- May 19, 2022

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Latest data from Glassnode suggests USDC may be becoming the crypto market’s preferred stablecoin over USDT.

USDC’s Supply Surged Up Recently, While USDT’s Plunged Down

As per the latest weekly report from Glassnode, USDT has observed a large amount of redemptions recently, taking its supply down.

The relevant indicator here is the the “circulating supply,” which is a measure of the number of coins currently in circulation.

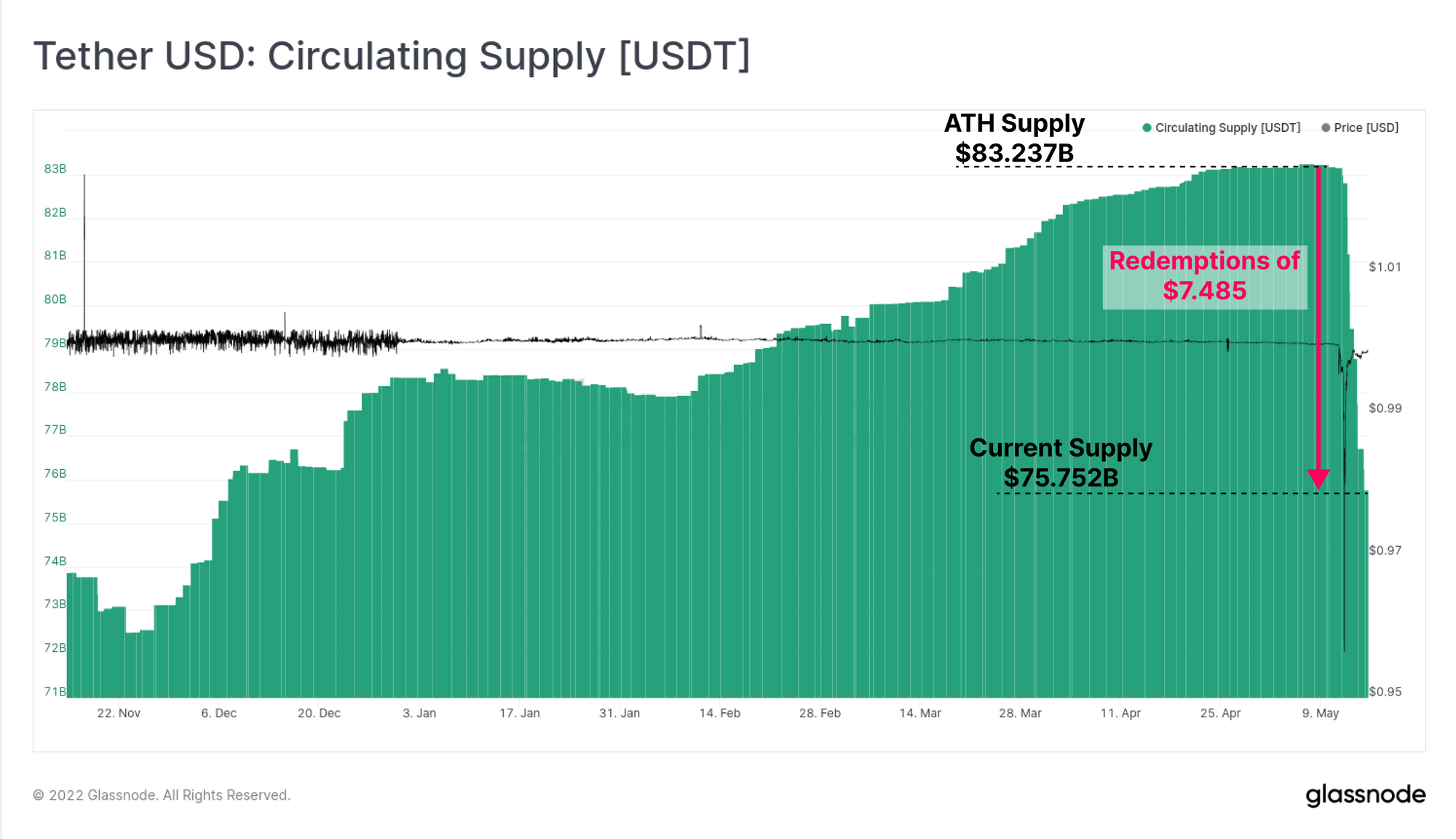

The below chart shows the trend in the Tether USD supply over the past few months:

Looks like the value of the metric has fallen down recently | Source: Glassnode's The Week Onchain - Week 20, 2022

As you can see in the above graph, the total USDT supply had been sitting at all-time high values of around $83 billion just earlier in the month.

However, in the past week the indicator has observed a steep plunge as about $7.5 billion were redeemed from the coin. The total supply of Tether is now at $75.7 billion.

This decline in USDT’s supply came after Terra USD’s collapse as investors may have started to pull out of the stablecoin in fear of a similar event taking place with Tether.

The coin’s peg came under pressure as the supply sharply began to decline, and its price dropped down to as low as $0.95 on 12th May.

Related Reading | Bitcoin Fees Remain Low Despite Increased Activity, What’s Driving This?

However, it didn’t take too long until the coin came back close to the USD price again. While this was happening, this is how USDC’s supply changed:

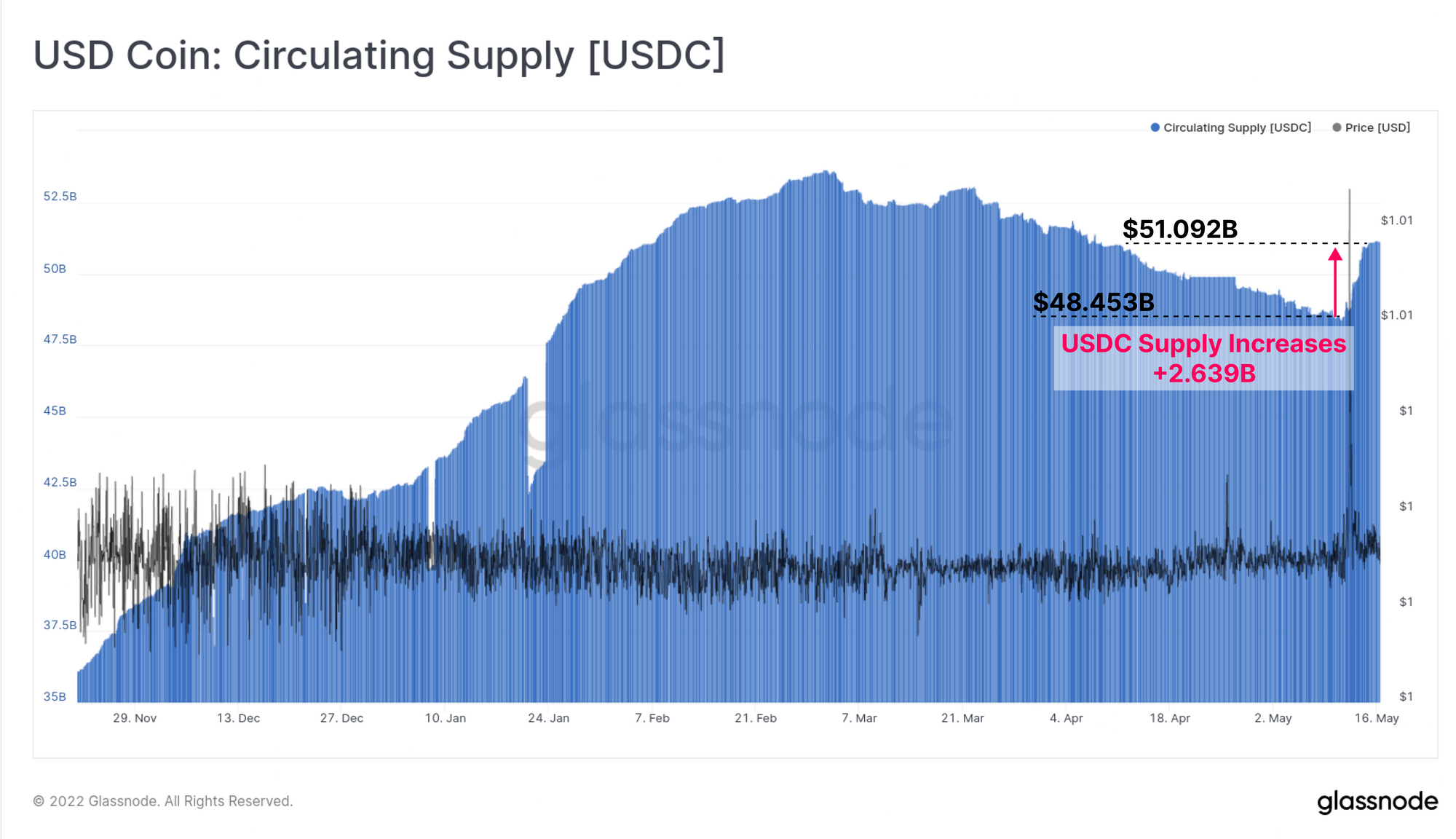

The value of the metric seems to have observed an increase in the past week | Source: Glassnode's The Week Onchain - Week 20, 2022

USD Coin’s supply had been on a decline since February of this year, but over the last week the indicator has flipped the trend and is now sharply rising.

Related Reading | USDC Exchange Reserves Start Fall, Dry Powder For Bitcoin?

The total supply of the coin now stands at around $51 billion, following an increase of $2.6 billion during the period.

The trends in the supplies of the two coins may suggest that investors are now increasingly preferring to use USD Coin over Tether USD during times of fear such as in the current market.

BTC Price

At the time of writing, Bitcoin’s price floats around $29.5k, up 4% in the last seven days. Over the past month, the crypto has lost 27% in value.

The below chart shows the trend in the price of the coin over the last five days.

Seems like the price of the crypto has dwindled down over the last couple of days | Source: BTCUSD on TradingView

Bitcoin has still been continuing to consolidate sideways around the $30k level, showing no real signs of any recovery.

Featured image from Unsplash.com, charts from TradingView.com, Glassnode.com