- February 16, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

This annual report looks at cross-chain data from the blockchain industry to outline the most important metrics and trends from 2022 in GameFi.

By looking at last year through the lens of on-chain analytics, we can map the trajectory of the GameFi industry and make more intelligent investment decisions and analyses in 2023.

By the numbers, 2022 was a catastrophic year. After hitting euphotic highs, investors, GameFi participants, and NFT holders saw the value of their holdings drop precipitously. Those who were more unlucky lost all their assets as they got caught up in the collapses of Terra, BlockFi, Celcius, FTX, or one of the other smaller projects which failed or got hacked.

Nevertheless, well-known game studios continued to invest heavily in GameFi. Analysts still foresee that blockchain games—when they become more playable—will be one of the primary vehicles driving mainstream crypto adoption.

But until then, most GameFi projects still fail. That means those involved in the blockchain industry must look beyond headlines and whitepapers to determine what’s happening within a protocol and to determine its sustainability.

Where does on-chain analysis come in?

For players and retail investors: Games still struggle to break out of the death spiral cycle, and GameFi investing still resembles Ponzi schemes, where the objective is to get in early, then get out before the project goes down. If playing a game mainly for enjoyment, one must be extremely wary of on-chain signals which indicate a decline is incoming.

For developers: Developers must closely track cross-chain trends as their choice of launch or expansion platform can significantly impact a project’s success. Considerations include ecosystem support, user base, and performance. Our assessment of GameFi projects considers these factors.

Finally, if you’re a VC or media outlet researcher, your job depends on generating accurate insights about the GameFi industry. This report looks at the underlying data.

It will answer three questions:

- What is the most critical data from 2022, and how does it affect the outlook of the GameFi industry?

- What projects were the most significant last year, and how had they impacted blockchain gaming?

- Which networks are attracting GameFi development and why?

Key Findings

Overall Market

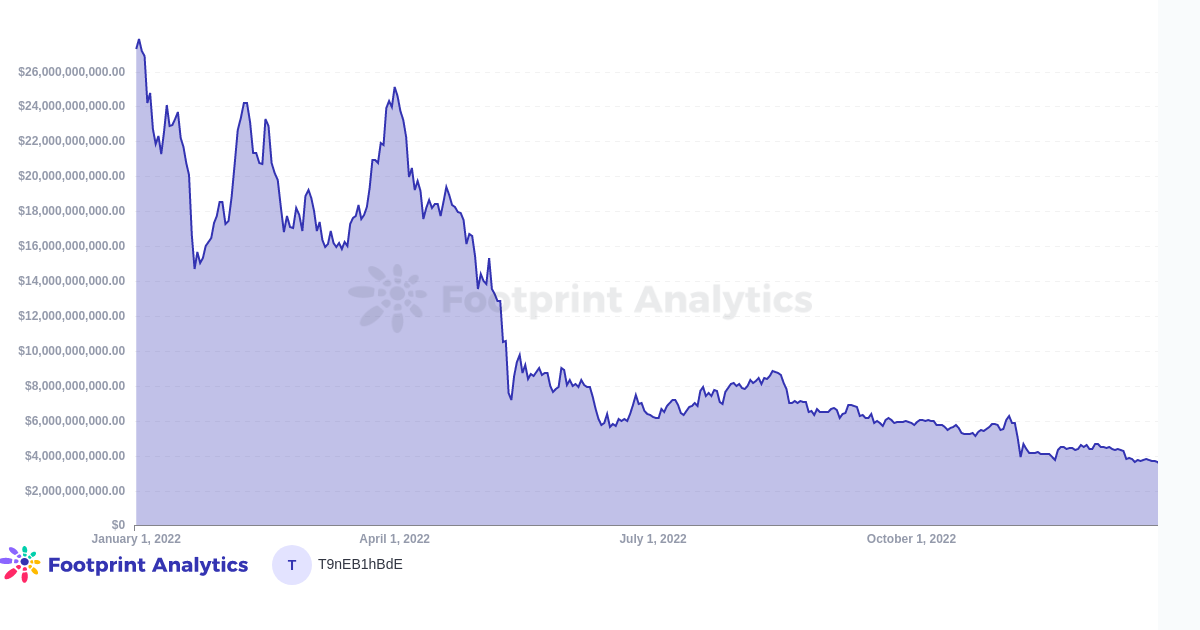

- The market cap of GameFi tokens droppers from $27B at the beginning of the year to $3.3B by the end

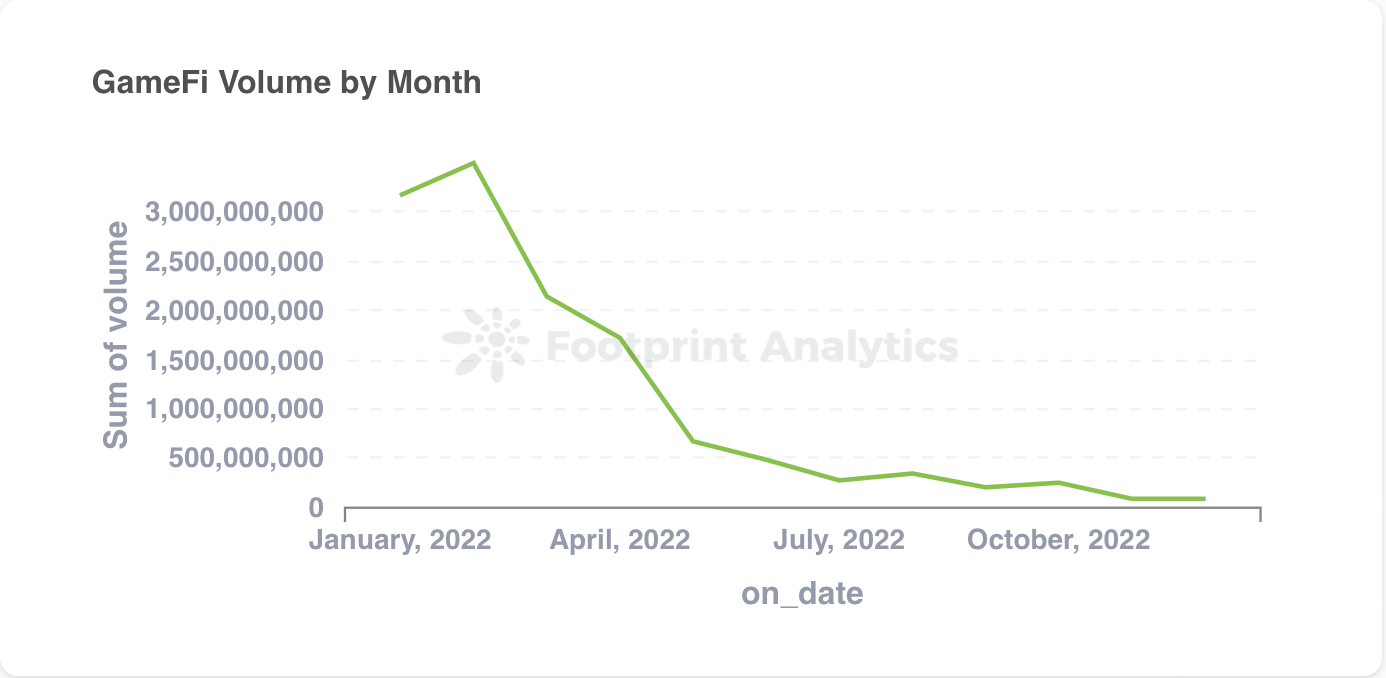

- The monthly volume of GameFi transactions declined severely, going from $3.1B in January to $80M in December, an 97% drop

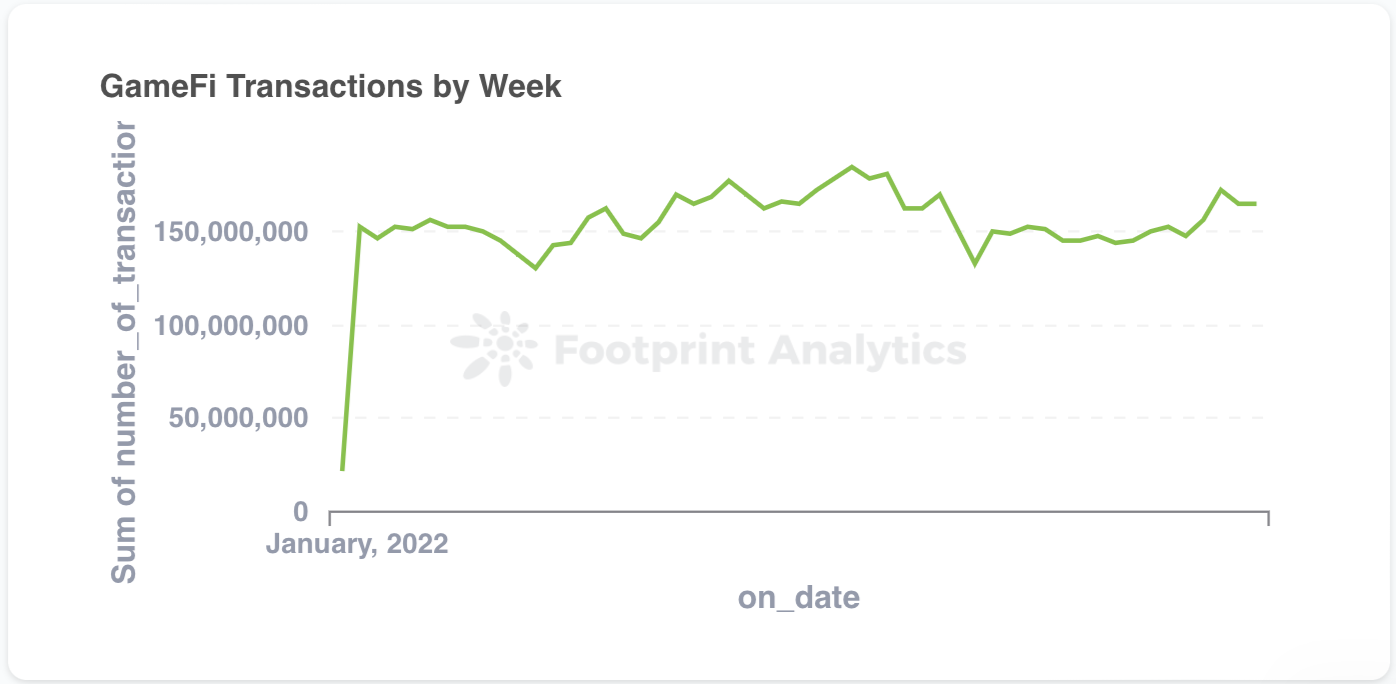

- However, the number of transactions in blockchain games remained relatively constant, bouncing within the band from 130M to 185M

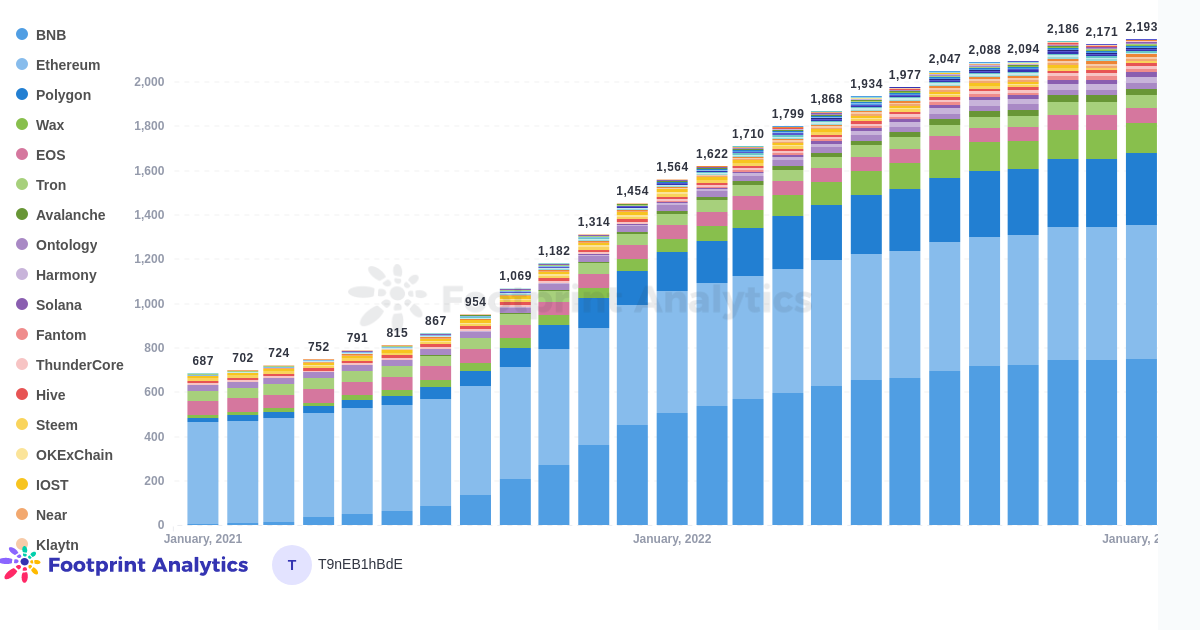

- BNB attracted the largest number of new projects in total, with 296

- However, Polygon, Wax, and Solana grew by greater relative numbers, doubling and tripling their number of projects compared to 2021

Financing & Investment

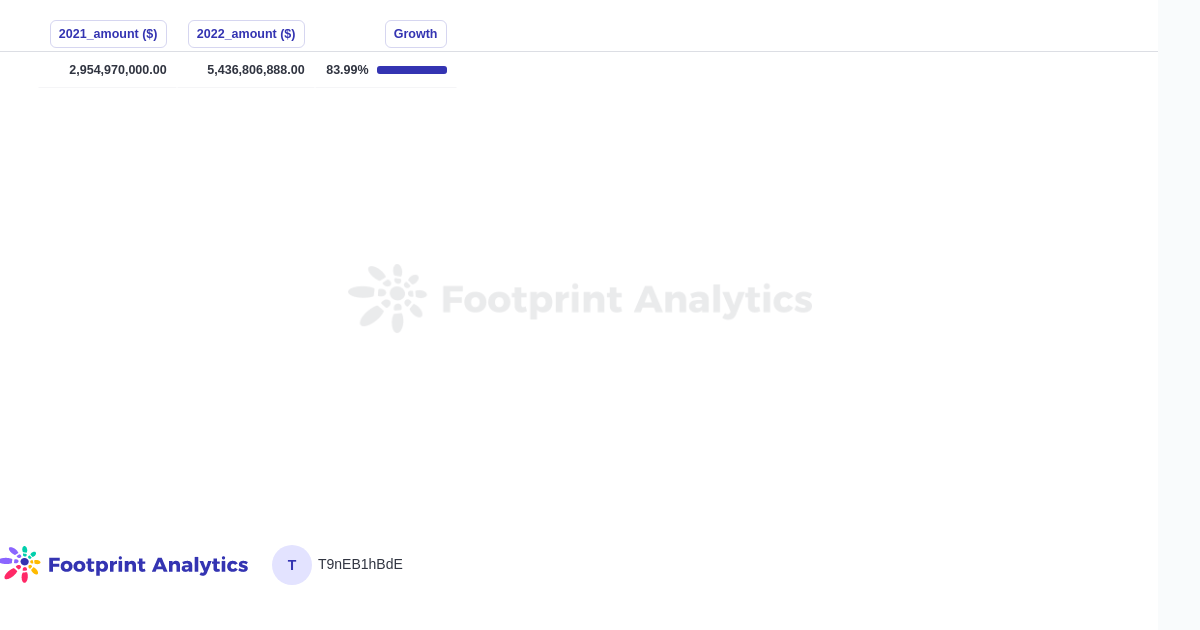

- GameFi funding increased by 83% compared to 2021, with $5.4B in investment compared to $2.9B

- Despite the bear market, big-name studios either continued to, or began to, venture into GameFi

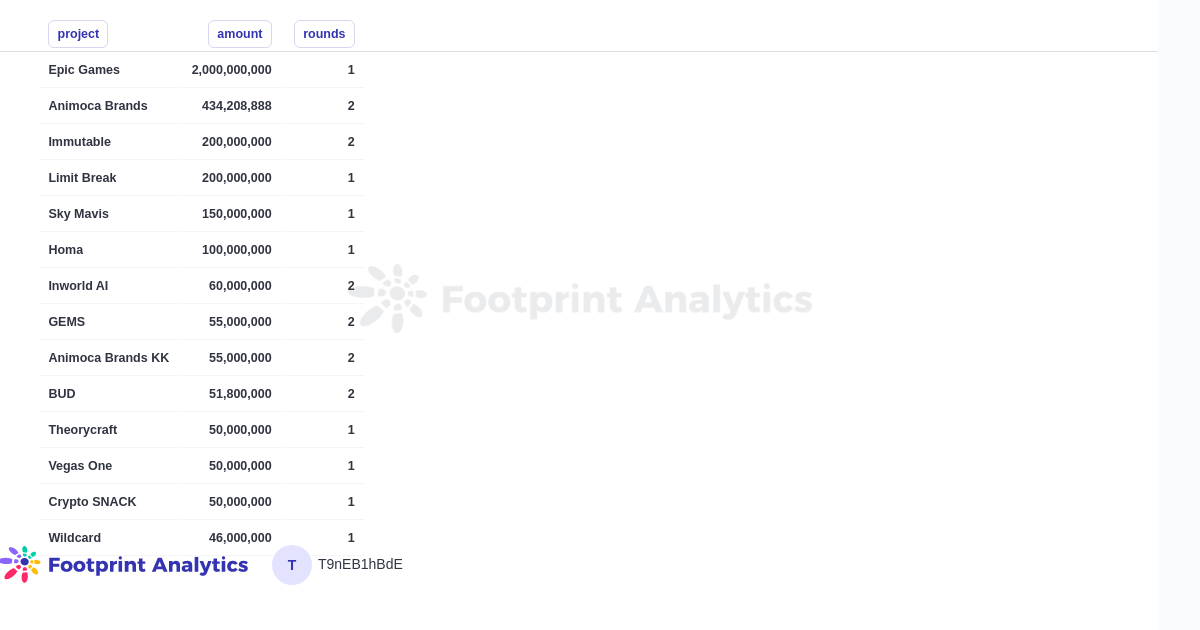

- The biggest fundraising event happened in April when Epic Games, the studio behind Fortnite, raised $2B led by Sony for its metaverse project

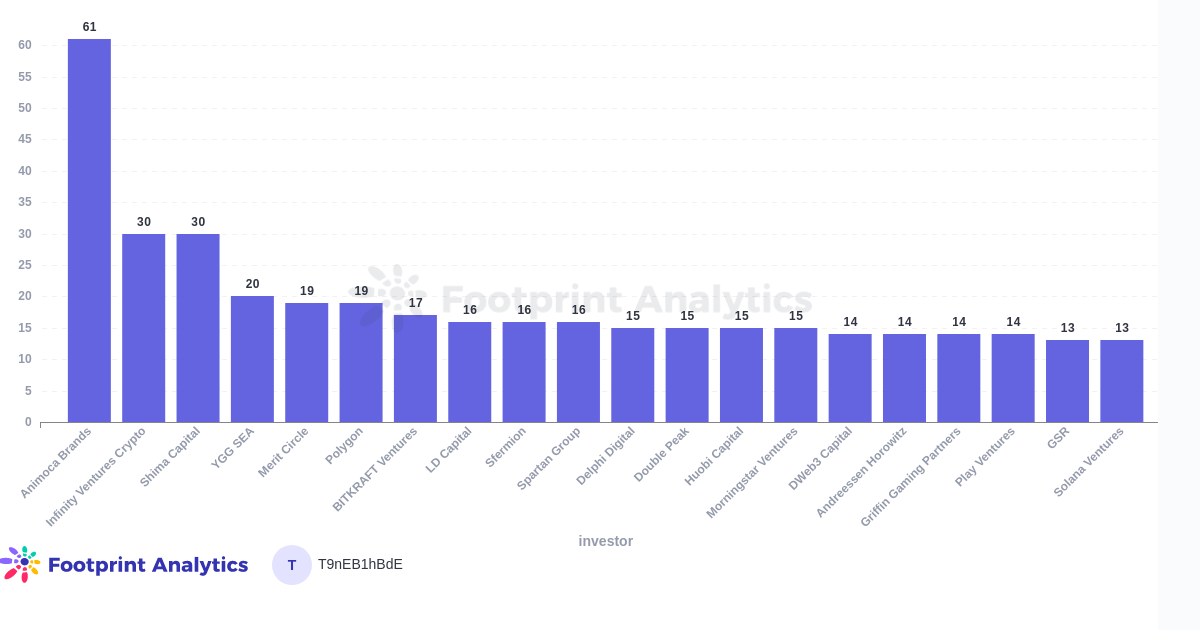

- Animoca solidified its position as the most active leader in GameFi, having closed 61 rounds, more than twice as many as the next most active investor

- Animoca also received the second-highest amount of funding after Epic Games, with $434M

GameFi Users

- In GameFi, more users do not correlate with more volume or more transactions, making it difficult to form a holistic picture of activity on-chain

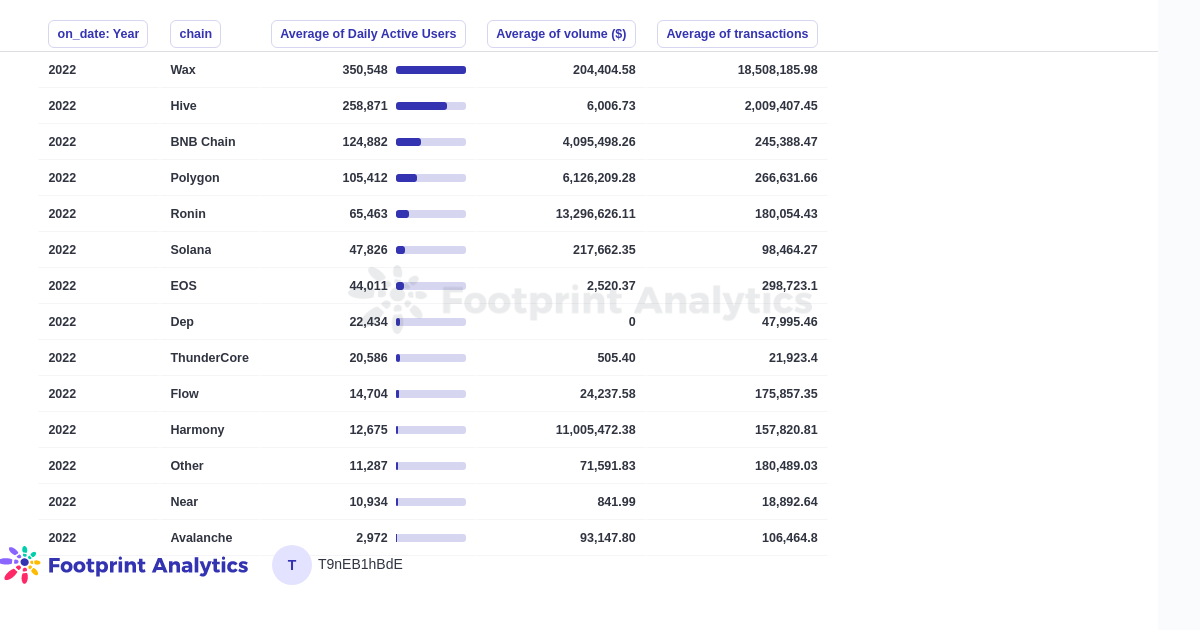

- However, Wax had the highest average of daily active users, followed by Hive and BNB

- Depending on your outlook, this can either indicate the strength of Alien Worlds and Splinterlands, or the prevalence of bots on these games

- Among the top 5 chains by active users, Polygon had the most considerable growth, increasing by 381%

Projects Overview

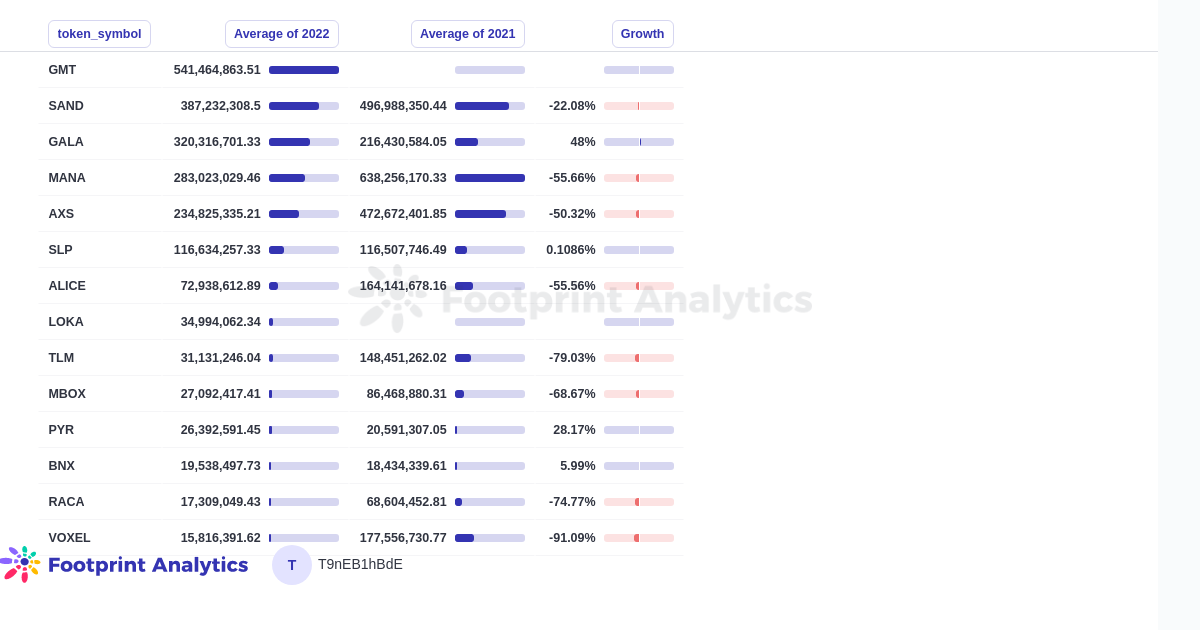

- GMT had the highest average volume of any GameFi token in 2022, at $541M

- Solana became the go-to chain for Move-to-Earn projects, with both STEPN and Walken

- Out of the top 5 games by average GameFi toke volume, MANA had the most significant decline YoY, at -55.6%

- Splinterlands and Alien Worlds were the most actively-played games in 2022, with 383K and 228K average active users, respectively

- None of the highly-awaited, so-called AAA blockchain games, e.g. Illuvium and Phantom Galaxies, launched in 2022

Overall Market

The overall market was grim in 2022. Judging by the price of GameFi tokens or NFTs, it looked like the entire industry bled out and, when it couldn’t get worse, was taken behind the shed and put out of its misery.

But looking beyond the most superficial numbers, there were several highly optimistic signals in the industry, despite the loss of value. Whereas all of the development pre-2022 occurred on Ethereum, other ecosystems have attracted developers, creating more innovation.

- GameFi tokens market cap dropped by 87%

From $27B at the beginning of the year to $3.3B by the end, the market cap occurred as the price of all crypto altcoins collapsed amid tightening macroeconomic conditions. Perhaps as an optimistic indicator for the future, they were also some of the most highly inflated assets during the 2021 bubble, indicating that investors see blockchain games as a high-risk but incredibly high-growth opportunity.

- The monthly volume of GameFi transactions dropped 97%

The drop in monthly volume was perhaps the most jarring statistic from the last year. This decline saw the volume go from $3.1B in January to $80M in December. However, it is crucial to note that this does not reflect the overall activity. As the price of GameFi tokens dropped, so too did the amount of volume, which is calculated at the amount of value in USD being exchanged within protocols

- The number of transactions hovered between 130M and 185M.

While the number of transactions had its ups and downs, it was relatively constant, unlike the sharp decrease tracked by the metric of overall volume. This means that, even as returns declined, GameFi still retained most of its activity. (Or, possibly, its bots.)

- BNB attracted the largest number of new projects in total, with 296

With its ease of development and cheap network fees, BNB attracted many light games and smaller projects. Few of these titles became hits, and BNB has yet to rope in a game of the magnitude of The Sandbox, Illuvium, or Axie Infinity.

- Polygon, Wax, and Solana grew their number of projects by 2x or more

Polygon doubled its number of GameFi protocols from 153 to 306. Wax grew by 158% from 53 to 137 games. Solana had just 2 games in 2021 but broke out in 2022 with 19 new titles

GameFi Funding in 2022

- GameFi funding increased by 83% compared to 2021

$5.4B of investment was disbursed to the GameFi sector compared to $2.9B in 2021. In 2021, institutional investors were still thrown off by the novelty of so-called “blockchain games,” as Axie Infinity, The Sandbox, and Decentraland hit the headlines for the first time.

2022 was the year when people realized that GameFi could become a genuinely disruptive force if vast piles of VC cash were used to empower traditional gaming studios and established blockchain companies to build ambitious projects.

- Big-name studios invested in GameFi

Some of the most notable examples are Sony, Epic Games, Ubisoft and Nintendo.

Epic Games, the studio behind Fortnite, raised $2B led by Sony to build out a metaverse. Details are still vague as of the beginning of 2023. However, the plan includes LEGO. This was by far the most significant fundraising milestone of the year.

- Animoca became the most influential institution in Gamefi

The studio and investor solidified its position as the most active leader in GameFi, having closed 61 rounds, more than twice as many as the next most active investor. It was also the second-highest recipient of funding after Epic Games, with $434M

Animoca is the company behind The Sandbox, Benji Bananas, Arc8, and Phantom Galaxies.

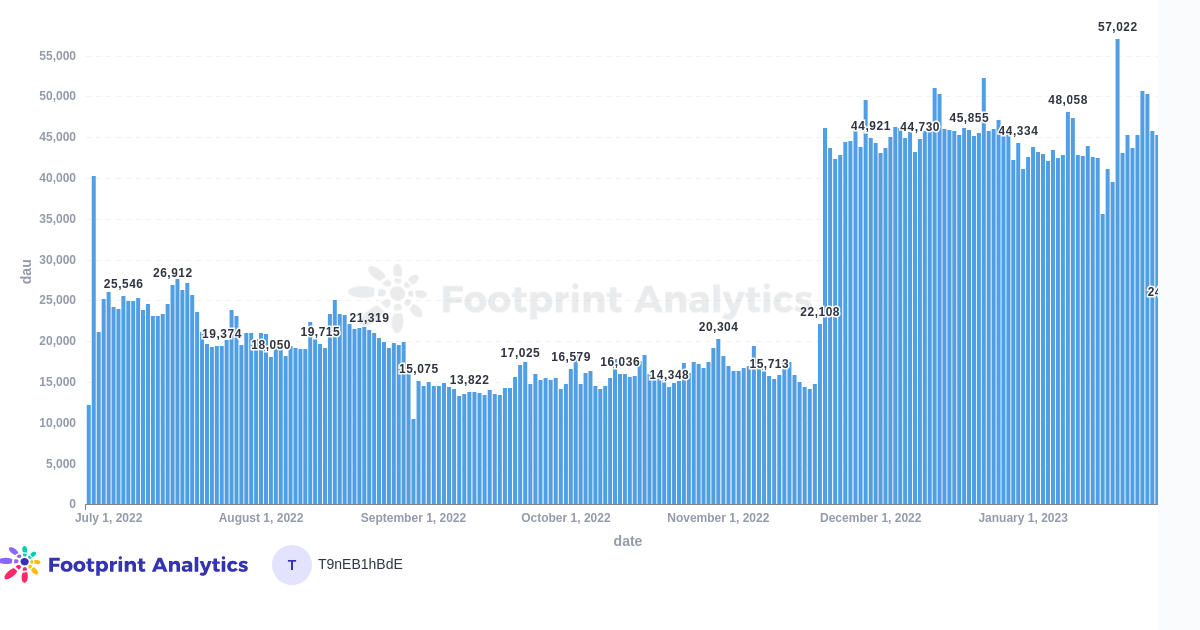

GameFi Users in 2022

- Wax had the highest average of daily active users, followed by Hive and BNB.

Throughout 2022, Splinterlands (Hive’s main title) and Alien Worlds (Wax’s) were neck-and-neck for the number of active users. Depending on your outlook, this can either indicate the strength of Alien Worlds and Splinterlands or the prevalence of bots in these games.

- Polygon had the most considerable growth, increasing by 381% in active users among the top 5 chains

Polygon is an EVM L2 built to scale up Ethereum. Even though the project goes back to 2017 and its token, MATIC, went live in 2019, the network had its breakout year in 2022, showing span performance in DeFi, NFTs, and GameFi. The games with the most average monthly DAU in 2022 on Polygon were Planet IX (70K) and Benji Bananas (25K).

Projects Overview

- GMT had the highest average volume of any GameFi token in 2022, at $541M

STEPN was the last breakout success of the bull market and was one of the only innovative titles to reach headlines, introducing a mobile-app-based “Move-to-Earn” gameplay. However, after a month of its NFT asset sneakers and tokens inflating to the sky, the game entered the death spiral, and prices collapsed. The game is still the second most played on Solana.

- While Solana has had a rough time in the aftermath of the FTX collapse, it has become the go-to chain for Move-to-Earn projects

Aside from STEPN, the “Walk-to-Earn” title Walken is also built on Solana.

- MANA had the most significant decline YoY, at -55.6%, of the top 5 GameFi tokens

This reflects a loss of confidence in its game, Decentraland. Decentraland was one of the original big 3 GameFi and metaverse titles that gained widespread recognition for its in-game assets’ exorbitant price, besides The Sandbox and Axie Infinity.

- Splinterlands and Alien Worlds had 383K and 228K average active users, respectively

They were the most actively-played games in 2022. As we previously mentioned, both Splinterlands and Alien Worlds are card and text-based games with no 3D world—making them surprisingly primitive for market leaders.

- None of the highly-awaited, so-called AAA blockchain games, e.g. Illuvium and Phantom Galaxies, launched in 2022

As of the beginning of 2023, Illuvium’s Beta has already been launched and a full version is expected to launch to the public midway into 2023.

This piece is a joint report by Footprint Analytics

The Footprint Community is a place where data and crypto enthusiasts worldwide help each other understand and gain insights about Web3, the metaverse, DeFi, GameFi, or any other area of the fledgling world of blockchain. Here you’ll find active, diverse voices supporting each other and driving the community forward.

- Footprint Website: https://www.footprint.network

- Discord: https://discord.gg/3HYaR6USM7

- Twitter: https://twitter.com/Footprint_Data

The post Annual GameFi Report: What happened in 2022 and where is the industry heading? appeared first on CryptoSlate.