- July 13, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

Analysis of FRED Data: Bitcoin Price vs. Personal Savings Rate

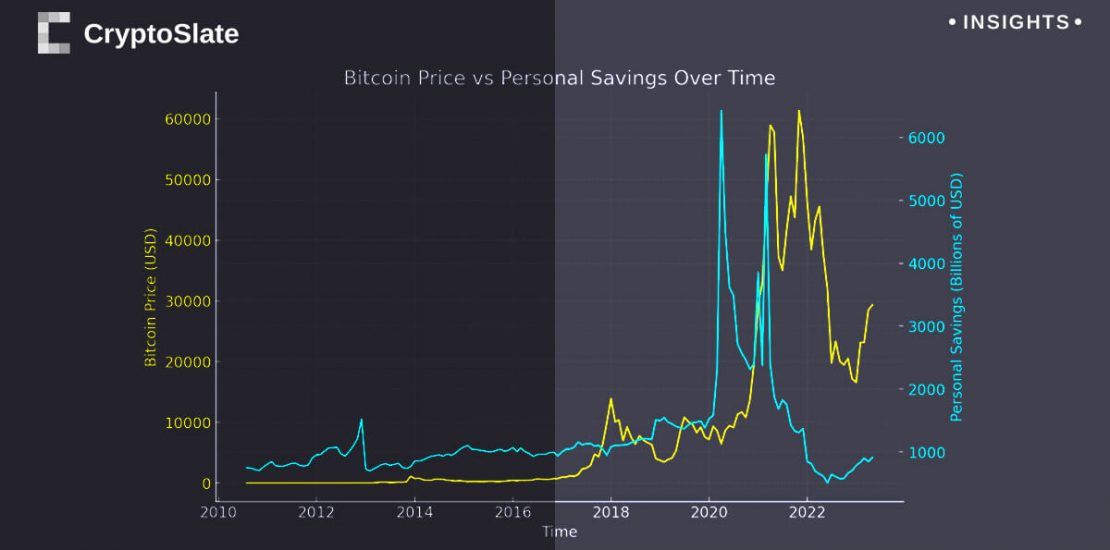

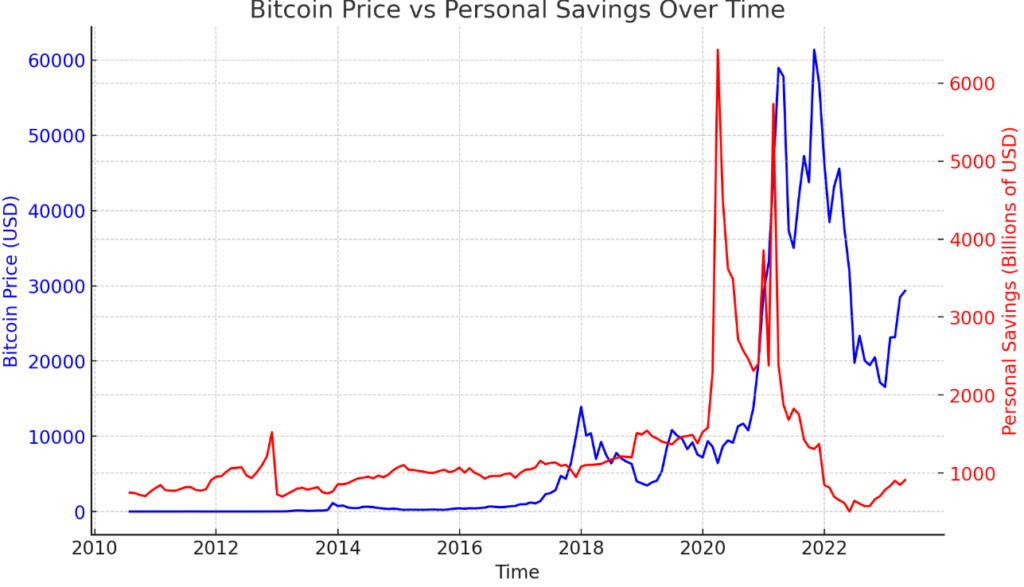

Our examination of the data from the Federal Reserve Economic Data (FRED) brings out an interesting correlation between the Bitcoin price and the personal savings rate.

The graph below delineates this relationship – the personal savings rate, represented in red, tends to peak before there is a subsequent surge in Bitcoin prices.

A clear instance of this pattern was observed in 2013, when there was a significant rise in savings. This was closely followed by a peak in Bitcoin prices six months later. Furthermore, the personal savings rate continued on an upward trajectory from 2013 to 2017, which coincided with another price surge in Bitcoin in 2017.

The year 2020 marked an enormous uptick in savings, largely fueled by the COVID-19 stimulus packages. This capital eventually found its way into Bitcoin and other asset classes, contributing to a spike in their values.

Currently, the data suggests that the personal savings rate has hit a low and is showing signs of increasing once again. It’s worth observing if this trend will repeat itself with another surge in Bitcoin prices in the near future.

The post Do personal savings levels correlate with Bitcoin price increases? appeared first on CryptoSlate.