- August 10, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Mutual fund giant Fidelity has purchased 7.4% of bitcoin mining company Marathon Digital Holdings to be spread across multiple funds.

Multinational financial services corporation Fidelity Investments purchased a 7.4% stake in Marathon Digital Holdings, a prominent bitcoin mining operator in North America, reported Forbes. Fidelity spent $20 million on the shares and will reportedly spread them across four broad index-based funds that combined have a market capitalization of $170 billion.

The four index funds, popular in retirement accounts, are Fidelity Extended Market Index Fund (FSMAX), Fidelity Nasdaq Composite Index Fund (FNCFX), Fidelity Total Market Index Fund (FSKAX), and Fidelity Series Total Market Index Fund (FCFMX).

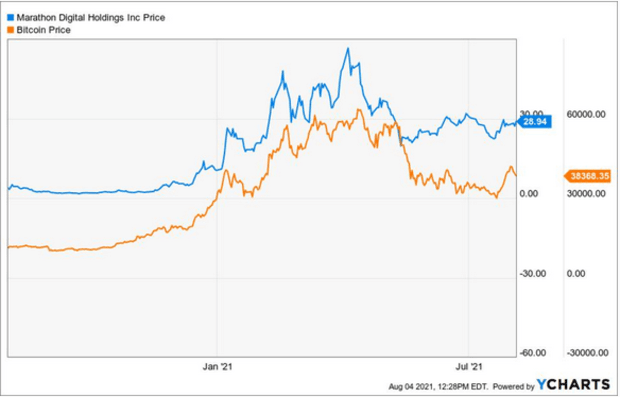

The purchase showcases a trend in 2021 of obtaining bitcoin exposure through associated equity securities. Marathon’s shares, for instance, have traded similarly to the price of bitcoin for the past year, so these Fidelity index funds will be able to gain some exposure to the price of bitcoin without holding it directly.

“We’re super excited about the institutional ownership,” said Marathon CEO Fred Thiel in an interview following the Fidelity disclosure. “If you look at the change from last year to this year and even the last two quarters have just been amazing [in] how much institutional ownership has grown in our stock.”

Besides Fidelity, other institutional giants with a stake in Marathon include Vanguard Group, Susquehanna, and Blackrock.

On August 3, the bitcoin miner announced updates on its bitcoin production and mining operations. During July, the company mined 442.2 BTC and increased its total bitcoin holdings to around 6,225.6 BTC.

“We are excited to see all the applications that are going to be rolled out on bitcoin and the expansion of bitcoin as it permeates itself into the kind of mainstream financial markets,” said Thiel, on Bitcoin’s role in the future.

In May, Marathon Digital Holdings was heavily criticized for undergoing a practice of censoring bitcoin transactions. The miner sought to mine blocks fully compliant with U.S. regulations then but has since stopped the practice. Later that month, Marathon published a statement saying that it would stop censoring transactions and signal for Taproot activation.