- May 12, 2022

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The bears can’t keep miners down as data shows increasing hash rate — which could lead to some uncomfortable hash price realities.

Bitcoin may be in a bearish market, but the mining industry is growing bigger than ever. Bitcoin mining difficulty set a new record high for the sixth time this year on Tuesday, reaching 31.25 trillion, according to mining data from Braiins. The 4.89% adjustment was the third-largest increase this year.

Even though the leading cryptocurrency’s price has dropped sharply through April and May and continues sitting over 50% below its all-time high from late 2021, the mining industry’s growth is not slowing. Traditional investors, retail buyers, and even day traders may be bearish on bitcoin, but miners are not. This article unpacks some of the data that demonstrates the mining sector’s growth despite bitcoin’s current bearish market conditions.

Bitcoin Mining Growth Data

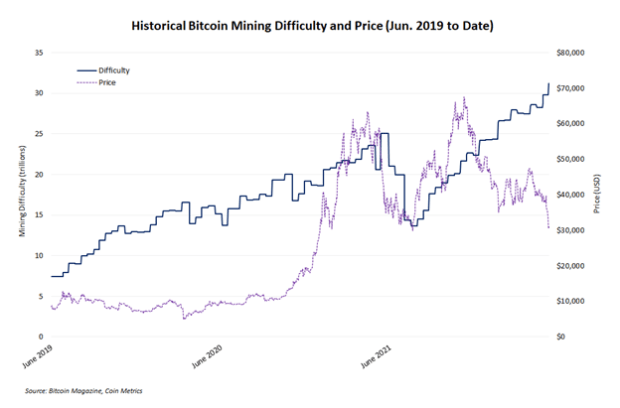

Bitcoin’s price and mining difficulty demonstrated a fairly strong positive correlation throughout most of 2021. During the bullish periods of early 2021 followed by the China-ban-related crash in the summer and a market rebound to close the year, both metrics moved closely together. But difficulty and price are typically only positively correlated during bullish markets when both metrics increase together. The line chart below visualizes price and difficulty data from the past three years, and for the past six months as bitcoin’s price has fallen, mining difficulty has continued to surge.

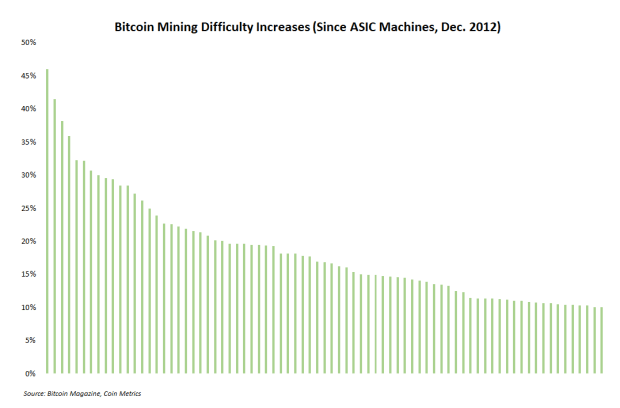

Despite consistently setting record highs this year, all the difficulty increases have been fairly mild on a percentage basis. Difficulty continues grinding upward as more miners deploy new hash rate, but none of the increases in 2022 have been 10% or larger. In late January, difficulty increased by 9.3%, but every other increase has been roughly 5% or smaller. The bar chart below shows a simple ordering of all historical difficulty increases since ASIC mining hardware entered the market in late 2012. But none of these adjustments have happened in 2012.

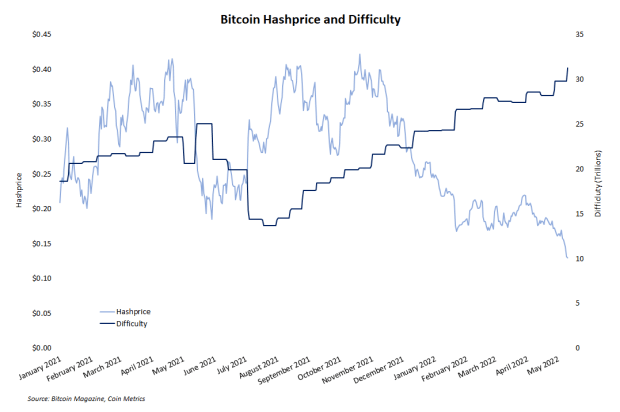

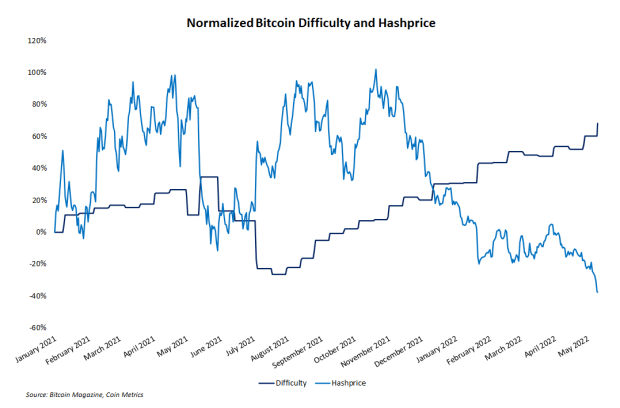

Difficulty increases come from more hash rate, which means an increasingly large amount of computing power is being spent to process transactions for the Bitcoin network and protect the integrity of its distributed ledger. This is objectively a good thing for Bitcoin. But for the economics of some miners, it’s not always something to celebrate because as difficulty increases, hash price drops.

Hash price is a measure of expected revenue per unit of hash rate a miner contributes to the network. Hash price goes up when bitcoin’s price increases faster than difficulty. It also goes up when bitcoin’s price drops slower than difficulty. But when difficulty increases and bitcoin’s price drops as is happening under current market conditions, hash price plummets.

The line chart below shows hash price and difficulty data since early 2021 and the steep decline in hash price is obvious as difficulty soars.

So, even though more miners securing the network is fundamentally bullish, it can be bearish for mining economics especially in a downward-trending market.

Timing Of Bitcoin Mining Growth

To anyone who isn’t intimately familiar with the dynamics of bitcoin mining, it’s reasonable to question why the sector continues to grow despite an ongoing bear market phase. A few general reasons offer some explanation for this growth, and the following section on where growth is happening now will add more context.

Mining projects, from start to full deployment, are very time-consuming and capital-intensive projects. Much of the hash rate being added to the network now was planned at least two years ago. After battling delays and supply chain disruptions during the global COVID-19 response, miners are not ignoring market conditions as much as simply finishing projects they started planning years ago.

Bear markets are often friendlier conditions to start new mining operations anyway. Hardware is cheaper. Hype has dissipated. Focus is easier to maintain. And miners who join the industry in the heat of a bull run tend to have a significantly higher likelihood of failing or being squeezed out of the market compared to miners who begin building in bearish markets. And more important for most miners than current price fluctuations is the block subsidy schedule. The next reward halving is almost exactly two years away, meaning miners are building now to capitalize on as much of the remaining 6.25 BTC period until it ends, and some miners are inevitably squeezed out of the market.

Also, even though this article has repeatedly referenced the current “bear market” for bitcoin, it’s worth noting that there has almost never been a true bear market period for bitcoin’s hash rate growth, and by extension for difficulty. China’s mining ban caused a historic break from the normal up-and-to-the-right growth trend for hash rate, but now growth is back on track. As the line chart below shows, hash rate is almost always in a bull market.

Mining Growth Breakdown

So, where is the mining sector’s growth happening? Home and small-scale miners are still very much active in building their own operations and using many of the new retail-focused products and services that launched during the bull market. Twitter and other social media are saturated with photos and videos of at-home mining setups.

Public mining companies also continue planning big expansions. For example, Riot Blockchain, one of the market-leading mining firms, announced a new one-gigawatt facility planned for Navarro County, Texas in addition to the 400 MW facility already developed in Rockdale. Other market leaders like Bitfarms and Core Scientific also made recent announcements of considerable growth.

Even cities and local municipalities are entering the mining industry, albeit at very small scale. Bitcoin mining start-up MintGreen is working to make North Vancouver the world’s first city heated by bitcoin mining. And the city council in Forth Worth, Texas voted to pass support to launch a small government-run mining pilot project with some Antminer S9 machines.

Some of the most exciting growth for general bitcoin audiences comes from news of an increasing number of energy and utilities companies exploring the mining industry. The Hungarian subsidiary of multi-billion-dollar utilities company E.ON has been running a mining pilot project for months with plans to expand. Some of the biggest oil producers in the U.S. – ExxonMobil and ConocoPhillips – are also building partnerships with miners. And miners are saturating the Permian Basin with educational efforts to build partnerships with other energy producers.

Conclusion

Despite bitcoin’s bearish price action, the mining industry is still in its own bull market. And even though continued hash rate growth despite downward trending prices means dwindling revenue for some miners, the aggregate growth of the industry is a strong signal for the security of the network and the long-term resilience of the entire bitcoin economy.

This is a guest post by Zack Voell. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.