- April 19, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

No Comments

Quick Take

- As economic instability increases worldwide, concerns about the reserve currency will always be questioned.

- Reserve currencies tend to last around 100 years; we have heard these are the last days of the US dollar hegemony for decades.

- We don’t believe the dollar will lose its reserve currency status soon; however, news stories in recent weeks and especially since the Ukraine Invasion, freezing Russia off the swift system doesn’t bode well.

- CryptoSlate did a recent market report on de-dollarization and the possible implications for Bitcoin.

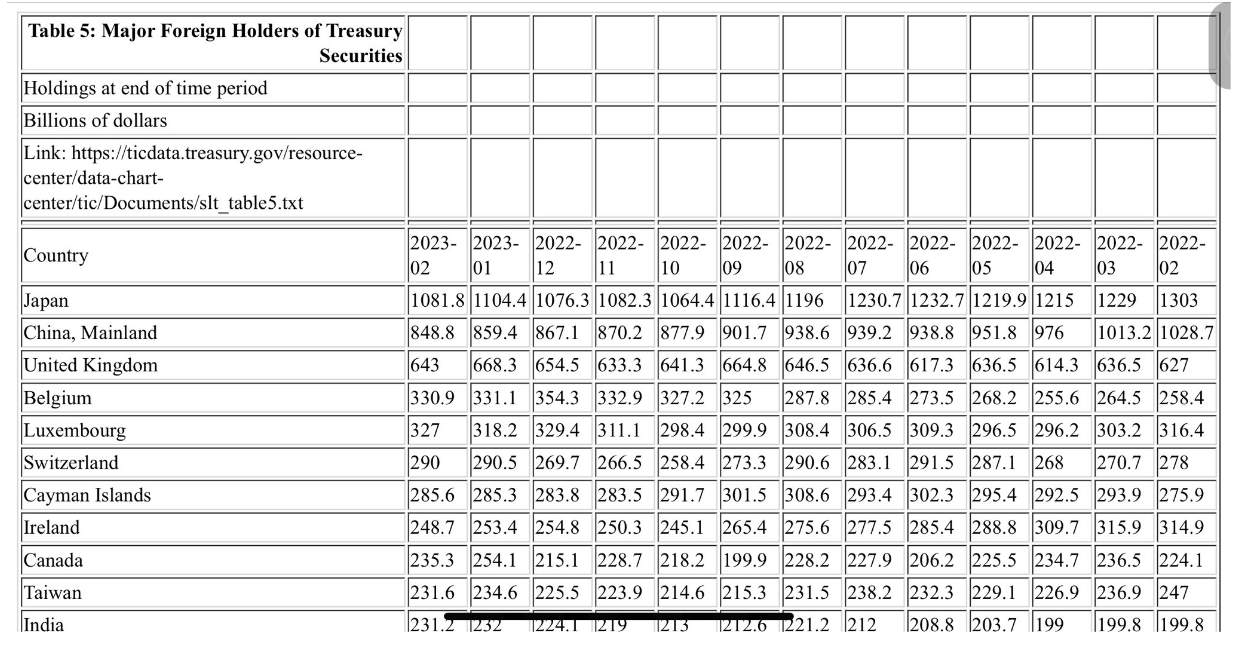

- U.S. Treasuries are the benchmark for the global economy, deemed the “risk-free” rate of the world. However, major nations are starting to offload treasuries, most notably China and Japan.

- China sold almost 18% of its holdings in the last 12 months, while Japan sold 17% of its treasuries in the same time period.

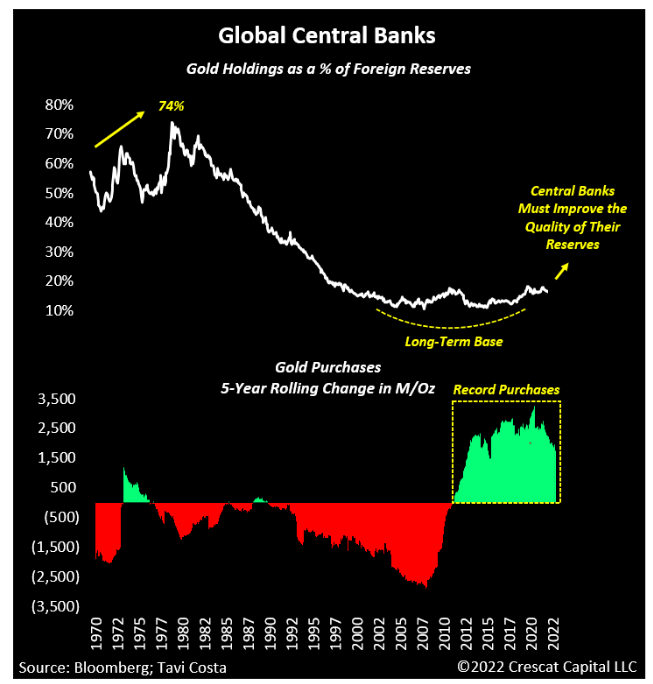

- This so happens to coincide with a time when global central banks, mainly in the East, are increasing their Gold holdings as a % of foreign reserves.

The post Global shift away from the US dollar prompts offloading of US treasuries appeared first on CryptoSlate.