- January 2, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

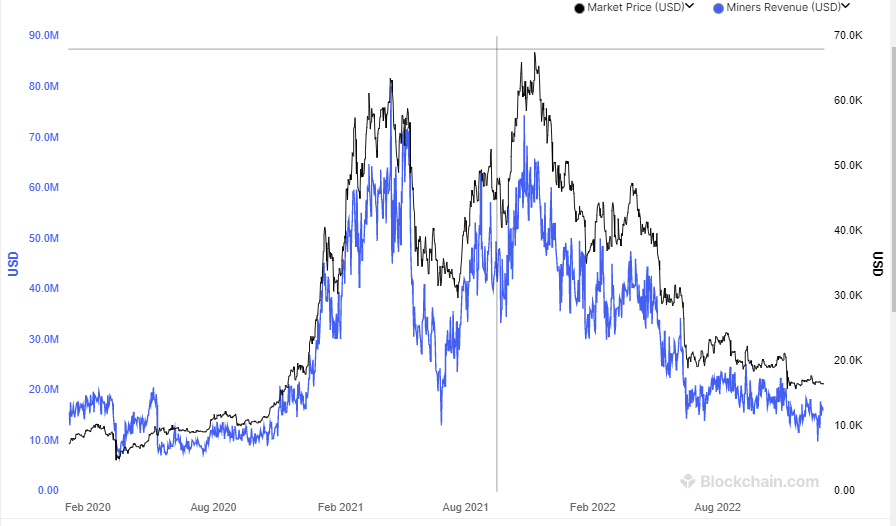

Bitcoin mining revenue was down to $9.55 billion in 2022 from $15.3 billion in 2021 – a 37.5% decline.

Since the peak of a massive rally in 2021, cryptocurrencies have lost more than $2 trillion in market cap to reach below $900 billion. There has been more than a 70% drop in Bitcoin, the world’s largest digital coin since it reached an all-time high of nearly $69,000 in November. In addition, several high-profile company and project failures have sent shock waves in the past year.

This all began in May with the collapse of terraUSD, which brought down other firms like Three Arrows Capital, a crypto-oriented hedge fund. Then, in November, FTX, one of the world’s largest cryptocurrency exchanges, collapsed, affecting the industry.

Additionally, rising interest rates have put pressure on risk assets, such as stocks and crypto, along with crypto-specific failures.

As investors became wary of volatile assets, deteriorating market conditions also affected miners. Aside from market conditions, miners also faced high electricity costs and record mining difficulty. In 2022, mining difficulty reached a record high due to an increase in hash rate, which left some miners struggling for profitability.

Due to this, the miner’s daily revenue has fallen sharply to $16.173 million – down from $63.548 million on Nov. 10, 2021.

Top Mining firms suffered in 2022

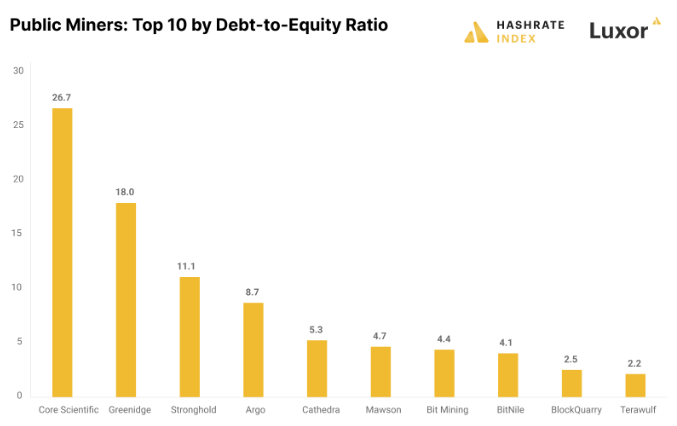

According to Hashrate Index, the debt-to-equity ratio more than tripled for many mining firms, indicating greater financial leverage.

Core Scientific has the highest debt-to-equity ratio at 26.7, followed by Greenidge and Stronghold at 18 and 11.1, respectively. Argo also has a high debt-to-equity ratio of 8.7.

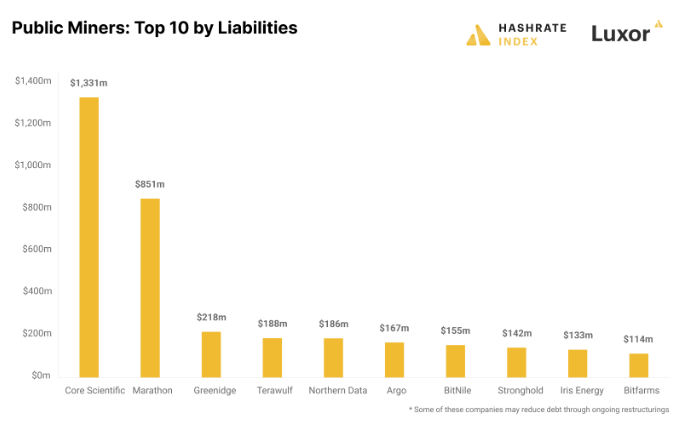

According to Core Scientific’s balance sheet, as of Sept. 30, the company owed the most, with $1.3 billion in liabilities. The second-largest debtor is Marathon, with $851 million in liabilities.

As a result, miners with high debt-to-equity ratios, such as Core Scientific (CORZ), filed for bankruptcy. Whereas Greenidge Generation (GREE) and Stronghold Digital Mining restructured their debt obligations.

Due to the bearish sentiment in 2022, miners’ profitability suffered. Bitcoin’s profitability is measured in dollars per terahash, or TH, per second. During its peak in 2017, bitcoin mining generated $3.39/TH per second, but it dropped to $0.104/TH in 2022.

Prominent public mining companies suffered considerable losses in 2022 that rose over 90% on average.

The post Bitcoin miner revenue down 37.5% in 2022 YoY appeared first on CryptoSlate.