- March 19, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

As bitcoin eats into capital held in other stores of value, how much wealth will eventually transfer to BTC from equities?

If you’ve been following potential bitcoin price targets, you know that many analysts expect bitcoin to completely consume or eat into portions of gold, money supply (M2), global fiat-denominated debt, stocks (equities) and real estate.

Once you’ve grasped the implications of bitcoin having no counterparty risk and no dilution risk, you should recognize that bitcoin will fully inhale all wealth stored in gold, M2 and global debt, but what portion of the wealth stored in equities (stocks) will be reallocated into bitcoin?

It’s a very complicated idea to ponder.

Two weeks ago, we published our thoughts on how the valuation of a fictional company, Wyoming Red Ribeyes, would change post-hyperbitcoinization. Now, we’re going to dive in a bit further and run a scenario analysis that shows how much the valuation of a typical S&P 500 company would change based on two relatively unknown predictor variables:

- The BTC inflation rate: How do we expect a relative CPI index (price of goods) to trend over time?

- The BTC equity risk premium: What expected percentage return (BTC denominated) will motivate investors to invest their BTC into publicly-traded equities?

BTC Inflation Rate

It is realistic to expect the average BTC consumer price index (CPI) inflation to fall somewhere between 0 percent and negative 10 percent. The current system attempts to produce roughly 2 percent CPI inflation annually. Since the Bitcoin monetary standard operates under a fixed supply, bitcoin savers will be rewarded with all future productivity enhancements through lower and lower prices.

Generally, it is reasonable to expect a CPI of roughly negative 5 percent, which indicates that economic growth under a Bitcoin standard will be faster and more sustainable.

BTC Equity Risk Premium

An equity risk premium is the excess return that investing in stocks is expected to provide over a risk-free real return of simply HODLing bitcoin (or potentially earning yield on Lightning Network lease channels).

This is difficult to predict as it will ultimately come down to the bitcoin HODLers. They will be the ones to determine the equity risk premiums they are willing to accept for their bitcoin.

Based on current bitcoin-denominated lending rates (6 percent at BlockFi), we would likely expect the equity risk premium to be above this, since this is the rate for fairly safe debt, hence “equity risk premium.” It may be realistic for an S&P 500 company to have an equity risk premium between 0 percent and 30 percent.

While this depends on how the market weighs specific business risks, generally it is reasonable to expect around 10 percent, which indicates that investors won’t be willing to part ways with HODLed BTC unless they expect a 10 percent return to accompany the risk of investing in a publicly-traded equity.

What Store Of Value (SoV) Percentage Is In Equities?

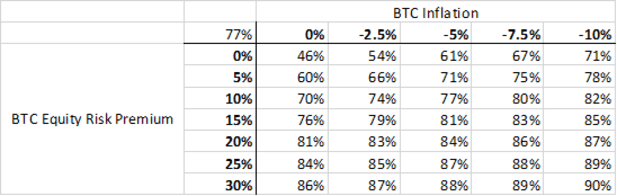

Below is a data table that displays what percentage of wealth stored in publicly-traded equity valuations is simply looking for a generic SoV (i.e., bitcoin). Note that this data table is using the discounted cash flow (DCF) models of Wyoming Red Ribeyes as a typical fictional S&P 500 company.

The two predictor variables, BTC inflation and BTC equity risk premium, are the only two variables changing in the DCF models.

Looking at our estimations of negative 5 percent BTC CPI inflation and 10 percent BTC equity risk premium, the estimated SoV percentage currently stored in public S&P 500 equities is 77 percent. This indicates that 77 percent of the real wealth stored in the S&P 500 could re-allocate to bitcoin.

This estimation varies depending on the two predictor variables. For example, on the low end (0 percent equity risk premium and 0 percent inflation), bitcoin will only capture 46 percent of the wealth stored in publicly-traded equities. However, on the high end (30 percent equity risk premium and negative 10 percent inflation), bitcoin will capture 90 percent of the real wealth stored in the S&P 500.

Updated Price Targets

Starting with the baseline assumption that Bitcoin eats the wealth stored in gold, M2 and global debt, we begin at $17.1 million per BTC.

If we use our analysis to determine that bitcoin will intake 77 percent of global equities, that pushes the total BTC market cap to $427.9 trillion, indicating a price of $20.4 million per BTC. From there, we can conservatively add in that bitcoin will take the SoV out of real estate (50 percent of total real estate), which pushes us to a total BTC market cap of $568.4 trillion, indicating a price of $27 million per BTC.

Compared to our previous price target incorporating both stocks (50 percent) and real estate (50 percent), it only increased by $1 million (from $26 million to $27 million). However, $1 million BTC sounds pretty great right now.

Future Research

We want to also dive into real estate valuations, since we simply used a baseline of 50 percent to determine the wealth stored in real estate that will be absorbed by bitcoin. This could be higher or lower. In addition, we could further attempt to price in the future the productivity gains that bitcoin will bring, as well as the high propensity to hold a counterparty-risk-free and dilution-risk-free asset.

The global wealth numbers originated from Visual Capitalist and the ”Mimesis Bitcoin Investment Research Report.”

This is a guest post by Mimesis Capital. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.