- February 5, 2022

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Bitcoin development in Africa, with a proper regulatory environment, could equally accelerate the continent and the technology.

In this piece, we’ll be analyzing the current state of the Bitcoin developer ecosystem in Africa, ways to improve it and what the road ahead looks like.

Since 2009, Bitcoin has graduated from an obscure open-source attempt at creating electronic money, worked on by a handful of programmers, to a global effort with almost a thousand contributors from varying parts around the world, tirelessly working on maintaining and building out a network behind a ~$1 trillion asset.

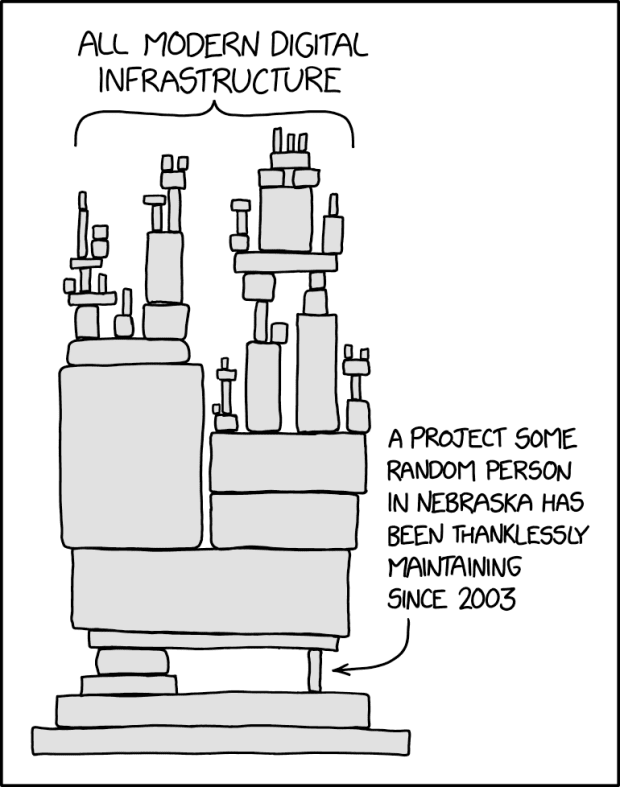

Despite all this growth and adoption, as it stands today, the number of developers working full time on the Bitcoin reference client — Bitcoin Core — is well below 40, and the number of maintainers is within single digits. These are the individuals around the globe working day and night on the most foundational infrastructure.

One of the biggest threats to the future of Bitcoin is not having enough skilled and talented developers to maintain the code that underlies its entire ecosystem.

It is, therefore, not only imperative that we expand this pool of Bitcoin developers, but we must also decentralize this developer base to further fortify future development from influence by rogue actors and sponsors.

Current State Of Bitcoin Development In Africa

There are an even smaller number of Bitcoin developers on the African continent, with the number further shrinking as we go lower in the stack, from the Lightning Network daemon (LND) all the way down to Bitcoin Core. This shallow number of developers working on Bitcoin development is the result of multiple factors — one of which is the widely held belief among developers that Bitcoin is devoid of innovation and is a deprecated technology (or at least soon to be).

Crypto projects operating in the Web 3.0 space capitalize on these perceptions and often propagate them. These projects tend to capture a lot of the developer mindshare especially through hackathons and other avenues — save outright throwing money at developers — to get them working on their platforms and chains.

Further complicating matters is the idea that Bitcoin is a scam or Ponzi scheme and is used primarily for illicit activities. Some certain realities do lend credence to these beliefs in the eyes of many, such as, in the early days of Bitcoin proliferation around the world, numerous fraudulent projects and entities banked on the popularity of Bitcoin to outright defraud unsuspecting masses, with certain scams persisting to date. The mainstream media was also swift, early on, to magnify the minute instances of nefarious groups using bitcoin to fund their operations. Nowadays, stories revolve around concerns about Bitcoin’s energy consumption to the same effect.

Most times, developers happen to harbor this warped framing of Bitcoin and are, therefore, unwilling to pay attention to it, let alone venture into Bitcoin development. They also assume the Bitcoin developer community is toxic and unwelcoming based on the brash micro-community of Bitcoiners on Twitter, which couldn’t be further from the truth. However, for those who may have weathered all the FUD (Fear, Uncertainty, and Doubt), contributing to projects such as Bitcoin Core — and Bitcoin development in general — is seen as exceedingly daunting. Additionally, in practice, these developers do not view Bitcoin development as a sustainable career path (often citing an assumed lack of funding).

While it is no surprise that Bitcoin development is not an easy task, it is a stretch to consider it out of reach for developers, even for ones without prior experience working on open-source projects. What is required is a learned skill set that includes significant focus, mental context switching, knowledge about the Bitcoin protocol and software, and decent programming acumen.

The Bitcoin Development Path

It’s not entirely far-fetched to consider Bitcoin development a tiresome and unsustainable career choice. After all, most Bitcoin contributors and developers do it pro bono — as is the case for most open-source projects.

However, the recent increase in funding sources for developers working on Bitcoin (e.g., Human Rights Foundation, Bitmex, Spiral, etc.) has made this only partially true. Nevertheless, I would be remiss if I didn’t acknowledge the realities and limitations of relying solely on grants to work on Bitcoin as a viable career path; the payments are infrequent, though substantial, and may not be an in-place replacement for traditional employment. However, there are now year-long grants provided by Brink, for example, that make it a lot more sustainable to work full-time on Bitcoin.

Notwithstanding, we can narrow down the possibilities for developers seeking to venture into Bitcoin development into the following:

- Work on FOSS (Free and Open-Source Software) and get grants or sponsorships.

- Work at a Bitcoin company and earn a salary.

- Work at a Bitcoin company that allows you some time to, or employment to solely, work on open-source Bitcoin projects.

All of the above have their strengths and weaknesses. However, they are still viable paths for developers seeking to work on Bitcoin development, specifically at the protocol level.

Further, it is vital to highlight that the Bitcoin development landscape includes multiple layers of software that interact and form an entire ecosystem and is not limited to working on protocol-level projects.

Bitcoin development stretches far beyond maintaining Bitcoin Core or LND and includes their alternative software implementations, Bitcoin node operating systems, utility and client libraries, and an entire set of associated software such as wallets, payment processors and even exchanges.

Therefore, developers can still contribute to Bitcoin development by working on software outside of protocol-level projects, and greatly provide value and earn a living, as some of the projects have companies behind them that can hire them and provide a salary to work on their projects and ventures.

Bitcoin Education

All these issues discussed so far can first be effectively tackled through more outreach and education.

This education must come as a holistic package: both technical and pragmatic. For example, for developers, it is crucial to teach them about wallet architecture, protocol-level and other foundational concepts, and at the same time ensure individuals learn how to store bitcoin securely and other “out-of-spec” skills.

Technical Education

In trying to educate developers, we must expose them to all possible avenues of contributing to Bitcoin development in the open-source context, or as a fellow Bitcoiner put it, partake in the “unglamorous parts” of open-source work such as labeling issues, minor reviews, documentation and trivial pull requests (PRs).

There is still a chasm we must be cognizant of between opening your first PR and establishing oneself as a Bitcoin contributor to get grants and other forms of funding to work full-time. Thus, it is pertinent for us to attend to those stuck between carrying the “newbie” label and becoming experienced developers by providing the necessary fundamental knowledge and skills to grow and gradually cross over. We do so by ensuring we build and support programs, initiatives and resources targeting this demographic.

An immediate issue facing developers — regardless of skill level — is a lack of structure for a path to becoming a Bitcoin developer, as there is for becoming a web developer, for example.

We, therefore, need more projects and initiatives tailored toward the pivotal stages of a Bitcoin developer’s journey, starting with training junior developers without coding experience to a stage where they have the necessary technical foundation and coding skill level, ensuring they have a clear path toward progressing into more mid-level development.

This can be achieved with programs that can help refine their skills (along with other engineers and senior developers) that can transition into working in the industry, building out innovative solutions, and working on base layer infrastructure.

In that same light, my fellow Bitcoin developers and I have had the privilege of launching Qala — a developer program that would train the next generation of African Bitcoin developers. We intend to develop the technical talent locally and, at the same time, ensure there is adequate financial support during (through stipends) and after training (through employment and or grants or sponsorships) to make Bitcoin development a sustainable career path. Though currently targeted at more mid-level to senior developers, it ultimately intends to impart the required technical knowledge to contribute to Bitcoin and the ecosystem at large. (You can subscribe to the Qala newsletter to keep up with developments in the Bitcoin space in Africa.)

Nevertheless, existing technology skills acquisition centers and bodies (e.g., technology hubs) need to be pulled along and provided with the necessary Bitcoin educational resources to help train and educate more novice developers. By leveraging existing organizations focused on technology and digital literacy, it would be possible to build out a thriving pipeline of junior developers.

Hackathons, boot camps and other associated programs could be supplementally beneficial to the progression of budding developers into mid-level and senior developers.

With the presence of programs such as Qala and others that may be spawned across the continent, it would provide these developers with the following opportunities at the end of the tunnel:

- Contribute to protocol-oriented projects such as Bitcoin Core and LND.

- Contribute to application-oriented projects such as BlueWallet, BDK and Umbrel.

- Gain employment in Bitcoin-first or Bitcoin-only companies.

- Strike it out on their own and build out innovative solutions in the greater Bitcoin ecosystem.

To avoid duplicating efforts, we must, essentially, seek out talent, create and sponsor local initiatives, and collaborate to move things forward and get a thriving developer pipeline from zero to Bitcoin developer.

Beyond Technical Education

Africa is home to more than a thousand indigenous languages, with non-English speaking countries. The majority of Bitcoin material available is in the English language, which means we must also engage in translation efforts to unlock knowledge for millions of non-English speakers on the continent, both on the developer and user front.

Currently, there are efforts around Africa to translate Bitcoin material into different languages such as Amharic, Arabic and Wolof by Kal Kassa, Arabic_HODL and Fodé Diop, respectively, with ongoing work on others. These efforts are valiant and must not only be supported but empowered and expanded. Porting Bitcoin educational material grows the set of developers and individuals that can not only use Bitcoin as a tool for economic empowerment but contribute their talent and skill to build solutions tailored to solve issues facing their locale.

While the source code of projects may be in English, translating out-of-code material into other languages can bootstrap understanding and get individuals up to speed and involved in the global Bitcoin conversation.

As a side note, developers and non-developers can also contribute to language translations and grammar or spelling fixes (e.g., in projects like LND). We can bring awareness to these possibilities by educating individuals and disillusioning them about the requirements for contributing and becoming equipped with the necessary technical knowledge about Bitcoin. In so doing, we must ensure projects are not spammed with frivolous changes to avoid disrupting development.

We must draw clear distinctions about what constitutes the contributions we are discussing to ensure willing contributors are adding value.

It is important to reiterate that both technical and nontechnical education must be viewed as two sides of the same coin, as they intricately go hand in hand. Though usage from the end users influence the design and flow of software, understanding and communicating best practices from developers is a good way of ensuring users do not harm themselves and face economic consequences, especially in the case of Bitcoin — for example, loss of funds due to the imprecise use of Bitcoin software.

Contributing to the Bitcoin development ecosystem does not stop at translations or contributing code, as there are other ways, in the context of education, that one can help. For example, content writers exploring Bitcoin can significantly contribute to education efforts by breaking down concepts, highlighting developments and other similar detailings.

Artists and designers could also use their artistic voices to educate and bring about awareness of Bitcoin or help improve user interfaces, accordingly.

Additionally, individuals who already understand Bitcoin can contribute to the ecosystem by educating their immediate circle: family, friends and neighbors. The education could range from explaining to the best of your abilities what Bitcoin is all the way to teaching them about how to keep their mnemonic safe.

Supporting Bitcoin Development On The Continent

Unfortunately, in the open-source space, projects at the very core of a technology stack tend to be underfunded compared to projects that depend on them. In the case of Bitcoin, developers working higher up the development stack (i.e., wallets, exchanges, etc.) tend to experience higher levels of — and more frequent — funding relative to developers working on more base layer projects such as Bitcoin Core.

In growing a thriving Bitcoin development ecosystem, it is essential to provide funding at various levels of development. Developers in the space mostly work on open-source software that has no direct source of funding, as is the case for working as a hired developer in a company on closed-source software. To enable working on open-source software — which is at the core of the Bitcoin ecosystem — it is essential to provide avenues for funding, whether through grants, sponsorships or donations.

Currently, there are organizations such as the Human Rights Foundation, Bitmex and Brink, which offer a variety of funding structures varying from year-long sponsorships to one-time grants. The growing number of these organizations and sources of funding from the inception of Bitcoin development is a testament to its continued growth and importance in the global landscape.

Moving forward, as Bitcoin continues to gain more adoption, it will become increasingly necessary to grow the basket of available sponsors for developers working in the ecosystem.

Decentralization is at the core of Bitcoin, and this quality extends into funding. Down the line, it is vital to ensure sources of funding for Bitcoin development become distributed across varying territories. One reason behind this is to avoid any single — or set of — sponsors from using their monopoly to influence or control Bitcoin development and the future of Bitcoin.

It is integral to decentralize the funding pool to avoid scenarios where development relies on a single large backer — or set of backers — who could pull out or go bust and leave developers without financial support.

It is just as integral to the future of Bitcoin development to ensure that there are independent developers that aren’t beholden to any entity, which could make them compromised — in the sense that they become vassals carrying out the bidding of their sponsors.

Financial support isn’t limited to well-funded companies, as individuals can also financially contribute to projects — they usually provide ways of donating, e.g., Bitcoin addresses — and to individual Bitcoin developers. You never know what impact your contribution could have on the project or developer. It takes a lot more than companies to make any meaningful change.

Beyond providing direct sponsorship, grants and donations from organizations, Bitcoin companies and exchanges can employ Bitcoin developers and pay them to work on Bitcoin open-source projects such as Bitcoin Core (similar to how companies hire Linux engineers to work on the kernel).

Alternatively, as pointed out by a fellow Bitcoiner, these employers could consider giving their hires some time out of their week to work on Bitcoin, which can translate to a way of giving back to the Bitcoin community without explicitly giving out grants or funding. It also comes with the added advantage of helping them internally as most Bitcoin companies use and rely on open-source libraries and projects in the ecosystem.

Building Critical Bitcoin Infrastructure

Currently, we are experiencing two separate but highly related asymmetries on the continent: (1) between the number of talented developers and those of them that work on Bitcoin development, and similarly, (2) between the number of reliable Bitcoin on- and off-ramps and the number of enthusiastic Bitcoin consumers, where there is a divide between available products or solutions and the growing Bitcoin consumer base.

To address and correct these asymmetries, we must engage in Bitcoin technical capacity building: educating and training developers to grow the pool of Bitcoin developers. These developers are crucial in building the much-needed tools, services and software to address local economic challenges, simplify access to Bitcoin and tap into a global monetary network.

Building tools, apps and services atop Bitcoin allows individuals to access a global payment network that is censorship-resistant, open and cheap. By leveraging the Lightning Network, we can provide cheap instant settlements across the globe.

Those without formal accounts can use bitcoin to engage in both local and global commercial activities in a way that is instant, free from government oppression and orders of magnitude cheaper. It is, therefore, a powerful substitute for the unbanked.

In short, Bitcoin localizes the global economy under a single payment interface.

With Bitcoin, it is possible to build infrastructure which provides an alternative to existing inefficient and unsophisticated payment infrastructure. By providing a more reliable, resilient, instant and cheaper payment network, you expose individuals to a novel set of possibilities regarding how they communicate economically in their locale and with others in different parts of the globe.

Providing real economic empowerment to these communities can only come about by working with those on the ground in harnessing the potential and building out critical infrastructure and solutions.

As part of our efforts toward growing the Bitcoin development ecosystem, we must also focus on building Bitcoin infrastructure to aid in further securing the network and expanding on its resilience. In this light, we must ensure the network continues to be decentralized and open to everyone.

The case for distributed access to the Bitcoin network is a significant component in this regard, especially in developing regions lacking reliable internet connectivity. As an example, Blockstream’s satellite kit and receivers are a good example, as they provide a direct communication line — without requiring reliance on existing internet providers — to access the Bitcoin network. Individuals in communities can be guaranteed always-on-demand access to the Bitcoin network without fear of being left out due to substandard internet access in their region.

Other off-grid solutions such as mesh networks will increasingly be vital in building out reliable Bitcoin infrastructure that is needed to serve individuals from varying socioeconomic backgrounds.

Ensuring that the Bitcoin network remains decentralized is also greatly important to keep it open and censorship resistant. Having individuals rely on a small set of nodes increases the chances of eclipsing them (where they can be isolated from the rest of the network by a malicious adversary). Though there is a risk of having nodes connect to peers in their geographic location, as that could fragment the network, it is still crucial to provide a variety of nodes from different parts of the globe to connect to and avoid being subject to potential network-based attacks.

Bitcoin Mining

Bitcoin mining is another facet of the entire Bitcoin infrastructure stack that needs to be distributed around the globe and avoid pockets of concentration to maintain censorship resistance. It is paramount that mining remains open, competitive and distributed across multiple geographies.

A concentration of mining pools in a specific region could give rise to potential censorship of transactions of a specific origin, kind or ones spending from, or to, addresses of interest. To illustrate this, take the following example:

A mining pool could choose to discriminate — whether for ideological or even regulatory reasons — between which transactions get in the chain (outside normal operating parameters such as analyzing transaction size and fee rate), which would result in a significant compromise to an essential part of Bitcoin — censorship resistance.

Another more commonly referenced risk is a 51% attack, where a miner or set of miners amass 51% of the Bitcoin network’s hash rate and could perform attacks such as double-spending of coins.

It, therefore, becomes a lot clearer why requiring more distributed mining pools across the world is concomitant with protecting the network and its users from economic censorship.

Beyond the distribution of mining pools across the globe, the inhabitants of the African continent stand to benefit from participating in Bitcoin mining.

Addressing Gas Flaring In Nigeria Using Bitcoin Mining

There are numerous incentives for investors and energy plants alike to venture into the mining space.

According to the World Bank, Nigeria is ranked as the seventh largest gas flaring country worldwide, and in 2020 emitted more than 7 billion cubic meters of gas. It is possible to harness this flared gas that would otherwise be released into the atmosphere to power ASICs for Bitcoin mining. Not only will this roll back the carbon footprint, but it’ll provide energy-generation companies with an alternative revenue stream that can be channeled into developing local infrastructure.

The benefits extend far beyond helping curb energy curtailment and extant pollution in Nigeria, as it also helps further decentralize the global distribution of miners.

Developing Communities Through Bitcoin Mining

Through Bitcoin mining, we can bootstrap electricity generation for communities and infrastructural development to both rural and urban areas accordingly.

It is, unfortunately, the case that certain parts of Africa have underdeveloped energy infrastructure, extending from generation to distribution. There are several instances across the continent where there is a disconnect between the energy-generation capacity and existing transmission capacity. It is, therefore, the case that numerous locations are in a state of infrequent electricity delivery or none at all, as the distribution infrastructure is just unable to transport energy to communities in need of this electricity.

It is possible with Bitcoin mining to build off-grid solutions in these areas without requiring immediate distribution infrastructure or high local demand for electricity. The idea is to set up ASICs as the primary consumer of this electricity, and revenue from the mining process can be used to invest in building out transmission and distribution infrastructure.

The ASICs are initially the majority consumer of electricity, and with time, as the surrounding infrastructure develops, the mining operation can be gradually scaled down as demand for electricity in the community increases.

With such a setup, it is economically feasible to provide electricity to underserved communities and even build out energy infrastructure in these areas.

Beyond the few use cases identified thus far, and with the maturation of Bitcoin development on the African continent, a whole host of possibilities still awaits with even further far-reaching benefits.

We must, therefore, take the first steps toward maturing the Bitcoin development ecosystem.

The Future Ahead

To attain the level of adoption that would unlock transformational economic opportunities at an individual and societal level, we must engage with lawmakers and governments to ensure mutual benefit and Bitcoin-friendly regulations. Failing to do so would mean large swaths of individuals, who might not possess the technical expertise to circumvent restrictive regulations, would be left with no tangible avenue to access Bitcoin. It is, therefore, vital that we educate and bring onboard lawmakers to ensure they, too, understand the attendant benefits of allowing the proliferation and integration of the Bitcoin network into our global legacy financial system.

As more countries on the continent begin to understand the potential benefits at a state level, we may even see countries, within this decade or the next — most likely smaller ones — adopt Bitcoin as a legal tender, just as El Salvador has done.

Nevertheless, the gaps and opportunities previously cited can only be addressed and tapped into, accordingly, by increasing the pool of Bitcoin developers and other ecosystem stakeholders to build out, manage and maintain all the infrastructure.

We are at the precipice of global monetary evolution, and as Africans, we cannot afford to be outside this global transformation. We must strategically position the continent to be at the forefront of the global Bitcoin development to provide a net positive impact by harnessing the existing talent and capitalizing on all the attendant benefits of Bitcoin.

We, therefore, have no option but to unite the existing — but fragmented — developer ecosystems across the continent to bring about the development we need to build the future.

The road ahead looks bright, and I am cautiously optimistic that the African continent will play a pivotal role in not only furthering the development of Bitcoin but in utilizing it to launch Africa into the forefront of this monetary revolution.

Special thanks to Khalil for the review and feedback on an early draft.

This is a guest post by Abubakar Nur Khalil. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine