- March 11, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The cryptocurrency market has seen a decline in the value of Dogecoin (DOGE) as massive amounts of fear, uncertainty, and doubt swept across the market after Silicon Valley Bank collapsed on Friday morning as a result of a bank run and a capital crisis precipitated the second-largest failure of a financial institution in the history of the United States.

The collapse of crypto-friendly bank, Silvergate, has also triggered market sell-offs with the market cap of top meme tokens down by nearly 11% in the 24-hour period. The trading volume of DOGE has surged by almost 30%, indicating an impending intense market sell-off.

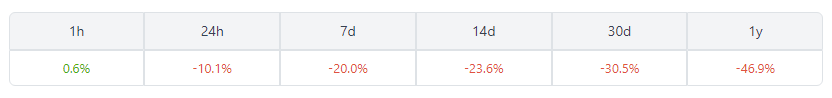

At the time of writing, DOGE was trading at $0.0640, indicating a 21% decline in the last seven days. Additionally, data from crypto market tracker, Coingecko, shows that the dog-themed coin has lost 11% of its value in the last 24 hours alone.

The meme token has declined by 31% in the last 30 days and by 24% in the last two weeks, with only a 2% increase since the beginning of 2023.

For its part, Bitcoin – the biggest crypto in terms of market cap – saw its price falling from the $21,000 level, trading at $20,372 at the time of writing as BTC investors brace for the next episode in the ongoing crisis that befell Silicon Valley Bank.

The macroeconomic uncertainty surrounding DOGE is due to its highly speculative nature and lack of fundamental value. Its value is largely driven by demand from investors and traders, making it unpredictable and subject to sudden shifts in sentiment.

Silicon Valley Bank Failure Drags Down DOGE

But today’s price decline in DOGE can largely be associated with the sudden implosion of Silicon Valley Bank.

SVB’s decline was partly attributed to the Federal Reserve’s forceful hike in interest rates over the previous year.

Banks had amassed long-term Treasuries that seemed low-risk when interest rates were almost at zero.

However, as the Fed intensified interest rates to manage inflation, the worth of these investments dropped, resulting in unrealized losses for the banks.

Despite this, DOGE’s 24-hour trading volume has returned to $681 million, up 103%, generating bustling market activity that can easily translate into gains when the conditions are right.

Will SVB Implosion Impact Shibarium Launch?

On the other hand, the SHIB army has had reason to celebrate as the burn rate of their favorite meme coin increased by a staggering 36,497.56%, as reported by Shibburn.

The forthcoming release of the Shibarium Beta layer-2 blockchain may account for the recent surge in the crypto’s burn rate.

However, how this plays out could depend upon how bad the collapse of SVB is and how it affects investor sentiment and the excitement surrounding Shibarium’s launch.

More Pain For The Crypto Market?

Meanwhile, some market observers now expect more pain for the crypto sector following the failure of Silicon Valley Bank and the spread of FUD about hidden risks in the financial and banking sector in general.

Christopher Whalen, chairman of Whalen Global Advisors, said in quotes by Reuters:

“There could be a bloodbath next week as […] short sellers are out there and they are going to attack every single bank, especially the smaller ones.”

While SHIB continues to generate bustling market activity, larger addresses have started to unload their assets, leading to a decline in the number of whale transactions.

Meantime, analysts keep an eye on the next developments on Silicon Valley Bank – and how it may impact Dogecoin’s price in the coming days.

-Featured image from Mental Floss