- March 22, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Bitcoin has been much of the market to new all-time highs as institutional investors pile into digital finance, but it could be the arrival of Coinbase, a leading crypto exchange, on Wall Street that may make a significant impact.

Bitcoin may be the most dominant player in the world of cryptocurrencies, but Coinbase has grown into a market leader in terms of platforms in which investors can buy and sell coins. Shares in the company reportedly traded for between $350 and $375 based on a recent private Nasdaq auction, amounting to a pre-IPO company valuation of up to $100 billion.

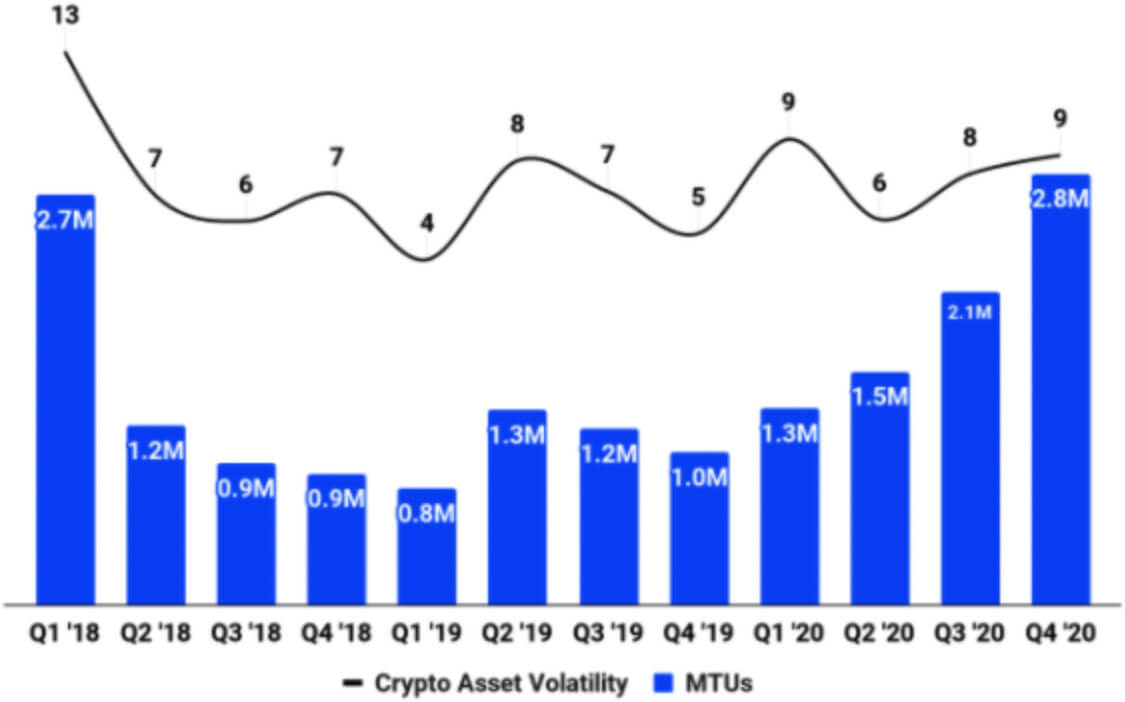

As we can see from the chart above, Coinbase’s monthly transacting users (MTUs) have risen to a level that hasn’t been seen since the end of the 2017 crypto bull run. The timing of Coinbase’s arrival on the New York Stock Exchange could hardly come at a better time as Bitcoin has entered 2021 in a state of price discovery as new all-time highs are repeatedly broken for the world’s oldest cryptocurrency and various altcoins.

While such growth has certainly helped the Coinbase push to go public, it’s worth asking what the impact of a cryptocurrency being floated on Wall Street will mean for a cryptocurrency ecosystem that still exists away from mainstream acceptance and widespread adoption?

Building on The Coinbase Bounce

Because of Coinbase’s stature in the crypto market, cryptocurrencies have become known to experience a boost in price in the immediate aftermath of becoming listed on the exchange. This phenomenon has become known as ‘the Coinbase effect’ and it has the potential to generate significant levels of trading volume for coins as huge volumes of investors become exposed to the new coins for the first time.

As Coinbase opts for a direct listing on the NYSE, we may see a different kind of effect altogether on the crypto market. The furore surrounding Coinbase going public may well bring optimism to the world of cryptocurrencies as its biggest exchange intertwines with the world of stocks and shares.

As the ecosystem’s primary exchange, a successful launch for Coinbase could carry a significant impact on the prices of assets like Bitcoin and various altcoins. In a market that’s often struggled for acceptance among retail investors, a cryptocurrency exchange going public could bring a further layer of validation on top of the significant institutional investments from the likes of Tesla and MicroStrategy.

Coinbase going public may be a leading influence in terms of cryptocurrency adoption within an industry that some investors have found too mysterious or volatile to buy into. With this in mind, Coinbase’s successful listing could further break down barriers between retail investors and the wider world of crypto.

It’s worth noting that the influence of Coinbase’s listing could work both ways. If the cryptocurrency exchange fails to inspire investors in a meaningful way, the falling price of the exchange could drag a cryptocurrency market that’s already suffered from some levels of volatility over February and March down significantly.

The cryptocurrency market has often used Coinbase as a great springboard for generating larger market caps and reaching higher asset values. Now, with the leading exchange set to go public, the entire landscape will be hoping that Coinbase can leverage an almighty boost for the entire market.

What Impact Will a Direct Listing Have?

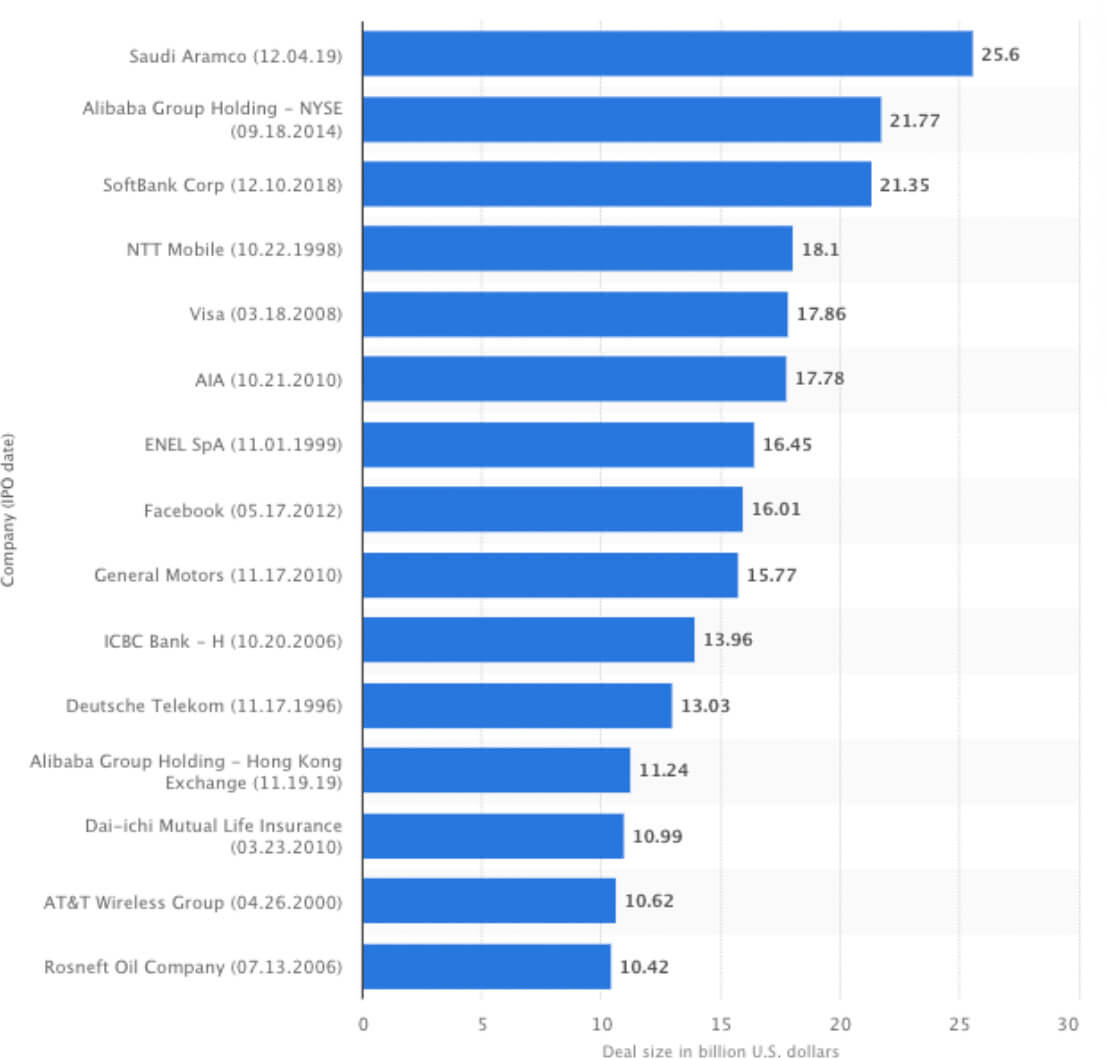

Although many had anticipated Coinbase going public with a formal initial public offering, the exchange chose the option of a direct listing rather than an IPO.

The reason behind this could have involved the fact that companies that offer IPOs traditionally create brand new shares for investors to buy. Though the SEC lifted these restrictions, Coinbase opted to go public without creating new shares and diluting its existing equity. This form of listing will also mean that Coinbase can sidestep the costly requirements of utilizing underwriters to launch its IPO.

The move could be seen as a welcome one for investors. This is because Coinbase’s direct listing looks set to enable anybody to buy and trade shares at the same time in the company. This has the potential to open the door to retail investors who are curious about the world in which the exchange operates.

Although IPOs have the power to create a buzz surrounding a company set to go public, the world of initial public offerings are typically more exclusive and restricted more to institutional investors who have the power to buy large volumes of shares in one transaction, as opposed to retail traders who would likely only buy single shares at a time.

Despite IPOs generally being restrictive to typical retail investors, there are a number of platforms that allow the general public to take part, including the Nasdaq-listed Freedom Holding Corp. (NASDAQ: FRHC) enables retail investors to participate in IPOs, however, in order to take part a threshold of $2,000 is required and there’s an application process attached, too.

There are also more traditional brokerages that offer participation in IPOs. One such company is Fidelity, where investors can buy into initial offerings provided they have between $100,000 and $500,000 in household assets, while TD Ameritrade also offers this service to anyone as long as they have an account value of over $250,000.

Although retail traders can access initial public offerings, Coinbase’s choice of a direct listing has ensured that, just like with its exchange, the company is open to everyone – regardless of whether they’re institutional investors or members of the general public. Furthermore, this is likely to come across as appealing to the cryptocurrency purists, who revel in the decentralized level playing field that the market stands for.

In choosing a direct listing, Coinbase is looking to uphold the values that the crypto marketplace is built on. If its approach can open the door for new widespread investment in the industry, then the company’s approach may be fully vindicated.

The post Cryptocurrency’s arrival on Wall Street: How the Coinbase IPO could impact the crypto ecosystem appeared first on CryptoSlate.