- April 6, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The U.S. banking crisis that began with the collapse of Silicon Valley Bank seemingly did little to curb interest in crypto trading.

According to a recent report from CCData, the total trading volume across centralized exchanges increased by over 25% in March, showing that crypto trading flourishes in highly volatile markets.

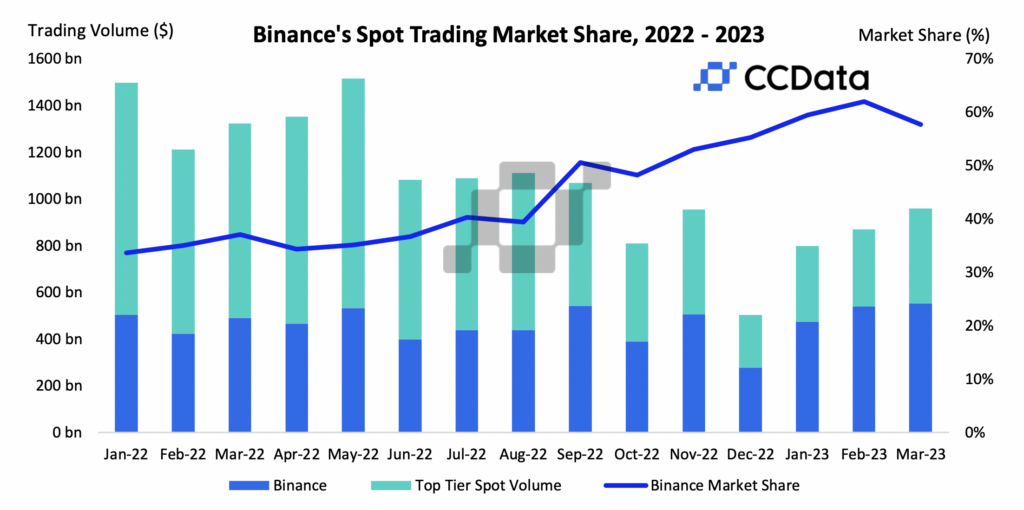

The attention USDC got for losing its peg quickly focused on Binance, whose regulatory struggles cost it a significant chunk of its market dominance.

The exchange’s spot market share across top-tier exchanges fell for the first time in five months, decreasing from 62% in February to 57.7% in March. Despite its spot trading volume increasing by 2.54%, it lost market dominance as competitors OKX and Coinbase saw a 29.7% and 23.5% increase.

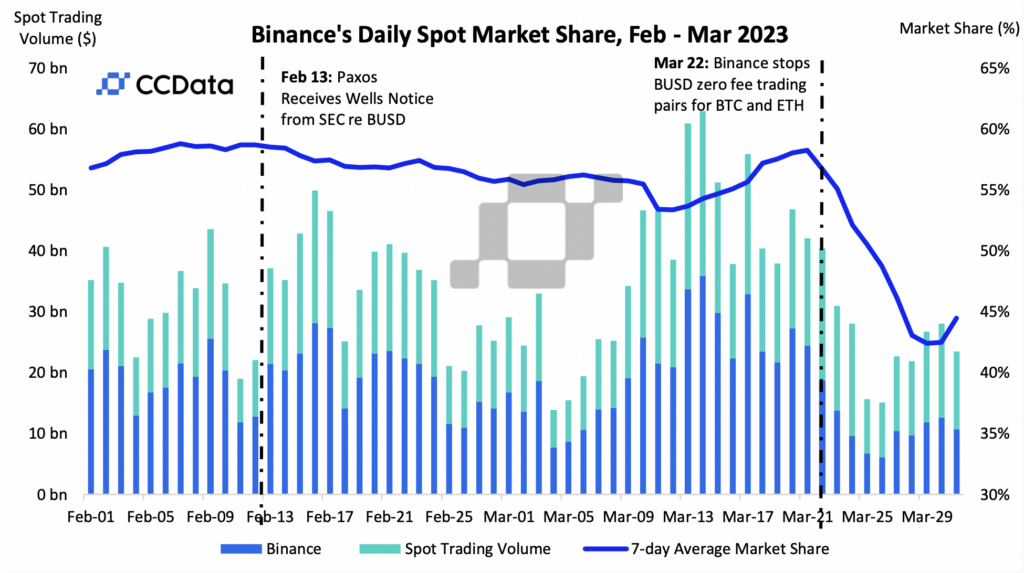

Binance’s decreasing spot volume dominance is most likely due to the exchange’s decision to halt zero-fee trading for BTC/BUSD and ETH/BUSD pairs, contributing to a large chunk of its trading volume. The regulatory issues BinanceUS faces certainly contributed.

The seven-day average market share shows a much steeper decline, with Biannce’s daily spot trading volume market share at just 44.5% at the end of March.

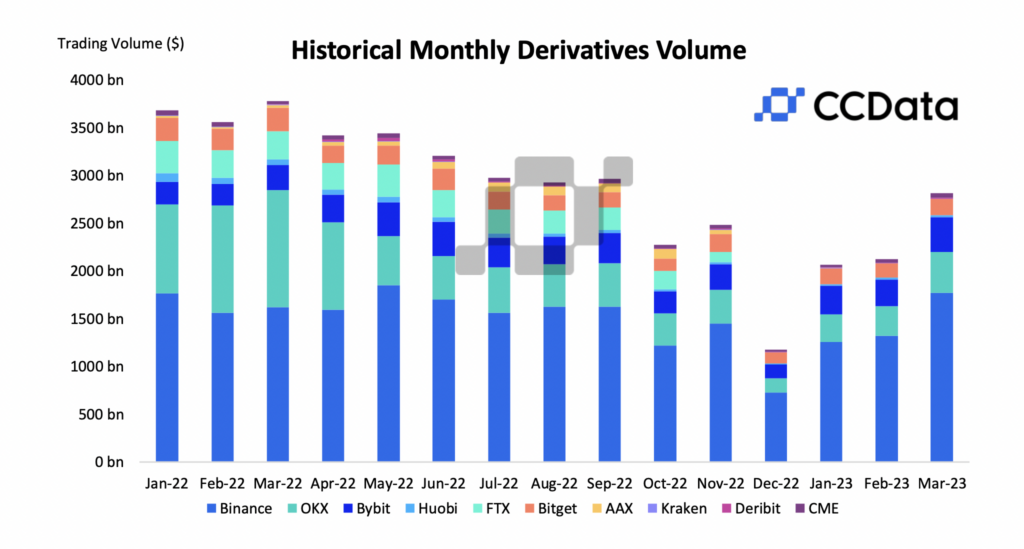

Nonetheless, the exchange saw a significant increase in derivatives trading volume on its platform. Derivatives trading volume increased by 32.6% across all centralized exchanges, pushing Binance’s derivatives market share to an all-time high of 64%.

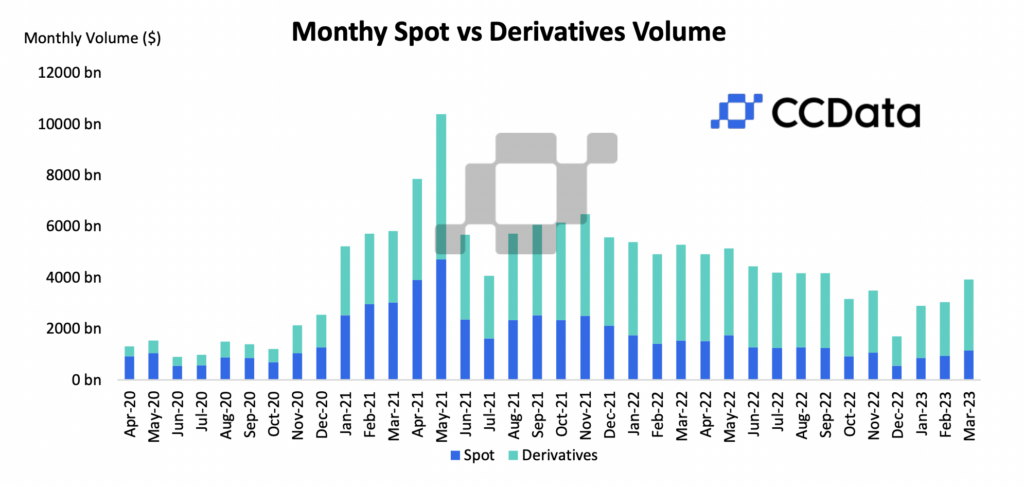

As of April 2023, derivatives accounted for 72.7% of the total crypto trading volume across centralized exchanges. CCData notes that the increase could result from increased speculation after the USDC contagion caused multiple stablecoins to de-peg.

The total derivatives volume reached $2.77 trillion in March, with the intra-month high of $170 billion recorded on March 14. According to the report, it was the highest monthly trading volume since September 2022. The daily high of March 14 is a 47.3% increase from February’s intra-month high of $116 billion.

“This is an all-time high for the market share of derivatives, highlighting the increase in usage of leverage as the narrative for bitcoin and crypto assets gets stronger under the current turmoil in the banking sector,” CCData noted.

The post Markets could not get enough of crypto in March, pushing CEX trading volumes to 6 month high appeared first on CryptoSlate.