- March 15, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Given current monetary policy, the insurance industry and bitcoin are a match made in heaven. Here’s why.

Early on the morning of March 10, NYDIG, a financial services firm dedicated to Bitcoin and built specifically for institutional clientele, announced that Ted Mathas, chairman and CEO of New York Life Insurance Company, would be joining its board of directors.

New York Life is an insurance giant with more than $700 billion in assets under management as it operates as the nation’s largest mutual life insurer. Mathas also serves as the chairman of the American Council of Life Insurers, which represents 280 companies and accounts for 95 percent of the life insurance industry in the United States, with more than $7 trillion in assets under management.

The news of Mathas joining the board of NYDIG cannot be understated. As signalled by MassMutual buying $100 million worth of bitcoin in early December 2020, the asset has seemingly crossed the rubicon and become sufficiently derisked, and is now crossing into must-own territory for institutional investors and asset managers. While Mathas hasn’t commented publicly on the move, one can reasonably expect that there is plenty of action happening behind the scenes to get the majority of the insurance industry off of a 0 percent bitcoin allocation. The insurance industry and bitcoin are a match made in heaven for several reasons, and it is quite reasonable to expect the industry to allocate in a meaningful way over the coming years.

Why The Insurance Industry Needs Bitcoin

Zero Interest Rate Policy

In March 2020, the Federal Reserve lowered the federal funds rate to the zero lower bound in response to the COVID-19 pandemic and ensuing economic lockdowns. This presents a large challenge for insurance companies that collect premiums with the potential obligation of having to pay out funds to the policyholder at a later date.

Calculating insurance premiums and potential payouts becomes extremely challenging in an environment where the “risk-free return” of U.S. Treasury bonds are actually presenting return-free risk with negative real yields across nearly the entire yield curve. (This is assuming that the Consumer Price Index (CPI) is an accurate measure of inflation, but that is a different topic entirely.) Below are the real rates of treasury bonds across the yield curve.

Traditionally, the portfolios of insurance firms held a majority of their assets in bonds. As recently as 2010, insurance firms held 69.7 percent (!!!) of their portfolios in bonds as per the NAIC. Now, a decade later and 150 basis points lower on the 10-year treasury, yields offer no real return and very little upside in terms of principal appreciation.

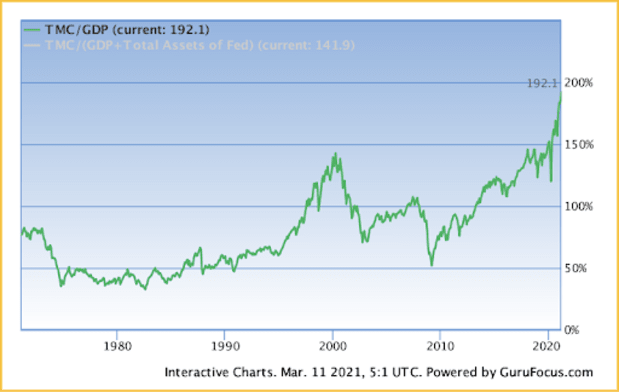

This dynamic of negative real interest rates does not only have an impact on the bond market, but also the equity market as well. Currently, the United States equity market is worth 192.1 percent of total GDP, the highest reading ever. Regardless of how optimistic one is on the future of the American economy, the expected forward real returns are unfavorable when buying equities at such a steep multiple of current productivity.

Bitcoin: A Perfected Store Of Value In The Digital Age

So, how might the insurance agency combat record-low yields, record high equity multiples and record levels of monetary expansion? Insert: Bitcoin.

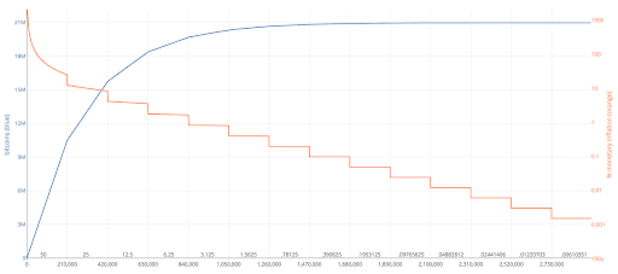

Bitcoin is the perfect store of value for the digital age, and nothing comes close. Most importantly, bitcoin is absolutely scarce, with a perfectly inelastic supply issuance. No one can change the monetary policy of the protocol.

A skeptic may bring up that Bitcoin has had the same properties for the past decade, so why does it now make sense for institutional investors to enter the market?

Undoubtedly, the macro landscape and unprecedented central bank monetary policy has forced investors’ hands, but also notable is that bitcoin has gained a remarkable amount of legitimacy and more importantly liquidity over the last 12 months, making the asset investable to a large pool of capital that previously could not enter the market. Crossing the $1 trillion market cap threshold just recently in February 2021, institutional allocators can now begin to dabble with an allocation. Remember, $1 trillion is still a mere drop in the bucket among hundreds of trillions of dollars in financial assets such as bonds, equities, real estate and gold.

While this is purely my individual opinion, I suspect that, over the coming decade, asset managers in the insurance industry will come to the realization that there isn’t a better way to protect and maintain their balance sheets than by simply stacking sats. Stay humble, stack sats.