- February 2, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

While yesterday’s Biden-McCarthy meeting did not result in an agreement on the debt ceiling in the U.S., this could have direct implications for the entire financial market and Bitcoin. And the implications for the Federal Reserve’s efforts to fight inflation are nothing short of massive.

When the question of how the Fed would handle a failure to raise the debt ceiling came up during the FOMC press conference yesterday, Chair Jerome Powell was noticeably annoyed.

“There’s only one way forward here, and that is for Congress to raise the debt ceiling so that the United States government can pay all its obligations,” Powell said yesterday, further stating: “No one should assume that the Fed can protect the economy from the consequences of failing to act in a timely manner.”

Debt Ceiling’s Impact On Bitcoin Price

But what exactly does it mean for the financial markets and specifically Bitcoin if the debt ceiling is not raised? Jurrien Timmer, Director of Global Macro at Fidelity Investments has commented on this.

Timmer explained in a Twitter thread that the “fiscal cliff” is a “complicated dance” and could thwart the Fed’s quantitative tightening (QT) efforts. Since the Fed began siphoning liquidity through higher interest rates and QT a year ago, overall liquidity has declined.

However, liquidity has stabilized since then as tightening has been offset by an influx of liquidity from reverse repos (RRP) and the Treasury General Account (TGA). Remarkably, the stock market, and Bitcoin due to its correlation to traditional markets, stopped falling at this point.

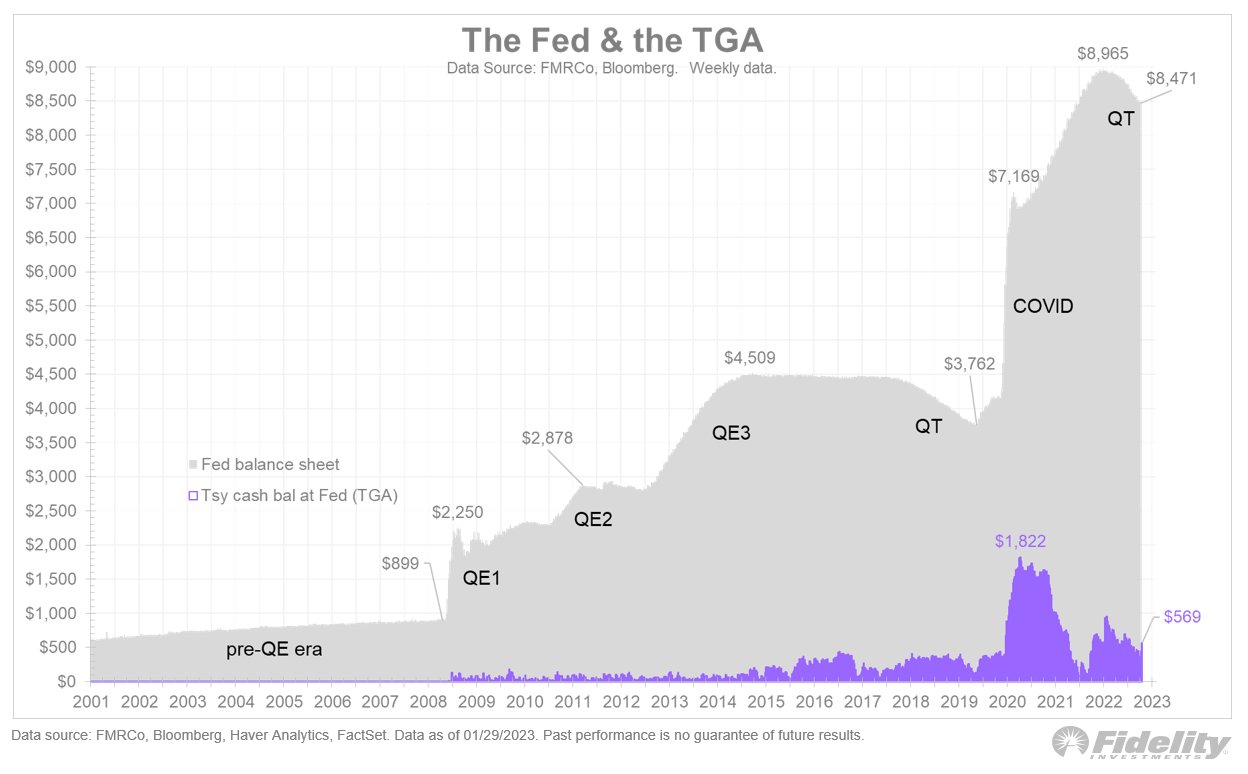

The chart below shows the Fed balance sheet (gray) and the TGA (purple). Timmer explains, “Note how the TGA spiked in 2020 as the Fed grew its balance sheet from $3.76 trillion to $8.97 trillion. Then the Treasury drew down its TGA balance to pay for the stimulus bill.”

Timmer describes the relationship between the debt of the U.S. government, the Fed, and the TGA as follows:

How is that for debt monetization? The Fed monetizes the Treasury’s debt, in the process generating income on its portfolio, which then goes into the TGA, which the Treasury then draws on to pay its bills. Creative accounting, to say the least!

A Liquidity Rally

Ironically, Timmer says, a political showdown over the debt ceiling would force the Treasury to drain its $569 billion TGA balance to avoid a technical default. This would be stimulative and would have a significant negative impact on the Fed’s efforts to fight inflation through QT.

As more liquidity would be flushed into the market, it could be “the fuel that enables the market to keep climbing the wall.” On the other hand, if the debt ceiling is lifted, the TGA would not need to be drawn down, which could have a negative impact on risk assets such as Bitcoin.

Currently, it is not clear when the debt ceiling will be reached in the United States. Estimates so far are for the second half of the year, although the ceiling could be reached much sooner, as other experts argue, referring to the actions of the U.S. government.

As the market thrives on expectations, and yesterday’s FOMC meeting revealed dovish tones by the Fed (for the first time in this cycle), Bitcoin could continue its move towards $25,000 if the debt ceiling debate continues over the next few weeks.

At press time, the Bitcoin price stood at $23,761, being rejected once again at the crucial resistance zone above $24,000.