- March 17, 2022

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

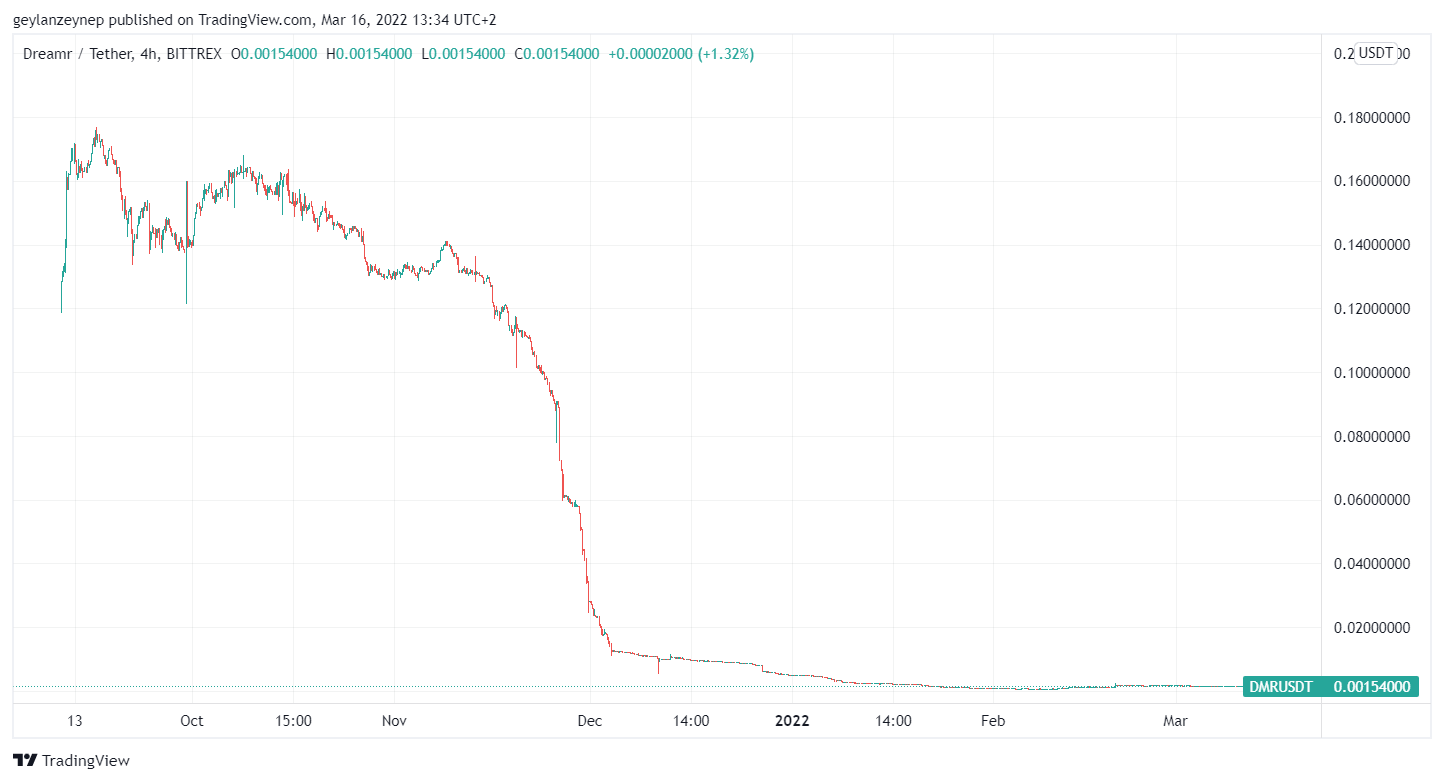

Bahamas-based Dreamr App’s native token DMR’s launch was planned for August 31, 2021. However, it was delayed until September 12, 2021. Moreover, there were further complications with the additional token releases. These delays caused the DMR token to lose momentum and a 93% value loss within 90 days after token release.

On the planned launch date, one DMR token was valued at around 0.13 USDT. It performed fairly well during the delay and dumped rapidly after the launch. Since then, it has been valued at approximately 0.0015 USDT.

According to the Dreamr team, their token release was sabotaged, and they filed a lawsuit against the allegedly responsible actors to retrieve their lost capital.

What is Dreamr App?

Dreamr app was launched in 2015 to create an ecosystem where participants could support each others’ dreams.

The app users can declare their dreams in a text or media format to receive support, start crowdfunding or establish partnerships with other users to make their dreams come true. App users also include graphic designers or software engineers looking for new opportunities.

DMR tokens are Dreamr’s governance currency. Users can either earn their DMR tokens from within the app by participating in giveaways or purchase from the Bittrex Global exchange platform. DMR token holders can rate the changes in the app roadmap and its policies

Dreamr APP is essentially a mobile application with an extra blockchain layer used to finance projects within the app. To launch the DMR token, the Dreamr team collaborated with Deltec Bank’s well-reputed blockchain affiliate, Delchain. The

What are the allegations?

Dreamr team claims that both Deltec Bank and Delchain conspired against Dreamr by postponing the token release -among other things- which caused Dreamr to lose more than $20 million. Commenting on the lawsuit, the Dreamr team stated:

“Defendants, individually and collectively, caused Dreamr to lose more than $20m. Dreamr retained and paid each defendant to provide certain advisory services concerning Dreamr’s attempt to launch and list Dreamr’s DMR crypto-tokens on a recognized cryptocurrency exchange, Bittrex Global.”

they further elaborated:

“Rather than support Dreamr’s endeavor, each defendant instead conspired against Dreamr and sabotaged Dreamr’s crypto token launch by, among other things, causing a delay of the release of Dreamr’s tokens; preventing and stalling the transfer of Dreamr’s tokens out of its bank accounts, and coercing Dreamr into an unjustified settlement agreement in exchange for additional compensation.”

Delchain dismissed these allegations by claiming that “Dreamr Labs was seeking to blame itself and others for their own failure.”

On the other hand, Deltec Bank argues that they are only involved in this lawsuit as a result of their affiliation with Delchain. They say that these allegations are both “unfounded and unsubstantiated” and “frivolous and vexatious”, given that they are not directly involved in the digital assets/cryptocurrency space.

What are the facts?

First delay

The first delay pushed the launch date from August 31 to September 7. This decision was made unilaterally by Delchain’s CEO, Bruno Macchialli, due to additional due diligence concerns. However, at the time, press releases were ready to go; Bittrex Global had already gotten paid and approved a market open date for DMR tokens.

Dreamr team argues that Macchialli issued this unnecessary delay because he needed time to funnel certain assets through Delchain before listing on the Bittrex exchange. Tokens were released on September 12.

Second complications

More complications arose on November 17, when the Dreamr team requested Delchain to release their locked-up DMR tokens. This request was accounted for as Delchain was the custodian, and these tokens held by Delchain’s CEO were to be released between 90-120 days after initial token listing.

However, Macchialli came up with several excuses to not release DMR tokens.

First, Macchialli claimed that Delchain and Deltec Bank needed to schedule a video conference before DMR tokens were released. Dreamr team argues this is video conference was a delaying trick since it wasn’t mentioned during the token release planning.

A few days later, according to the Dreamr team’s allegations, Macchialli said that Delchain and Deltec Bank had received a letter from a third-party alleging fraud on Dreamr’s part and certain other irregularities. Therefore, Macchialli refused to release the locked-up DMR tokens. Delchain and Deltec Bank denied the Dreamr team’s requests to expose the letter and the sender.

Locked-up token release

On November 26, Macchialli suddenly agreed to release the DMR tokens. Commenting on this release, the Dreamr team stated:

“Around November 17, the Dreamr tokens held in Dreamr’s account at Delchain and Deltec were valued at 0.12 cents per token. On November 26, 2021, when Delchain and Deltec agreed to release the Dreamr tokens, the value of the Dreamr tokens had dropped from 0.12 cents per Token to 0.06 cents per Token”

Dreamr team argues that while Machialli, Delchain, and Deltec Bank refused to release the tokens, they knew that many parties, including themselves, were selling DMR tokens already on the market. So, after they all sold out and maximized their profit, they released the remaining tokens, causing the value to decrease gradually.

The post Here are the facts on the alleged sabotage on the DMR Token appeared first on CryptoSlate.