a wallet.”

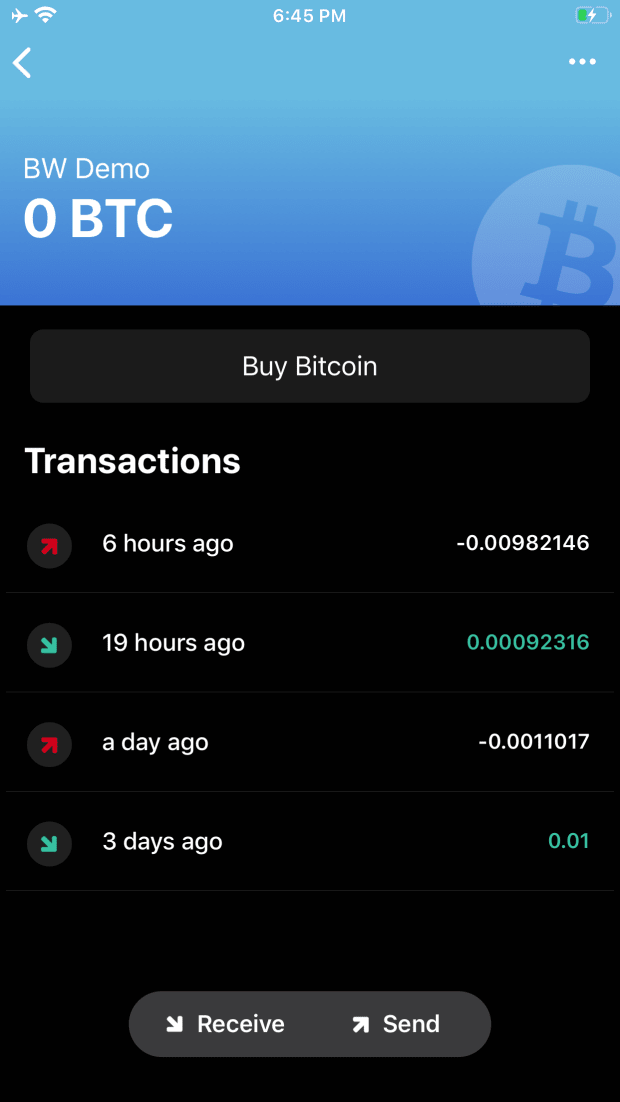

You can name your wallet anything that is convenient for you, I chose “BW Demo” for this example.

Then you can choose the kind of wallet that you would like to create. I chose a Bitcoin wallet for this example.

If you decided to enable the advanced options, you will notice that you can choose the address type for your new Bitcoin wallet. I recommend sticking with the BIP84 Bech32 native SegWit address type. These are the addresses that start with “bc1” and typically, they can save you on data space in your transactions which translate to less expensive miner fees.

Then, if you would like to provide your own entropy in your wallet seed, you can select “Provide entropy via dice rolls” and then you will be able to select various sided dice or you can flip coins to generate random numbers to include in the generation of your seed. This is not required, but it is a nice option to have.

Alternatively, select the blue “Create” button when you are ready to move on.

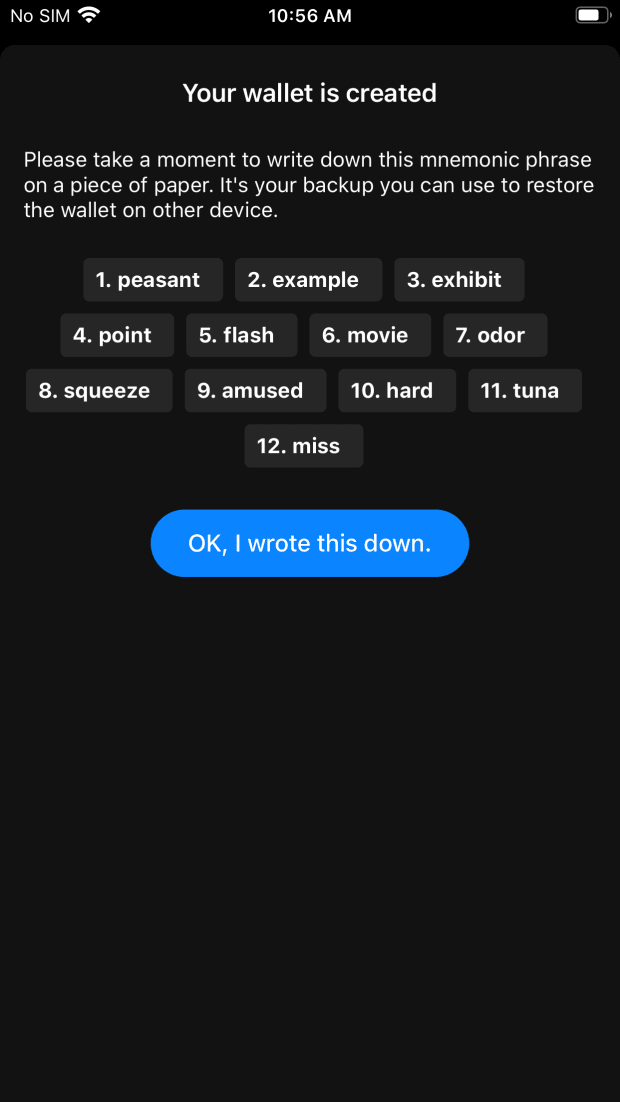

Step Three: Secure The Seed Phrase

Note: This is the most important step.

- Write down your words in order on a piece of paper

- Secure this piece of paper as though it were gold or jewelry

- Do not screen-shot these words

- Do not save these words on a computer or on your phone

- Do not say these words out loud

- Never share these words with anyone for any reason

- Your bitcoin is only as secure as your 12 words

- Double check your work then confirm acknowledgement that you have secured your 12 words

- Select “OK, I wrote this down”

Note: If you utilized the advanced option to provide your own entropy, then you should have 24 words to write down. Once you get more serious about Bitcoin, consider securing your seed phrases in metal instead of on paper.

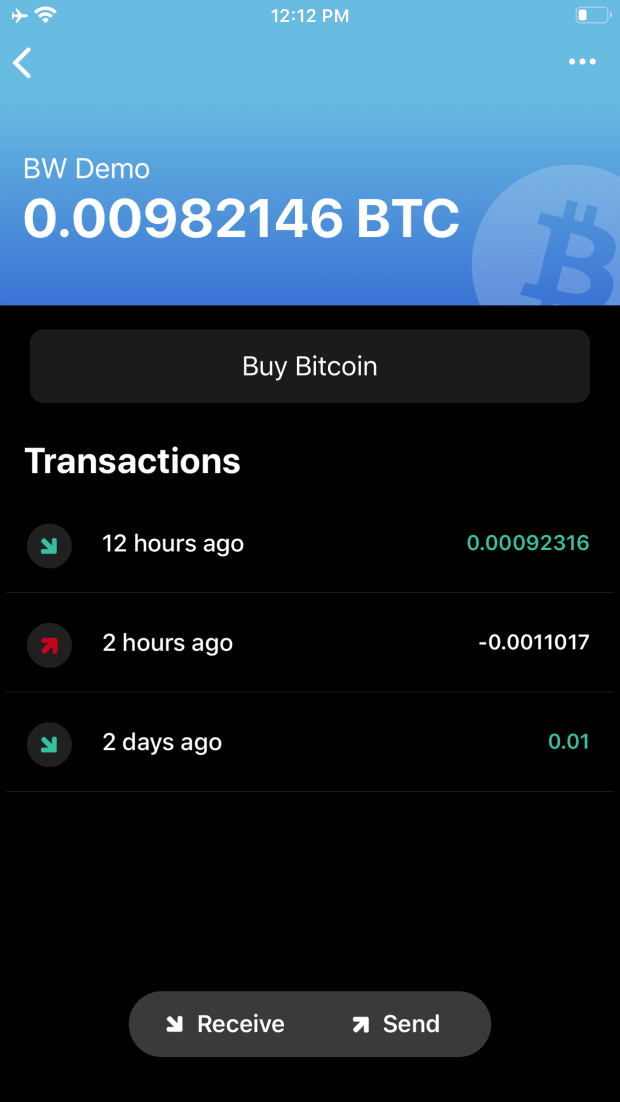

Step Four: Receive Bitcoin

Now that your new Bitcoin wallet is set up and you have secured your 12-word seed phrase, you are ready to start receiving bitcoin.

From the homescreen, simply select the wallet icon for the wallet you just created.

This will bring you into the wallet where you can then select the “Receive” button at the bottom of the screen to display your first Bitcoin address QR code.

Before displaying your QR code, Blue Wallet will double check with you to be sure that you have written down your seed phrase. Then you will be asked if you would like to receive notifications of incoming payments.

Now you should see your first Bitcoin address QR code. You can physically display this QR code to someone and they can scan it with their wallet to send you bitcoin. Or you can copy/paste the address text and send your receiving address to someone that way. Be aware of the privacy implications when sharing your Bitcoin address; all transactions on the blockchain are available to the public, so it is a good idea to keep this information separate from your identity.

Once a payment transaction from your sender is broadcast to the network, you should see the pending receipt in your wallet within moments. Your transaction will remain in a “pending” state until it has a certain number of confirmations. Each confirmation means that an additional block has been added to the Bitcoin blockchain after the block that contains your transaction. Typically, it is recommended to allow at least three to six block confirmations before trusting that your received funds are secure.

Step Five: Spend Bitcoin

Once your received funds have been confirmed, a green deposit arrow will be displayed next to the transaction. Likewise, spent funds will have a red withdrawal arrow next to them once they have been confirmed.

As you make transactions from your wallet, they will appear in a list when you open your wallet. To spend bitcoin that is available in your wallet, simply select the “Send” button at the bottom of your screen.

You will be prompted for additional details on the next screen.

On the next screen, you will be asked for the Bitcoin address that you want to send funds to. You can either paste an address if you have copied one onto your clipboard, or you can select the “Scan” icon in the address dialog box to initialize your iPhone’s camera and physically scan a Bitcoin address QR code from someone that you are sending funds to.

Once scanned, the address text will be displayed in the address dialog box. It is important to check and double check that the address text matches the address you are trying to send funds to.

If you want, you can spend your wallet’s full balance by selecting the three-dot menu in the upper-righthand corner. Then select “Use Full Balance.” You will be asked to confirm that you want to spend the entire balance of your wallet.

Blue Wallet also has the option of advanced features like coin control, replace by fee and more from this menu.

Finally, you will be asked to select a miners’ fee rate. This is based on the data size of your transaction and is used as an incentive to get your transaction included in the blockchain more quickly. You can select from three predetermined speeds or you can choose a custom fee rate.

Once ready, confirm the details of your transaction one last time and then select the blue “Send now” button.

Your transaction will be broadcast to the Bitcoin network. Remember, if you are not using your own node, you are trusting someone else’s. Running your own node goes beyond the scope of this article but for some good resources check here, here and here.

Once your transaction has been sent, it will be displayed in your transaction list in your wallet.

You can also watch this video for more on installing and setting up Blue Wallet on iPhone.

Conclusion

Blue Wallet is a sleek and powerful wallet available on iPhone as well as Android. I only covered the iPhone application in this article.

Blue Wallet is packed with advanced features like user-provided entropy via dice rolls and coin toss, coin control, variable miners fees, duress wallet, and Lightning integration. But my favorite feature is the ability to handle partially-signed bitcoin transactions (PSBT). With PSBT, you can import your hardware wallet xpub and use Blue Wallet as a watch-only wallet. This allows you to monitor the balance on your hardware wallet while on the go as well as to generate receiving addresses for your hardware wallet. Watch-only wallets cannot spend from your hardware wallet, so your funds are always secure.

When you want to spend from your hardware wallet, you can enter the watch-only wallet in your Blue Wallet application, construct the spend transaction and then export it as a PSBT. Then you can load this PSBT into your hardware wallet via the MicroSD card option and sign the transaction with your hardware wallet’s private key. Once signed, the transaction can be passed back to your Blue Wallet and broadcast to the network.

You should now have a basic understanding of how to install Blue Wallet on your iPhone, how to secure your wallet’s 12-word seed phrase and how to receive/send bitcoin.

Bitcoin Wallets For Beginners, Part Four: Installing Sparrow Wallet

If you have a desktop computer, then I highly recommend using Sparrow Wallet. This article will walk you through the basic steps for installing, securing and using Sparrow Wallet on desktop. Sparrow is meant to connect to your own Bitcoin node, if you don’t have a node setup already then check out this guide by @BitcoinQ_A and also this guide is a great resource for Sparrow Wallet. Before getting started, it is a good idea to have a pen and paper ready. Remember to start with small amounts of bitcoin until these concepts make more sense and you are comfortable putting your funds in a mobile wallet. And always backup your seed phrase!

Step One: Install Sparrow Wallet

Sparrow wallet is a desktop software application that is designed to be used with your own Bitcoin full node. In this example, I connected it to my Raspberry Pi Bitcoin full node running Bitcoin Core. Sparrow Wallet can be downloaded from: https://sparrowwallet.com/

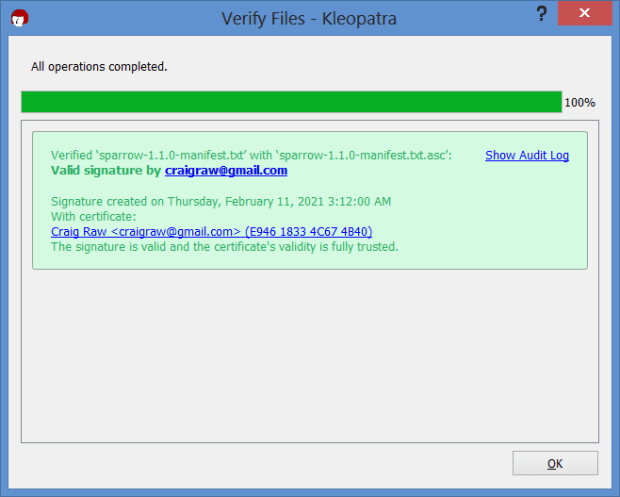

It’s good practice to verify any software that you download. I used Kleopatra. Verifying PGP signatures goes beyond the scope of this article, but it is a way that you can verify that you are downloading the purported software. For good software verification guides, check here and here for the basic concepts.

The TL;DR is: import the developers’ public key. Download the signed hash value. Verify the signature. Calculate the hash value on the executable file. And compare the checksums. When finished you should have a verified confirmation like this:

Now, I know that the hash values contained in the signed file are valid. Then I can compare those hash values to the .exe file I downloaded. If the signed hash value matches mine, then I can run the executable file in confidence.

d192d2199ef412aa9fbeb8c088b3167e5504315c0c3b3e0d563b581c4b1a21d4 *Sparrow-1.1.0.dmg

16105c0211aaa48035e9252d83f535b43056beb5f9af81e1735ceb2611b167ae *Sparrow-1.1.0.exe

29aa7cde1bfeac94e5c36f22282d0df25cbb5298df6d54375cca71fa9d76d726 *Sparrow-1.1.0.zip

d8d38626a47043d29e838472ad4a9721d3234f071fab7a8a3d3818a916f069f4 *sparrow-1.1.0-1.x86_64.rpm

1951239513265ec97556e63e5f320fb5bdfcdb37ac3803e5ce466f9e3b08d005 *sparrow-1.1.0.tar.gz

76f138e2bdda6511d1435a77352f215b313604703ff7e06739f81eb0984f71bf *sparrow_1.1.0-1_amd64.deb

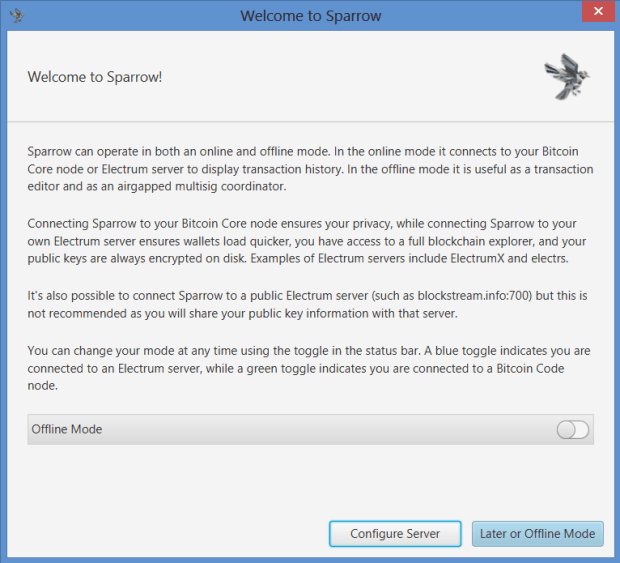

Step Two: Configuration

Once installed, toggle to offline mode and select “Configure Server.”

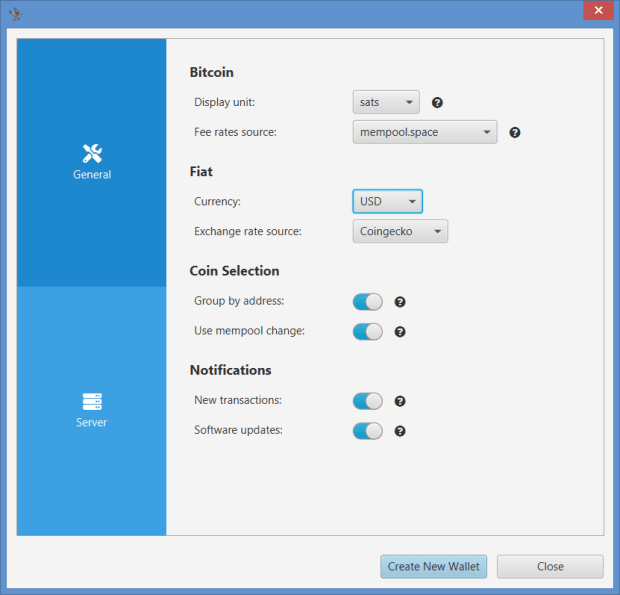

Next, you can configure the general settings like bitcoin unit, preferred fiat currency, coin selection and notifications.

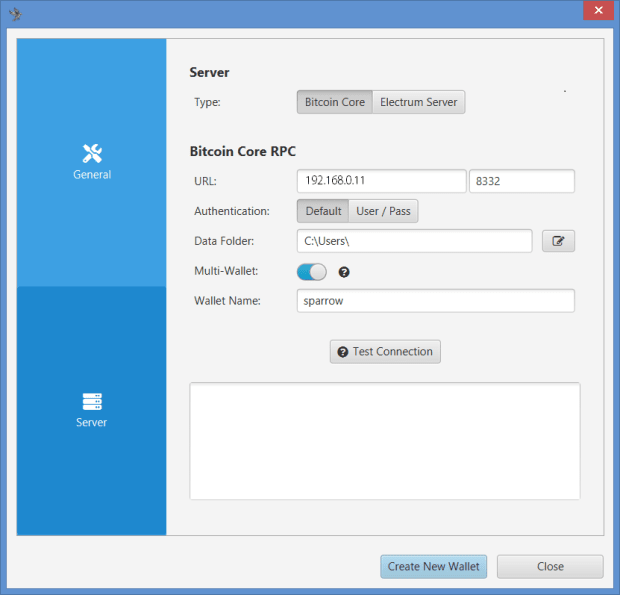

Then in the server settings section, you will want to enter your Bitcoin node’s local IP address and username/password.

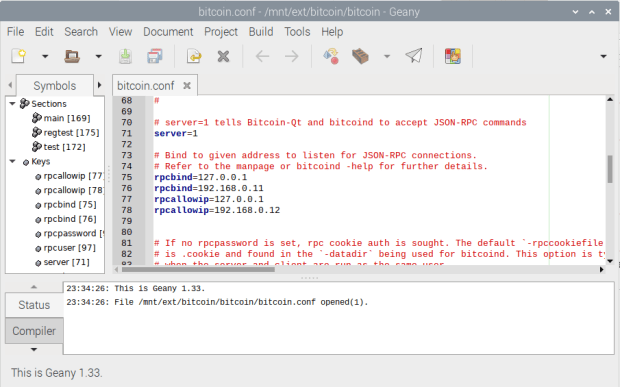

If you haven’t done so already, this information first needs to be set up in your Bitcoin.conf file, which is typically accessible by running the following command from the same folder in which you have Bitcoin installed, in the terminal on your Raspberry Pi:

sudo nano bitcoin.conf

Once in your bitcoin.conf file, make sure you take the hashtag (#) off of your rpcuser and rpcpassword. Set them accordingly however you want.

You should be able to find your Raspberry Pi local network IP address by logging into your router. Then, make sure you have your local IP address notated so that you can enter the following information in the bitcoin.conf file:

rpcbind=127.0.0.1

rpcbind=192.168.0.11 (your node)

rpcallowip=127.0.0.1

Rpcallowip=192.168.0.12 (desktop)

After editing your bitcoin.conf file, save your changes, then you will need to restart Bitcoin.

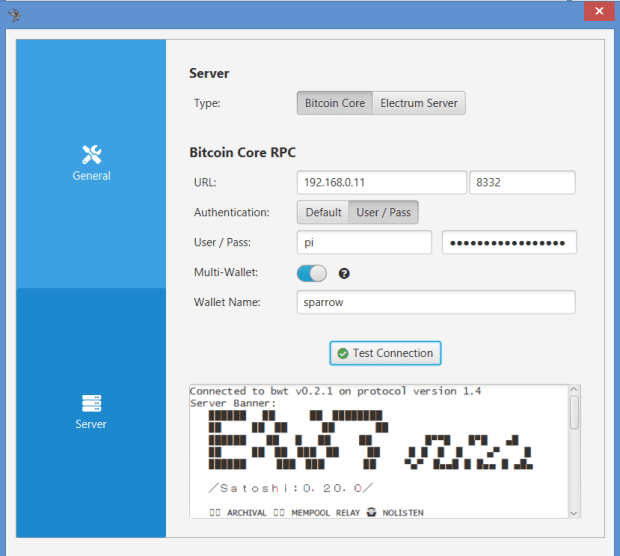

Then, once it is back up and running, use the same rpcbind IP address as the URL with 8332 as the port. And use the same User/Pass that you entered in the bitcoin.conf file. Test the network connection from Sparrow Wallet. If it’s good, you should see the green check mark next to “Test Connection” and some information populated in the dialog box below that. Then select “Create New Wallet.”

If you get an error, you’ll have to shut down Bitcoin, edit the configuration file, start Bitcoin and try testing again. It took me a few tries to get everything correct because I’m not very good at network configurations.

More details can be found on Sparrow Wallet’s website here.

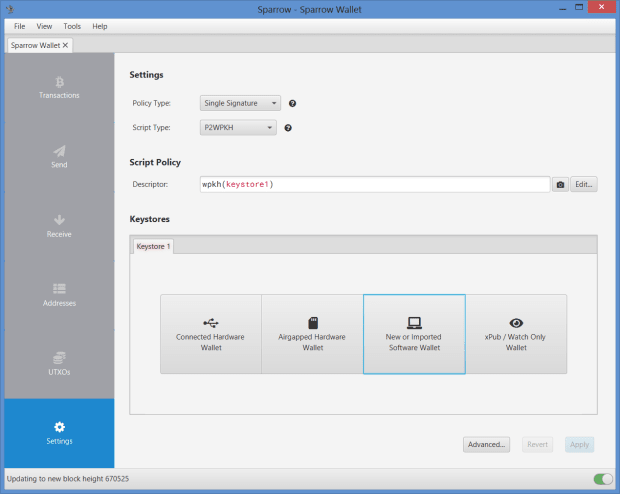

Step Three: Wallet Setup

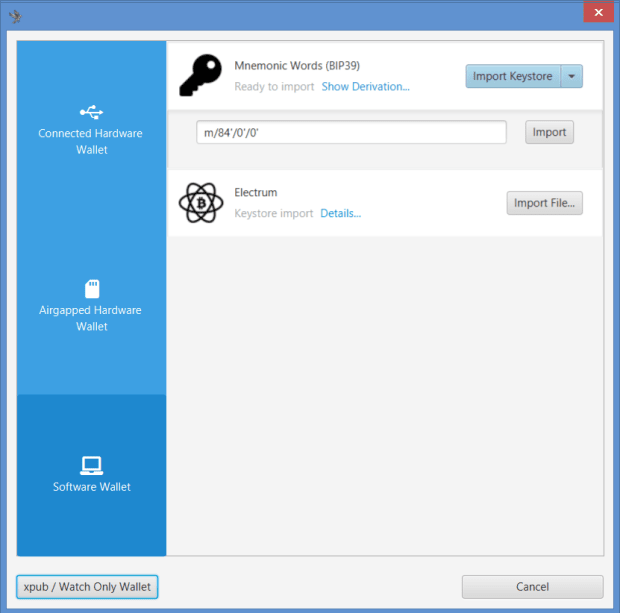

Sparrow Wallet has several wallet configuration options available. You can use Sparrow Wallet to connect a hardware wallet, an air-gapped wallet and a watch-only wallet. You can choose different script types if you want legacy addresses that start with “1” or nested-SegWit addresses that start with “3.” You can also set up multi-signature policy types. There are a lot of options.

To make a new single signature P2WPKH (Native SegWit) wallet — addresses that start with “bc1” — select “New or Imported Software Wallet.”

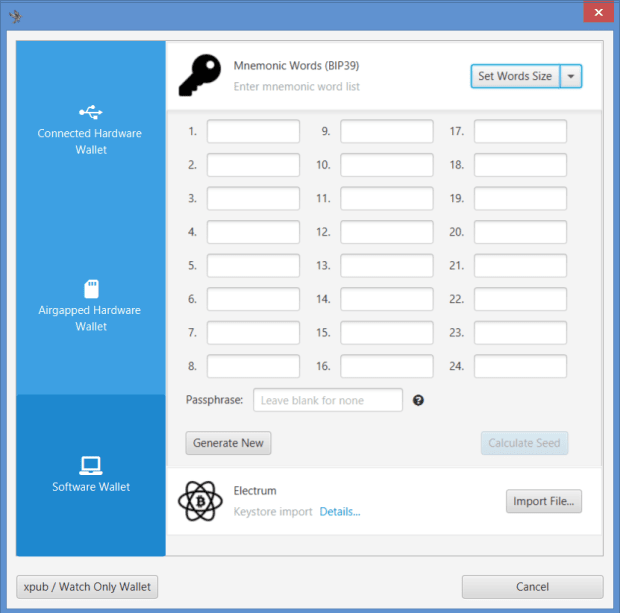

On the next screen, you can select how many words you want in your seed phrase. I recommend just sticking with 24 seed words.

Then, select “Generate New.”

Step Four: Secure Your Seed Phrase

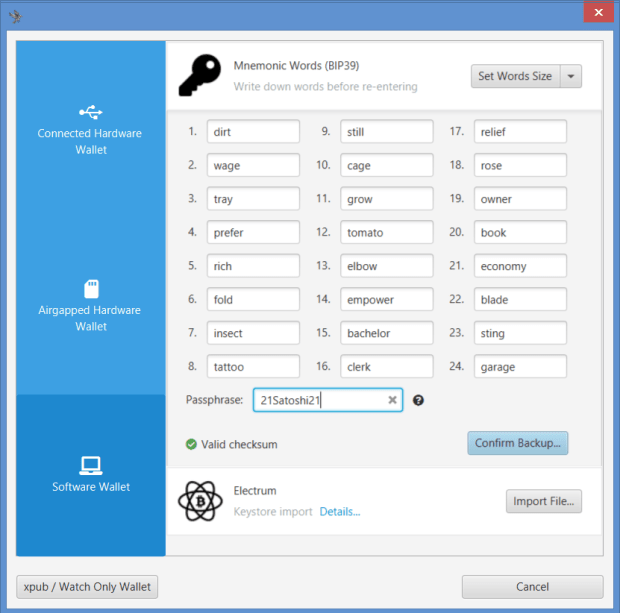

Sparrow Wallet will generate your 24-words and then you can add a passphrase.

I recommend using a strong, high-entropy passphrase that cannot be guessed easily like this one. Others may suggest using a passphrase that can be easily memorized. Weigh the tradeoffs for yourself and do what is best for you. Whatever you choose, remember that this passphrase will be necessary to recover your wallet in the event that your desktop is lost, damaged or replaced.

Note: This is the most important step.

- Write down your words in order on a piece of paper

- Secure this piece of paper as if it were gold or jewelry

- Do not screenshot these words

- Do not save these words in a computer or on your phone

- Do not say these words out loud

- Never share these words with anyone for any reason

- Your bitcoin is only as secure as your 12 words and passphrase.

- Double check your work

- You will also need your passphrase from above for a complete secure backup.

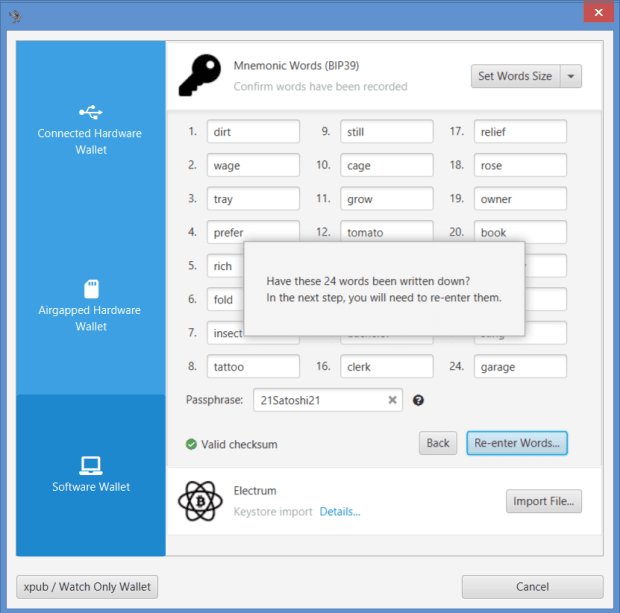

Then, select “Confirm Backup” and then you will be asked to re-enter all of your words and passphrase to verify that you wrote them down.

You will need all of your seed words in the correct order and your passphrase to restore your wallet.

Note: Once you get more serious about Bitcoin, consider securing your seed phrases in metal instead of on paper.

Step Five: Finalize

On the next screen, you will be asked if you want to use the default derivation path. I recommend leaving the derivation path as the standard m/84’/0’/0’.

Then, select “Import Keystore.”

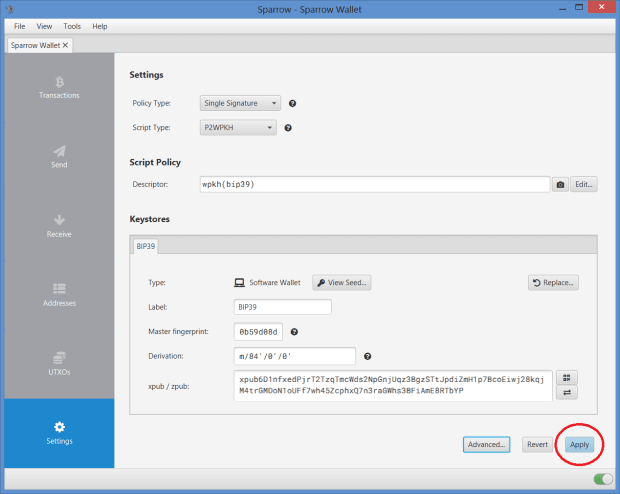

After the import is complete, make note of the master fingerprint. This is how you can confirm that you have restored the correct wallet in the future. This fingerprint is unique to your wallet accessed by your 24 words and passphrase.

Then, select “Apply.”

You will also be asked to name your wallet and set an optional wallet password. The password is what encrypts your wallet file on your computer. This is different than your passphrase, which acts as a “twenty-fifth word” for your wallet seed phrase.

Your node will automatically scan your new wallet to see if you have any funds. Once your node is done scanning your new wallet, you can start generating receive addresses and get some bitcoin.

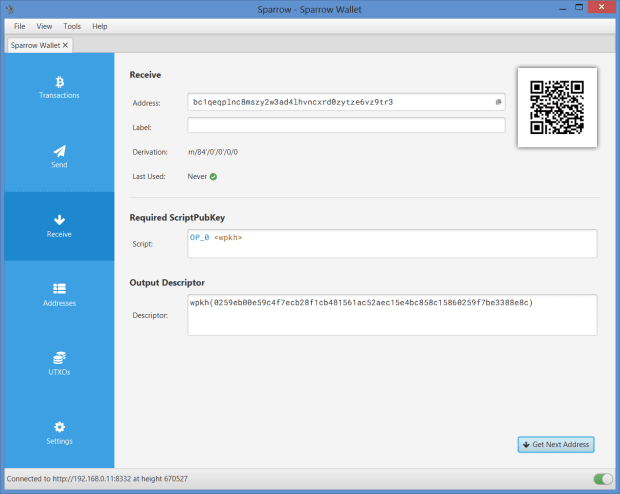

Step Six: Receive Bitcoin

Wait until your node is finished scanning. Then by navigating to the “Receive” tab, you can select the “Get Next Address” button to generate your first receiving address. Now you can scan your QR code with your mobile wallet or copy/paste the address and send it to someone for payment. Sparrow Wallet displays additional information about your address like the derivation path, the script and the descriptor.

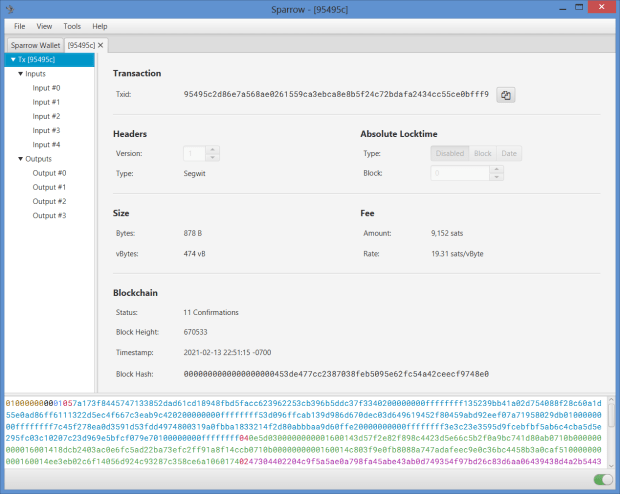

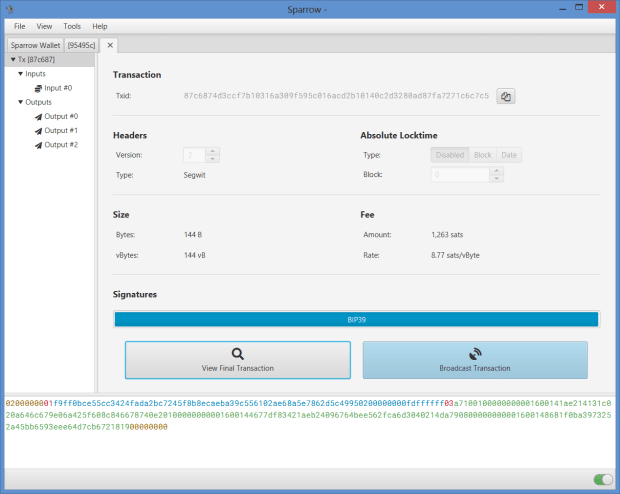

I sent some bitcoin from one of the mobile wallets generated in the previous guides. Once your receipt is confirmed, you can see all kinds of details about your transaction.

Sparrow is like its own block explorer using your node.

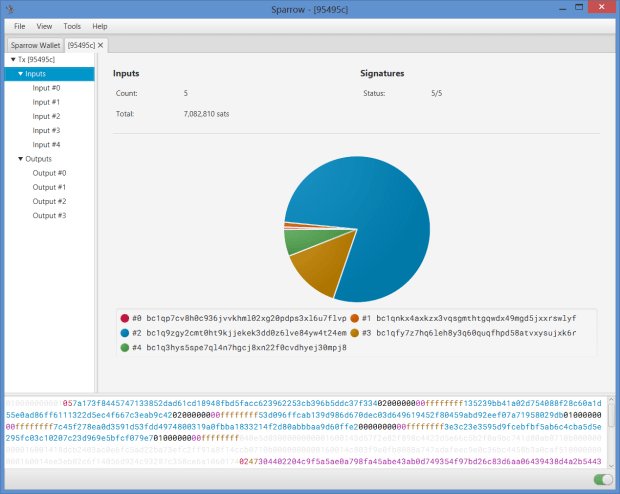

You can also explore the inputs in further detail:

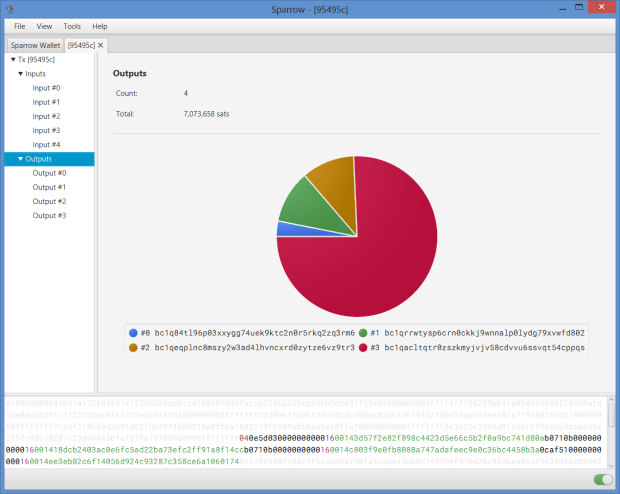

You can also explore the outputs in further detail:

Step Seven: Send Bitcoin

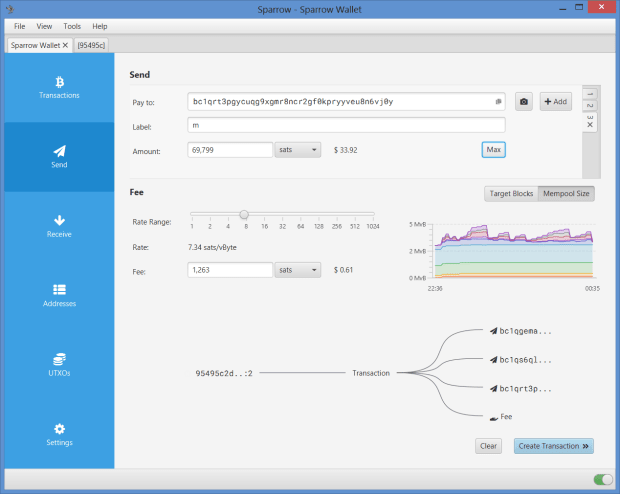

Once you’re ready to spend, navigate to the “Send” tab. There, you can add several receivers in the same transaction by either copy/pasting the receiver’s Bitcoin address or by activating your computer’s camera to scan a Bitcoin address QR code.

You can add a label if you like, enter the amount you wish to spend and you can easily slide the miners fee to where you want it.

Sparrow Wallet maps out a little graph with the mempool.space data as well to help you estimate how fast your transaction will be included in the blockchain. There is a little transaction connection graph displayed as well.

Once everything looks good, select “Create Transaction.”

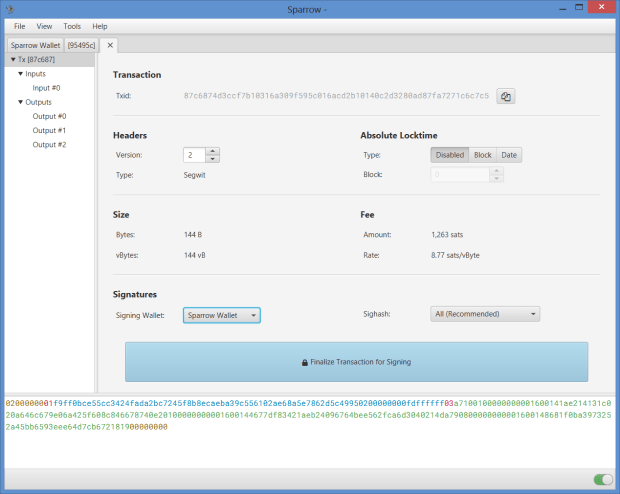

On the next screen, review the details. You can even add a transaction delay based on block height or date.

Once ready, select the “Finalize Transaction for Signing” button.

Then, select the “Sign” button and enter your wallet password, if you enabled this feature.

Once signed, the transaction is ready to be broadcast. Select the “Broadcast Transaction” button to send it to the Bitcoin network.

Once broadcast, your node will send the transaction to other nodes on the Bitcoin network until it gets pulled out of the mempool and mined into a block.

Conclusion

Sparrow Wallet is a beautifully-designed Bitcoin wallet packed full of features. This wallet supports single-sig or multi-sig, multiple address types, multiple node connection options, coin control, transaction labeling, built-in Tor and Testnet. Additionally, Sparrow Wallet supports partially-signed bitcoin transactions (PSBT).

With PSBT, you can import your hardware wallet xpub and use Sparrow Wallet as a watch-only wallet. This allows you to monitor the balance on your hardware wallet more conveniently as well as generate receiving addresses for your hardware wallet. Watch-only wallets cannot spend from your hardware wallet so your funds are always secure. When you want to spend from your hardware wallet, you can enter the watch-only wallet in your Sparrow Wallet application, construct the spend transaction and then export it as a PSBT. Then, you can load this PSBT into your hardware wallet via the MicroSD card option and sign the transaction with your hardware wallet’s private key.

Once signed, the transaction can be passed back to your Sparrow Wallet and broadcast to the network. Plus, it has an integrated blockchain explorer powered by your own node. There is too much to unpack in this article, but check out Sparrow Wallet’s full features page here.

There is a great best practices guide on Sparrow Wallet’s website here.

To learn more about Sparrow Wallet, jump in its Telegram group here.

To hear what’s up directly from the source, check out this episode of Citadel Dispatch by @matt_odell featuring Sparrow Wallet’s lead developer, @craigraw and yours truly, @econoalchemist.

Bitcoin Wallets For Beginners, Part Five: Buying KYC-Free Bitcoin

Now that you understand the importance of self custody and the dangers of KYC, and have installed a mobile or desktop wallet, here is how you can start getting bitcoin safely and privately.

There are many ways to get non-KYC bitcoin. You can earn it in exchange for goods and services. You can mine it at home. You can buy it at an ATM. Or you can buy it on a peer-to-peer exchange. This article will show you how to buy a small amount of bitcoin at an ATM, install and set up Bisq and then use the bitcoin to fund your first Bisq trade.

Step One: Buy Bitcoin At An ATM

If you followed the instructions in part two or part three of this series, then you now have a fresh mobile Bitcoin wallet. Take your mobile wallet with you to the Bitcoin ATM so that you can deposit your funds onto your mobile wallet.

Make sure that you have cash on hand. The majority of Bitcoin ATMs will have varying levels of KYC requirements based on dollar-amount thresholds. These thresholds can vary by jurisdiction or ATM operator or a number of other factors. Typically, if you are buying between the $1 to $500 range, the only requirement will be a phone number for a text verification.

Consider using a burner phone number for this to preserve your privacy and not have any Bitcoin ATM transactions potentially traced back to your name through your mobile service provider.

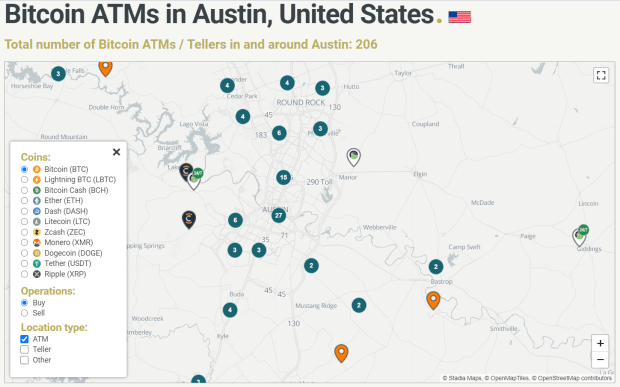

Next you will need to find an ATM near you. I like Coin ATM Radar because it has a handy mobile app and there are a lot of good resources about the Bitcoin ATM industry on its website.

With your mobile phone and cash, travel to your desired ATM location, being cautious of security cameras at the place of business that may capture your license plate. Consider parking a couple of blocks away, out of view of surveillance cameras, and walking the rest of the way.

Once you approach the Bitcoin ATM machine, the basic steps are as follows:

- Touch screen to begin

- Select “Bitcoin”

- Input a phone number

- Verify the code that was sent via text message

- Display the receiving address QR code on your mobile wallet

- Insert your cash

- Print the receipt

- You can expect the funds to arrive in your wallet within 1 – 3 hours typically

Here is a video of the whole process.

Now that you have your first little bit of bitcoin, you can go home and setup your Bisq client and then use this bitcoin to fulfill your escrow requirement on your first Bisq trade. I recommend getting at least 0.0075 BTC from the ATM, you may need to make multiple trips. This should be more than enough to fund the security deposit of your first trade as well as cover the trading and miners’ fees.

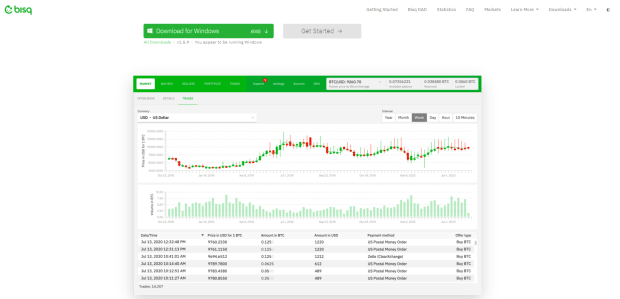

Step Two: Download Bisq

Bisq is a decentralized peer-to-peer network of bitcoin traders. Buyers and sellers from all around the globe can find each other over Tor on Bisq to trade safely without the coordination of a central authority or the need to expose sensitive KYC information to large corporations.

Bisq has many trading pairs, such as USD to bitcoin, euro to bitcoin and many more. There are also many different payment options, such as Amazon gift cards, Revolut, Uphold and more.

The basic idea is that you find or post a trade in the currency pair that you want and for the payment method that you want. Once the trade is initiated, both trading peers deposit a small amount of bitcoin in escrow as a security deposit. You exchange fiat payment with your trading peer out of band. Once both peers confirm the trade is complete, you receive your purchased bitcoin plus your security deposit to your Bisq wallet. From there, you can send your non-KYC bitcoin wherever you like; to your mobile wallet, your desktop wallet or a hardware wallet.

Navigate to the Bisq website to download the software for your operating system.

Keep in mind that your trade is only available to the rest of the peer-to-peer network when your instance of the Bisq application is running and connected to the internet. You may want to install this on a computer that you can leave running.

After you have downloaded the program, install it by running the executable (Windows) or other (macOS or Linux) installation methods. If you are familiar with verifying software, do so at this point. I recommend that you learn about PGP keys/signatures by checking here and here for the basic concepts.

After you have run the Bisq installer, followed all of the prompts and agreed to use them, Bisq is going to connect to a few Tor nodes and connect to a few Bitcoin nodes. This can take a couple minutes. Once everything is synchronized, you should see something like this:

Step Two: Set Up A Bisq Bitcoin Wallet

You will need a Bisq Bitcoin wallet so that you can fund your security deposits for your trade escrow requirements. This wallet will be set up in a similar way to the other wallets we have discussed in previous parts of this guide.

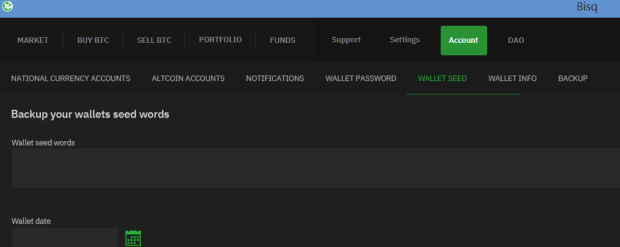

Navigate to the “Account” tab, and then the “Wallet Seed” tab. You will receive one warning that it is recommended to make a backup of the Bisq files on your computer. Then you will receive another warning that you have not created a password yet. You will do that in the next step.

Write down your seed words on a piece of paper, along with the wallet date. You will need both pieces of information to restore your Bisq wallet in an emergency. The same best practices apply to this wallet as you learned with the other wallets:

Note: This is the most important step.

- Write down your words in order on a piece of paper

- Secure this piece of paper as if it were gold or jewelry

- Do not screenshot these words

- Do not save these words in a computer or on your phone

- Do not say these words out loud

- Never share these words with anyone for any reason

- Your bitcoin is only as secure as your 12 words and passphrase.

- Double check your work

- You will also need your wallet date from above for a complete secure backup

Note: Once you get more serious about Bitcoin, consider securing your seed phrases in metal instead of on paper.

You will need all of your seed words in the correct order, wallet date and your password to restore your wallet.

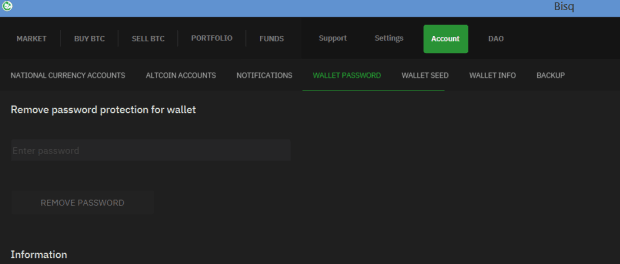

After you have secured your seed words and wallet date, now you can set your wallet password. This will encrypt your Bisq wallet information on your computer.

Navigate to the “Wallet Password” tab.

Set a strong password that cannot be guessed and is at least eight characters long. Once you type your password in, you will be warned that this will encrypt your wallet information on your computer and that you will need your password to view your seed words in the future. Make sure that you secure this password like you did with your seed words and wallet date.

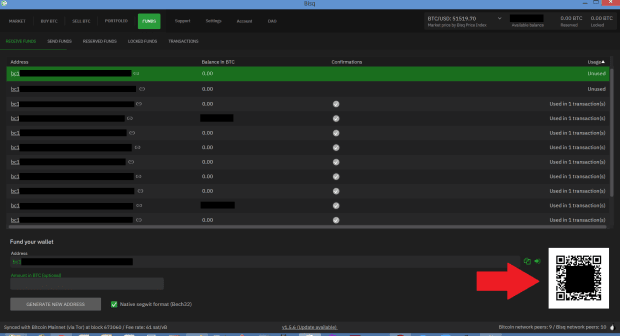

Step Four: Fund Your Bisq Bitcoin Wallet

Now that you have set up your Bitcoin wallet, you can navigate to the “Funds” tab and then the “Receive Funds” tab under that. This is where you can find the QR code for your first Bisq receiving address.

Using the mobile wallet that you used to deposit your funds from the Bitcoin ATM, send those funds to this wallet now. Once you have received a few confirmations on your Bisq wallet deposit, you are almost ready to make your first Bisq trade.

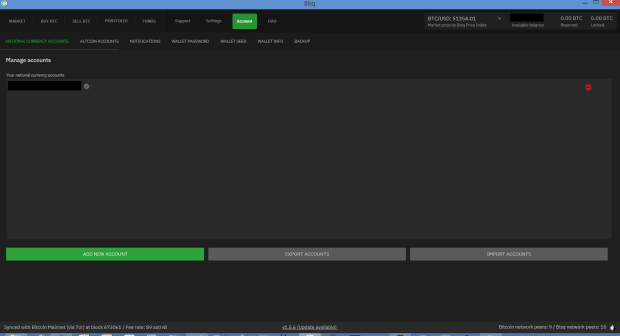

Step Five: Set Up A Fiat Currency Payment Method

In order to make trades on Bisq, you will need to set up a fiat currency payment method so that trading peers can agree to this payment method when trading with you.

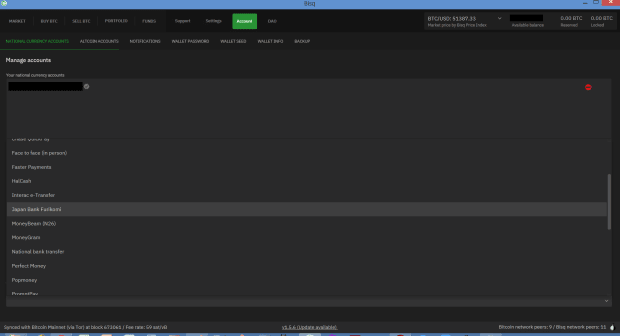

Navigate to the “Account” tab and then the “National Currency Accounts” tab below that. Then, you will want to click on the “Add New Account” button.

This will populate a drop-down menu where you can find all of the supported fiat currency accounts in Bisq. Select the account that matches your available options.

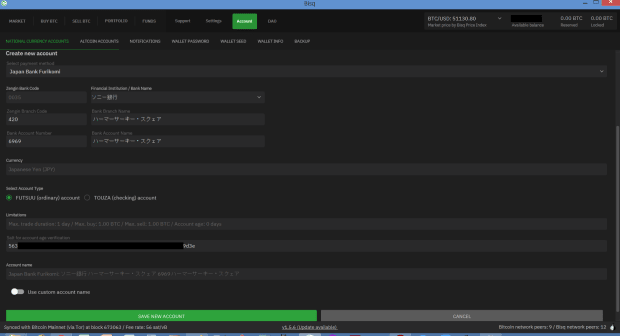

Next, you will need to enter all of your information correctly. When you make a trade on Bisq, your trading peer will need certain information about you in order to send you money out of band via the payment method you have selected. It is important to note that certain information about you will be exposed to your trading peer. However, this is necessary to make the out-of-band payment and it has minimal effect on you, considering that it is only to one other person.

Note: Consider establishing an LLC through a registered agent to keep your personal name off of the public record and to protect your identity and privacy by using the company name on your national currency account through your business bank account.

Once you have entered your details, select “Save New Account”. You are ready to start trading.

For most national currency accounts that you set up in Bisq, they will initially be throttled to 0.01 BTC trades, for example. These limitations vary depending on the account type, so be sure to familiarize yourself with the account signing and aging requirements here.

Once you have completed a successful trade with a peer who has a signed and aged account, then they can sign your account. Once your account is signed, a 30-day timer will start. Once you have reached 30 days, then your initial 0.01 BTC limit is raised to 0.125 BTC, for example. Then, after 60 days, all limits on your account are lifted and you are only restricted by the limitations of your payment method.

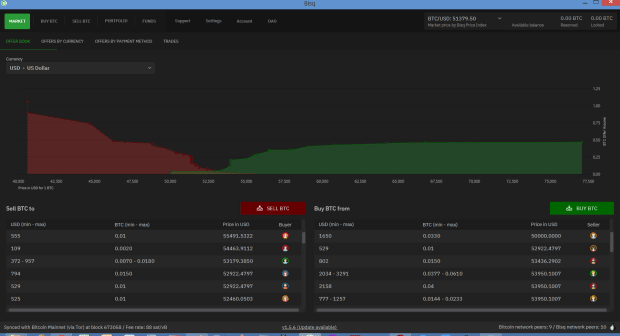

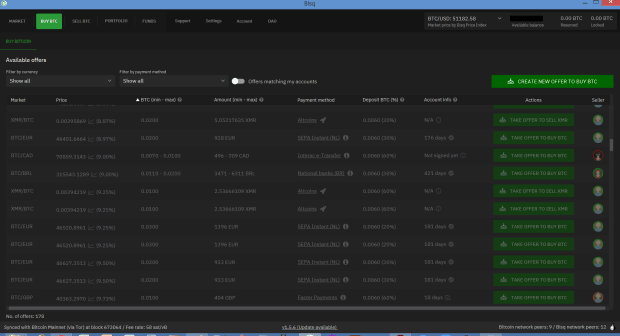

Step Six: Make Or Accept A Trade

Now you can navigate to the “Buy BTC” tab and see all of the available offers to sell your bitcoin. You can filter this list by your payment method or currency type. Be mindful of the percentage over the market price. Once you see an offer that is satisfactory, you can take it by selecting “Take Offer To Buy BTC.”

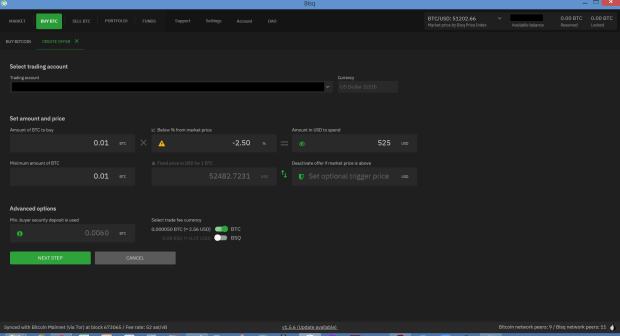

Alternatively, you can make an offer to buy bitcoin by selecting the “Create New Offer To Buy BTC” button in the upper-righthand corner. Then you can enter your desired trade details, such as your out-of-band payment method, the amount of bitcoin and the percentage above or below the market price you are willing to pay. You can even set a trigger price to turn the trade off if bitcoin hits a specified price.

You will see at the bottom that for a 0.01 BTC trade, there is a 0.006 BTC security deposit required. This is why you deposited the bitcoin from your ATM purchase into your Bisq wallet. Once you post this trade, Bisq will transfer your security deposit, trading fee and miners’ fee out of your Bisq wallet and into escrow. Once the trade is complete, you will receive your 0.006 BTC security deposit back.

Follow the prompts to make your trade viewable to the other peers and leave your instance of Bisq and your computer running and connected to the internet until someone takes your trade.

Once your trade is taken, you will start receiving notifications in Bisq, alerting you as to the trade’s progress. Typically, each trade is given a predetermined amount of time to complete. And there is an option to send a message to your trading peer.

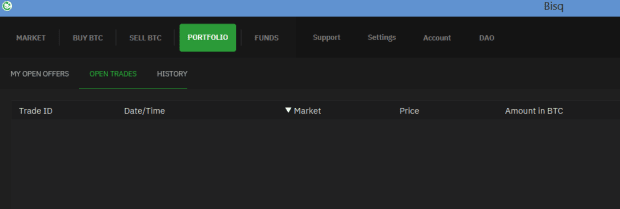

You can monitor your trades under the “Portfolio” tab. Your “Open Offers” are trades you have posted that are still waiting to be taken. The “Open Trades” tab is where you will find your trades that are in progress. And the “History” tab is where you can find all of your trade history.

There is Bisq arbitration standing by in the event that something goes wrong with a trade. If you stick to the rules, follow the instructions and operate within the time limitations, then you should never have a problem.

Once your trade has been completed, use the bitcoin you purchased to fund more security deposits for more trades and keep this up until you have reached your goals. It is a good idea to send your Bisq funds to Whirlpool to break the deterministic links to prior transaction history.

Conclusion

Buying bitcoin at an ATM has a high premium, but you only need to do it with enough money to get your first Bisq trade funded. From there, you have way more control over the prices that you pay. You can set orders on Bisq below the market price and wait for peers to take your trade.

Even though there is no central authority with Bisq, you are still exposing minimal information to a stranger on the other side of your trade. I recommend taking every privacy precaution you can to protect yourself. Having an LLC is a great way to interact with the world in a private manner.

There are a ton of features on Bisq that I did not cover here because I just wanted to show you the basics to get started. You can save on trading fees by using the Bisq token, BSQ, and you can use mempool.space as a BSQ block explorer. You can connect Bisq to your own Bitcoin node. There is a mobile app you can use to receive notifications on the go of your trade progress.

Bisq is an open-source project, check out its website to learn more. There is also a Bisq Wiki packed full of all of the information that you need to use Bisq. If you ever have any questions, jump in the Bisq Telegram channel here for community support.

This is a guest post by Econoalchemist. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.