- March 6, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Over the last few weeks, the concept of contango has been making the rounds on Bitcoin Twitter. But what is it and why is it important?

Over the last couple of weeks, the concept of “contango” — the situation where a futures price of a commodity is higher than the spot price, made popular among Bitcoiners by Preston Pysh and Plan B — has been discussed (and meme’d) throughout the Bitcoin community, particularly on Twitter. But what actually is contango? Why is it important? And how does it affect the price of bitcoin?

The goal of this piece is to provide you with the answers to these questions, in layman’s terms, in addition to explaining how contango accelerates the supply suffocation that is already naturally taking place due to Bitcoin’s programmatic, four-year supply halving.

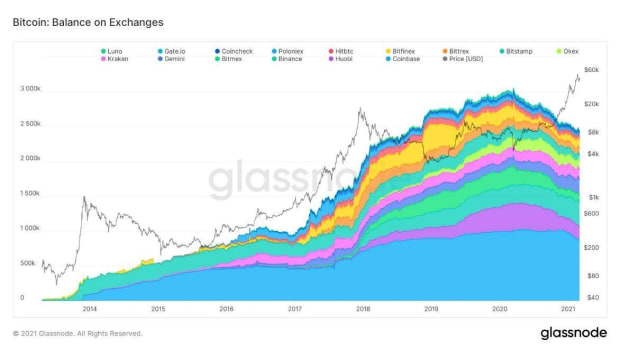

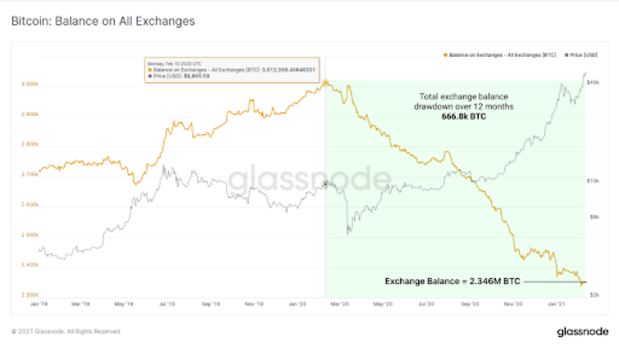

(In the chart below, note the sharper-than-normal slope downward in the number of bitcoin of exchanges. In addition to better education/institutional custody of coins, contango is likely playing a part in this.)

What Is Causing Bitcoin Contango?

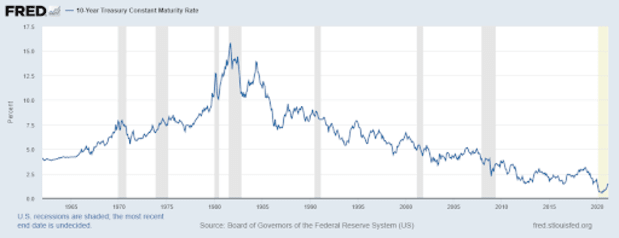

Before getting into what contango is, I would like to illustrate the macro backdrop of why this phenomenon is able to take place. It is first important to understand that asset prices are inversely correlated to risk-free yields, higher yields equal lower equity valuations (and vice versa). As risk-free, fixed-income instruments (U.S. Treasury bonds) sell-off, yields rise; as they are bought, yields are driven down. In a free and open market, this effect reaches equilibrium as yields rise/lower in correspondence to what the free market agrees upon.

However, this is not the case any longer with U.S. Treasury bonds. Due to decades of poor monetary policy decision making, particularly since 2008, the entire financial system is extremely fragile. The U.S. Federal Reserve is now manipulating fixed-income yields directly by buying its own treasury bonds. By buying treasuries, thus pinning the yields used in financial valuations down, this creates manipulated growth in legacy asset markets, such as the stock market. Following the decoupling of the U.S. dollar from gold in 1971, the Fed began to use the tool of manipulating yields to create the illusion of growth.

(This can be illustrated in the chart below, showing the 10-Year treasury bond in particular.)

If the Federal Reserve were to stop buying treasuries and pinning their yields down, the free market would blow them out, thus causing the collapse of asset prices. Therefore, the Fed has no other choice but to continue buying treasuries to keep the system afloat. Similar to a spring, at this point, the whole system has been coiled so tightly that the unpinning of risk-free yields would cause havoc in markets.

The New Bitcoin “Risk-Free” Yield

In the bitcoin market, futures are trading at a substantial premium to spot market price. Why these futures are trading at a premium is currently unknown, as there is no storage cost; which is the reason commodity futures traditionally trade at a premium. There are two likely explanations for the premium: the ease of access to leverage through futures markets, or that certain entities are unable to get exposure to bitcoin price appreciation via spots, so they have to buy at a premium through futures markets. I suspect that the premium is more likely caused by the former. Although the exact reason behind why these spreads exist isn’t fully understood, they do exist and are there to be captured.

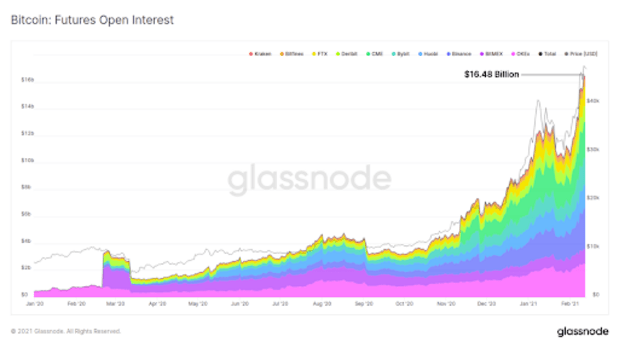

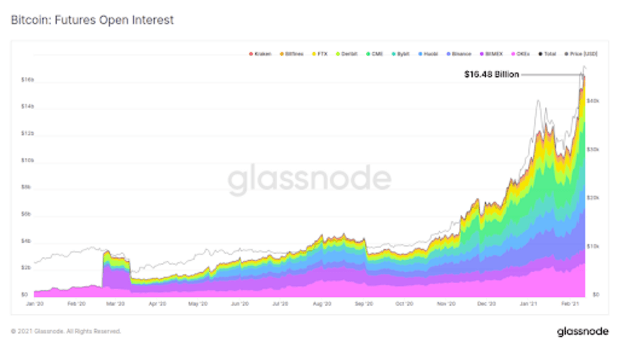

(The chart below illustrates the dramatic increase in futures open interest.)

To arbitrage and capture the difference between spot and futures prices, a financial entity can simultaneously go long/short, giving them a yield that is essentially risk- ree. For example, an August CME futures contract is priced at $54,105, while the current spot price on Coinbase is $50,905. By simultaneously buying spot for $50,905 and going short via futures, a financial entity can pocket the $3,205, or 6 percent return, over five months, given they hold these positions until the August expiry. On an annualized basis, this is a 14.4 percent yield, nearly risk-free; dramatically higher than the current one-year U.S. Treasury bond, which yields .08 percent. In addition, as the bitcoin price appreciates and becomes more volatile, there will be even fatter spreads to arbitrage through this method.

Over Collateralization

We have discussed the method by which one could arbitrage the spreads in bitcoin spots/futures, but now I’d like to illustrate how the increasing popularity of this trade will accelerate the supply suffocation already naturally occurring via Bitcoin’s programmatic, four-year halving cycle.

The accelerant is over-collateralization, which is unique to bitcoin lending/borrowing markets. For physically-settled futures contracts, an entity must borrow BTC from a lending platform such as BlockFi in order to sell bitcoin short and take on the long/short trade described in the paragraph above. Due to bitcoin’s volatility, these bitcoin lending platforms require that the borrower must post twice whatever they are borrowing in collateral to BlockFi, or in other words, the loan-to-value (LTV) ratio of a loan is 50 percent.

For example, if I were to borrow $50 to sell bitcoin short, I would need to post $100-worth of collateral to the lending platform. To reduce counterparty risk, BlockFi then takes that collateral posted and turns it into bitcoin to be held in escrow until the borrower pays back the loan. Given the 50 percent LTV we mentioned above, this means that there are two bitcoin being locked in escrow for every one bitcoin that would naturally be removed from supply.

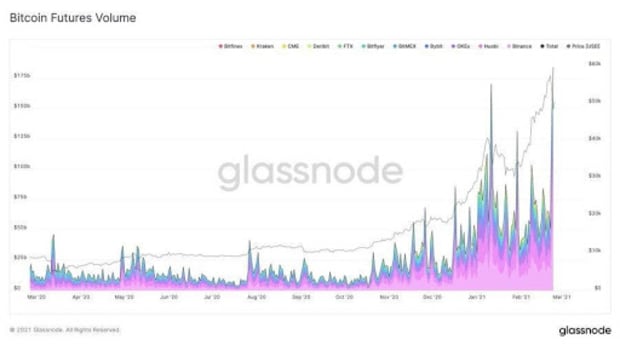

As spreads increase and the arbitrage opportunity becomes more attractive, this effect will accelerate, causing increasing amounts of bitcoin to be locked up. It will be extremely interesting to see how this plays out, as there has never been a mature derivatives market and lending/borrowing market in previous bitcoin bull cycles. This effect could be the catalyst for bitcoin to reach escape velocity. Taking a look at futures volume/open interest in comparison to balance on exchanges, the two seem to have an inverse correlation, possibly illustrating growing interest in the opportunity to capture yield spreads and the over-collateralization of borrowed coins required for the trade.

(The charts below represent futures volume, futures open interest, and balance on exchanges.)

Asset Price Revaluations And The Endgame Of Contango

As touched on at the beginning of this article, asset prices are inversely correlated to risk-free yields. As of right now, the average price-to-earnings (PE) Ratio for the S&P 500 is just above 34. This may seem astronomical, but in comparison to current treasury yields, it makes sense. As a rule of thumb, equity returns should equal a PE ratio of one. The expected return on an equity with a PE ratio of 34 would be 2.94 percent, which is still far more attractive than ten-year treasuries that currently yield 1.47 percent.

However, if the market begins to recognize the growing yields that exist in the bitcoin market as the new risk-free rate used to determine valuations, there could be a dramatic repricing of assets. For example, if bitcoin yields were to blow out to 20 percent, PE ratios would need to be well below five in order for risk-on equities to offer a more attractive return than that 20 percent risk-free rate. If the average price-to-earnings ratios were to drop from 34 to five, that would be an 85.29 percent stock market correction. In addition, there is also the $128 trillion yield-deprived, fixed-income market to consider as well.

These new bitcoin risk-free yields that aren’t possible in the current manipulated, fixed-income market could be the catalyst to release the pressure built up in the monetary “spring” that has been coiling up for decades, with nowhere for that monetary energy to flow until now, into these free and open bitcoin markets.

To conclude, with these new “risk-free” bitcoin yields attracting increasingly more of the $128 trillion of monetary energy from fixed income, financial instruments denominated in an eroding currency (USD), that the rest of the business world stops using to conduct economic calculation, would be dramatically impaired. Eventually, post-hyperbitcoinization, it would be attractive to rotate bitcoin back into equities and other assets, once their valuations are more attractive in comparison to the returns that the arbitrage yields offer.

This is a guest post by William Clemente III. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.