- September 16, 2022

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

A moving average (MA) is a stock indicator commonly used in technical analysis. As its name suggests, the indicator smooths out price data by creating a constantly updated average price over a specific time period.

In technical analysis, moving averages help identify trend directions by analyzing previous price actions.

Moving averages are extensively used when analyzing the price of Bitcoin. Out of all the cryptocurrencies, Bitcoin behaves like stocks the most, and has historically responded well to such analysis.

Although technical analysis (TA) remains a controversial topic in the crypto industry, analyzing Bitcoin’s MAs can be used alongside other metrics to determine the current state of the market.

In the context of Bitcoin, moving averages can be used to identify where support and resistance are formed. Looking back at the historical data, we can use moving averages to identify periods where Bitcoin’s price dropped to its cycle lows.

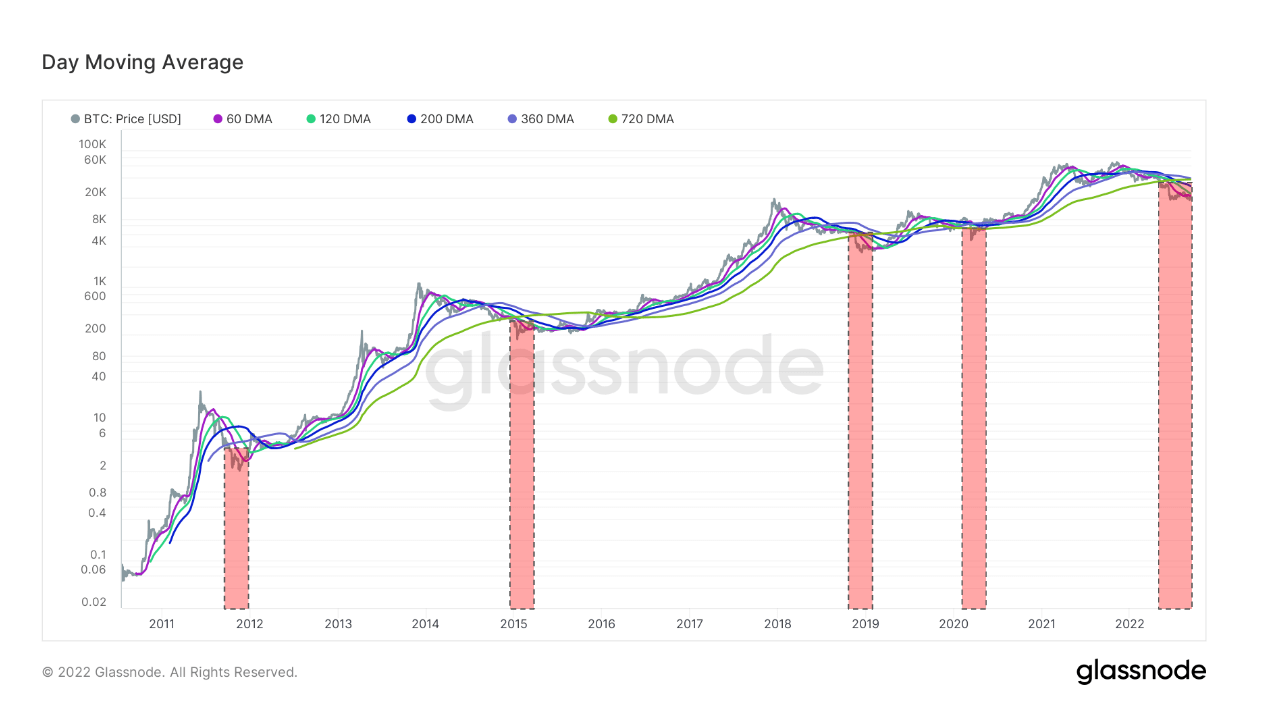

When analyzing Bitcoin, the 60-day, 120-day, 200-day, 360-day, and 720-day moving averages are particularly important. Every time Bitcoin’s price dropped below these MAs, the market saw what some analysts call a “generational buy” opportunity.

According to data from Glassnode, Bitcoin has fallen below all key moving averages for the fifth time ever. Bitcoin’s current stint below the moving averages is also the longest ever — coming in at almost twice as long as the previous drops we’ve seen at the end of 2011, 2015, 2019, and 2020.

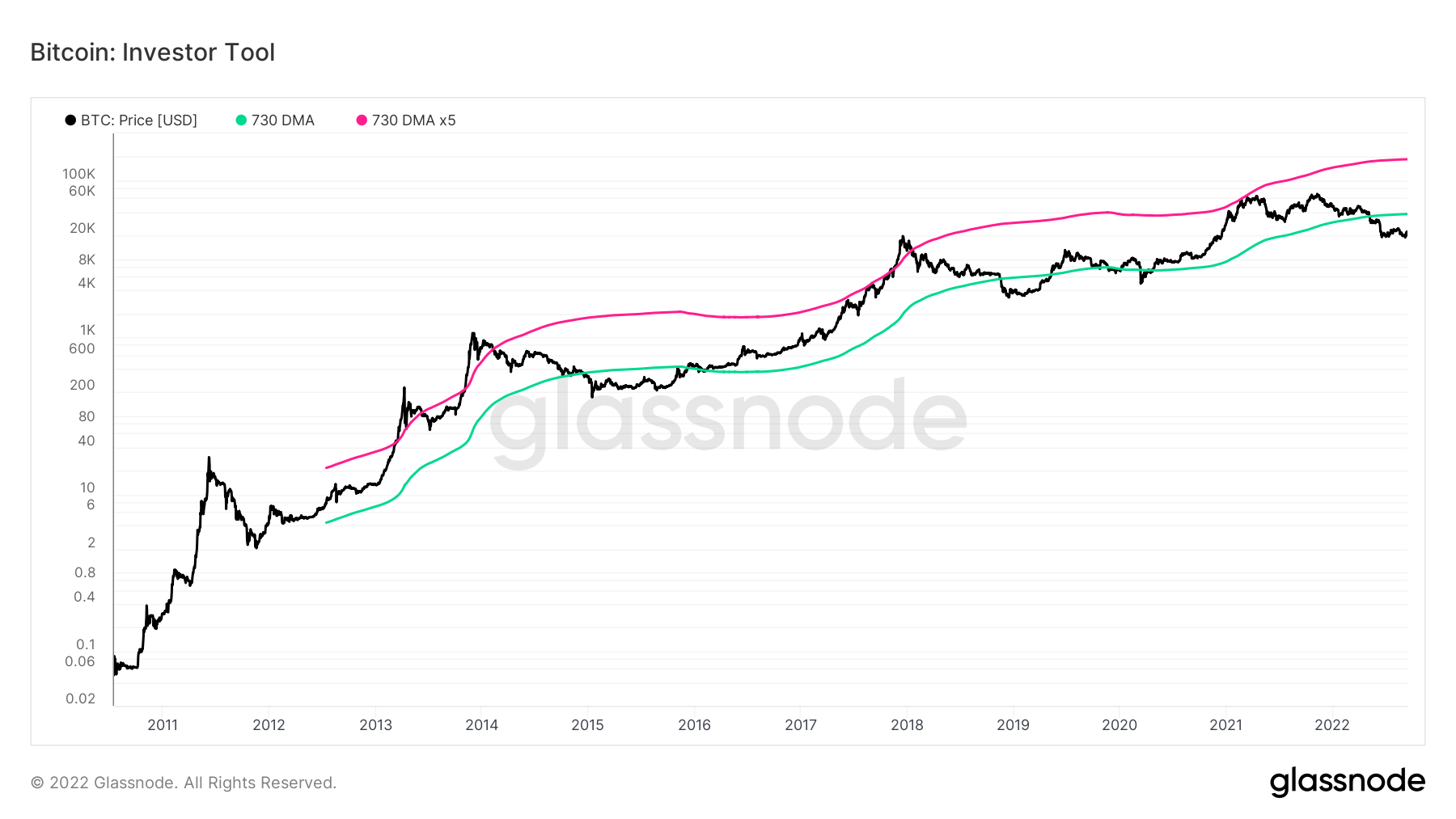

Moving averages are also part of other key indicators for determining the Bitcoin market cycle. One of those indicators is the Bitcoin Investor Tool, created by analyst Philip Swift. Intended as a tool for long-term investors, the indicator consists of two simple moving averages of Bitcoin’s price — the 2-year MA and a 5x multiple of the 2-year MA.

These moving averages are used as the basis for determining undervalued and overvalued conditions in the market. It indicates periods where prices are likely to approach cyclical tops and bottoms.

Bitcoin’s price trading below the 2-year MA has historically generated outsized returns and signaled bear cycle lows. When the price traded above the 2-year MA x5, it signaled bull cycle tops and a zone where long-term investors de-risk.

Since the Terra (LUNA) collapse in May, Bitcoin has remained below the 730-day MA. Since 2011, BTC went below the 730-day MA only three times — between 2015 and 2016, in 2019, and briefly in 2020. Each time BTC spent below the 730-day MA was shorter than the previous one. Its drop in March 2020 was measured in days, not months. Bitcoin’s current stint under the MA has broken this pattern and is entering its fourth consecutive month.

Bitcoin recovered from every drop below the 730-day MA. If its historical patterns repeat, it’s also set to recover from this drop. However, it’s still early to tell how fast its recovery will be. The current crypto market uncertainty is worsened by deteriorating macro conditions, making it hard to predict what the incoming winter will bring.

The post Research: Bitcoin falls below all key moving averages for the fifth time ever appeared first on CryptoSlate.