- May 16, 2022

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

A contrarian take on the current market structure suggesting that the bitcoin bottom is near and the Federal Reserve will reverse its hawkish course.

Watch This Video On YouTube or Rumble

Listen To The Episode Here:

In this episode of the “Fed Watch” podcast, Christian Keroles and I, along with the livestream crew, discuss macro developments relevant to bitcoin. Topics include the recent 50 bps rate hike from the Fed, a consumer price index (CPI) preview — the episode was recorded live on Tuesday, before the CPI data was released — and a discussion on why owners’ equivalent rent is often misunderstood. We wrap up with an epic discussion of the bitcoin price.

This could be a pivotal episode in the history of “Fed Watch,” because I’m on the record saying that bitcoin is “in the neighborhood” of the bottom. This is in stark contrast to the mainstream uber-bearishness in the market right now. In this episode, I rely heavily on charts that didn’t always line up during the video. Those charts are provided below with a basic explanation. You can see the whole slide deck that I used here.

“Fed Watch” is a podcast for people interested in central bank current events and how Bitcoin will integrate or replace aspects of the traditional financial system. To understand how bitcoin will become global money, we must first understand what’s happening now.

Federal Reserve And Economic Numbers For The U.S.

On this first chart, I point to the Fed’s last two rate hikes on the S&P 500 chart. I wrote in a blog post this week, “What I’m trying to show is that the rate hikes themselves are not the Federal Reserve’s primary tool. Talking about hiking rates is the primary tool, along with fostering the belief in the magic of the Fed.” Remove the arrows and try to guess where the announcements were.

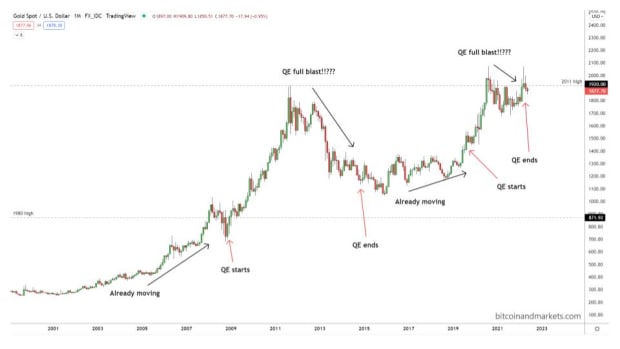

Same goes for the next chart: gold.

Lastly, for this section, we looked at the bitcoin chart with quantitative easing (QE) and quantitative tightening (QT) plotted. As you can see, in the era with “No QE,” from 2015 to 2019, bitcoin experienced a 6,000% bull market. This is almost the exact opposite of what one would expect. To summarize this section, Fed policy has little to do with major swings in the market. Swings come from the unknowable complex ebbs and flows of the market. The Federal Reserve only tries to smooth the edges.

CPI Mayhem

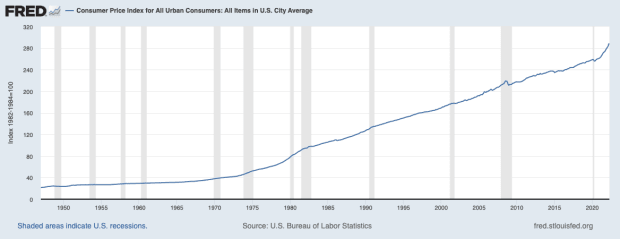

It’s hard to write a good summary of this part of the podcast, because we were live one day prior to the data dropping. In the podcast, I cover Eurozone CPI going slightly higher, to 7.5% in April year-over-year (YoY), with a month-over-month rate of change dropping from a staggering 2.5% in March to 0.6% in April. That is the story most people are missing on CPI: month-to-month changes rapidly slowed in April. I also covered CPI forecasts for the U.S. on the podcast, but now, we have hard data for April. U.S. headline CPI dropped from 8.5% in March to 8.3% in April. Month-to-month change fell from 1.2% in March to 0.3% in April. Again, a big decline in the rate of CPI increase. CPI can be very confusing when looking at YoY figures.

It looks like inflation in April was measured at 8.3%, when in fact, it was measured at only 0.3%.

Next topic we cover in the podcast is rent. I very often hear misunderstandings of the CPI measure on shelter and specifically owners’ equivalent rent (OER). For starters, it’s very hard to measure the impact of increases to housing costs on consumers in general. Most people do not move very often. We have 15- or 30-year fixed-rate mortgages that are not affected at all by current home prices. Even rental leases are not renewed every month. Contracts typically last a year, sometimes more. Therefore, if a few people pay higher rents in a certain month, that does not affect the average person’s shelter expenses or the average landlord’s revenue.

Taking current market prices for rentals or homes is a dishonest way to estimate the average cost of housing, yet not doing so is the most often-quoted critique of the CPI. Caveat: I’m not saying CPI measures inflation (money printing); it measures an index of prices to maintain your standard of living. Of course, there are many layers of subjectivity in this statistic. OER more accurately estimates changes in housing costs for the average American, smooths out volatility and separates pure shelter costs from investment value.

Bitcoin Price Analysis

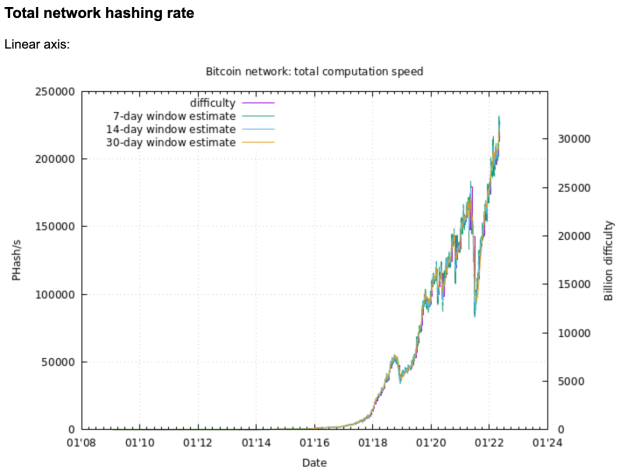

The rest of the episode is talking about the current bitcoin price action. I start my bullish rant by showing the hash rate chart and talking about why it is a lagging and confirming indicator. With the hash rate at all-time highs and consistently increasing, this suggests that bitcoin is fairly valued at its current level.

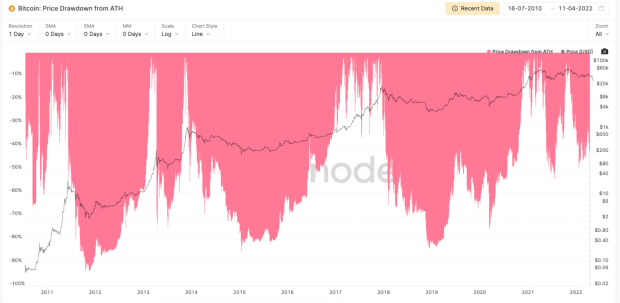

Recent years have seen shorter, smaller rallies and shorter, smaller drawdowns. This chart suggests that 50% drawdowns are the new normal, instead of 85%.

Now, we get into some technical analysis. I concentrate on the Relative Strength Index (RSI) because it is very basic and a fundamental building block of many other indicators. Monthly RSI is at levels that typically signal cycle bottoms. Currently, the monthly metric shows that bitcoin is more oversold than at the bottom of the corona crash in 2020. Weekly RSI is equally as oversold. It is as low as the bottom of the corona crash in 2020, and before that, the bottom of the bear market in 2018.

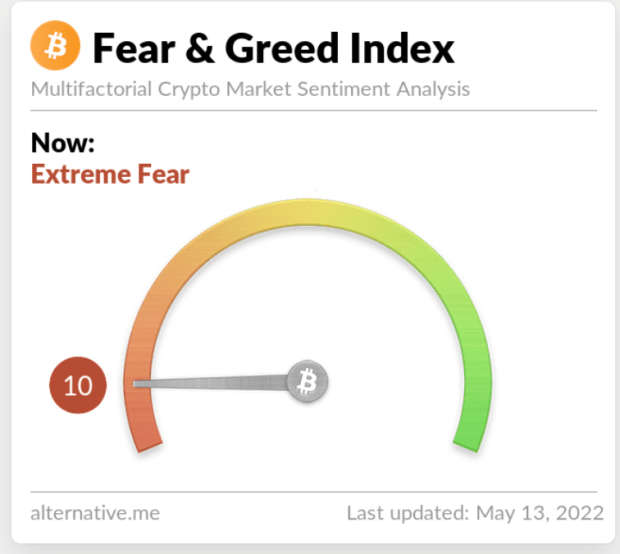

The Fear and Greed index is also extremely low. This measure is showing “Extreme Fear” that typically registers at relative bottoms and at 10, ties for the lowest rating since the COVID-19 crash in 2020.

In summary, my contrarian (bullish) argument is:

- Bitcoin is already at historic lows and could bottom at any moment.

- The global economy is getting worse and bitcoin is counterparty-free, sound money, so it should behave similarly to 2015 at the end of QE.

- The Fed will be forced to reverse its narrative in the coming months which could relieve downward pressure on stocks.

- Bitcoin is closely tied to the U.S. economy at this point, and the U.S. will weather the coming recession better than most other places.

That does it for this week. Thanks to the readers and listeners. If you enjoy this content please subscribe, review and share!

This is a guest post by Ansel Lindner. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.