- August 20, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Talking to Bloomberg, Vitalik Buterin spoke openly about various aspects of Ethereum, including perhaps the most challenging issue it faces to date, scalability.

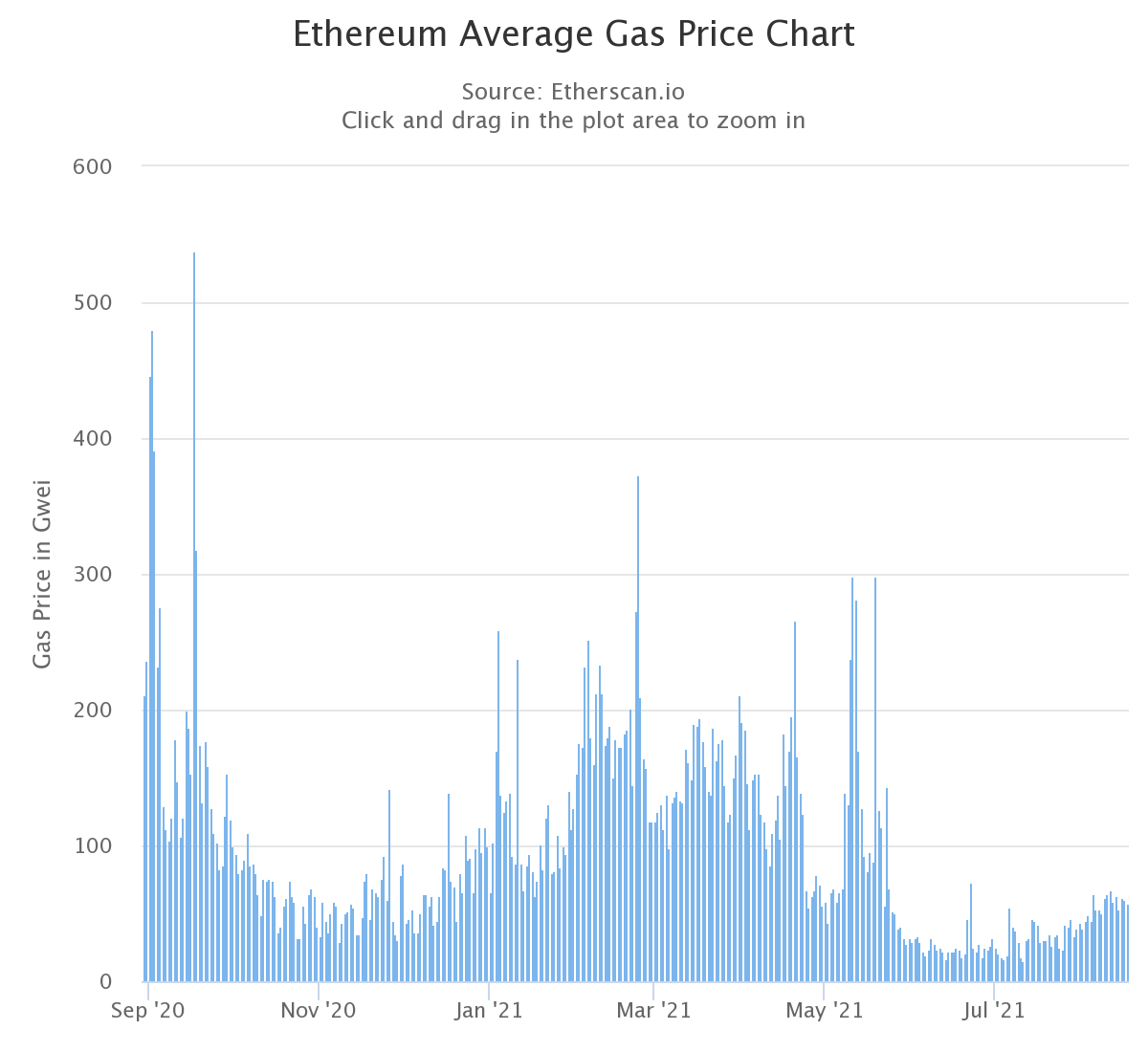

The Ethereum ecosystem features the most dApps and has the highest total value locked in native DeFi protocols. However, some say it has become the victim of its own success, as evidenced by high gas fees and a bottlenecked system.

The current throughput for Ethereum comes in at around 10 transactions per second (TPS). Contrast this with XRP, which is said to handle 1,500 TPS consistently but can manage up to 65,000 TPS.

Seeing off the competitors to its crown means Ethereum must overcome its scalability issues.

Ethereum and its scalability problem

Opening the point, host Emily Chang described the issues above as “growing pains,” leading to the question of why they exist in the first place.

Responding to the question, Buterin simplified it by framing it as a supply and demand problem. He said the result of users competing for limited block capacity drives transaction fees higher.

“If the number of people who want to send transactions goes up, but the amount of space for transactions on-chain doesn’t go up then all of these people who transactions are bidding against each. And only the ones willing to pay a really high amount can actually get in.”

As far as solutions are concerned, Buterin admitted the only way to solve the issue is by increasing transaction capacity to handle more user traffic.

Since Ethereum’s inception, Buterin said the dev team had implemented incremental improvements. To date, these upgrades have yielded an increase in scalability by a factor of five.

“We’ve been doing all kinds of incremental improvements to the blockchain clients, and the protocol code over the last five years. Ethereum’s scalability has increased by about a factor of five since the project started.”

The London hard fork and EIP 1559

In the most hyped improvement in recent times, EIP 1559 went live early this month, under the London hard fork.

When devs first floated the proposal, they sold it on the premise of countering spiraling gas fees. But only by making them more predictable. This in itself does not necessarily equate to lower gas fees, even though that is what users hoped would happen.

Recently, Buterin claimed on-chain capacity had seen a 9% increase post-London. In theory, this should have resulted in lower fees due to less competition for block space.

However, analysis of average gas prices shows a slight increase since the London rollout. Currently, at 57 gwei versus 46 gwei on August 4 (the day before the hard fork).

Maybe it’s too soon to say EIP 1559 wasn’t worth the effort. In any case, devs had always maintained its rollout may not mean lower gas fees.

But on initial examination, perhaps ETH 2.0 is the only way Ethereum can solve its scalability problems.

The post Vitalik Buterin: Ethereum (ETH) scalability has increased by a factor of 5 appeared first on CryptoSlate.