- January 6, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Multiple rumors surrounding Huobi and its supposed “shadow owner” Justin Sun are currently fueling fears that another crypto exchange may experience a bank run. Seychelles-based exchange Huobi has seen a significant increase in net outflows over the past 24 hours, according to Nansen data.

$60.9 million of the $94.2 million in net outflows last week occurred on the last day alone. The top withdrawals are mainly in USDT, USDC, and ETH from wallets with high balances. DefiLlama reports that as recently as December 15, the crypto exchange saw an inflow of $87.9 million. Since then, a total of $204.65 million dollars has flowed out.

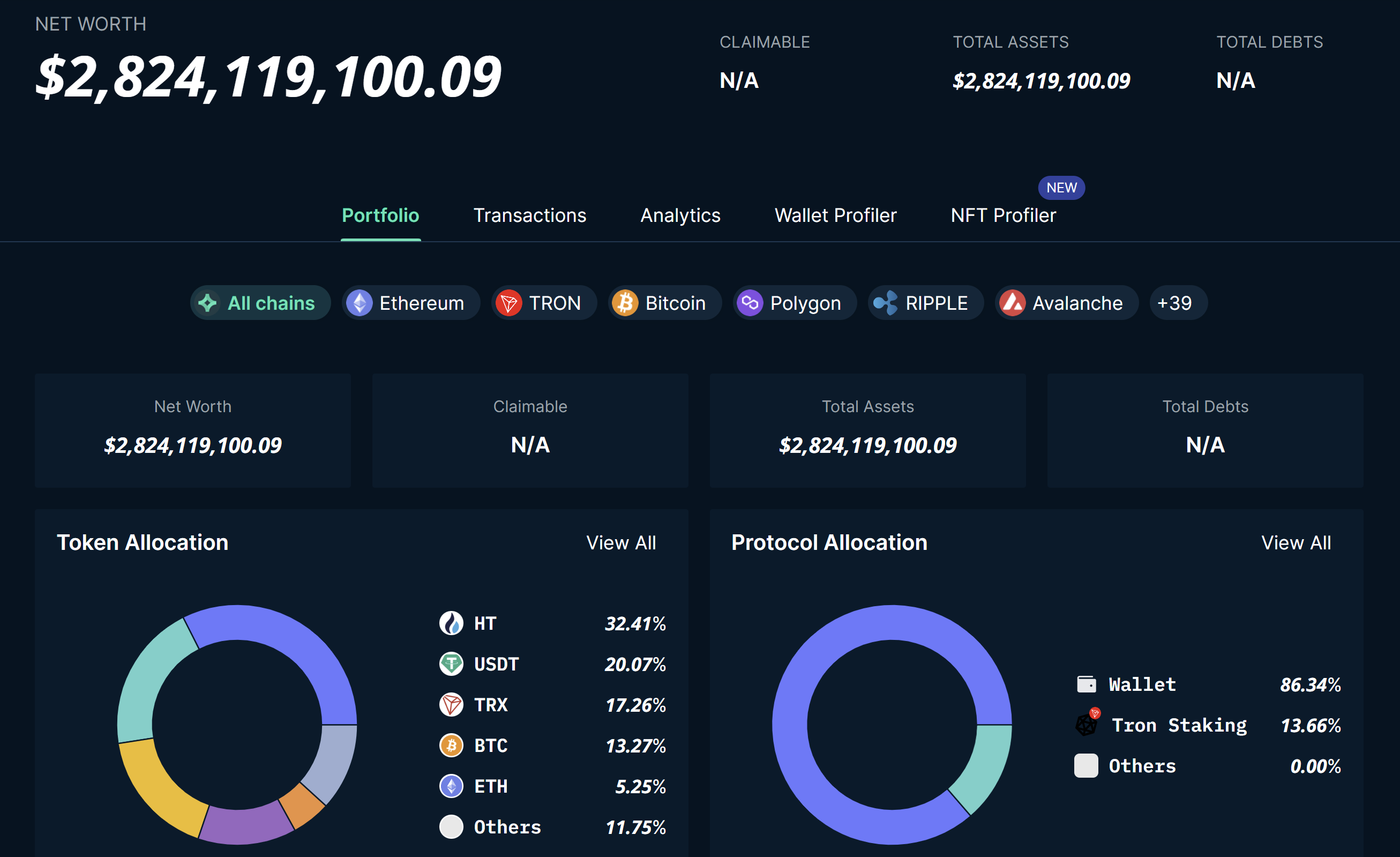

However, a look at Huobi’s reserves shows that the “calls” for a bank run are very premature. According to Nansen‘s data, the crypto exchange holds $2.8 billion worth of customer funds, so the current outflows can be considered marginal.

Crypto Community Speculates About Events

As Nansen writes, the increased withdrawals may have been triggered by rumors that Huobi “is melting down in real time, possibly along with the fortune of His Excellency Justin Sun.”

Chinese journalist Collin Wu first reported on December 30 that Justin Sun’s Huobi crypto exchange was slashing all year-end bonuses, preparing to decimate its team from 1,200 people to 600-800, and cutting the salaries of senior executives, according to several insiders.

On January 4, Wu tweeted that Justin Sun’s HR department has communicated with all Huobi employees to change the payment of salaries from fiat money to USDT/USDC. Employees who do not accept this are to be laid off. The move sparked massive protests from some employees.

In a tweet, a Chinese Twitter user reported that Sun closed all internal employee communication channels and locked employees out of the channels to quell the rebellion. According to him, it is quite possible that internal employees may rebel and directly throw away users’ assets, or that programmers may install backdoor trojans.

“Such incidents have occurred on several crypto exchanges in the last year,” the user stated and warned that “those who have funds on Huobi need to withdraw them quickly, and those who do not have funds need to uninstall the Huobi app to prevent it from being automatically updated to a Trojan horse version.”

《重要提醒》

孙割火必今天已经关闭了和内部员工沟通群,封锁了所有和员工沟通反馈通道。这很危险,接下来不排除有内部员工造反直接rug走用户资产或者程序员添加后门木马。这类事件去年在多家交易所都出现过。

火币上有资产的务必火速提现有人,没资产的要卸载火必app,防止被自动更新成带木马版本。

— BitRun (@BitRunX) January 5, 2023

A long-standing criticism of Huobi is its reserves. Of all the top-tier exchanges, Huobi relies most heavily on its own tokens to denominate its reserves. About 50% of its reserves consist of HT (31.41%) and Tron (17.26%), evoking certain memories of FTX and FTT.

Also of concern is that Huobi holds 81% of HT’s circulating supply (131.6 million out of 162.2 million). Mike Alfred, Board of Directors at Iris Energy Eaglebrook Advisors commented as follows:

Huobi’s shadow owner is Justin Sun. Justin Sun is perhaps the most erratic billionaire in crypto. Justin has been sending billions of dollars of stablecoins around the space, including in and out of Binance. Something huge is afoot. Withdraw all coins from unregulated exchanges.

Justin Sun has also spoken out, denying the layoffs at Huobi in an interview with Hong Kong’s SCMP. In a Twitter thread today, Sun also assured the crypto exchange’s security.

At @HuobiGlobal, we believe that the key to success in the world of cryptocurrency is to "Ignore FUD and Keep Building."

— H.E. Justin Sun

(@justinsuntron) January 6, 2023

Meanwhile, the prices of the exchange token and Tron (TRX) are under pressure. In the last 24 hours, HT has fallen almost 11% at one point, but managed to bounce back (-0.6%) and was trading at $4.68 at press time. TRX is down 7.7% and stood at $0.05048.

Featured image from Pandaily, Chart from TradingView.com