- May 11, 2022

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Bitcoin is in a league of its own compared to other cryptocurrencies and it’s important to know the distinction to protect financial freedom.

As someone who learned the importance of “Bitcoin-only” from the personal experience of getting rekt, I feel a determination and duty to ward off newcomers from other cryptocurrencies, which I believe to be outright scams at worst (or subtle ways for others to take your bitcoin, at best). In my experience leading meetups and teaching lessons about Bitcoin, I’ve found that many people, if not most, feel that bitcoin is boring or that some other cryptocurrency is better than bitcoin for various reasons.

The reasons are familiar to me. I, too, thought Bitcoin was slow and inefficient. I bought ETH before I even bought bitcoin. It wasn’t until I had spent hours and hours reading books, listening to podcasts, lurking on Twitter and perusing Bitcoin guides that I learned the value of Bitcoin, specifically, and why other cryptocurrencies are unnecessary and are most likely scams. But hundreds upon thousands of hours of studying to the point of obsession is not enough for people who are new to cryptocurrency and are sure [insert coin name] is different.

Oftentimes, I hear newcomers express excitement about some cute opportunity to collect 8-bit art that they think is unique or rare. The contrast between bitcoin and other cryptocurrencies does not hinge on the differences in their utility, but in the ethos of their users. Bitcoiners are here for a peaceful, monetary revolution to create a brand new society in a way that’s never been done before and without any rulers. Most people who are into cryptocurrency are here to mint some monkeys on a blockchain and make a quick buck. The more time one spends in the digital asset space, the easier it is to notice the major differences between the two groups.

Unfortunately, on a regular basis, I find myself blue in the face trying to convince many people I know personally and who I otherwise respect, that they are at serious risk of losing all of their money by getting into glorified gambling schemes as they attempt to make wise investments based on YouTube personalities or random finance bloggers.

This article stems from one such group of people, where a recent in-person information session was held and an article was shared that recommended “five compliant cryptos” that will apparently do well in 2022. (Ironically, this private group was formed around the fact that these people were decidedly non-compliant with mask mandates and lockdowns.) I felt an obligation to write a piece that demonstrates why bitcoin, and bitcoin only, is the cryptocurrency of sovereignty-seekers and those who want to thwart an agenda of globalization and centralization. This article is written from the perspective of those who wish to remain sovereign in body, mind, spirit and wallet.

Bitcoin Is A Leaderless System Of Rules, Not Rulers

Leaders are not the most trusted group of people for many of those who questioned the decisions made by those in power in response to COVID-19, such as making society lock down and forcing questionable health mandates. Because of this, it may be prudent to seek a system for our money that is not impacted by the whim of humans who wield political power.

It is possible for a monetary system to run without leaders. Currently, our money system is operated by a group of people who make decisions based on their assessment of what is happening and on predictions of what may happen in the future.

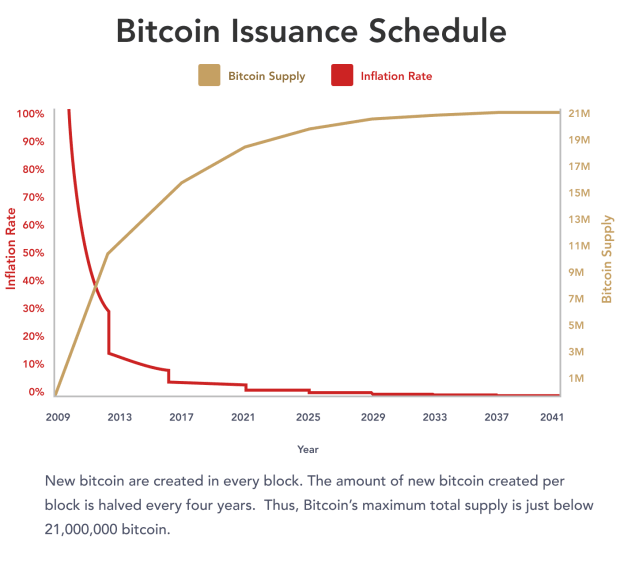

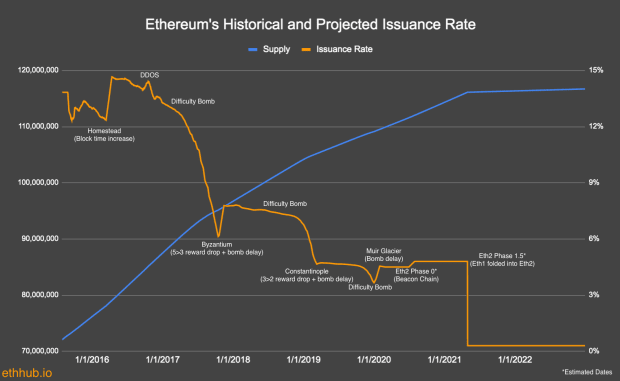

When it comes to other cryptocurrencies, the issuance is decided by a group of people who are public-facing and susceptible to greed and coercion. In addition, the issuance of other cryptocurrencies is not necessarily based on a fixed schedule. Bitcoin’s issuance is predetermined, based on code and public for anyone to see. Anyone who runs a node has complete freedom to choose the rules they wish to follow. Should some millionaire want to change the Bitcoin code to become proof-of-stake, he is free to do so, but my node will continue to run the current code. Everyone who runs a node is an equal participant and it doesn’t matter if they have 2 million bitcoin or 2 satoshis — running a node levels the playing field.

One of the greatest things that the pseudonymous creator of Bitcoin, Satoshi Nakamoto, ever did was to disappear after launching the protocol. It means that there is no single person to take to court, to physically come after or to attempt to persuade a change in the protocol. Bitcoin is a system of rules, not rulers.

Bitcoin Is Actually Decentralized

Decentralization is a much-overstated buzzword that is an untrue property of the majority of cryptocurrency projects that claim it. Decentralization is important for people who believe world powers are working in conjunction to limit freedoms and mandate measures that deny bodily autonomy. It matters because it makes a system antifragile in a hostile environment.

If a protocol is decentralized, then it can withstand attacks from antagonistic governments or military forces. This is what happened when China banned Bitcoin mining and the network continued to operate as intended. A combative government tried to shut down Bitcoin, and it stayed online — producing blocks and processing transactions.

I’ve heard some people say that decentralization is a spectrum. I disagree; something is either decentralized or it isn’t. If your blockchain of choice can go offline for 72 hours, or just be shut off to give developers uninterrupted time to fix it, then it isn’t decentralized. If it isn’t decentralized, your money is susceptible to the inclinations of internet service providers. Bitcoin is actually decentralized because its hash power is distributed across the globe and copies of its ledger are similarly spread throughout the world through users who run full nodes.

Bitcoin Is Censorship-Resistant

Another one of Bitcoin’s important features, especially for people who spoke out against mandates, is freedom of speech. In Citizens United, the Supreme Court famously held that money is, indeed, speech. The last few years saw numerous attacks on free speech, including a sitting President being permanently banned from Twitter, doctors losing their licenses for sharing information about COVID-19 that didn’t fit with the narrative, and Canadians having their bank accounts frozen for donating to a cause that was deemed unacceptable by their government.

Considering money as speech under the law, it is imperative that it cannot be frozen or stopped for any reason. Bitcoin fits that bill. Should an entity attempt to blacklist an address, said owner can elect to pay a higher fee to get their transaction included in the next block. Only one mining pool has attempted to censor transactions, and they changed their mind shortly afterwards to validate transactions like every other miner.

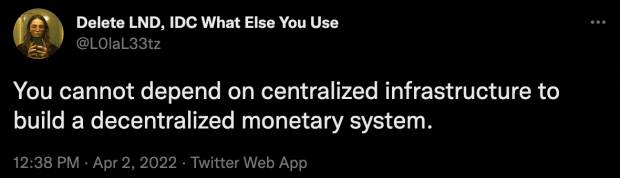

Not all cryptocurrency is censorship-resistant. The Ethereum blockchain had an exploit in a decentralized autonomous organization (DAO) in 2016, which resulted in $150 million being stolen and the code being hard-forked in order to pretend the hack never happened. If the code can be changed to pretend a hack never happened, it can be changed to prevent certain transactions going through. For example, the most widely used Ethereum wallet and the biggest NFT platform, Metamask and OpenSea respectively, blocked users from Iran and Venezuela from using their platforms because the countries are on the U.S. sanctions list. Similarly, Metamask and Infura (both inextricably linked to Ethereum infrastructure) blocked unspecified areas of the world due to a concern of legal compliance. If people are limited from accessing their money, they are limited in their freedom of speech. Bitcoin is censorship-resistant.

Bitcoin Is Seizure Resistant

This is a complicated topic and needs to be clarified. Bitcoin is not seizure proof, but it is seizure resistant. This property of Bitcoin came into question recently when the Canadian Freedom Convoy had bitcoin funds that were raised and subsequently confiscated. A private key was handed over during a police raid and some of the bitcoin funds were able to be impounded. Importantly, not all of the funds were taken, with some being locked in a multisignature quorum or having already been handed out to protestors. As quoted in the first article referenced, “No matter how immune bitcoin is from governmental power, its value and utility will always be undermined by the fact that its users are not.”

Bitcoin users have the choice to make their bitcoin as easy or difficult to confiscate as they wish. Recently, hackers who were able to make off with 120,000 bitcoin had the funds sequestered by the FBI after it was found that they were keeping the private key online in cloud storage. (Remember folks: The cloud is just someone else’s computer.) If they were wiser, they would have locked their funds in a multisignature solution that was geographically distributed around the world.

In another story with a different outcome, a German hacker was able to successfully evade having his bitcoin seized when he served a two-year jail term for surreptitiously installing mining software on people’s computers and amassing over 1,700 bitcoin. He refuses to give up the passphrase and police are unable to access the “seized” funds. Bitcoin is as seizure resistant as you make it.

Bitcoin Had A Fair Launch

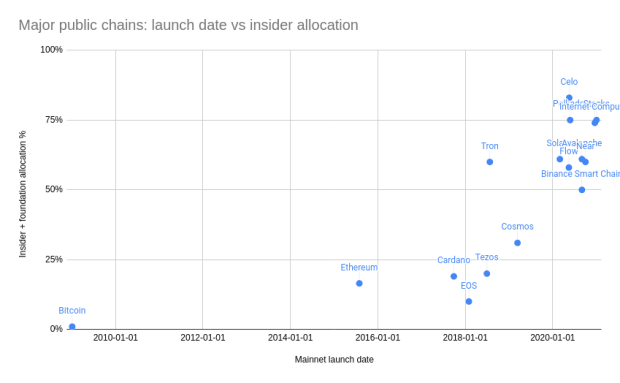

Satoshi Nakamoto announced Bitcoin on a public forum for anyone who was paying attention to see. When it was officially launched in early January 2009, anyone who was running the protocol could earn bitcoin in exchange for using the electricity to power their computer. The same cannot be said for any other cryptocurrencies. The people launching the Ethereum Network gave their insiders 9.9% of initially created tokens with the creator, Vitalik Buterin, praising this premine.

In Vitalik Buterin’s own (though satirical) words, “One noisy proxy for the blockchain industry’s slow replacement of philosophical and idealistic values with short-term profit-seeking values is the larger and larger size of premines: the allocations that developers of a cryptocurrency give to themselves.” Bitcoin’s genesis was a once-in-a-lifetime chance for a fair launch for anyone to participate. The chart below shows popular cryptocurrencies, their launch date on the x-axis and the percentage that was premined on the y-axis. It’s extremely clear how Bitcoin is in a class of its own with almost no percentage going to insiders or even the creator before it was released. Satoshi ran the code with everyone else who opted in and had the likelihood of finding a block proportional to the amount of CPU they were using in the process.

According to Camilla Russo who wrote the article cited above which detailed the Ethereum premine, “Satoshi Nakamoto gave anyone who was interested the same opportunity to gain bitcoin when the network was launched, as he announced when mining would begin and published the software beforehand.”

To this day, anyone who wishes to join the network, needs only to download a wallet and earn bitcoin. Or if they have the resources, they can purchase an ASIC miner and plug it in to earn bitcoin by mining. Bitcoin was the only fairly launched cryptocurrency and there will never be another opportunity to fairly distribute money in this way.

Bitcoin Is Issued Based On Proof-Of-Work

Other cryptocurrencies that operate based on proof-of-stake are able to have the code changed by those with the most amount of money “staked,” if they only vote for the change. This sounds eerily similar to the way governments operate today, with Big Pharma, Big Agriculture, Big Tobacco and other “Bigs” using their deeply lined pockets to lobby politicians for the changes they wish to see enacted for their benefit. Bitcoin’s proof-of-work algorithm means that each player is an equal participant in the network.

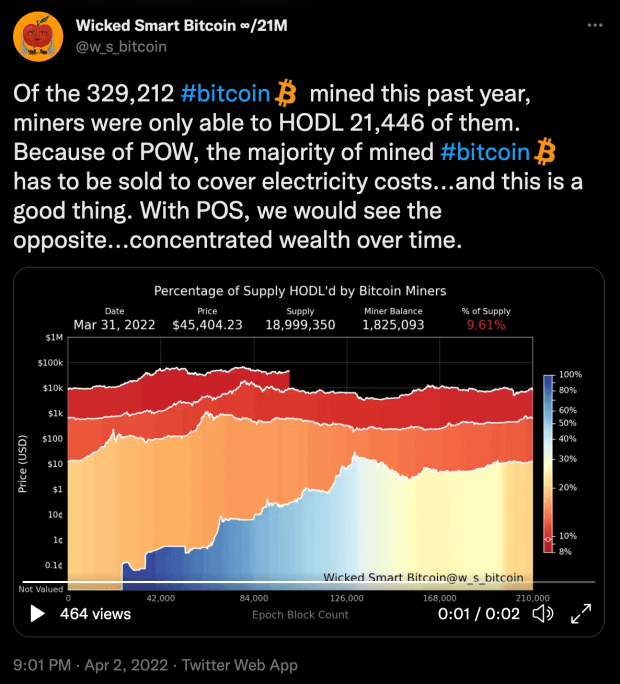

In a recent article for Forbes, Pete Rizzo outlines why Bitcoin uses energy in the first place. “By tying Bitcoin issuance to the energy market, however, bitcoins became fairly and widely distributed.” Most people around the world have access to electricity, which could be used to mine bitcoin if so chosen. Because Bitcoin uses energy, it allows the value it creates to be distributed fairly by anyone who is using energy to mine it, while securing the history of transactions by writing them onto the blockchain. Using electricity means that miners have to sell some of the earned bitcoin in order to pay for energy costs, which further distributes the bitcoin.

Rizzo’s article is a great starting place for those curious about cryptocurrency, but concerned about a possible climate catastrophe, or for those who think proof-of-stake is a better option. Ultimately, proof-of-work is what separates Bitcoin from other cryptocurrencies and gives it advantage over government or centrally planned money.

Bitcoin Is Scarce

Unlike other assets that cannot be audited, Bitcoin is extremely easy to audit with a simple command. For users that run a full node, there is the command “gettxoutsetinfo” that tells anyone who runs it exactly how much bitcoin there is in circulation, as well as other relevant information about the Bitcoin blockchain — such as block height, estimated size of the blockchain, etc. This command is one of the things that set the bitcoin asset apart from other cryptocurrencies because its users don’t have to trust the calculations of other people to determine the circulating and total supply. In addition to having to trust other people to calculate correctly, this also does not provide a fool-proof way for multiple, distributed parties coming up with the same answer.

Some proponents of other cryptocurrencies may claim that a hard-capped supply is not the main marker of utility. They may insist that their cryptocurrency of choice has more things built on top of it. In response, one must think of architectural design when building on top of alternative blockchains. It is impossible to build a robust, resilient, decentralized system on a centralized platform. This goes back to a previous point that Bitcoin is decentralized; should an internet service provider shut off access to the base layer, then any program or DApp built on top of it will no longer work (because it’s not decentralized).

Bitcoin’s hard-capped supply of 21 million bitcoin is one of the main innovations of Bitcoin. No one can change this limit. If they do, anyone who runs a node can (and will) choose to keep running the true Bitcoin codebase. Until Bitcoin’s creation, there had never before been true digital scarcity.

Bitcoin Requires Personal Responsibility

Apparently, one of the arguments in the cryptocurrency discussion that was the inspiration for this article was that there will be some type of wealth redistribution by whomever takes down the one world government in the future. I hate to be the bearer of bad news, but the wealth redistribution is already happening and it’s Bitcoin. Everyone feels late when they first get into Bitcoin, but we are still so early. Though the rate of global adoption is extremely hard to quantify, data by Chainanalysis show that the majority of the world has still not adopted cryptocurrency in a significant way.

Bitcoin is a newer way of engaging with financial sovereignty; it requires you to take full ownership of your assets, which can be frightening for some because there is no entity to help you if you lose access to your private key.

Luckily, there are many services that provide alternative means of custody, such as Casa or Unchained. These companies support customers who may be ready to take ownership of their private keys, but want a backup, just in case. Though there are ways to alleviate some of the pressure of needing to be completely responsible for all of your assets, Bitcoin requires a high degree of personal responsibility.

In Conclusion

This is my final attempt to bring attention to the momentousness of Bitcoin and forewarn against its imitators. The aforementioned reasons why Bitcoin is paramount to all other competitors are significant enough for this author to stay away from other cryptocurrencies. Bitcoin is the only viable option because of node decentralization, immutability, a hard-capped supply, fair launch and proof-of-work mining. If, after reading this, someone chooses to purchase anything besides bitcoin, I have done everything I could to sway them otherwise. A wiser person than myself once said, “If you don’t believe me or don’t get it, I don’t have time to try to convince you, sorry.” That being said, if you walk away from this article curious for more resources about Bitcoin, I’m happy to share.

This is a guest post by Craig Deutsch. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.