- December 21, 2022

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Solidus Labs’ 2022 Rug Pull report revealed that 8% of all Ethereum (ETH) tokens and 12% of all BNB Chain tokens are rug pull scams.

The report considers data from Jan. 1 to Dec. 1, 2022, and also detected over $11 billion worth of ETH transactions were either directly linked to scam tokens or were included in the money laundering process of rug pulls.

This data leads to the estimation that 8% of all Ethereum tokens are programmed to execute rug pulls.

Evaluating the exposure to these scam tokens, the report also revealed that the BNB Chain hosts the highest number of scam tokens, with 12% of all BNB Chain tokens being scams.

117,629 scam tokens in 2022

The report acknowledges that the industry research identified 24 rug pulls in 2021 and 262 in 2022. However, Solidus Labs’ smart contract scanning tool Threat Intelligence identified over 200,000 scam tokens deployed between Sept. 2020 and Dec. 2022.

Threat intelligence detected 83,268 scam tokens between Jan. 2021 and Dec. 2021. This number recorded a 41% spike in the first 11 months of 2022 and increased to 117,629.

Larger impact than FTX

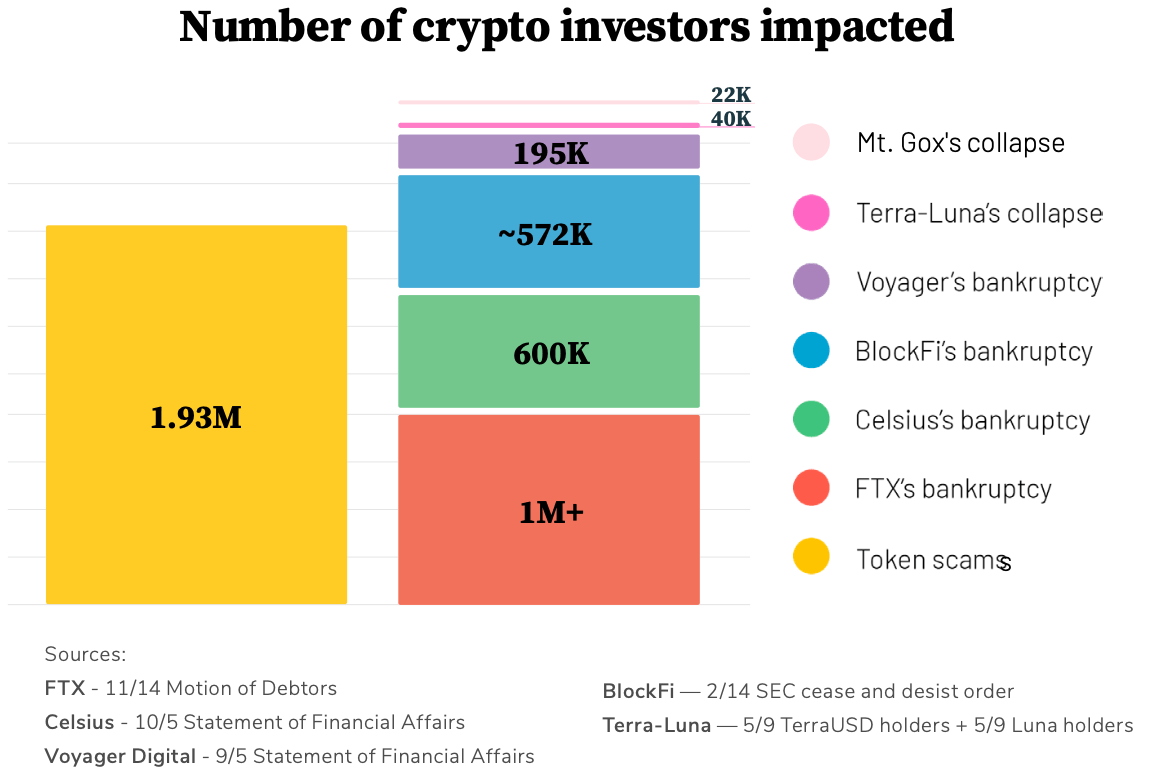

Solidus Labs also compared the impact of these scam tokens with the major events of 2022, including the Terra (LUNA) collapse that started the bear market and the FTX fallout.

The results showed that 1.93 million investors had lost funds to scam tokens, more than the number of investors affected by the Terra and FTX collapses combined.

Excluding the impact of the scam tokens, the FTX collapse had the largest impact on the industry by affecting just above 1 million investors. Celsius’ and BlockFi bankruptcies followed as second and third by affecting 600,000 and 572,000 investors, respectively.

Considering the significance of these numbers, Terra’s collapse almost appears as a minor crisis since it impacted nearly 40,000 investors.

CeFi exposure

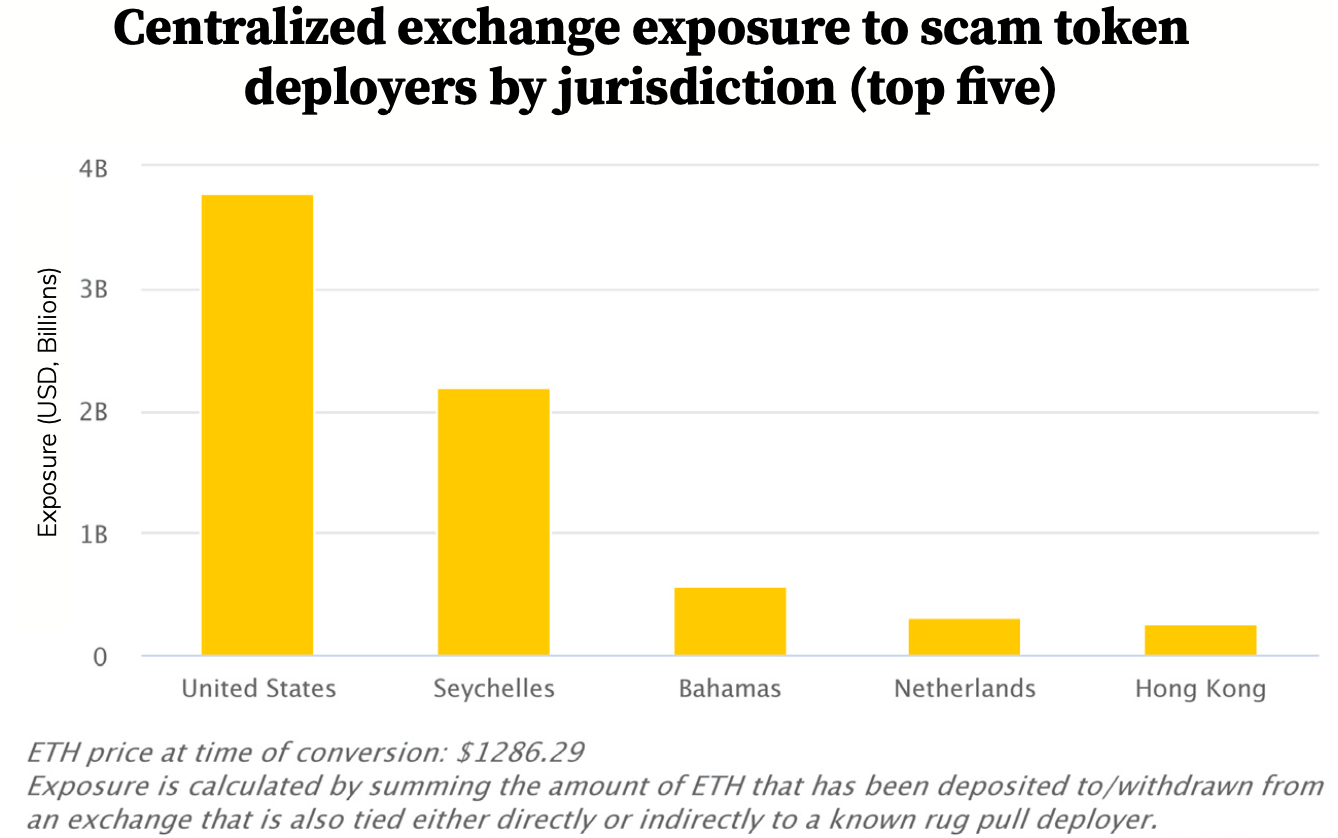

According to the report, 99% of these scam tokens weren’t detected by traditional approaches. These scams preferred to deploy in centralized exchanges (CeFi) and managed to deposit and withdraw funds from 153 different CeFi platforms.

The report also provides a breakdown of the exchanges in question. According to data, CeFi exchanges based in the U.S. have the highest exposure to scam tokens, with around $3,75 billion.

East African country Seychelles follows as the second with just above $2 billion, while the Bahamas comes third with $500 million.

The post Report reveals 12% of BNB Chain and 8% of ETH tokens are scams appeared first on CryptoSlate.