- June 13, 2022

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

A combination of unique energy infrastructure, favorable policy and unique incentives is making Texas the Bitcoin mining capital of the U.S.

By its nature, Bitcoin mining is energy intensive and incentivizes the use of cheap energy to turn a profit. Bitcoin miners have started to flock to Texas because of the current “goldilocks” situation for cryptocurrency mining created by three main factors:

- The state’s energy infrastructure allows for access to cheap power from its deregulated power market;

- Its growing energy source mix from renewables, particularly wind energy; and

- Its supportive policy and backing by policymakers

Bitcoin Mining: Leaning On Texas’s Energy Infrastructure

While Bitcoin mining has been criticized for being energy-intensive, Texas Governor Greg Abbott, among others, views Bitcoin mining as a solution to other related issues, such as taking advantage of untapped energy, including natural gas (such as surplus gas or associated gas) that would otherwise be flared or vented because of limited infrastructure to transport it to a destination.

It’s no secret that for years, oil and gas companies have struggled to solve the problem of flaring, not only in Texas but across the U.S. Unlike oil, which can be transported by truck or rail, natural gas requires pipeline infrastructure to deliver it to market. If a driller has no means of transporting its gas, either economically or because there isn’t available pipeline infrastructure to do so, they flare (or burn) it, and the environmental implications of doing so are substantial.

Instead, bitcoin miners can tap into this surplus gas, whether it’s the result of flared gas or bad netbacks, and divert it to generators, which then can convert the gas into electricity and then use it to power their sophisticated mining equipment.

“Companies tapping surplus gas to run their cypto-mining computer banks see a double benefit – reducing the negative impacts of gas flaring and cutting their carbon footprint,” according to Argus Media.

According to research from Crusoe Energy Systems, one of the largest Bitcoin miners in the U.S., the process reduces the carbon dioxide equivalent emissions by about 63% compared to flaring, Argus Media reported. This opportunity to repurpose otherwise stranded energy and monetize it has not only been attractive to Bitcoin miners, but also to oil and gas companies to increase returns on their production while also complying with environmental, social and governance (ESG) initiatives — more specifically, the “E” component for reducing their carbon footprints.

Regardless of the energy source for the Bitcoin miner, be it the gas that would otherwise be flared or energy sourced by renewables, the Bitcoin miner essentially behaves like a power plant by purchasing power at an agreed-upon, fixed price and owning the ability to sell the power back to the grid.

In contrast to Abbott’s position that cryptocurrency mining provides financial incentives to build power infrastructure and produce more energy, his opponents have argued that doing so would also trigger greater demand and stress on an already unstable power grid.

Abbott’s position, however, relies on the belief that if a severe weather event occurred, such as Winter Storm Uri in February 2021, which resulted in substantial surges in power demand, miners would be forced to pause operations when ordered to do so. In other words, miners would halt their operations and return the power to the grid when demand surges. This concept is not only supported by basic humanitarian principles, morals and ethics, dictating that power should be redirected to save human lives, but it’s also supported by the dynamic of the market itself. In the event of demand for power surges — as it did during Winter Storm Uri — spot power prices increase (sometimes dramatically) and therefore the miner would be financially incentivized to sell power back to the grid as opposed to consuming it.

For miners, the benefits are not exclusive to their ability to source cheap power but also the flexibility and optionality to return that power to the grid. For Texas, particularly ERCOT, the state’s power regulator, the ability for miners to “turn off” during peak demand prevents the need to turn on less efficient peak demand power plants, allowing ERCOT to stabilize the grid more effectively.

‘Clean’ Bitcoin?

According to the Texas Blockchain Council, there are at least 27 mining operations in the state with more on the way. This growth is not only attributable to the points discussed above but also to the larger crackdown on bitcoin mining abroad, particularly in China, pushing many miners to flee to the U.S.

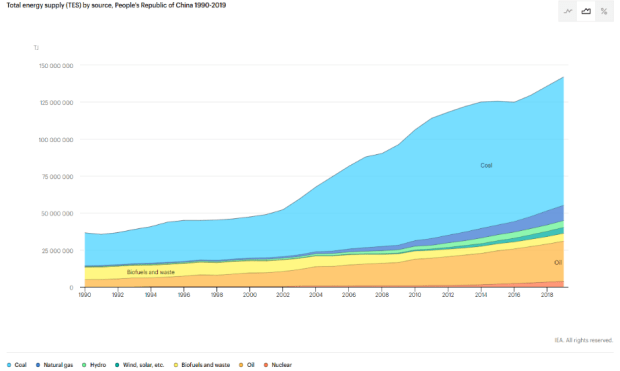

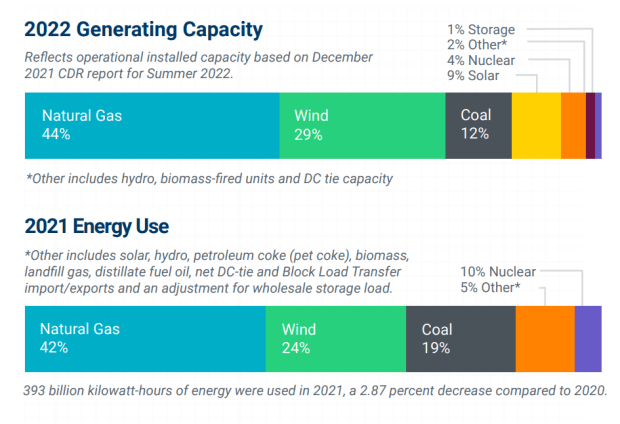

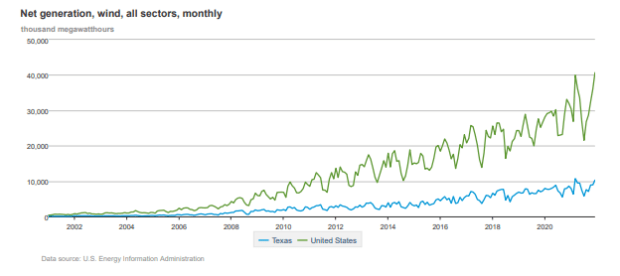

It’s important to note that China is heavily dependent on “dirtier” energy sources such as coal, which produces roughly twice as much carbon dioxide emissions as natural gas. Meanwhile, Texas is home to “cleaner” sources such as natural gas and wind. Moreover, within the U.S., Texas is a leader in the nation’s wind-powered electricity generation, comprising approximately 26% of the nation’s total net wind generation.

Altogether, these factors have incentivized and attracted Bitcoin miners to Texas with the Lone Star State becoming the fourth-highest hash rate (the measure of how much power is being supplied to the Bitcoin network) of any state, at approximately 14%.

Bitcoin Miners Call Texas Home, For Now

From Rockdale, Texas, home to the two biggest Bitcoin mining companies in the world, to the first city in the U.S. to mine Bitcoin, to Fort Worth, Texas, the Lone Star State is welcoming the Bitcoin mining industry with open arms.

This is a guest post by Ryan Dusek and Cooper Ligon. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.