- March 14, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

On-chain data shows around 2.7 million more coins have entered a state of profit following Bitcoin’s jump above the $25,000 level.

65% Of The Adjusted Bitcoin Supply Is Now In The Green

According to data from the on-chain analytics firm Glassnode, an additional 20% of the adjusted supply is now enjoying profits. The relevant indicator here is the “percent supply in profit.” As its name already implies, it measures the percentage of the total circulating Bitcoin supply currently holding unrealized gains.

The metric works by going through the on-chain history of each coin in the circulating supply to check what price it was last moved at. If this previous value for any coin was less than the latest Bitcoin price, then that coin is counted under the supply in profit.

There is a problem with this indicator, however, and it’s that a large amount of dormant supply has been lost because the wallets that store said coins are no longer accessible.

This old supply was last moved at very low prices compared to the BTC value today, so it’s technically holding massive unrealized profit. But as these coins are lost, they are essentially out of the circulating supply and should thus not influence the current market.

Because of this reason, the supply in profit indicator can gradually become inaccurate compared to the actual picture. To mitigate this issue, Glassnode has come up with the “adjusted percent supply in profit” metric, a modified version of the original indicator that filters out the data of all coins older than 7 years.

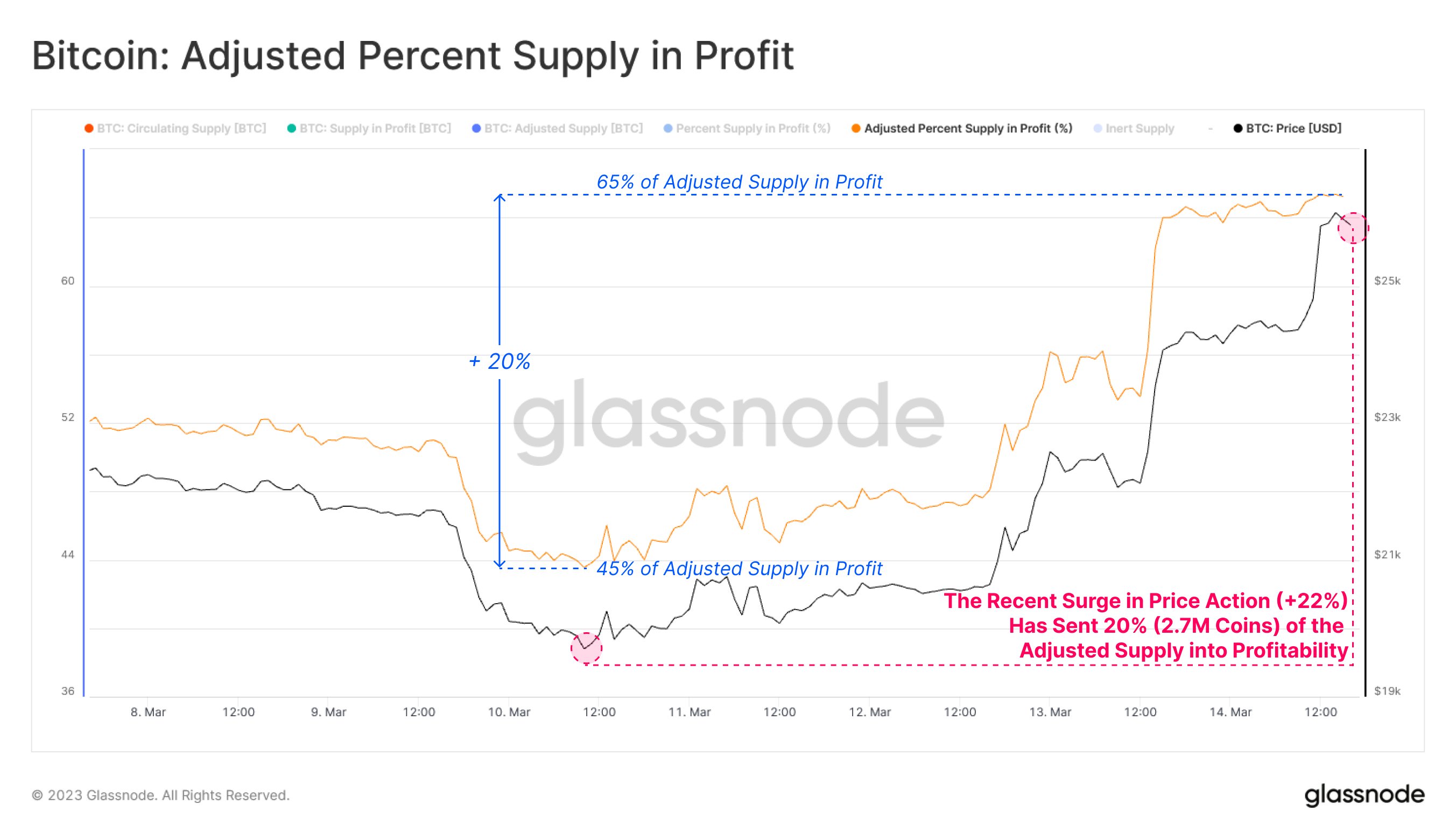

Now, here is a chart that shows how the value of this Bitcoin indicator has changed during the past week:

As displayed in the above graph, the Bitcoin adjusted percent supply in profit was around a value of 45% just a few days ago when the price was floating around the $20,000 level. This means that 45% of the supply younger than 7 years had some gains at that point.

Since then, BTC has enjoyed some sharp upwards momentum and has even broken above the $26,000 mark briefly before seeing a pullback to the current $25,000 level.

As a result of this rapid growth, the adjusted supply in profit has also seen a big jump to about 65%, meaning that 20% of the adjusted supply or 2.7 million coins have entered into a state of profit now.

A natural implication is that investors acquired 20% of the adjusted supply at prices in the $20,000 to $26,000 range.

BTC Price

At the time of writing, Bitcoin is trading around $25,100, up 13% in the past week.