- August 11, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Since China started cracking down on bitcoin mining, North American miners have enjoyed lower difficulty to mine and HODL more BTC.

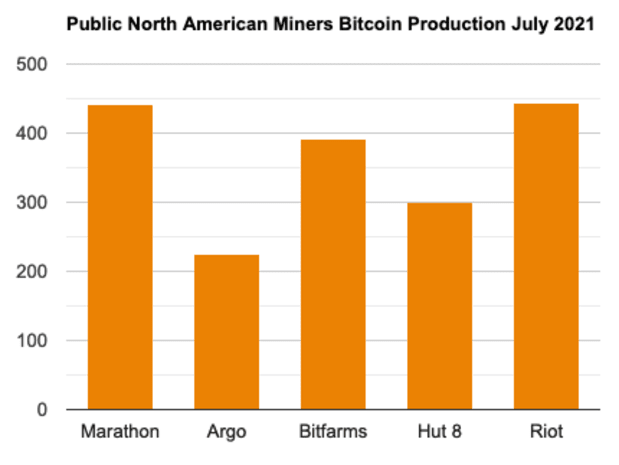

In July, North American bitcoin miners have enjoyed a bigger bitcoin production without meaningful increases in hash rate capacity. Five publicly listed firms mined a combined total of 1,802 BTC that month, a 58% average increase over June.

The production update statements released by each of the five miners, Marathon, Argo Blockchain, Bitfarms, Hut 8, and Riot Blockchain, detail their unusually productive month in July. Without a big increase in hash rate power, all five could substantially increase their BTC mining production.

Riot and Marathon topped the productivity increase list, increasing their bitcoin mined in July by 82% and 66.42%, respectively. In June, the two miners had produced only 243 and 265.6 BTC, respectively.

The increased bitcoin production by the publicly listed North American miners is likely mainly due to the broad bitcoin crackdown instituted in China. The country, which historically was a bitcoin mining hotbed, took increased regulatory sanctions towards the industry in May and June, shutting down miners and ensuing an ASIC exodus. Many miners have since set up shops overseas, thereby changing the bitcoin mining landscape permanently.

As a result, bitcoin miners in North America have emerged as big winners from the Chinese crackdowns. As firms shut down operations in the East, the total Bitcoin network hashrate dropped sharply. Consequently, Bitcoin’s difficulty adjusted downwards, making it “easier” to mine blocks and thus receive the coinbase transaction (new BTC as miner reward). So, those companies that maintained regular operation saw their daily bitcoin mining rate increase substantially – including those five North American companies.

More notably, however, instead of selling unexpected BTC to increase profits, most miners have committed to a HODL mentality. As they could mine more bitcoin than anticipated, North American miners have indulged in increasing their bitcoin stack, which they plan on holding long-term – resorting to bitcoin-backed loans if necessary.