- June 24, 2022

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Both Jerome Powell and Christine Legarde held recent press conferences where they place blame for inflation on factors outside their control.

Watch The Episode On YouTube or Rumble

Listen To The Episode Here:

“Fed Watch” is the macro podcast for Bitcoiners. In each episode we discuss current events in macro from across the globe, with an emphasis on central banks and currencies.

In this episode, Christian Keroles and I listen and react to highlights from this month’s two central bank press conferences with Federal Reserve Chair Jerome Powell and European Central Bank President Christine Lagarde. Central banks are one of the most misunderstood institutions in our modern world. Many analysts simply tell you what the Fed or the ECB thinks and what they do to disrupt the global economy, but on our show, we like to give you primary source material from which you can start to form your own educated opinion.

We livestream most of our shows on the Bitcoin Magazine YouTube channel on Tuesdays at 3:00 P.M. Eastern time. Mark your calendars!

Highlights And Reactions From The Fed Press Conference

Powell’s comments were highlighted by a few narratives. These claims are simply what the Fed says they are doing:

- Their primary concern is fighting inflation.

- They will be adaptive to new data.

- A tight employment market threatens to exacerbate inflation.

- They cannot affect the supply side, so they will tamp down demand to bring down prices.

The main metric guiding the Fed’s course of rate hikes is CPI and “inflation” expectations. There are several ways to measure these, but the Fed uses consumer surveys. There is a critical distinction between surveys and market-derived expectations because surveys will not distinguish sources of price increases whereas the market-derived measures will.

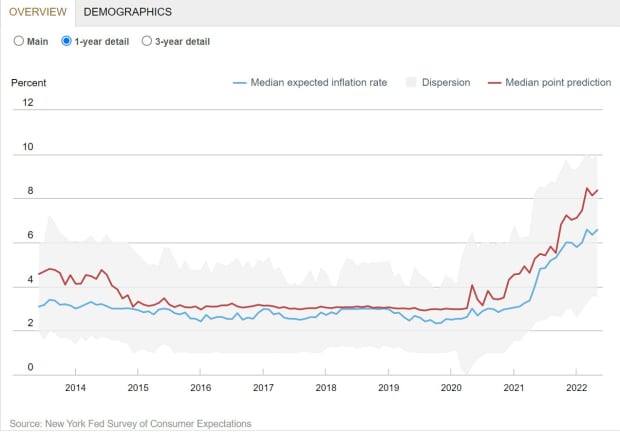

Below is the Fed’s survey of inflation expectations. You can see that the median prediction is above 8%.

However, the market-derived data, namely the 5-year and 10-year breakevens and the 5y-5y forward, are showing inflation expectations around 2.5%. What accounts for this huge difference? It is because the market-derived data is measuring actual money printing, or in other words, actual inflation. The survey data on the other hand is measuring generic price increases which are much more highly affected by supply shocks; in this case, self-imposed supply shocks.

Highlights And Reactions From The ECB Press Conference

We also listen to a few clips of Lagarde’s press conference. Here we get a flavor for the ECB’s formative narratives:

- Inflation is the fault of COVID-19 and Vladimir Putin.

- Their governing council has expertly formulated a journey to normality.

- They will begin to raise rates and tighten their balance sheet in July.

- They are dedicated to “anti-fragmentation,” or in other words, avoiding a European debt crisis 2.0 and keeping the eurozone together.

- They have all-powerful tools.

The ECB faces a different challenge than the Fed. The ECB must raise rates for some of the more indebted countries, already with anti-European parties growing, and they are facing uneven effects, as we can see with credit spreads in Italy for example.

That does it for this week. Thanks to the watchers and listeners. If you enjoy this content please subscribe, review and share!

This is a guest post by Ansel Lindner. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.