- October 23, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Bitcoin is in direct opposition to the monopolies Illich envisioned as ensnaring the world economy through the financial access it provides.

The work of Ivan Illich — ronin of the Catholic Church, “errant pilgrim,” and subtle, surprising and far-ranging social theorist — is experiencing a renaissance among many who worry that technology poses corrosive threats to human culture and well-being. A trenchant and unique critic of the Catholic Church in which he came up, Illich went on to critique many modern institutions, whose failures he saw as reflective of the failures of the Church.

Illich’s unique critiques of “industrial institutions” throw new light on our modern monetary system, and Bitcoin’s place within it. In this essay, I’d like to introduce how Illich thought about institutions and tools, apply that lens to our present-day monetary system, and finally, consider Bitcoin as an alternative.

Across a body of thematically linked work, Illich argued that our modern societies increasingly confuse large-scale and bureaucratic “institutions,” like those of “schooling” and “medicine,” with the goals they nominally arose to combat. In so doing, we commodify core aspects of our once-social being, and we cede individual and communal capacity to vast institutions with increasingly “radical monopolies” over the services they render and goals they claim to serve.

This consolidation into “industrial institutions” with “radical monopolies” over the services they offered disempowered both communities and individuals. This combined disempowerment and monopolization inevitably led to counterproductive institutions, which lost sight of, and began to undermine, their stated aims.

Schooling, the subject of Illich’s “Deschooling Society,” provides an example. Illich argued that “schooling” had come to be confused with “learning.” Learning was historically an individualized and active process, specific to each person’s needs and context — lifelong, communal, curiosity-driven and unconstrained. One learns naturally and without much explicit instruction: from one’s community, work, role models or autonomous engagement with the world.

This learning is inherently active, tailored, compelling and “vernacular,” or naturally absorbed: Think of language.

Schooling is fundamentally different. Once a component of broader learning, schooling supplanted other forms of learning. The global dominance of modern schooling — driven by well-meaning activists (and the Prussian army) and supported by government funding and the global export of an American “industrial” vision — replaced natural learning with institutional learning.

In this new model, Illich argued, time spent “in seat” at an institutionally accredited school — a metric of consumption of an institutional good — became the measure of “learning” achieved. This change elevated credentialism, and it made the open-ended, self-driven and practical model of learning vocationally impractical in competition with the institutional and consumerist one. Over time, this destroyed broader learning.

The new institutional schooling model was based on discrete units of imposed and uniform training consumed in an increasingly authoritarian setting. The very structure of this mode of education is antithetical to free thought, skepticism, risk-taking and creativity. Units of this product consumed predominantly reflect willingness and capacity to be “excellent sheep,” along with privileged institutional access.

Conformity to authority is central to the model and necessary for continued consumption. A public school teacher, Illich pointed out, has become a triplicate authority of moral, epistemic and civic judgment — a primary arbiter of one’s inherent and societal value, and key to the door of the modern economy. As Illich put it, “The distinctions between morality, legality, and personal worth are blurred and eventually eliminated. Each transgression is made to be felt as a multiple offense.”

As growing numbers of “students” and “teachers” are minted in this ecosystem of authority, knowledge itself becomes institutionalized and confused with increasingly gated “expertise.”

Institutionalization feeds on its own failure. As this process makes schooling prerequisite to social access, it also transforms schooling into the monomaniacal target of reform. Well-meaning reformers dive in to “solve” educational gatekeeping, not by questioning educational gatekeeping or encouraging alternatives, but by attempting to shove more individuals through the gate. Simply infeasible levels of equality of “schooling” (not learning) are demanded for larger and larger numbers of people throughout the globe.

As institutional schooling metastasizes, it drives down quality (and equality) and exacerbates gatekeeping far faster than it improves relevant “learning.” Simultaneously, it absorbs a larger and larger share of society’s resources. It comes to strangle and replace — to radically monopolize — all other forms of learning. Along the way, this educational behemoth shapes cultures and economies in its image, replacing the custom, communal solutions which flourished with massive, restrictive, uniform and grossly unequal and nonfunctional bureaucracies.

In a way, these monopolistic institutions were simply one species of “tool” which Illich argued had become socially pathological. Unlike more “convivial” tools, which can be individually or democratically controlled and which augment our abilities and creative drives, some tools — which Illich referred to as “manipulative” — are fundamentally controlled and controlling. These manipulative tools redirect human energies toward metastasizing “radical monopolies” which shape human freedom and behavior in ways ill-suited to happiness and autonomy.

Manipulative tools typically involve central control, are fundamentally unequal in results and access, and generate dependency. For Illich, the superhighway system of the United States was one such “tool.” It resulted from political pressures and gave new powers to a prioritized set of rich individuals and corporations with cars and trucks. At the same time, it created “traffic” and commuting, trapping growing amounts of time in transport and forcibly slicing up human societies.

Convivial tools, by comparison, involve democratic or equal access and expand individual agency. Illich provides the mail system as a core example. Available to all at an accessible and nearly flat rate, and using a clear and open protocol, the mail system is relatively unbent to the purposes of any single group. It empowers those who opt into it — without forcing upon those around them a new structure of interaction.

With this as background, we can turn to the modern monetary system.

We tend not to think of this, but modern governments have a radical monopoly on money, which itself is a tool at the center of all modern societies. Just like the schooling monopoly, the monetary monopoly shapes our society in profound and foundational ways. As with schooling standing in for learning, we’ve come to think that “fiat currencies,” like the U.S. dollar, are money — confusing the institution with the concept.

The monopoly on money is radical, in the Illichian sense, in that it monopolizes practically the whole space of economic value transactions. Alternative media of exchange are strongly discouraged by legal tender laws and taxing policy. This monopoly on value transactions is also, almost unavoidably, a monopoly on money generation, and this paired monopoly sits at the base of our economy and shapes society in manifold ways.

Because monetary systems undergird economies, and the U.S. dollar’s money monopoly is fundamental to the globe’s monetary system, the dollar money monopoly is almost maximally radical. It sits at the near-literal root of our economic and social structure and has systematic effects across the globe.

As a consequence of its fundamental position, features of the dollar have extraordinary global impact. Most notably, the U.S. dollar is a rapidly and arbitrarily inflating currency — in terms of “monetary inflation,” the simple expansion of the money supply. This has confusing but powerful effects.

When more monetary units are added into an economy, the real-world wealth in the economy is essentially unaffected. Each monetary unit of measure for that value, however, decreases in worth relative to this static economic wealth.

Monetary inflation would, therefore, naturally lead to “price inflation,” or the increase in the prices of market goods — relative to what would happen absent the inflation in the monetary supply and other dynamic factors. If, for example, the number of circulated dollars in a closed and static economy were suddenly to double, the value of each dollar in terms of market goods would cut in half. To put it obversely, each good now costs twice as many dollars. It does so simply because the same real-world total wealth — the same quantity of goods and services in “the market” — is now divided between twice as many fractional representations of that wealth.

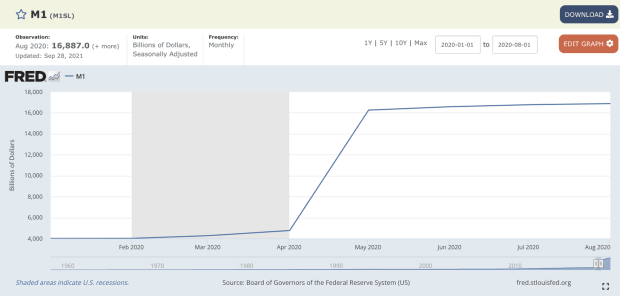

In 2020 alone, the M1 money supply, the most narrow measure of dollars in circulation, increased by more than four times!

This gives us some sense of the “monetary inflation” component of this system, but in reality, each entity in this complex equation involving monetary and price inflation is unknown and essentially unknowable. The complete supply of money-like instruments is a complex summation of physical and digital dollars, eurodollars, precious metals, stocks and assets, treasuries and many other financial instruments. Above all this sits a vast mountain of leveraged credit in great and unknown excess to the first-layer financial instruments upon which it is based.

These base monies themselves come into circulation through a complex variety of explicit and implicit schemes. Furthermore, the relationship between monetary and price inflation is effectively impossible to measure, because price inflation is the sum of that unknown monetary inflation (relative to the unknowable mountain of both money and credit) and the incalculable deflationary effect of technological growth.

Price inflation itself is only estimated through proxy. Bureaucrats track the “consumer price index,” or CPI, the averaged changing prices of an arbitrary basket of goods in an arbitrary set of markets, subjected to arbitrary “hedonic adjustments” to attempt to compare apples to apples across time. The validity of this fundamentally arbitrary bureaucratic measure is further brought into question by a century of pressure from adjacent governmental institutions. Those whose livelihoods depend on these institutions — which in turn depend on continued income streams — very much value the ability to “print” new money, as do the politicians who use money printing to more easily fund the pork-barrel legislation for which they are lobbied. This ability to print in turn depends on citizens’ systematic underestimation of monetary inflation’s deleterious effects. The CPI, a malleable metric only loosely determined by reality, is a tool for the extension of political control.

The oversimplification, then, is directionally correct: When the dollars in circulation increase, that has the corollary effect of increasing the cost — in dollars — of goods and assets. This thereby decreases the value, in goods and assets, of each dollar.

Given the rate of governmental and credit-based money “printing,” which vastly exceeds the rate of taxation, monetary inflation acts as an invisible tax of a scale far greater than all visible taxes. This tax is not only invisible but also highly regressive. Those who hold more of their wealth in dollars — primarily, the poor — lose, and those who hold more assets — mostly the rich — win. The inherent effect of monetary inflation, then, is “redistribution” from the have-nots to the already-haves.

The regressive nature of this invisible tax is even more pointed, in that, as with illicit counterfeiting, new money does not enter the economy in all places at once. Rather, to oversimplify again, it enters the economy through the hands of bankers and bureaucrats in what is referred to as the Cantillon effect. When the Federal Reserve “prints” money to buy newly minted U.S. treasuries (or the government mints a “wacky” trillion-dollar coin to avoid “financial Armageddon”), that money is spent in government appropriations or dolled out to back-stop (and unavoidably generate moral hazard for) bank speculators.

All of this, through the magic trick of engineered monetary inflation, comes at the cost of “the little guy.”

Given his concerns with excess consumerism, Illich might have decried yet another effect of this radical monopoly on money: An inflationary monetary system drives consumerism. This is because it devalues money in the future, which encourages spending over saving.

Recall, if you can, the days of $1 coffees and consider whether it would have been wise to hold onto that dollar for a coffee today.

This is not an accident, but in fact an explicit goal of Keynesian monetary theory, which aims to achieve “economic growth” through consumption. You may recall the post-9/11 exhortations to restart the economy through spending, but the chief driver of this consumerism is not political exhortations but subtle incentives.

The goal is increased growth through increased spending; the mechanism is increased spending through a money that devalues in your pocket. To Keynes, saving was hoarding, which “depresses the business of preparing to-day’s dinner without stimulating the business of making ready for some future act of consumption” and which should consequently be discouraged. Whatever the merits of this goal, this explicit choice to incentivize spending shapes human decisions in subtle but radical ways. It produces, insidiously, a culture which is relatively short-term oriented by design and whose citizens can only avoid this short-termism by seeking assets which don’t devalue — for example, gambling on the stock market.

Conceived as a tool, then, fiat money “manipulates” its holders to consume more than they otherwise would. “Otherwise” here refers to a clear alternative: Using the sorts of moneys toward which people have oriented across history. People have consistently revealed their preference for monetary instruments that hold their value over time. This is clearly why much of the world settled on gold and, in earlier communities throughout the world, unique, costly and scarce resources such as wampum or rai stones. Like most “manipulative tools,” fiat money has repeatedly been foisted upon people against their will.

The pervasive and insidious effects of this radical monopoly are hard to believe. Fish to fish: This is the water we live in, and it is hard to see. But the invisible effects of the money monopoly seem just as destructive — I would argue more so — than many of the radical monopolies which Illich criticized.

You might find this all somewhat excessive or unbelievable. If so, I introduce a brief quotation to add some intellectual heft — from Keynes himself — to my assertions:

“Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security but [also] at confidence in the equity of the existing distribution of wealth.

“Those to whom the system brings windfalls, beyond their deserts and even beyond their expectations or desires, become ‘profiteers,’ who are the object of the hatred of the bourgeoisie, whom the inflationism has impoverished, not less than of the proletariat. As the inflation proceeds and the real value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless; and the process of wealth-getting degenerates into a gamble and a lottery.

“Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.”

As Keynes’ analysis suggests, the levers of this inflationary system are far from democratic reach. Even were we to “diagnose” this problem, the Federal Reserve is antidemocratic by design. Despite vehement objection to bailouts and money printing, the Fed continues unabated. Across administrations, the printer “brrrrs.”

The institution of fiat money and its failures as a tool seem forced into our hands and beyond the reach of political change. Illich, who frequently (and somewhat cryptically) referred to “participatory democracy” as a more ideal means of governing our institutions and choosing our shared tools, would likely not have appreciated this structure.

Given this background, we can compare Bitcoin to the modern monetary system from an Illichian perspective.

Bitcoin is a “decentralized” cryptocurrency. That decentralization, and its import, are often poorly understood. Bitcoin is decentralized in the sense that its core protocol was designed such that no single party can control its programmatic issuance or usage. Instead, Bitcoin is

- a narrow rule set, codified in a protocol,

- a network of nodes (individual computers) which speak that protocol, and

- a unit of value (lowercase “bitcoin”) that transfers along that network, using that protocol.

The value of each bitcoin sent is communally determined, and the rules within the protocol are set and maintained not by any small group or individual, but by a complex game-theoretic interplay between various types of nodes on the network, all of which are incentivized to support the network’s health and the coin’s value.

There is no Bitcoin™ Incorporated. Decentralization here is tightly coupled with accessibility, flexibility and fairness: This is not a highway system, built to the specifications of individual lobbying industries, but rather an open system, controlled by those involved in it and operating as an unobtrusive alternative. Unlike our fiat monetary system, usage is not legally obligated or pressured but is fundamentally and exclusively opt-in.

With this understanding of decentralization, we might compare Bitcoin to mail, Illich’s prime example of conviviality. Bitcoin is an open network, with an extremely low barrier to entry. Unbanked individuals in impoverished countries can find their only banking services in this network and can onboard by selling anything of value for any “satoshis” sold in exchange. A slow internet connection and a simple phone app are all one needs to start transacting peer to peer with anyone in the world. The Bitcoin Lightning Network — a “Layer 2” network “on top” of Bitcoin which expands its functional reach — then allows any individual to transact instantaneously and for essentially zero fee.

This functionality is transparent and non-discriminating, because it is based on open, un-gated networks with no knowledge of or interest in who you are. Although the cost of sending bitcoin is per transaction, not per monetary size (meaning a billion dollar and five dollar “on chain” transaction cost the same), Lightning provides small-scale transactions for essentially zero fee.

Moreover, Bitcoin’s rule set and evolution are governed by a process of “participatory democracy” among stakeholders in the network, protocol and monetary unit. Changes to the protocol are furiously debated among owners of the coin, operators of network nodes and “miners” who validate the transaction history, and they must achieve extremely high levels of adoption to be implemented — 90% for the most recent protocol upgrade. This is a form of democracy whose varied participants each have “skin in the game” — investment in the network’s health and value — and which is fundamentally resistant to centralization. The network is designed to handle dissidence by ejecting nodes that fail to follow the protocol, meaning that the highly democratic rule set applies equally to all.

Bitcoin is an Illichian convivial tool in another manner: Since the protocol is transparent and open source, any technical individual can build upon it for their own creative use. Within a short time, anyone can learn to create their own “wallet.” With minimal investment, any individual or community can set up their own node — or use someone else’s. Unlike Visa or Mastercard, this open protocol allows for a flowering of novel and custom tools to interact with it, many of them “free and open-source software” supported by the community. Self-sufficiency is central to the global community’s ethos.

The customized applications for El Salvadoran Lightning wallets illustrate Bitcoin’s tremendous capacity for empowerment. As El Salvador has adopted bitcoin as a form of legal tender parallel to the dollar, the government has published its own wallet software. But El Salvadorans are free to adopt any other software they want, and the protocol allows them to send funds to or from the government wallet using any other piece of Lightning software, including some they might build. A team in El Zonte, El Salvador (aka “Bitcoin Beach”), has spent months living with the community and understanding their specific constraints and needs to build out wallet software that conforms to them. This software is community-specific but uses the global Bitcoin and Lightning networks to provide instant final settlement and interoperability with the rest of the world. Concretely, Bitcoin has drastically reduced the cost and difficulty of remittances for El Salvadorans and is moving to sharply reduce the friction of sale in local marketplaces in those countries.

From this perspective, Bitcoin seems like an ideal Illichian tool. It is a significantly more democratic system of money, more in line with the characteristics of money toward which people have gravitated throughout history. It removes the manipulative drive of fiat currencies toward consumerism, is far more open to individual access and creative usage, is exclusively opt-in, is far less coercible, and reduces the concentration of power unavoidably downstream from the ability to generate money from thin air.

The Bitcoin-powered overthrow of this monetary monopoly would also threaten monopolies downstream from it. Many of the “radical monopolies” Illich criticized are supported by unrestricted bureaucratic funding. The U.S. Department of Education, for example, with its annual budget north of $60 billion, is impossible to imagine in the same shape absent the huge quantities of money generated via magic trick and funneled into our federal bureaucracies. (It was founded eight years after Nixon removed the U.S. from the gold standard in 1971.) The U.S. government supports literal trillions worth in non-expungeable student loans (largely for upper-middle-class students). Absent massive direct and indirect funding of these departments and industries, they might shrink to more manageable, or even salutary, size.

This is because federal expenditures like these are not simply large but inflated — far in excess of what our taxes alone would fund. They represent a further leap of funding above and beyond that reached through our nominally republican (lowercase R) processes. And they are the result of the degradation of that process into one where the heavily lobbied individuals of the legislative state debate multi-thousand-page bills nobody has read, while executive bureaucrats govern massive departments well beyond public oversight. Both spew out bottomless streams of money to growing hoards of rent seekers.

Much of this money streams out globally, through U.S. funding of the World Bank or International Monetary Fund. Both institutions, and many others, are essentially nongovernmental arms of the Fed, whose pipes in the money pool pump money to bureaucrats, bankers and politicians abroad. Through the leash of free money, these institutions exert control.

This radical monopoly, in other words, is an engine for both money and power inequality, as well as the expansion of “industrial institutions” and ways of thinking, both in the U.S. and abroad. It is a tool for forcing the preferences and goals of bureaucrats and a money-associated oligarchy over all other people throughout the world. Often, these bureaucratic goals are in support of radical institutional monopolies. By shrinking their funding, Bitcoin looks to similarly reduce their reach to what could be supported by explicit taxation.

Looking at not just the present but future alternatives, “fiat” money looks to become an even more manipulative tool. China has begun rolling out its own “central bank digital currency” (CBDC). Embedded within a social tracking system explicitly designed to grade individual behavior, China’s digital yuan grants the government capacity to dial up or down the half life (or simple quantity) of money in your individual account or to curtail your ability to purchase chosen goods based on your position vis-a-vis the centralized arbiters of social fitness. This massive, Orwellian system of centralized control would radically transform Chinese society into a seamless and practically inescapable authoritarian state.

China’s example is particularly frightening but is unlikely to remain unique for long. Other countries and global institutions look to jump on this CBDC train and have made this desire explicit. This sits uneasily with the authoritarian overreach of recent history. This past year, we’ve seen increasingly authoritarian governmental measures globally, including the tracking of quasi-mandated health interventions used as gating factors for societal access. These have been accompanied, within the U.S. and elsewhere, by anti-“terrorism” measures (including against parents advocating for curricular change) that hearken quite eerily back to the post-9/11 attack on individual freedoms which we will never regain. Color me conspiratorial, but the global trend seems toward an even more coercive and radical monopoly on the way we communicate value with one another.

Although frequently lumped in with Bitcoin as “cryptocurrencies,” these technologies are, in ethos and practice (and technology), inherently opposed. Centralized in every way, they represent, instead, the most recent and worrisome update of the institution and tool of “fiat money,” and Bitcoin seems to be their only feasible alternative.

From another perspective, however, Bitcoin seems very much like something Illich might object to. Illich was highly concerned about “industrial society,” and, in his book “Energy and Equity,” he argued that energy usage above certain per capita “quanta,” engendered alienation and cultural destruction.

Bitcoin mining uses energy, and there seems to be little doubt that were the world to “hyperbitcoinize” and bitcoin to become its dominant reserve currency, mining would be an energy-intensive technology.

There are powerful arguments against this as a core concern, however. Most notably, Bitcoin looks to replace currencies which are as high or higher in environmental cost, but whose energy (and social) costs are not nearly so “transparent.” Modeled explicitly on gold, Bitcoin comes into the world through a process of “mining” that transparently requires work — in this case computational work — as part of its globally accessible process of validation and distribution. This energy use is explicit and quantifiable. And it varies according to the value of bitcoin, such that a more highly valued bitcoin would involve more energy use to secure and mint it, although precisely how much more isn’t calculable with great precision.

This energetic cost must be considered in contrast with the more hidden energetic costs of our current “fiat” monetary system, however. Tightly pegged to the valuation of oil since the OPEC crisis, the U.S. dollar depends on oil’s market value and the United States’ control over it. This “petrodollar” system, in which oil is almost exclusively sold for dollars, necessitates a massive army to protect and control the regions of the world where oil is richest. It is a hidden driver of unmeasurable scale behind American intervention in the Middle East. Since bitcoin aims to replace or significantly supplant these other currencies, its energy usage is best considered to be largely alternative, rather than additive, to currencies with more externalized energy and social costs.

Bitcoin’s energy usage is also unique in terms of its energy mix. Bitcoin miners are incentivized to search out the cheapest energy. This generally drives them toward excess or waste energy: methane that would otherwise be “flared”; hydroelectric or geothermal (volcanic!) energy “stranded” too far from a consumption point to meaningfully monetize; wind during an unusually windy day. Of course, Bitcoin will continue to also use new energy, but a large percentage of its “mix” is, through natural incentives, driven toward the more efficient usage of preexisting energy supplies.

More fundamentally, a significantly less inflationary money supply would decrease rates of consumption. This, in turn, would be expected to have a downward pressure on energy usage, by reducing the number of energetically costly items individuals are driven to buy. Those who believe that a “sustainable” future is only achievable by drawdowns on rates of human consumption should find this effect encouraging.

I can think of a final, more esoteric and economical response to critiques of Bitcoin’s energy use, although Illich may have found it less compelling: A predictable currency allows our markets to more efficiently meet the same communal desires. As a currency with predictable issuance and limited supply, bitcoin, if widely adopted, should be expected to drive toward a maximally predictable market value. This stable value will make it a more even ruler for economic measurement. Given just how unassessable and unpredictable our fiat currencies are, moving to Bitcoin could have powerful implications for economic (and energy) efficiency.

Currencies convey price signals in a market economy. These price signals are the information which the market — in effect, an emergent neural network — needs to best allocate scarce resources with alternative uses. If the currency fluctuated randomly from day to day, the ability of market agents to make informed decisions would plummet. Conversely, if the predictability of the price signal approached its theoretical maximum, so would the efficiency of our markets. That efficiency can be measured in terms of human desires met per resources invested. As it goes up, fewer resources are needed to meet the same human desires.

Given these arguments, the Illichian take on Bitcoin’s energy usage is unclear. It is clearly, at first blush, an energy-intensive industry. But its long-term energetic effects appear likely to drive less and more efficient energy use than our “fiat” status quo.

Finally, Illich may have criticized Bitcoin for its pure globalizing and market-driving effects. Illich was a nuanced and unique thinker, and he eschewed categorization as Marxist, anti-capitalist or any other pat label. But he clearly felt that the forces of global “industrial” capitalism were pathological in many ways. He argued that the West had globally exported a once-particular world view. This view ordered society around the efficient allocation of goods (including “human resources”) for consumption, and this view was increasingly replacing more local, cultural, communal, self-sufficient ways of living. In so doing, it was attacking our self-sufficiency, our ability to learn, be healthy, and interrelate, our traditions and customs, and our most fit and human ways of being.

Bitcoin is a fundamentally boundary-free technology. It is digitally native and creates a global digital marketplace. This seamless global interconnection, on its own, risks a further erosion of the particular cultures and traditions, and the human agency and independence associated with them, which Illich cherished.

But our world is already, for better or worse (in many ways, I think, both), an interconnected industrial marketplace. This ship — both good and bad — has already sailed. And while Bitcoin risks perhaps furthering the reaches of that industrial marketplace, it seems clear to me that that trend is inherent and unavoidable — and so should be shaped rather than combatted.

All in all, then, the place of Bitcoin within the framework of Illich’s thinking is complex and unclear. I, for one, believe it paves the way toward a brighter future in a way he would be likely to agree with. It nudges our future global economy toward openness, accessibility, fairness, creativity and security. It pushes forcefully against the churning drive toward ever-more unnecessary — and fundamentally unwanted — consumption and wrenches back control over our primary means of economic value transaction. It also fights against what I see, and believe Illich would see, as an otherwise dark economic and political future: A global digital panopticon, in which central powers track and control our every move, and the very means with which we communicate value becomes a monopolistic tool for manipulation.

This is a guest post by Sasha Klein. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.