- November 23, 2022

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Global NFT sales in October clocked in at more than $850 million over roughly 3 million total transactions. I looked into NFT wash trades last month and that research got me to look at the numbers more closely.

The trigger points for me to say that transactions are becoming more fake are as follows:

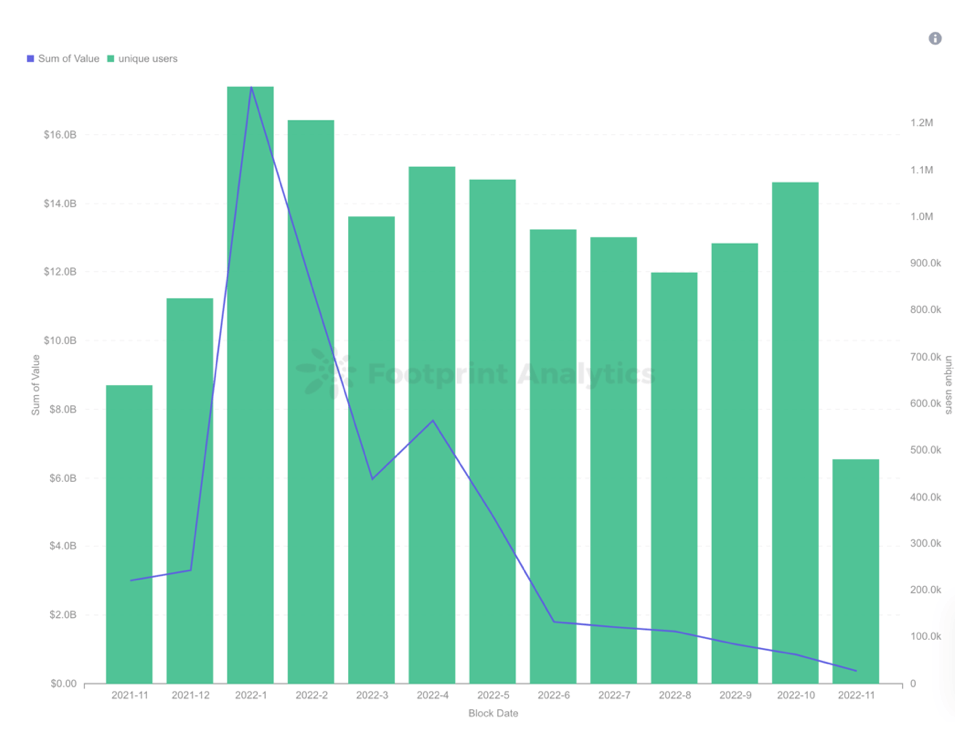

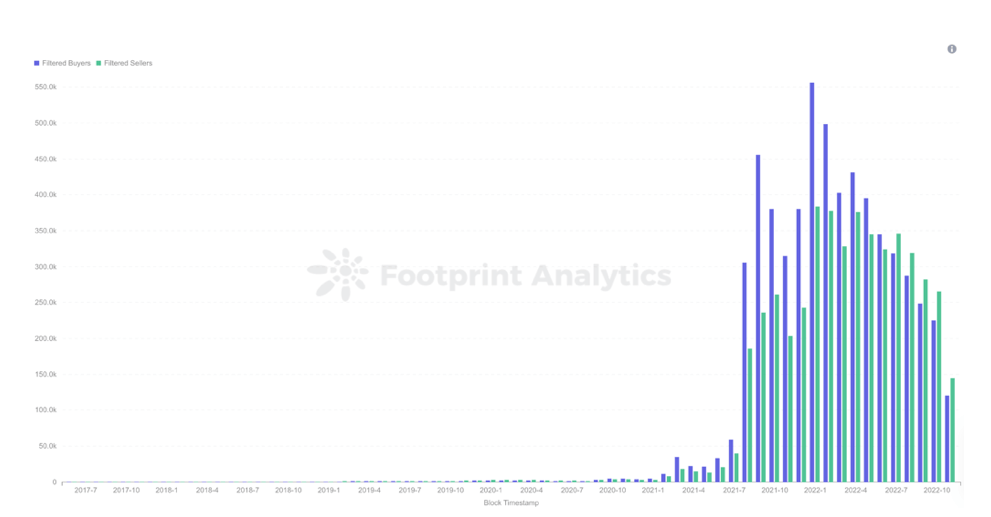

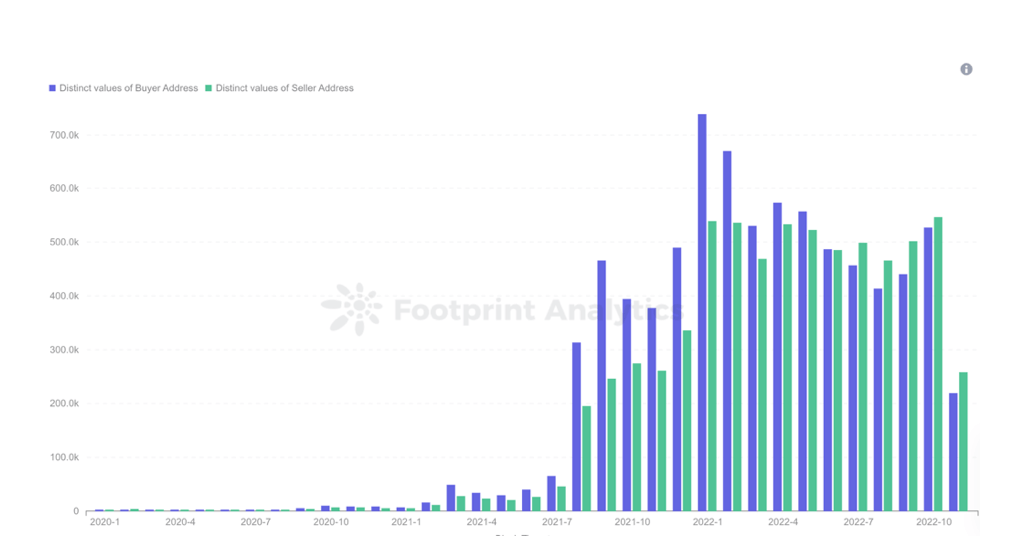

- Despite bad market conditions, we continue to see a high number of unique buyers and sellers. In October, we had over 1 million unique buyers and sellers. Both buyers and sellers have increased compared to September.

- The number of unique buyers and sellers seems to be inconsistent with the growth of sales value and transactions. Around 1 million users contributed more than 4 million sales value in May versus less than 250,000 in October. To me, it seems unlikely to have a growing market demand with less sales value traded.

To look into this further, I spoke with two centralized exchanges that operate NFT marketplaces. The exchanges said that around 80% of new buyers are keeping NFTs in their wallets, rather than selling them. With the market so unfavorable, holding these assets seems to be the sensible move.

So where are all these unique buyers and sellers coming from? I had a word with Footprint Analytics and brought up my points. I realized that the statistics I am looking at are way too big. It involved multiple chains and it is hard to track everything. We agreed to work on only Ethereum-based marketplaces as an example to dive deep into since it is the most popular.

Here are the findings:

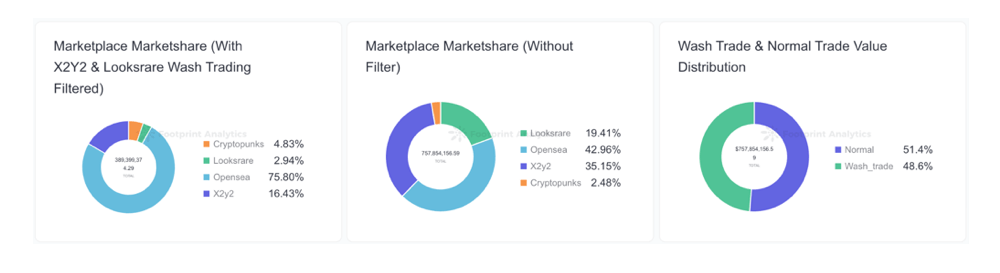

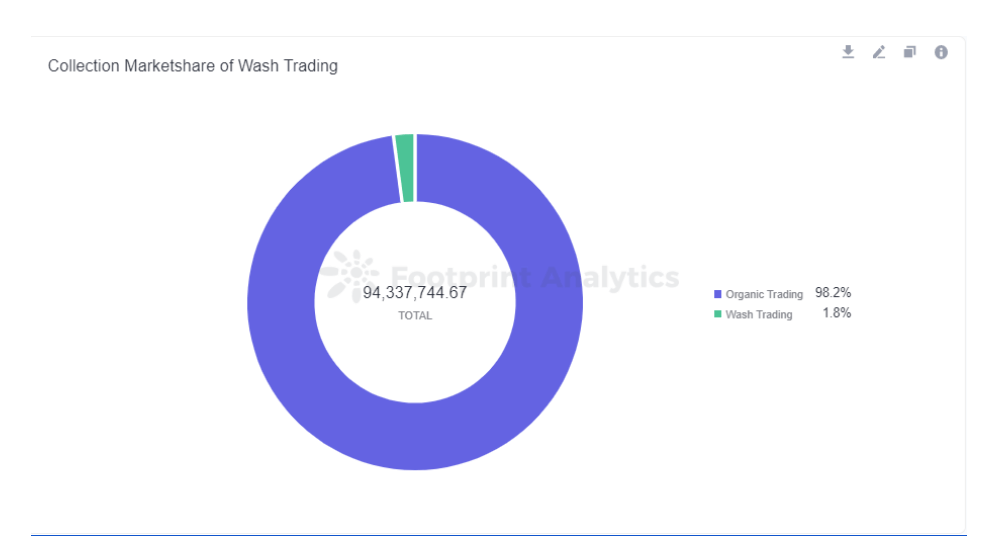

According to Footprint Analytics’ filters, wash trading makes up nearly half of all NFT trading volume.

Footprint Analytics – ETH NFT Market Overview (With Wash Trading Filtered)

Traders seeking to artificially inflate the price of collections or earn marketplace trading rewards generated $389 million in wash trades out of October’s total of $758 million in NFT trading volume — bringing the amount of wash trading in the NFT market close to half that of organic trading. The number of wash trading users accounts for nearly 46% of total users.

Wash trading is a form of market manipulation where an investor simultaneously sells and buys the same financial instruments to create misleading, artificial activity in the marketplace. It creates enormous dissonance in the NFT industry between what most people imagine NFT trading is i.e., someone buying an NFT for speculation, and the behavior which actually underlies the market — hundreds of insiders transferring NFTs between their own wallets.

There are several indicators to identify suspicious trading activity.

Signals and indicators include:

- Overpriced NFT trades with 0% creators fees

- Specific NFT IDs that are bought more than a normal amount of times in a day

- NFTs bought by the same buyer address in a short period of time

The incentives for wash trading are to earn platform rewards and to create an appearance of value or liquidity for assets. Because there is no way to prevent or discourage wash trading in the NFT market today, people have a hugely misguided picture of the amount of organic, genuine trading activity in the industry.

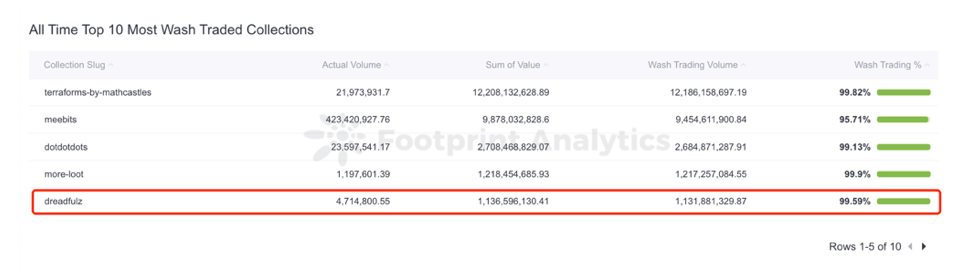

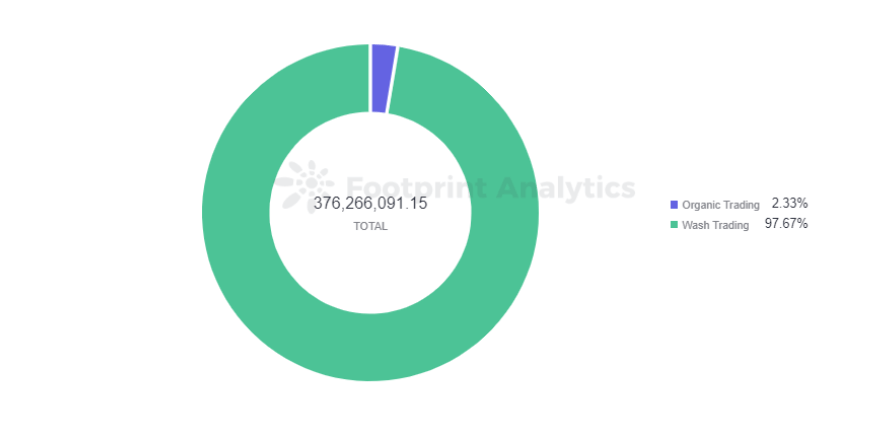

For example, 81% percent of all trades on X2Y2, one of the top 3 NFT marketplaces, were wash trades according to the filters applied. The main reason for X2Y2 wash trading is volume-based daily trading rewards. The larger the percentage of volume a user contributes to X2Y2, the larger the share of daily trading rewards the user will earn. A similar breakdown can be observed when looking at individual collections. For example, of Dreadfulz’ $1.1 billion in total volume, $1.131 billion was flagged as wash trading.

An analyst or writer who does not understand this wash trading dynamic risks grossly misunderstanding the current market. For example, here’s what Business2Community wrote on Oct. 12 about Terraforms by Mathcastles:

“Non-fungible token collections continue showing strong resilience amid the current general crypto market downturn so far this year. Here are some of the top-selling NFT collections this week: 1. Terraforms Reclaim The Top Spot. Terraforms, a non-fungible token (NFT) collection from Mathcastles, has reclaimed the top spot after flipping below our ten top-selling lists last week. Terraforms has a 24-hour sales volume of 1,814 ETH.”

The next collections the article listed were BAYC and CryptoPunks, which have nearly no wash trading. This would give a reader the impression that Terraforms more of a popular collection than those blue chip collections when in reality there were almost no organic trades.

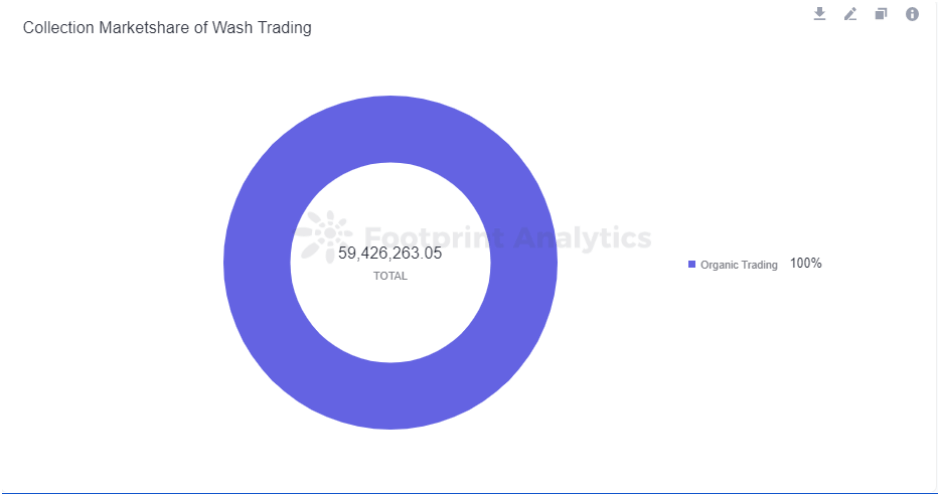

By filtering trades for wash trading, traders, analysts and investors can more accurately evaluate NFT assets and the industry. Having accurate datasets and using them are two separate things. My role here is not to whistleblow or break the NFT myths, I am here to share my knowledge and tell my side of the story to everyone.

Using this article, I would like to make a request to analyze CEX NFT marketplaces’ data. Binance or Bybit NFT Marketplace would be ideal.

The post Roughly 48% of Ethereum NFT trades in October were fake appeared first on CryptoSlate.