- January 23, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

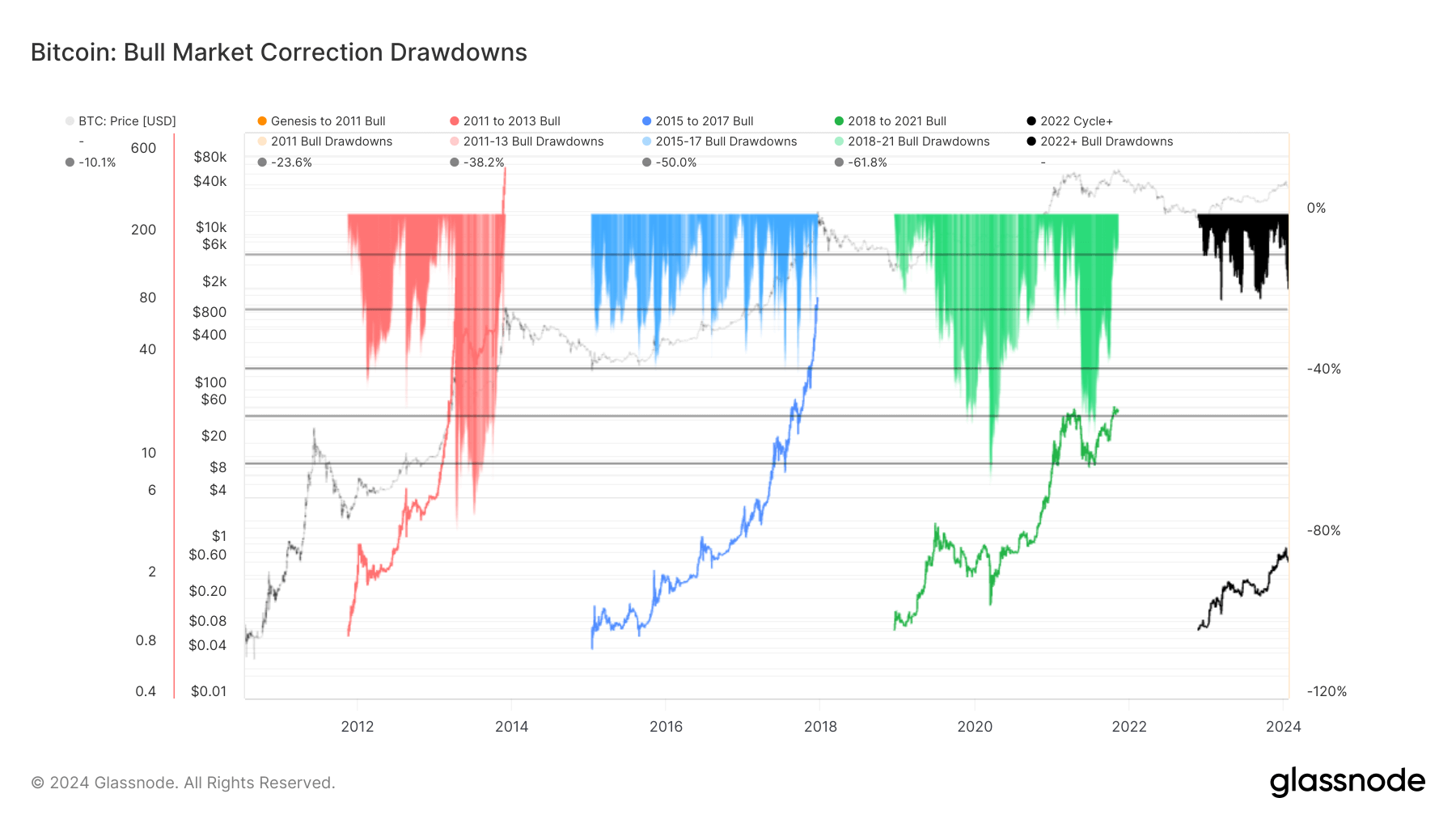

Recently, Bitcoin’s price broke below the $39,000 threshold, marking a noteworthy 20% reduction from its yearly high of $49,000. This event signified one of the most significant drawdowns in the current cycle, illustrating the inherent turbulence of this asset class.

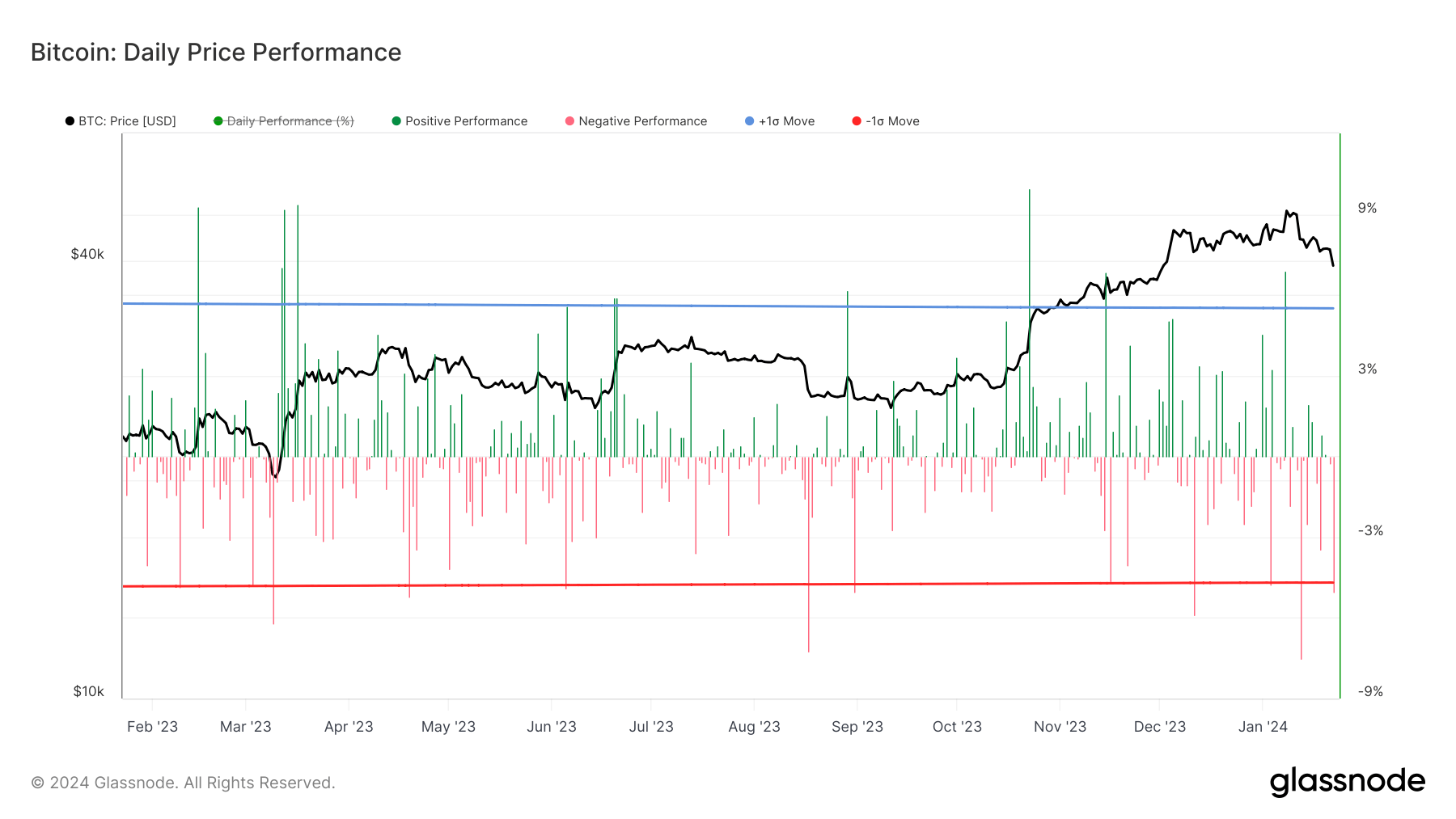

Historical data shows during bull market corrections, drawdowns can reach as much as 30%, emphasizing the significant risk and reward ratio in digital asset investments. Moreover, within the first month of 2024, Bitcoin witnessed three daily drawdowns of around 5%. Of these, the Jan. 22 event fell short of the 2024 record 7.5% single-day drawdown experienced on Jan. 12.

Over the past 24 hours, the digital asset market experienced $330 million in liquidations, with Bitcoin accounting for approximately $90 million. Notably, $77 million of Bitcoin’s liquidations were from long positions. The last hour saw $100 million in liquidations, predominantly long positions, according to Coinglass.

The post Bitcoin falls 20% from YTH high with further 5% daily drawdown in cascading liquidation event appeared first on CryptoSlate.